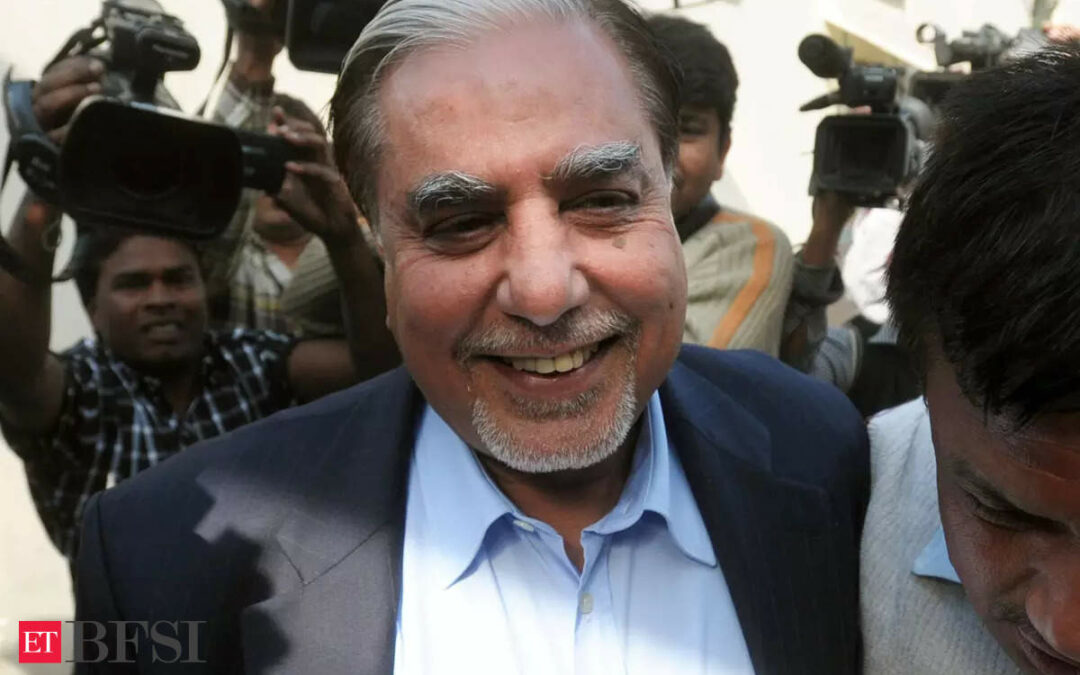

The bankruptcy court has admitted Indiabulls Housing Finance Ltd’s (IHFL) application to initiate insolvency resolution proceedings against Essel Group chairman Subhash Chandra for default by a company called Vivek Infracon. Chandra was a personal guarantor against the loans availed by the company.

The New Delhi bench of the National Company Law Tribunal (NCLT) presided by judicial member Ashok Kumar Bhardwaj and technical member Subrata Kumar Dash, while admitting the application, also appointed a resolution professional (RP) to ascertain the claims of lenders and personal assets of Chandra. The detailed order was not uploaded until the time of filing the story.

The tribunal has also disposed of applications filed by IDBI Trusteeship and Axis Bank that sought to intervene in the matter.

In this case, Indiabulls Housing Finance had moved an application to initiate personal insolvency against Chandra in 2022 after a loan of Rs 170 crore it had given to Vivek Infracon had turned into non-performing assets (NPA).

“The copy of the order is awaited. Appropriate steps will be actioned in accordance with the applicable law,” said a spokesperson from Subhash Chandra’s office.

Sanket Jain, partner at Pioneer Legal, said that this admission could have significant implications for Subhash Chandra.

“Beyond potential damage to his financial reputation, there may be personal and professional repercussions. He may have to undergo the insolvency resolution process, which could involve liquidating his assets to repay his debts or restructuring his liabilities under the supervision of the RP and the NCLT,” said Jain.

“As for other lenders, the admission of the insolvency plea means that they will be included in the insolvency proceedings as creditors. They will have the opportunity to present their claims and participate in the resolution process to recover the amounts owed to them by Subhash Chandra, who acted as a personal guarantor,” he added.

The development comes at a time when Chandra is also fighting a case against the Securities and Exchange Board of India (Sebi) in the Bombay High Court. He has filed a writ in court challenging a summon issued to him in connection with an ongoing investigation by the market regulator.

In 2021, Chandra had claimed he had settled 90% of the debt with 43 lenders.