Nasdaq, Inc. (NASDAQ:NDAQ) today reported financial results for the fourth quarter and year 2023.

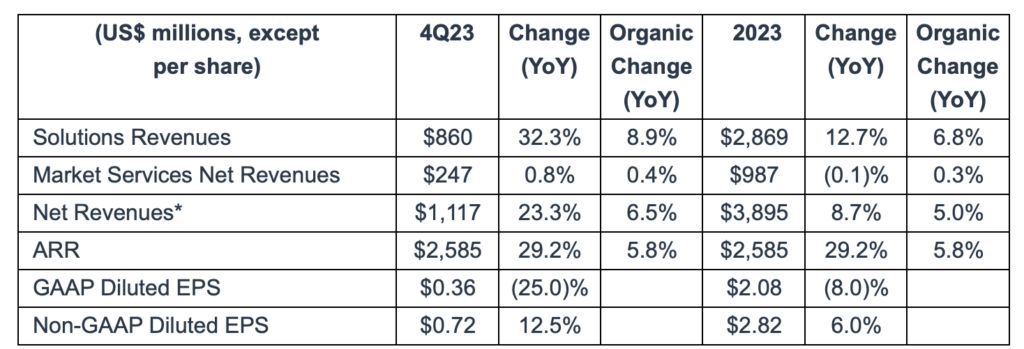

Fourth quarter 2023 net revenues were $1,117 million, an increase of $211 million, or 23%, from $906 million in the prior year period. Net revenues reflected a $59 million, or 7%, positive impact from organic growth, a $148 million net benefit from acquisitions and divestitures including Adenza, and a $4 million increase from the impact of changes in FX rates.

Solutions revenue was $860 million in the fourth quarter of 2023, an increase of $210 million, or 32%, with organic growth of 9%, reflecting growth from both the Capital Access Platforms and Financial Technology divisions.

Market Services net revenues were $247 million in the fourth quarter of 2023, an increase of $2 million, or 1%. The increase reflects $1 million in organic growth and a $1 million positive impact from changes in FX rates.

GAAP diluted earnings per share decreased 8% in 2023 and 25% in the fourth quarter of 2023. Non-GAAP diluted earnings per share increased 6% in 2023 and 13% in the fourth quarter of 2023.

Nasdaq generated $1.7 billion in cash flow from operations.

The company returned $127 million to shareholders in the fourth quarter of 2023 through dividends and $110 million in repurchases of our common stock.

Adena Friedman, Chair and CEO, said:

“We delivered another strong year of operating performance in a dynamic economic and capital markets backdrop. We executed well across our business in 2023, maintaining our listings leadership in the U.S., achieving a breakthrough year for Verafin in our strategy to move upmarket, and introducing new innovations across our products and services.

We successfully completed our acquisition of Adenza, bolstering our suite of mission-critical technology solutions, and accelerating our strategic vision of being the trusted fabric of the world’s financial system.”