Broader Money Supply (M3) growth and deposit growth in the Indian banking system have settled at a lower level (<15 per cent) over the past decade and even slipped below 10 per cent for a few years, leading to current liquidity tightness, revealed a latest report by Emkay Global Financial Services.

Slower M3 growth has been mainly due to prolonged sluggish credit growth to the commercial sector (since FY14) and lower net forex asset growth for the banking sector being the key sources.

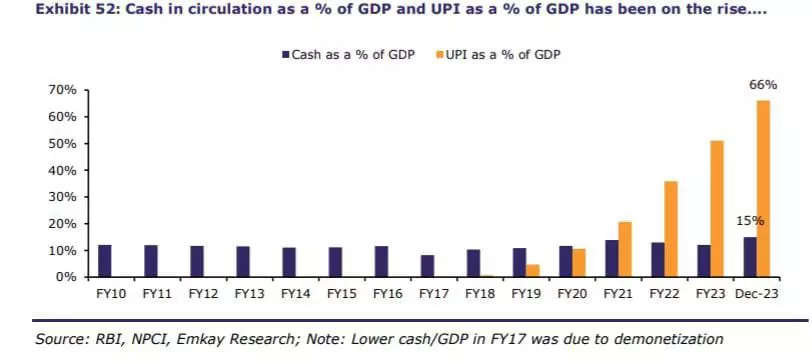

Additionally, a higher share of currency with the public, notwithstanding rising digital transactions as well as bank deposits with the RBI via CRR, has risen, thereby impacting the money supply/deposits growth in the system.

It is believed that the lagged impact of healthy credit growth over the past two years coupled with higher interest rates offered by banks should gradually reflect via some improvement in M3 and deposit growth in the near-medium term. However, long-term money supply growth will be conditioned to sustained strong credit growth and easing monetary policy by the RBI (including CRR cut), highlighted the report.

Impact of digital transactions on money supply

Innovations in technology have changed the Indian payment system and, thus, the need for cash to transact. Over the years, the cash-led Indian economy has transitioned to a smart, phone-led payment economy. Theoretically, a lower currency in circulation due to rising digital transactions is akin to a CRR cut for the banking system, as it results in better money supply and improved deposit formation, said the report.

However, this equation is yet to play out as the cash in the economy remains high for now. Separately, higher C2B UPI transactions have a transient impact on the overall retail deposit formation as it moves from the retail customer’s Savings a/c to the merchant a/c (current a/c), but eventually it evens out.

PPI (e-wallets) has the potential to impact the measure of monetary aggregates, as PPI/digital stored in e-wallets is supposedly not considered in any of the money supply aggregates of M0, M1, M2, or M3, the report added.

Can CBDC lead to erosion of bank deposits?

While CBDCs may help central banks regain lost ground in the payments market, commercial banks globally worry that if central banks offered a bank account directly to members of the public, then it could lead to erosion of deposits and, thus, funding instability for banks, highlighted the Emkay report.

On the other hand, this could impact regulatory policy transmission and, thus, should also in a way concern central banks and the government. The U.S. Federal Reserve too had raised similar concerns that it could reduce the aggregate amount of deposits in the banking system, which could in turn increase the funding costs of banks and reduce credit availability or raise credit costs for households/businesses.

Some global studies estimate that the introduction of a CBDC could lead to a 10-30 per cent drop in bank deposits or at least increase the cost of funding, depending on whether the CBDC will carry interest or not.

However, the adoption of CBDC has been relatively slow, while most central bankers are in favor of extensive bank involvement in CBDC distribution, which should resolve many of these concerns. In India, the RBI too seems to be favoring this view and, thus, hopes that CBDCs do not emerge as another element of risk for deposits in the long run, the report added.