The global financial markets is riding a wave of strong risk-on sentiment, propelling DOW and S&P 500 to historical highs overnight, while NASDAQ achieved its best daily gain in over a year. That followed the record closes in DAX, CAC and Nikkei yesterday. This enthusiasm for risk has led to the yen, dollar, and Swiss Franc emerging as the week’s underperformers, given their safe-haven status which tends to be less attractive during bullish market phases.

In the currency realm, Australian and New Zealand Dollars stand out as the strongest currencies, buoyed by the prevailing risk-on market sentiment. Meanwhile, Canadian dollar faces challenges following weaker-than-expected CPI data earlier in the week. Euro and Sterling find themselves positioned in the middle, with Sterling holding a slight advantage.

The tone in today’s Asian session, nevertheless, is more subdued, with stocks in Hong Kong and Singapore in red, while Japan observes a holiday. The market might now be taking a breather. With a relatively light economic calendar today, market participants’ focus might shift towards remarks from notable central bank figures, including BoE’s Megan Greene, ECB’s Joachim Nagel, and SNB’s Martin Schlegel. However, the overarching direction in the risk markets is expected to continue driving forex movements.

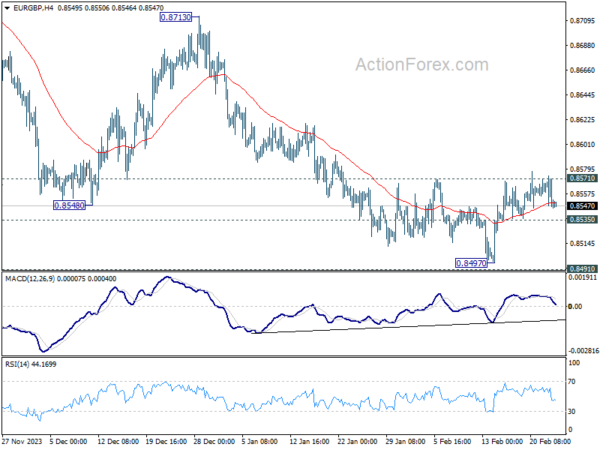

Technically, EUR/GBP is a pair to watch today. Rebound from 0.8497 lost much momentum, as seen in 4H MACD, as the cross struggled to break through 0.8571 resistance decisively. Break of 0.8535 minor support will indicate rejection by 0.8571 and retain near term bearishness. Further fall would then be seen to retest 0.8491/7 support zone, or below to resume larger down trend.

In Asia, at the time of writing, Hong Kong HSI is down -0.19%. China Shanghai SSE is up 0.05%. Singapore Strait Times is down -1.25%. Overnight, DOW rose 1.18%. S&P 500 rose 2.11%. NASDAQ rose 2.96%. 10-year yield rose 0.002 to 4.327.

Fed’s Waller seeks additional months to assess January CPI as speed bump or pothole

Fed Governor Christopher Waller advocated for Fed to “wait a little longer,” suggesting that “at least another couple more months” of economic data would be crucial before commencing any policy easing.

In a speech overnight, Waller expressed concerns regarding the recent high CPI inflation reading, describing it as potentially “a bump in the road” or a more serious indication that the significant progress made in controlling inflation over the past year could be “stalling.”

This uncertainty solidifies his viewpoint that a patient approach to policy adjustments is warranted, allowing more time to assess whether January data represents “a speed bump or a pothole”.

While Waller anticipates that it may become appropriate to begin easing monetary policy sometime within the year, he clarified that the timing and extent of policy adjustments would heavily rely on incoming economic data.

Fed’s Cook to wait for clearer inflation convergence before rate cuts

In a speech overnight, Fed Governor Lisa Cook articulated her stance on waiting for more definitive signs of inflation moving towards 2% target before considering any policy rate reductions.

“I would like to have greater confidence that inflation is converging to 2% before beginning to cut the policy rate,” she said.

Further, Cook shared an optimistic view on the inflation outlook, suggesting that a forecast showing 12-month PCE inflation moving towards target over time remains a “reasonable” baseline scenario.

However, Cook also advocated for a measured and data-driven approach to policy decisions. “We should continue to move carefully as we receive more data,” she advised, stressing the importance of maintaining the current level of policy restriction to achieve “sustainable” price stability.

Fed’s Harker warns against immediate expectations for rate cuts

Philadelphia Fed President Patrick Harker did not dismiss the possibility of a rate cut as early as May meeting. But he emphasized the importance of observing “a couple more months” of economic data before making such a decision. “I think we’re close,” Harker stated overnight, advocating for patience by suggesting, “just give us a couple meetings.”

“We may be in the position to see the rate decrease this year,” he remarked. But he also tempered expectations with a reminder of the need for deliberate consideration: “But I would caution anyone from looking for it right now and right away. We have time to get this right, as we must.”

Harker acknowledged the challenges inherent in the disinflation process, describing it as “bumpy and uneven at times.” This acknowledgment underscores the necessity for the Fed to demand “more evidence” before altering its policy course, aiming to discern genuine economic trends from the “vagaries of monthly data.”

In contemplating the initiation of policy easing, Harker advocated for a cautious approach: “let’s start on a steady, slow reduction, because that to me minimizes risk.”

New Zealand’s retail woes deepen with eighth consecutive quarterly decline

New Zealand’s retail sales volumes dropped by -1.9% qoq, a figure far below the expected decline of -0.2% qoq. This also marked the eighth consecutive quarter of contraction. Excluding auto sales, the decline was marginally less severe but still substantial at -1.7% qoq, again well below the anticipated -0.1% qoq decrease.

Melissa McKenzie, business financial statistics manager, highlighted the extent of the downturn, noting that “Ongoing falls in retail activity over the last two years were marked by a fall in most industries in the December quarter.”

The contraction in retail sales was widespread, with 14 out of 15 retail industries reporting lower sales volumes compared to the previous quarter. The most significant downturns were observed in motor vehicle and parts retailing, which fell by -2.5%, food and beverage services, which saw a -2.4% decline, and fuel retailing, which dropped by -3.6%.

In terms of retail sales value, there was a qoq decrease of -1.5%, with ten of the sixteen regions experiencing lower seasonally adjusted sales values.

Looking ahead

Germany’s GDP final and Ifo business climate are the only features of the day.

AUD/USD Daily Report

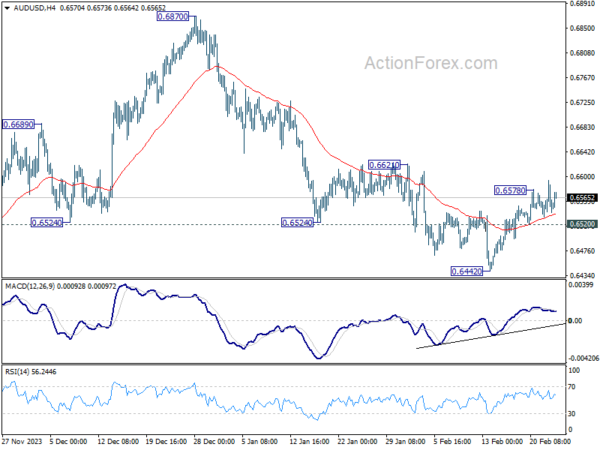

Daily Pivots: (S1) 0.6533; (P) 0.6564; (R1) 0.6588; More…

AUD/USD’s recovery resumed by breaching 0.6578 but upside is capped below 0.6621 resistance. Intraday bias stays neutral for the moment, and larger fall is still in favor to continue. On the downside, below 0.6520 minor support will turn bias to the downside for retesting 0.6442 first. Firm break there will resume the the decline from 0.6870 towards 0.6269 low. Nevertheless, considering bullish convergence condition in 4H MACD, decisive break of 0.6621 will turn near term outlook bullish for 0.6870 resistance instead.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which might still be in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Retail Sales Q/Q Q4 | -1.90% | -0.20% | 0.00% | -0.80% |

| 21:45 | NZD | Retail Sales ex Autos Q/Q Q4 | -1.70% | -0.10% | 1.00% | 0.40% |

| 00:01 | GBP | GfK Consumer Confidence Feb | -21 | -18 | -19 | |

| 07:00 | EUR | Germany GDP Q/Q Q4 F | -0.30% | -0.30% | ||

| 09:00 | EUR | Germany IFO Business Climate Feb | 85.5 | 85.2 | ||

| 09:00 | EUR | Germany IFO Current Assessment Feb | 87 | 87 | ||

| 09:00 | EUR | Germany IFO Expectations Feb | 83.8 | 83.5 |