Byju’s investors have raised red flags over the management’s failure to recover about Rs 1,400 crore from a Dubai-based reseller, More Ideas General Trading LLC, while paying out Rs 300 crore in sales commissions at a time when the debt-laden edtech firm is battling a severe fund crunch. Byju’s has, however, disputed the investors’ claim.

In an Extraordinary General Meeting (EGM) notice, a copy of which ET has reviewed, the investors said the company’s value has eroded due to the management’s neglect in enforcing its legal rights.

According to the document, More Ideas General Trading, the sole selling agent of Byju’s in GCC countries, owes the edtech firm over Rs 1,400 crore, which the company has been unable to recover despite paying over Rs 300 crore in commissions on sales of Rs 634.18 crores recorded in FY22.

Recently, a group of key Byju’s shareholders, collectively holding more than 30% stake, initiated proceedings for the EGM, aimed at removing founder Byju Raveendran and his family members from the board. They have listed out a litany of issues regarding governance, financial mismanagement, breach of its obligation to its shareholders, failure in performance and compliance.

Also read | Investors have no voting rights to remove CEO: Byju’s

Incidentally, the issue with the reseller is a concern that even the auditor MSKA & Associates had pointed out in Byju’s FY22 annual report, highlighting concerns regarding the company’s contractual arrangement with the Dubai-based unrelated party, issues with collectability, and FEMA compliance.

People familiar with the matter told ET that the FY23 audit is underway, and it is likely that the arrangement with More Ideas General Trading could be reviewed in greater detail as part of the audit process.

Responding to ET’s queries, a spokesperson for Byju’s said, “The figure of Rs 1,400 crore mentioned in the EGM notice — which is invalid in law — is grossly overstated. Based on the products sold as part of a multi-year sales cycle, the outstanding net amount due was $74 million (around Rs 614 crore). In recent months, the company started recovering some of the dues after persistent legal pressure. The vendor has committed to pay the entire balance of $69 million (around Rs 573 crore) over the next 12 months.”

The spokesperson added that Byju’s has not booked any fresh sales from More Ideas General Trading in FY23 and FY24. “However, he (the vendor) continues to service students onboarded as part of the multi-year cycle,” the spokesperson said.

For Byju’s, sales in GCC countries rose 27% to Rs 634.18 crores in FY22, from Rs 497 crores in FY21.

The auditor’s noted in the annual report that out of the sales generated from product transfers, revenues totalling Rs 260 crores have not been recognised because they did not meet the accounting standards related to the probability of collection.

However, the company paid 50% commission of the billed amount to the agent as per the terms of the arrangement—a sum of Rs 300.37 crore in FY22 and Rs 237 crore in FY21.

“The exclusive franchise agreement with the vendor has been a 50:50 revenue sharing deal. This was widely seen as a constructive arrangement, as similar deals are usually skewed much more in favour of the local franchise partner. Having said that, the company has not paid any commissions since the vendor started defaulting on revenue payments,” the spokesperson said.

The commission was debited to the P&L statement though the company has applied for an extension from the RBI to collect these foreign currency amounts after the year-end. As per the EGM notice, it appears that the receivable amount has since ballooned to about Rs 1,400 crore.

But the EGM notice does not share the methodology the investors have used to calculate the amount.

MSKA & Associates declined to comment, citing client confidentiality.

The investors are up in arms after Byju’s, run by Think & Learn, launched a rights issue to secure up to $200 million from existing shareholders.

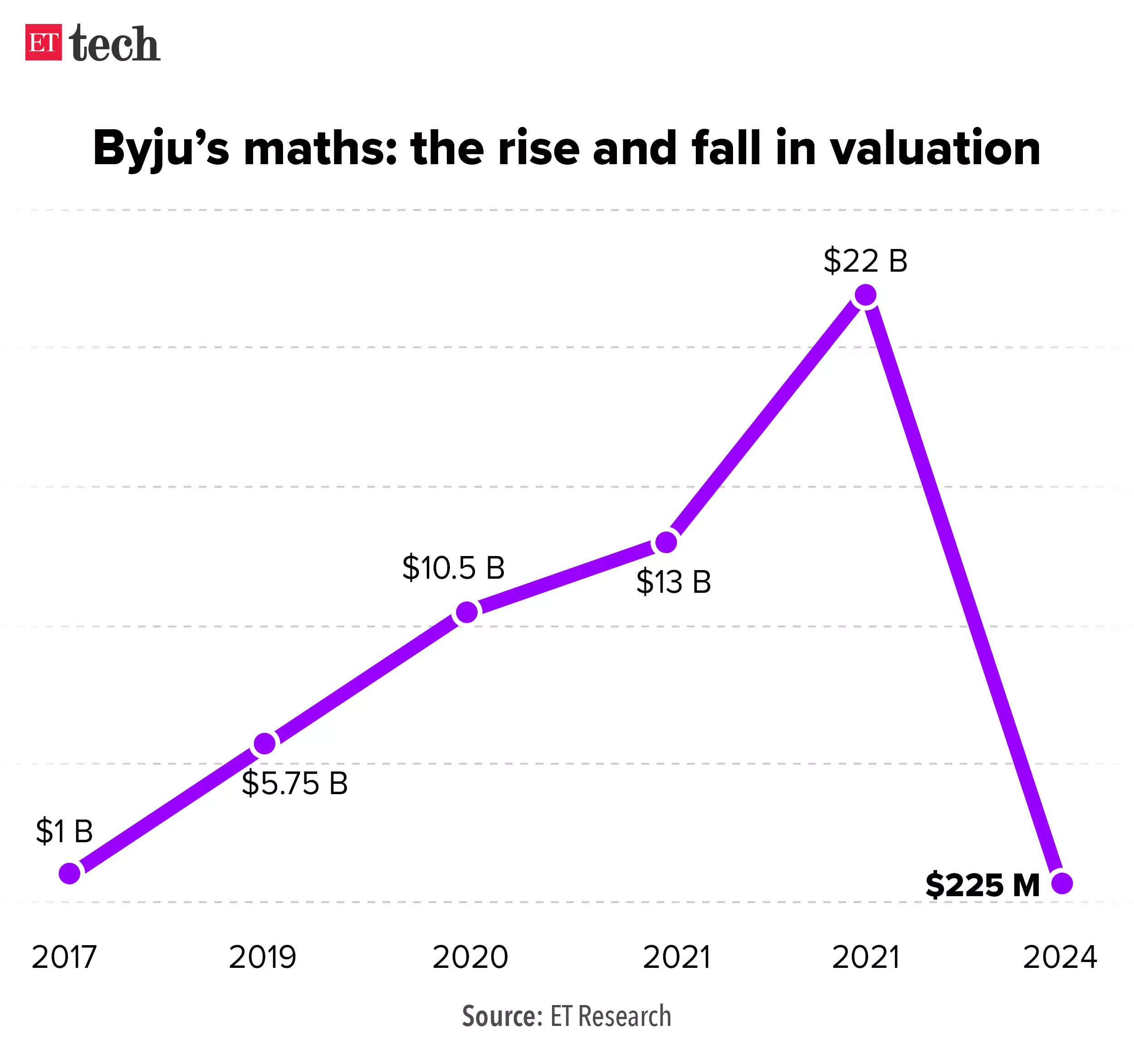

The company adjusted its valuation to $25 million as the pre-money valuation during the rights issue.

Following this round, its valuation would reach $220 million, a more than 90% cut from its peak of $22 billion a couple of years back.

Shareholders in Byju’s face potential stake dilution if they choose not to participate in the rights issue.

The embattled edtech firm has been grappling with escalating losses, soaring to Rs 8,245 crore from Rs 4,564 crore in the preceding year. Consolidated income has jumped to Rs 5,298.43 crore from Rs 2,428.39 crore, according to the FY22 annual report.

The auditor has also highlighted “material uncertainty” regarding the company’s ability to sustain itself as a going concern.

Byju’s total financial liabilities swelled to Rs 17,678 crore in FY22 from Rs 3,116 crore in FY21. This figure predominantly comprises “non-current liabilities,” including overseas borrowings of Rs 8,828.65 crore.

Also read | US lenders drag Byju’s to bankruptcy court in India

Byju’s has been struggling to raise capital to meet its operational liabilities and salary requirements. The investors have asked for discussion on the status of investigations by central investigative agencies—ED, MCA and SFIO— a forensic probe, delay in audited results, compliance with Articles of Association and shareholders agreement.