As the stocks of several of the so-called Magnificent Seven group of big tech companies set records, their bonds have had a less stellar week with net selling and spreads over U.S. Treasurys widening.

Meta Platforms Inc.

META,

is on track to close at a record high and add a record amount of more than $200 billion to its valuation on the day. That would make for the largest one-day market-cap haul in Wall Street history, according to Dow Jones Market Data — surpassing the $191.3 billion one-day gain that Amazon.com Inc. raked in back in February 2022.

The move comes after the company said it would pay its first ever dividend as it reported better-than-expected earnings. The news prompted speculation that two other Magnificent Seven companies — Amazon.com INC.

AMZN,

and Alphabet Inc.

GOOGL,

— would follow suit.

Opinion: Meta stuns Wall Street with its first dividend. Amazon and Alphabet could be next.

Amazon, meanwhile, was last up 6.7%, putting it on track to add about $111 billion to its valuation, driven higher by earnings called “the cleanest quarter in recent memory,” by one analyst.

Read now: Amazon says the ‘magic words.’ They could spur a $110 billion market-cap boost.

Apple Inc.’s

AAPL,

stock was slightly lower after its guidance disappointed. Microsoft Corp.

MSFT,

was up 1.9%.

Alphabet was slightly lower. Nvdia Corp.

NVDA,

was up 5% — it will be the last member of the group to post earnings later this month. And Tesla Inc.

TSLA,

was down 2% amid Chief Executive Elon Musk’s displeasure over a Delaware court ruling voiding his record $56 billion pay package and push to reincorporate in Texas.

Read now: Can Elon Musk do ‘whatever he wants’? Why moving Tesla out of Delaware may spook investors.

Tesla is the only member of the group with no outstanding bonds as convertible debt issued in the past has been converted to equity.

As the following chart from data solutions provider BondCliq Media Services shows, spreads on the group have widened this week from between 2 basis points to 10 basis points for a bond issued by Microsoft.

“We haven’t had that for quite a while,” said one market source.

Select bonds of Magnificent Seven: One-week spread performance.

BondCliQ Media Services

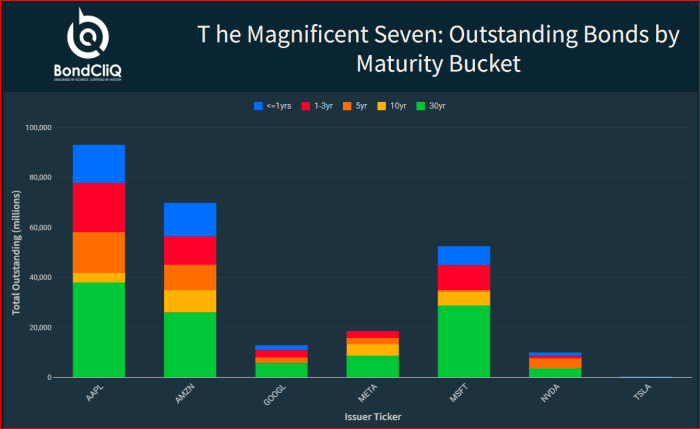

Apple has by far the most outstanding bonds of the group, followed by Amazon and Microsoft.

The Magnificent Seven: Outstanding bonds by maturity bucket.

BondCliQ Media Services

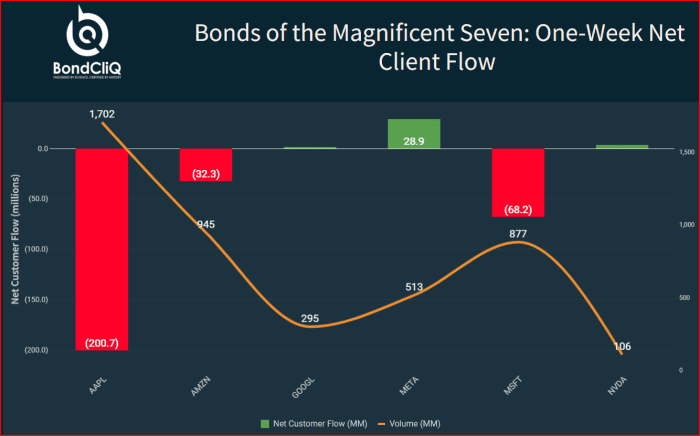

A chart of one-week client flows shows net selling, led by Apple.

Bonds of the Magnificent Seven: One-week net client flow.

BondCliQ Media Services

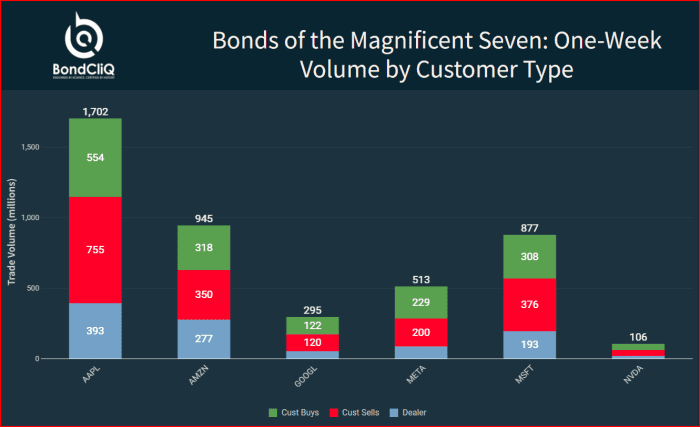

The next chart shows volume by customer type.

Bonds of the Magnificent Seven: One-week volume by customer type.

BondCliQ Media Services

The high-grade corporate bond market “is looking a bit tired,” said the market source. That may be due to the selling of Treasurys that has sent the 10-year yield back above 4% after the latest Federal Reserve meeting this week and a blowout jobs report on Friday.

The Fed can “take its time to recalibrate policy” after the strong U.S. jobs report for January, according to Renaissance Macro Research’s Neil Dutta.

The high-grade market also saw record new issuance in January and new issues this week performed badly in the secondary market, according to Bloomberg News.

Read now: Is it a bubble? ‘Magnificent 7’ market cap now equals the GDP of 11 major world cities.