The Reserve Bank of India (RBI)’s monetary policy mandate is to manage the stock of money in the economy, so as to balance its control of inflation with economic growth. When the RBI changes its monetary policy stance, the effects are seen on its operating target – the Call Market Rate, and the intermediate outcomes such as bank loans and financial markets.

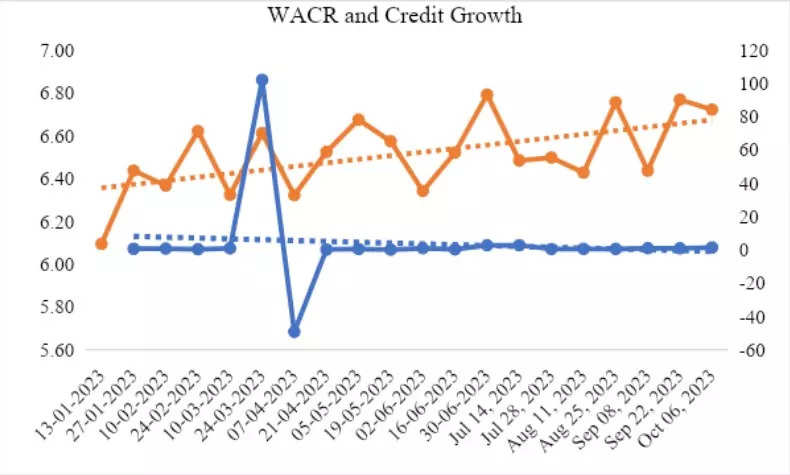

This process is called Monetary Policy Transmission. Now consider the recent movement in Weighted Average Call Market Rate (WACR), that shows a mild upward trend due to six consecutive hikes in the policy repo rate over 22 months till February 2023. Consequently, there has been a slight decline in credit growth rate. This is an expected outcome of monetary policy tightening. However, there is a catch.

Is the RBI’s policy tightening guaranteed to reduce credit growth sufficiently so as to bring down inflation on a sustainable basis? The answer lies in what banks do in response.

When we see inflation over the last 9 months (January-September 2023), the general trend has been a gentle decline. However, since September 2022, the inflation rate has breached the RBI’s upper tolerance limit (6%) six times. In most months, the rate has hovered close to 6%. There may be multiple reasons for this persistence in inflation such as supply factors that have been pointed out by others.

We argue that liquidity with banks, i.e., the nature of their loanable funds may be the culprit which may come in the way of effective transmission of monetary policy. In our recently published research, we found that the effect of monetary policy changes on bank lending crucially depends on the levels of liquid assets held by banks. Liquid assets include the available cash and cash equivalents such as government bonds— which can easily be converted to cash— held to meet the short-term business requirements of banks.

We found strong evidence for these liquid assets influencing the monetary policy transmission process. In other words, banks with more liquid assets are able to sustain their loan portfolio in the face of monetary tightening, while banks with less liquid assets are constrained by policy tightening. It means that banks’ liquid assets position may be coming in the way of effective monetary policy transmission in India.

We also found that, when monetary policy is tightened, banks holding less liquidity cut down on their non- priority sector lending and reallocate it to the priority sector, so as to earn higher interest income.

Moreover, when the RBI increases its policy rates, less liquid banks reduce their short-term and medium-term loans in favour of long-term loans, while more liquid banks do the opposite.

According to the RBI, growth in bank credit went up by 15% in 2022-23 which is higher than the 9.6% credit growth clocked in 2021-22. This is the result of re-distribution of loanable funds to already existing portfolios of loans. Thus, the policy tightening could not sufficiently check credit growth thanks to banks with high levels of liquid assets.

Our analysis helped us to identify the threshold level of liquid assets held by banks — 27 percent of their total assets — beyond which they are non-responsive to RBI’s policy changes. For instance, ICICI Bank, Axis Bank and Yes Bank currently hold liquid assets below the threshold. On the other hand, the Central bank of India, Punjab National Bank and Allahabad Bank possess liquid assets above the threshold.

The monetary policy transmission process is weakened by such banks who hold liquid assets above the threshold. These findings are useful for the RBI to manage system liquidity in pursuit of its inflation and growth objectives. The evidence is also useful for market participants to understand which banks will pass on RBI rate changes to their customers and which banks will continue to lend uninterruptedly on the back of higher liquid assets in their portfolios.

Understanding the role of bank liquidity is pertinent as there is considerable heterogeneity among Indian banks. The Total High Quality Liquid Assets (HQLAs) of Axis Bank increased from Rs. 229,885 Crores in December 2022 to Rs. 247, 981 Crores in March 2023, an increase of 8 per cent. On the contrary, we see relatively less increase in HQLAs of Punjab National Bank.

It increased from Rs. 283, 379 Crores in December 2022 to Rs. 295, 255 Crores in March 2023, an increase of 4 per cent. The bigger banks may have the capacity to build-up a large portfolio of liquid assets and shield themselves from the RBI’s rate action. From the policy point of view, it is essential to have a calibrated mechanism to ensure that liquid assets with banks do not hinder intended effects of monetary policy on bank lending and therefore inflation.

(The authors are professors at IIM; views are personal)