Forex

ECB’s Kazimir: Two more rate cuts this year not guaranteed

In an op-ed published today, ECB Governing Council member Peter Kazimir addressed market expectations for two additional rate cuts before the end of the year. He stated that while these market bets are “not entirely misplaced,” they should not be considered a “given...

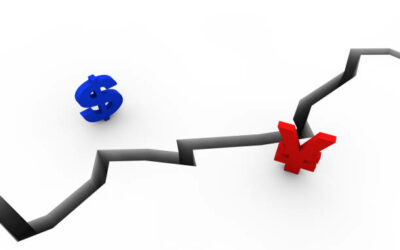

USD/JPY: Another Potential Relief Rally Leg Looms for JPY

A potential uptick in Japan’s core-core CPI led by PPI may increase the odds of a BoJ’s interest rate hike in September. Republican presidential nominee Donald Trump’s betting odds have slipped after US President Biden decided to bow out of the US Presidential...

Aussie Leads Decline in Commodity Currencies; Risk Aversion Dominates Following China’s Rate Cut

Australian Dollar leads other commodity currencies lower in Asian session today, reflecting a broader risk-off sentiment in the markets. The market’s risk-off sentiment is further emphasized by the strength of Yen and Swiss Franc, currencies typically favored during...

Gold Declines Sharply from All-time High

Gold jumped to its highest level ever on July 17 But reversed lower due to reaching overbought conditions Despite latest weakness, oscillators remain positively tilted Gold had been in a steady uptrend since late May, which led to a fresh all-time high of 2,483 last...

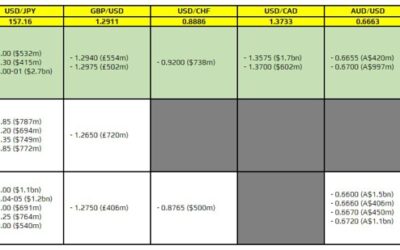

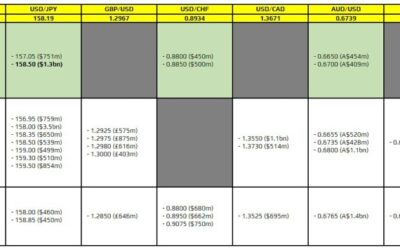

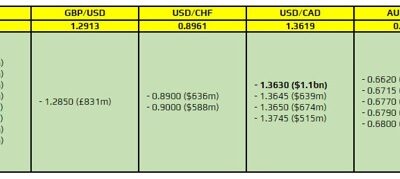

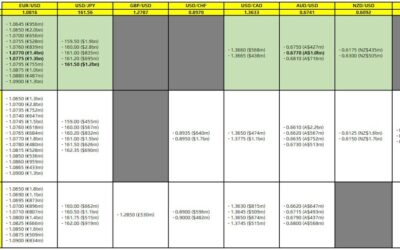

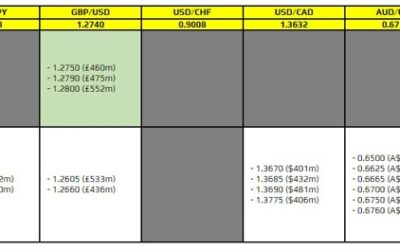

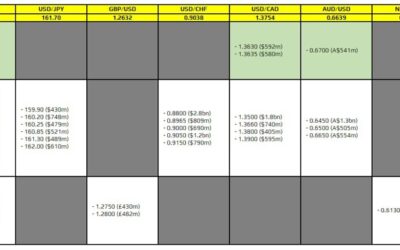

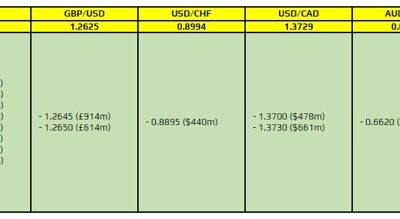

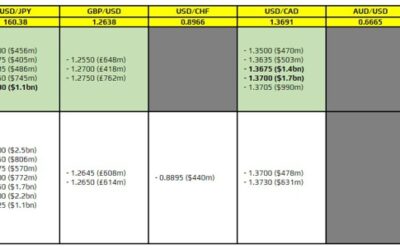

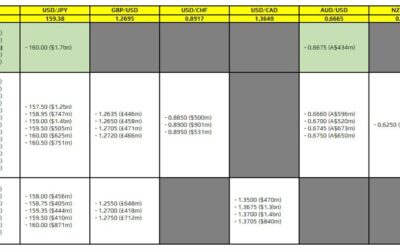

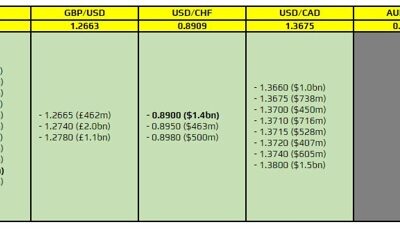

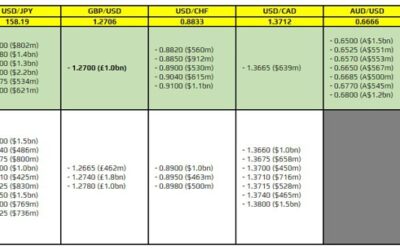

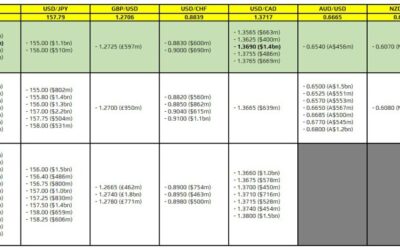

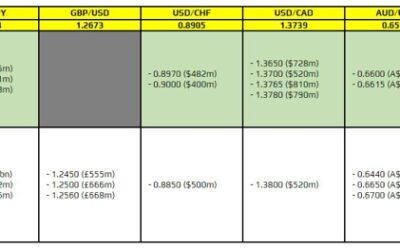

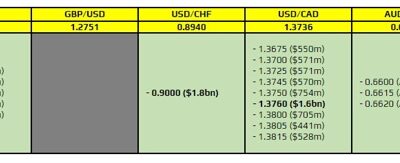

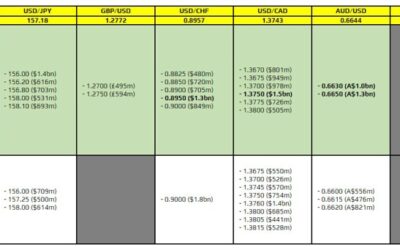

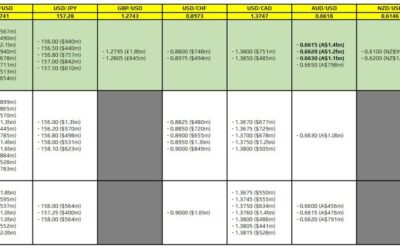

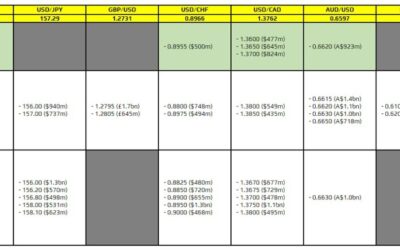

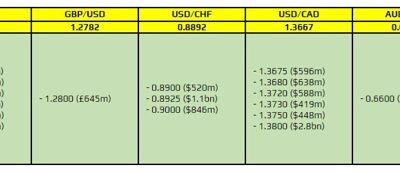

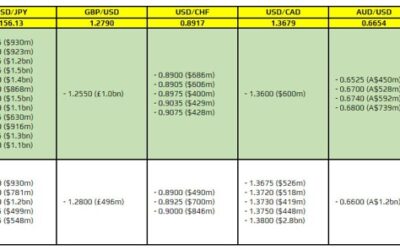

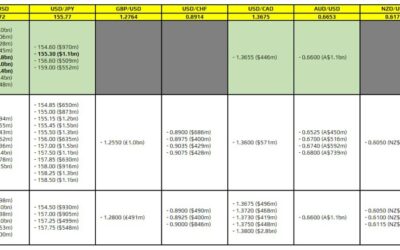

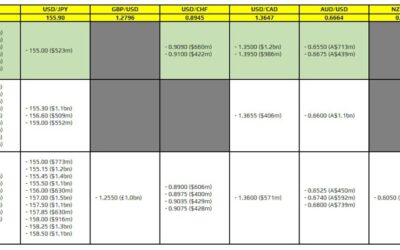

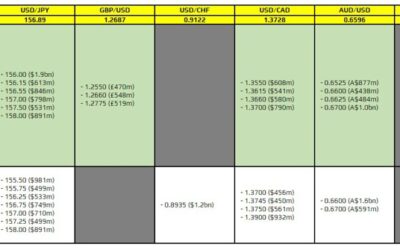

FX option expiries for 22 July 10am New York cut

There are a couple of large ones in the likes of EUR/USD, USD/JPY, and USD/CAD. However, they are all unlikely to feature as they are quite a distance away from the spot price currently. As such, the expiries should have no impact on price action with the focus to...

US Will Reveal Its Latest GDP Update

Joe Biden threw in the towel and announced that he quits the presidential race this weekend. He endorsed Vice President Kamara Harris to take his place. Harris said that she will do anything in her power to beat Trump, she got the support from Bill and Hillary Clinton...

EUR/CHF Weekly Outlook – Action Forex

EUR/CHF reversed after edging higher to 0.9772 but recovered after breaching 38.2% retracement of 0.9476 to 0.9772 at 0.9659. Initial bias is turned neutral this week first. Strong bounce from current level will maintain near term bullishness. Break of 0.9972 will...

EUR/AUD Weekly Outlook – Action Forex

EUR/AUD’s rebound from 1.5996 extended higher last week and broke through 55 D EMA (now at 1.6216). The development is taken as the first sign that whole correction from 1.0762 has completed with three waves down to 1.6000 fibonacci support. Further rise is expected...

EUR/GBP Weekly Outlook – Action Forex

EUR/GBP recovered after edging lower to 0.8382 last week. With break of 55 4H EMA (now at 0.8421), initial bias is mildly on the upside for stronger rebound to 55 D EMA (now at 0.8477). Nevertheless, outlook will stay bearish as long as 0.8498 resistance holds, and...

EUR/JPY Weekly Outlook – Action Forex

EUR/JPY’s fall from 175.41 short term top extended lower last week but recovered after hitting 169.98. Initial bias remains neutral this week first, and further fall is in favor as long as 172.91 resistance holds. Below 169.98 will target 38.2% retracement of 153.15...

GBP/JPY Weekly Outlook – Action Forex

GBP/JPY’s pullback from 208.09 extended lower last week but recovered after hitting 202.08. Initial bias remains neutral this week first. Further fall is in favor as long as 205.77 resistance holds. This decline from 208.09 might be correcting the whole rise from...

USD/CAD Weekly Outlook – Action Forex

USD/CAD’s strong rally last week suggests that consolidative pattern from 1.3845 has completed with three waves to 1.3588, after being supported by 38.2% retracement of 1.3716 to 1.3845 at 1.3589 Initial bias stays on the upside this week for 1.3790 resistance first....

AUD/USD Weekly Report – Action Forex

AUD/USD’s fall from 0.6798 short term top extended lower last week. Initial bias stays on the downside this week for 38.2% retracement of 0.6361 to 0.6798 at 0.6631. Strong rebound would be seen there to bring rebound. On the upside, above 0.6754 minor resistance will...

USD/CHF Weekly Outlook – Action Forex

USD/CHF dipped to 0.8819 last week as fall from 0.9223 tried to resumed, but recovered since then. Initial bias remains neutral this week first. Further decline is in favor as long as 0.8914 support turned resistance holds. Break of 0.8819 will target 61.8%...

GBP/USD Weekly Outlook – Action Forex

GBP/USD edged higher to 1.3043 last week but retreated since then. Initial bias remains neutral this week for consolidations first. Downside should be contained by 1.2859 resistance turned support to bring another rally. Break of 1.3043 will resume the rise from...

USD/JPY Weekly Outlook – Action Forex

USD/JPY’s correction from 161.94 extended to 155.36 last week but recovered since then. Initial bias remains neutral this week and further fall is expected with 158.85 resistance intact. Below 155.36 will target 38.2% retracement of 140.25 to 161.94 at 153.65. On the...

EUR/USD Weekly Outlook – Action Forex

EUR/USD edged higher to 1.0947 last week but retreated since then. Initial bias remains neutral this week first, and further rise is in favor as long as 1.0871 minor support holds. Break of 1.0947 will target 100% projection of 1.0601 to 1.0915 from 1.0665 at 1.0979....

Forex and Cryptocurrency Forecast – Action Forex

EUR/USD: FOMC – Are Surprises Expected on 31 July? This review will begin somewhat unusually, not from the start, but from the end of the past work week. On the evening of 18 July and the morning of the 19th, system administrators and users encountered non-functional...

Shift in Risk Sentiment a Short-Lived Anomaly or Start of a Longer Correction?

Last week proved to be a whirlwind for global markets, marked by a series of shocking events—from the failed assassination attempt on Donald Trump last weekend, to the historic global tech outage that occurred on Friday that brought significant attention but...

Weekly Economic & Financial Commentary: A String of Upside Surprises, but Growth is Slowing in the U.S.

Summary United States: A String of Upside Surprises, but Growth is Slowing in the U.S. Retail sales, housing starts and industrial production all surprised to the upside this week. Yet, an uptick in initial jobless claims was a reminder that conditions in the labor...

The Weekly Bottom Line: Nearing the Pivot Point

U.S. Highlights After an eerily calm few months, a fresh dose of volatility descended across global financial markets this week. Top Fed officials speaking this week noted that they are getting ‘closer’ to cutting interest rates. Financial markets have fully priced...

Weekly Market Outlook: US PCE, GDP, and Earnings Expected to Drive Volatility

This week, markets were influenced by trade war fears, US political developments, and a global cyber outage. In Asia, the Japanese yen weakened, and Chinese authorities remained silent on economic goals despite weak data. Next week, US PCE and GDP data, along with...

Summary 7/22 – 7/26

Monday, Jul 22, 2024 Tuesday, Jul 23, 2024 Wednesday, Jul 24, 2024 Thursday, Jul 25, 2024 Friday, Jul 26, 2024 The post Summary 7/22 – 7/26 appeared first on Action Forex.

GBP/USD: Cable Dips Further After Downbeat UK Retail Sales

Cable remains in red for the second consecutive day and extends pullback from new one-year high (1.3044). Weaker than expected UK retail sales increase pressure on sterling and add to bets for BoE rate cut in August (currently at 44%). Fresh bears broke below the...

US Dollar Index Outlook: Risk Aversion Lifts the Dollar

The dollar index extends recovery into second straight day, with strong bounce from new four-month low (103.31) on Thursday, being fueled by fresh risk aversion on global cyber outage, which hit financial centers, banks, airlines and many others, prompting investors...

EUR/USD Experiences Sharp Decline: Risk Appetite Heightens

The EUR/USD pair fell sharply to 1.0888, with investors speculating on the future of US interest rates and the potential implications of the upcoming presidential election, particularly as Donald Trump’s chances appear to be improving. These factors contribute to a...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0879; (P) 1.0911; (R1) 1.0928; More…. EUR/USD is still holding above 1.0871 support and intraday bias stays neutral. Further remains mildly in favor. Break of 1.0947 will resume the rise from 1.0601 and target target 100% projection of 1.0601 to...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2915; (P) 1.2968; (R1) 1.2997; More… Intraday bias in GBP/USD remains neutral at this point. Pullback from 1.3043 could extend lower but downside should be contained by 1.2859 resistance turned support to bring another rally. Above 1.3043 will...

Sunset Market Commentary – Action Forex

Markets One of the biggest-ever IT outages sparked volatility at the start of European trading but without lasting impact on general markets. A security update by CrowdStrike caused a global problem with Microsoft’s Windows. UK retail sales also printed at the onset...

AUD/USD: On Track for Biggest Weekly Drop Since Mid-April

Australian dollar continues to trend lower vs its US counterpart for the fifth consecutive day, on track for the biggest weekly loss since the second week of April. Bears have so far retraced 50% of 0.6575/0.6798 upleg and look for daily close below daily Kijun-sen...

Gold: Reversal or Typical Retreat?

Gold made an impressive 3% surge during the week, breaking May’s all-time highs. However, it then retreated to the downside, selling off throughout the second half of the week. What should you watch out for to see if this is a reversal? Pullbacks after making new...

Another Cut from BoC Will Bring Benchmark Interest Rate to 4.5%

Softer inflation in Canada in June provided a small relief after an upside surprise in May, and set the Bank of Canada up for another 25-basis point interest rate cut on Wednesday to build on its first cut in June. Similar to the June meeting, we think the central...

Week Ahead – Flash PMIs, US GDP and BoC Decision on Tap

US data awaited amid overly dovish Fed rate cut bets July PMIs to reveal how economies entered H2 BoC decides on monetary policy, may cut rates again Will investors add to their Fed rate cut bets? With investors ramping up their Fed rate cut bets, the US dollar...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8839; (P) 0.8859; (R1) 0.8898; More… Intraday bias in USD/CHF remains neutral for consolidations above 0.8819 temporary low. But further decline is expected as long as 0.9049 resistance holds. Break of 0.8819 will resume the fall from 0.9223 to...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 155.29; (P) 156.95; (R1) 157.84; More… Intraday bias in USD/JPY remains neutral at this point. Deeper decline is still expected as long as 158.85 resistance holds. Below 155.36 will extend the fall from 161.94, as a correction to rally from 140.25,...

Dollar Gains on Risk Aversion Amid Quiet Trading

Risk aversion continues to support Dollar in relatively quiet trading today. Both Sterling and Canadian Dollar weakened mildly after worse-than-expected retail sales data. Euro shrugged off dovish comments from some ECB officials. Meanwhile, Yen softened slightly...

Canada retail sales falls -0.8% mom in May, down further -0.3% mom in Jun

Canada’s retail sales fell -0.8% mom to CAD 66.1B in May, worse than expectation of -0.5% mom. Sales were down in eight of nine subsectors, led by decreases at food and beverage retailers. Core retail sales—which exclude gasoline stations and fuel vendors and motor...

USD/JPY Outlook: Bear-Trap Underpins But Recovery Still Faces Headwinds

USDJPY remains constructive on Friday and attempts to further extend Thursday’s strong bounce, with recovery being supported by signals of a double bear-trap, following a false break below pivotal Fibo support at 156.04 and thin daily cloud (spanned between 155.83 and...

Silver Sinks Below 30 – Action Forex

Silver erases June’s gains; eyes on 28.50 Technical signals favor the bears Silver’s performance took a hit, marking its worst week in 2024 as the US dollar switched to recovery mode and investors questioned China’s economic outlook. As a result, the metal swiftly...

Canadian Dollar Eyes Retail Sales Ahead of Rate Meeting

The Canadian dollar is calm on Friday. In the European session, USD/CAD is trading at 1.3717, up 0.08% on the day at the time of writing. We could see stronger movement in the North American session, with the release of Canadian retail sales. Will retail sales suffer...

ECB’s Villeroy: Market rate cut expectations “rather reasonable”

ECB Governing Council member Francois Villeroy de Galhau spoke on French radio BFM Business today, expressing that current market expectations for interest rate cuts seem “rather reasonable.” Markets are currently pricing in nearly two ECB rate cuts for the remainder...

ECB Not Confident that September Will Bring the Second Rate Ccut

TSM announced better-than-expected quarterly results and lifted its growth projections for this year’s revenue. Good news helped limiting the previous day selloff in chip stocks yesterday but couldn’t prevent the S&P500 and Nasdaq 100 from closing Thursday’s...

GBPJPY Retraces Lower After Hitting 16-year High

GBPJPY pulls back from its highest level since August 2008 RSI and MACD ease but remain in positive territories GBPJPY has been in a prolonged uptrend since early 2024, posting a 16-year high of 208.10 on July 11. However, the pair has been undergoing a pullback since...

USDCAD Advances Within Trading Range

USDCAD bounces off 1.3600 and 200-day SMA Momentum oscillators suggest more gains USDCAD has been still developing within a trading range of 1.3600 and 1.3790 since April 17, with strong support at the 200-day simple moving average (SMA). The recent rebound from...

ECB’s Simkus: Interest rates are getting lower, quite significantly

ECB Governing Council member Gediminas Simkus shared his views with reporters today, indicating that his outlook aligns with current market expectations, which anticipate two rate cuts this year. Simkus commented, “Interest rates are getting lower and, I think, will...

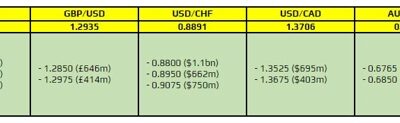

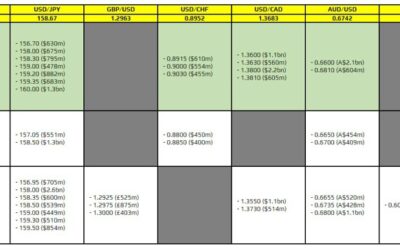

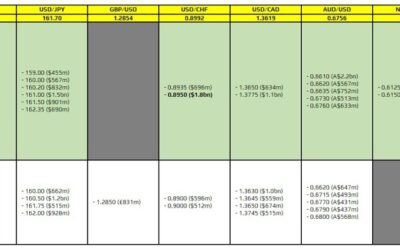

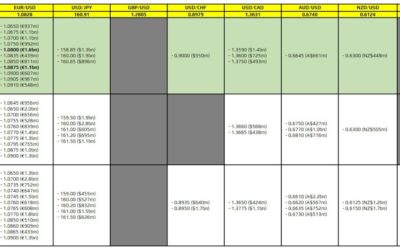

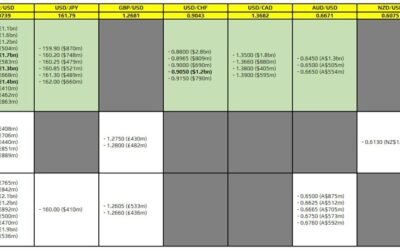

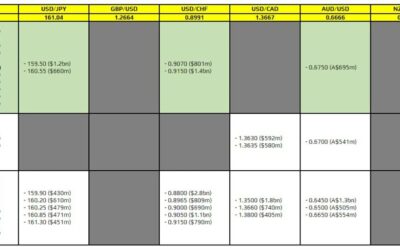

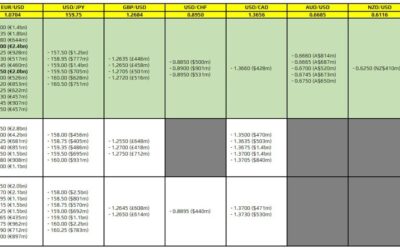

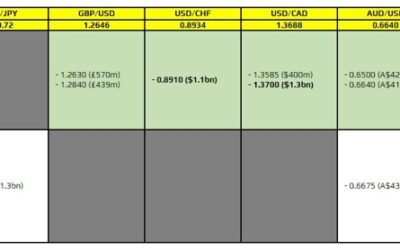

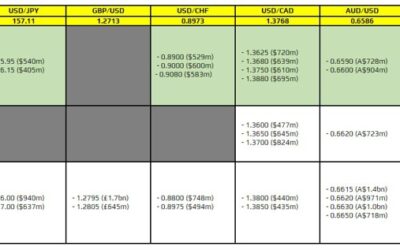

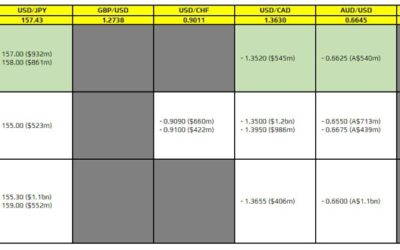

FX option expiries for 19 July 10am New York cut

There aren't any major expiries to take note of on the day. As such, trading sentiment will rely on the same key drivers from the day before mostly. The dollar saw recovery flows yesterday with yields pushing higher, so that will remain in contention in the session...

Dollar Strengthens as DOW Plunges; Yen Struggles to Extend Rally

Dollar rebounded broadly overnight following steep 500+ point selloff in DOW. Some analysts cited rotation away from big tech as the cause, but the decline was broad-based. Profit-taking could be a more likely factor after recent record runs, as traders and Fed...

(ECB) Monetary policy decisions – Action Forex

18 July 2024 The Governing Council today decided to keep the three key ECB interest rates unchanged. The incoming information broadly supports the Governing Council’s previous assessment of the medium-term inflation outlook. While some measures of underlying inflation...

ECB stands pat, headline inflation to stay above target well into next year

ECB left interest rates unchanged as wildly expected. Interest rates on the marginal lending facility and the deposit facility are held at 4.25%, 4.50% and 3.75% respectively. In the accompanying statement, ECB noted that incoming information broadly support the...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0907; (P) 1.0928; (R1) 1.0960; More…. Intraday bias in EUR/USD is turned neutral first with current retreat. Some consolidations would be seen below 1.0947 temporary top. But downside should be contained by 1.0871 support to bring another rally....

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2968; (P) 1.3006; (R1) 1.3048; More… A temporary top should be formed at 1.3043 as GBP/USD retreated after hitting rising channel resistance. Intraday bias is turned neutral for some consolidations first. Downside should be contained by 1.2859...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8790; (P) 0.8871; (R1) 0.8915; More… USD/CHF’s decline is still in progress and intraday bias stays on the downside. Fall from 0.9223 should target 60% retracement of 0.8332 to 0.9223 at 0.8672 next. On the upside, above 0.8884 minor resistance...

EUR/USD – Slightly Lower as ECB Holds Interest Rates

The euro has edged lower on Thursday. Early in the North American session, EUR/USD is trading at 1.0919, down 0.18% on the day. The euro hasn’t posted a losing day since July 9, gaining 1% during that period. ECB maintains rates at 3.75% The European Central Bank...

EUR/USD Outlook: Dips from New High Following ECB Decision

EURUSD eases further from new multi-week high (1.0948) as markets digested ECB’s decision to stay on hold and repeat its mantra that future action will be dependent on incoming economic data. On the other hand, confidence that the ECB will deliver two more rate cuts...

UK Jobs Data Cooled the Pound

The UK labour market is experiencing a cooling phase. The number of applications for unemployment benefits in June increased by 32.3K after a jump of 51.9K a month earlier. Prior to that, this indicator had been drifting for almost two years, adding an average of 2.5K...

JPY Technical Outlook: Price Action on USD/JPY, GBP/JPY

Japanese authorities have not confirmed whether they have intervened in the market to support the Yen. USD/JPY broke a long-term descending trendline but found support near the 100-day MA and 155.00 level. Price Action outlook and potential setups on USD/JPY and...

Is AUDCAD Ready to Extend Its Uptrend?

AUDCAD prints higher highs and higher lows RSI and MACD detect positive momentum Break above 0.9260 could signal trend continuation Dip below 0.9125 may allow a decent correction AUDCAD rebounded today from slightly above the support of 0.9270, marked by the low of...

Sunset Market Commentary – Action Forex

Markets The ECB kept its key policy rates unchanged today in an unanimous decision. In its policy statement, the central bank repeats that it doesn’t pre-commit to a particular rate path. They follow a meeting-by-meeting and data-dependent approach to determining the...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 155.29; (P) 156.95; (R1) 157.84; More… USD/JPY’s fall from 161.94 is seen as correcting whole rally from 140.25. Deeper decline is expected as long as 158.85 resistance holds, to 38.2% retracement of 140.25 to 161.94 at 163.65. On the upside, above...

Subdued Forex Trading as ECB Holds Rates Steady

Trading in the forex markets has been relatively subdued today. ECB’s decision to hold interest rates steady was widely expected, and President Christine Lagarde’s press conference did not introduce any significant new information. ECB’s accompanying statement...

US initial jobless claims rises to 243k vs exp 225k

US initial jobless claims rose 20k to 243k in the week ending July 13, above expectation of 225k. Four-week moving average of initial claims rose 1k to 235k. Continuing claims rose 20k to 1867k in the week ending July 6, highest since November 27, 2021. Four-week...

USDCHF Elliott Wave Analysis Favors Selling Bounces

Hello traders, welcome to a new blog post. Today, we will discuss the future path for the USDCHF currency pair. The recent breakout confirmed the bearish bias we shared with members of Elliottwave-Forecast. So, what is next for this pair in the coming weeks? On April...

Brent Oil Price Trends Upward Amid Positive Market Signals

Brent crude oil has reached $85.40, marking a continued increase over two consecutive sessions. This upward trend is primarily supported by recent US energy inventory statistics, which showed a significant decrease of 4.87 million barrels against an anticipated...

Change of Heart from Fed Governor Waller Significant

Markets We’ve given Fed governor Waller plenty of attention this year. He’s been the voice of the large minority inside the Fed who from the beginning of the year has been pushing to keep policy rates at their peak levels for longer. Markets had to gradually retrace...

Elliott Wave Intraday: Rally in Bitcoin (BTCUSD) Looking Impulsive

Rally from 7.5.2024 low in Bitcoin (BTCUSD) looks impulsive suggesting further upside. Pullback to 53570 ended wave ((4)) and Bitcoin has turned higher in wave ((5)). The crypto currency still needs to break the previous all-time high on 3.14.2024 high at 73794 to...

Commodity Currencies in Stable Ranges: Should We Expect a Breakout?

The currency pairs AUD/USD and USD/CAD, unlike the pairs with the Euro, Yen, and Sterling, continue to demonstrate long-term stability. These pairs have been trading in narrow price corridors for several months. Given the weakening of the dollar in many directions,...

USDJPY: What’s Happening With JPY? Scenarios after BoJ Intervention

Bullish Scenario: Buy above 156.45 with targets at 157.16, 157.90, and 158.10 in extension. Set S.L below 155.80 or at least 1% of the account’s capital. Apply Trailing Stop. Bearish Scenario: Sell below 157.16 or 157.90 (where a PAR* forms) with TP1: 156.00, 155.80,...

EURUSD Reaches the Midpoint of a Long-Term Downtrend

EURUSD rally slows down near 4-month high Gets bearish vibes, but positive trend is still alive above 1.0900 ECB to hold interest rates steady at 12:15 GMT; Will it signal a second rate cut? EURUSD took a breather after heightened expectations of a Fed rate cut lifted...

Some USD/JPY option expiries to be aware of for 10am NY time today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

WTI Oil Futures Hold Above 80.00

WTI futures rebound from a 3-week low Next target for the bulls is the July peak of 84.50 Momentum indicators are cautiously tilted to the upside WTI oil futures (August delivery) had been in a steady uptrend since early June before experiencing a pullback following...

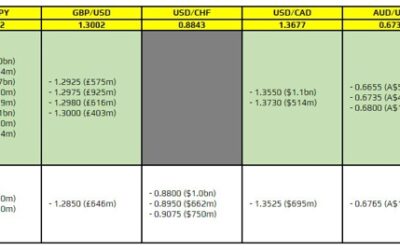

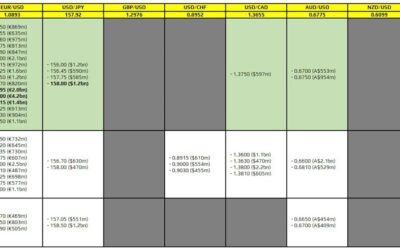

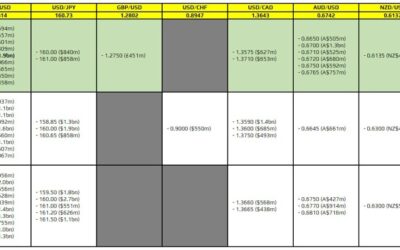

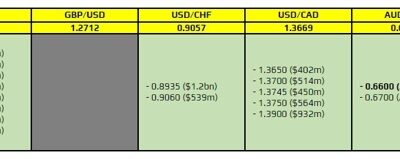

FX option expiries for 18 July 10am New York cut

There are a couple to take note of, as highlighted in bold.They are all for EUR/USD centered near the 1.0900 level. If anything else, that should help to limit any downside shoves in the session ahead at least before we get to the ECB policy decision later.Besides...

Euro Mixed as ECB Rate Decision Looms

While Euro maintains its strength against Dollar, its performance is more mixed against other major currencies. The market’s attention is now focused on the upcoming ECB rate decision and press conference. It is broadly anticipated that ECB will maintain deposit rate...

AUD/USD: Market Stabilizes Amid Rate Cut Expectations

The Australian dollar has stabilized against the US dollar, currently trading around 0.6738. This follows a period of decline influenced by ongoing speculations regarding the US Federal Reserve’s impending policy actions. Expectations are set for the Fed to initiate...

GBP Looks Stronger Than USD Thanks to Inflation

A batch of inflation statistics from the UK seems to have fuelled the Pound’s rally against the Dollar and Euro, which has been going strong since the beginning of the month. Consumer inflation remained at 2.0%, with the core index at 3.5% y/y. At the same time,...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2948; (P) 1.2965; (R1) 1.2992; More… GBP/USD’s rally resumed after brief consolidations and intraday bias is back on the upside. Current rise from 1.2298 should target 100% projection of 1.2298 to 1.2859 from 1.2612 at 1.3173, which is slightly...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0877; (P) 1.0900; (R1) 1.0916; More…. EUR/USD’s rally resumed after brief consolidations and intraday bias is back on the upside. Break of 1.0915 resistance should now extend the rise from 1.0601 to 100% projection of 1.0601 to 1.0915 from 1.0665...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8922; (P) 0.8951; (R1) 0.8967; More… Intraday bias in USD/CHF is back on the downside as fall from 0.9049 resumed through 0.8914 temporary low. Deeper decline is expected to retest 0.8825 support next. Firm break there will resume whole fall from...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 157.93; (P) 158.39; (R1) 158.88; More… USD/JPY’s fall from 161.94 resumed by breaking through 157.16 support and intraday bias is back on the downside. Current decline is seen as correcting whole rally from 140.25. Sustained trading below 55 D EMA...

Sunset Market Commentary – Action Forex

Markets After last-week’s softer than expected US CPI data, global investors gained ever greater confidence that the Fed will embark for a genuine, protracted easing cycle soon. Yields turned south, especially at the short end of the (US) yield curve. The dollar faced...

Australian Dollar Eyes Employment Report

The Australian dollar is steady on Wednesday. AUD/USD is trading at 0.6743 early in the North American session, up 0.08% on the day. Australia releases the June employment report early on Thursday. The market estimate stands at 20 thousand, compared to 39.7 thousand...

USD/JPY Outlook: Sharply Down, Markets Suspect Intervention

USDJPY was sharply down on Wednesday (down 1.3% during the European / early US session), with markets suspecting another intervention, after Japan’s authorities intervened in the market and pushed yen away from the lowest levels in nearly four decades.. Although...

Fed’s Waller suggests rate cuts may be nearing

In a speech today, Fed Governor Christopher Waller stated that Fed is “getting closer” to the time when a cut in the policy rate is warranted. He noted that Q2 data on inflation and the labor market has moderated, suggesting that “progress toward...

EUR/CHF Technical: Euro Underperformance Over Swiss Franc May Have Resumed

The recent 4-week rally of EUR/CHF from 19 June has started to show signs of exhaustion. The ongoing weakness of the France CAC 40 has triggered a negative feedback loop towards EUR/CHF. Watch the 0.9780 key short-term resistance on the EUR/CHF. The EUR/CHF cross pair...

Yen Jumps Amid Rumored Intervention; Pound Rises with Fading BoE Rate Cut Hopes

Yen surged significantly against all major currencies during European session, with speculation on whether Japan has intervened again in the markets. Last week, it was rumored that Japanese authorities had spent JPY 3.5 trillion to prop up Yen. Despite this, top...

Gold Shines at Fresh All-Time High

Gold ends sideways trajectory; enters uncharted territory Short-term bias positive but overbought signals suggest some caution A close above 2,480 might be necessary to boost buying confidence Gold bulls powered ahead to finally exit the three-month range and chart an...

GBP/USD Outlook: Cable Rises Above 1.3000 and Hits New 2024 High

Cable surged through psychological 1.30 barrier and hit its highest in one year on Wednesday, after hotter than expected UK June inflation data tempered expectations for first BoE rate cut in next month policy meeting. Fresh strength after a two-day pause for...

Fed’s Williams sees positive signs in inflation trend, awaiting more data

New York Fed President John Williams, in an interview with the Wall Street Journal, indicated that recent inflation readings over the past three months are “getting us closer to a disinflationary trend that we’re looking for,” noting these as “positive signs.”...

Market Analysis: AUD/USD and NZD/USD Poised For Fresh Gains

AUD/USD is attempting a fresh increase from the 0.6715 support. NZD/USD is also rising and could target the 0.6090 resistance. Important Takeaways for AUD/USD and NZD/USD Analysis Today The Aussie Dollar found support at 0.6715 and recovered higher against the US...

Eurozone CPI finalized at 2.5% in Jun, core at 2.9%

Eurozone CPI was finalized at 2.5% yoy in June, down from May’s 2.6% yoy. CPI core (ex-energy, food, alcohol & tobacco) was finalized at 2.9% yoy, unchanged from prior month’s reading. The highest contribution to annual inflation rate came from services (+1.84...

Analysis of XAU/USD: Gold Price Sets Historical Record

As the XAU/USD chart shows, on 16th July, the gold price rose above $2460 for the first time in history. The bullish sentiment is driven by: → Anticipation of Fed rate cuts, as the appeal of non-yielding bullion generally increases in low-interest-rate environments. →...

XAU/USD Outlook: Gold Hits New Record High

Gold hit new record high early Wednesday ($2482), following acceleration through former top on Tuesday (metal was up 1.9% for the day, the biggest daily gain since Dec 13). Break above previous all-time high ($2450) signaled an end of corrective phase ($2450/$2286)...

EURGBP Trades to a New 2024 Low

EURGBP drops to the lowest level since August 2022 Political unrest and weaker economic data keep the euro under pressure Momentum indicators could point to a reversal soon EURGBP is hovering around the lowest level since August 2022, having recorded a decent...

GBPUSD Hits Fresh 1-Year High

GBPUSD jumps to fresh 1-year high after UK CPI surprises slightly higher Technical indicators point to overbought conditions following steep rally UK employment figures next on the agenda due on Thursday 06:00 GMT The UK CPI inflation data on Wednesday gave GBPUSD a...

FX option expiries for 17 July 10am New York cut

There is just one to take note of, as highlighted in bold.That being for USD/JPY at the 158.50 level. It isn't one that holds any technical significance but could help to keep price action more contained before we get to US trading. That said, be wary of any surprises...

Sterling Steady, Kiwi Rebounds, Gold Hits Record

Forex markets have been relatively subdued today. Sterling remains steady after June’s UK CPI data revealed that both headline and core inflation were unchanged from the previous month. Significantly, services inflation also failed to cool, which could keep BoE...

US retail sales steady in Jun, ex-auto sales up 0.4% mom

US retail sales was steady mom at USD 704.3B in June, above expectation of -0.20% mom. Ex-auto sales rose 0.4% mom to USD 573.6B, above expectation of 0.1% mom. Ex-gasoline sales rose 0.2% mom to USD 652.4B. Ex-auto and gasoline sales rose 0.8% mom to USD 507.1B....

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0877; (P) 1.0900; (R1) 1.0916; More…. EUR/USD’s retreat from 1.0921 extends lower today but stays well above 1.0805 support so far. Intraday bias remains neutral first. Some more consolidations would be seen but further rally is in favor. Firm...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2955; (P) 1.2975; (R1) 1.2988; More… Intraday bias in GBP/USD remains neutral for consolidations below 1.2994 temporary top. But further rally is expected as long as 1.2859 resistance turned support holds. Above 1.2994 will resume the rally from...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8937; (P) 0.8955; (R1) 0.8975; More… Intraday bias in USD/CHF stays neutral first. Another fall is mildly in favor with 0.9000 resistance intact. Below 0.8914 will bring retest of 0.8825 low. However, break of 0.9000 will turn bias back to the...

U.S. Headline Retail Sales Flat in June, But Core Accelerated

Retail sales was virtually unchanged month-over-month in June. Despite this, the reading was still higher than the consensus forecast calling for a decrease of -0.3%. Additionally, May’s figure was revised upwards to a 0.3% monthly gain (previously 0.1%). Trade in the...

Canadian Inflation Eases, But Details a Mixed Bag

Headline CPI inflation decelerated in June to 2.7% year-on-year (y/y), right on consensus expectations and below last month’s 2.9% y/y print. The deceleration was led by gasoline prices, which dropped 3.1% month-on-month (m/m), compared to the +5.6% m/m gain last...

Kiwi Coming into Strong Support Ahead of Inflation Data

NZDUSD is coming out of consolidation, suggesting that the price action since the start of July was a triangle in wave B. Therefore, the whole retracement from June 12th is much more complex and deeper but still has a corrective shape. It looks like we are just...

USD/CAD Steady After Canadian CPI, US Retail Sales

The Canadian dollar is showing limited movement on Tuesday. In the North American session, USD/CAD is trading at 1.3687, up 0.03% on the day at the time of writing. Canada’s CPI lower than expected Canada followed the US and posted a better-than-expected inflation...

ECB Could Disappoint Expectations for a Dovish Shift

ECB meets with near zero chances for a rate cut ECB members continue to disagree about the rates outlook A dovish shift looks unlikely as the focus rests with the Fed Euro showing unexpected strength despite political unrest ECB meets but all eyes remain on the US The...

Gold’s Astounding Rally and the Challenges Ahead

Gold gains around 18% year-to-date But is it time for the uptrend to cool down a bit? Even if so, the broader outlook remains positive Gold shines bright Gold had a great year-to-date performance, gaining around 18% and hitting a record high of 2450 on May 20. As...

Sunset Market Commentary – Action Forex

Markets Global core bonds gained some ground going into today’s main dish, US retail sales. UK gilts slightly outperformed Bunds and Treasuries as markets gear for tomorrow’s June CPI numbers. A further easing on all accounts is expected but the sub 2% drop in the...

Dollar Gains After Retail Sales Boost; Gold Nears New Record

Dollar bounces higher in early US session, buoyed by stronger-than-expected retail sales data. This resilience in consumer spending comes despite the persistent high inflation and elevated interest rates. The robust retail sales figures lend support to Fed’s soft...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 157.32; (P) 157.88; (R1) 158.57; More… Intraday bias in USD/JPY remains neutral for consolidations above 157.61. On the downside, break of 157.16 and sustained trading below 55 D EMA (now at 157.72) will bring deeper correction to 38.2% retracement...

Canada CPI slows to 2.7% yoy in June, down-0.1% mom

Canada’s CPI slowed from 2.9% yoy to 2.7% yoy in June. The deceleration was largely the result of slower year-over-year growth in gasoline prices, which rose 0.4% in June following a 5.6% increase in May. Excluding gasoline, the CPI rose 2.8% yoy. Looking at the core...

GBP/USD Faces Challenges in Breaking Through Key 1.3000 Level

GBP/USD struggles to break above the 1.3000 level despite softer US data and a dovish comment from Fed Chair Powell. UK inflation data will be crucial in determining whether GBP/USD can break above 1.3000. Technical analysis suggests GBP/USD may struggle to break...

USD/JPY: May fall Further If US Retail Sales Miss in June

USDJPY remains in extended consolidation of last week’s sharp fall, sparked by US inflation data and intervention by Japanese authorities. Near-term action is holding above 55DMA (157.55) which repeatedly contained dips and marks solid support for now. Traders also...

XAU/USD: Gold Advances Further on Powell’s Dovish Stance

Gold price rose further in early Tuesday following more dovish tones from Fed Powell in his speech on Monday, which contributes to growing expectations that the Fed may soon decide to start cutting interest rates. Powell pointed to the recent inflation data which...

Gold Nears Record High as Fed Rate Cut Looms

Gold prices have surged, reaching $2430 per troy ounce on Tuesday, flirting with historic highs. The recent spike in gold prices is largely attributed to comments made by Federal Reserve Chairman Jerome Powell, which have bolstered expectations of an impending...

German ZEW falls to 41.8, first decline in a year

Germany ZEW Economic Sentiment fell from 47.5 to 41.8 in July, below expectation of 44.3. That’s also the first decline in a year since July 2023. Current Situation Index rose from -73.8 to -68.9, above expectation of -73.0. Eurozone ZEW Economic Sentiment fell from...

Eurozone goods exports fall -0.5% yoy in May, imports down -6.4% yoy

Eurozone goods exports fell -0.5% yoy to EUR 241.5B in May. Goods imports fell -6.4% yoy to EUR 227.6B. Trade balance showed a EUR 13.9B surplus. Intra-Eurozone trade fell -5.6% yoy to EUR 216.0B. In seasonally adjusted term, goods exports fell -2.6% mom to EUR...

NZD: Will Bearish Momentum Halt?

The NZDUSD pair remains under pressure near 0.6075 in early Asian trading on Tuesday, affected by weak Chinese economic data and a modest rebound in the US Dollar. Attention is on the upcoming US Retail Sales data for June. Focus will also shift to New Zealand’s CPI...

EURJPY Pulls Back from 32-Year High

EURJPY jumped to its highest since January 1992 last week But corrected lower after suspected Japanese intervention Oscillators weaken but remain above neutral zones EURJPY has been in a steep uptrend since the beginning of the year, storming to consecutive multi-year...

FX option expiries for 16 July 10am New York cut

There is one to really take note of on the day, as highlighted in bold.It is for EUR/USD and seen at the 1.0900 level once again. That is likely to help contain price action and limit any overextensions beyond the figure level, at least until we get to the US retail...

Yen Softens as Rebound Fades; Loonie Looks to Canadian CPI

Yen weakened broadly during Asian session today, giving back some of last week’s strong gains that were reportedly driven by Japan’s market intervention. Japan’s Chief Cabinet Secretary Yoshimasa Hayashi repeated in a press conference that it is crucial for currency...

Nikkei Index Has Risen To a Two-Month High

As we reported on 26th June, analysing the Nikkei 225 chart (Japan 225 on FXOpen): → The price is in a significant upward trend (shown by the blue channel); → The price may continue to rise along the median line. Since then, the Nikkei 225 index (Japan 225 on FXOpen)...

Bitcoin Has Surfaced Following a Dive

Market picture On Sunday, the cryptocurrency market moved to a rapid rise, completing a consolidation after a correction. Cryptocurrencies positively played off the strengthening chances of Trump’s victory after the assassination attempt. In addition, buyers were...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0876; (P) 1.0893; (R1) 1.0925; More…. No change in EUR/USD’s outlook and intraday bias remains on the upside for the moment. Decisive break of 1.0915 resistance will resume whole rise from 1.0601 to 100% projection of 1.0601 to 1.0915 from 1.0665...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2930; (P) 1.2960; (R1) 1.3019; More… No change in GBP/USD’s outlook and intraday bias remains on the upside. Rise from 1.2298 is in progress for 100% projection of 1.2298 to 1.2859 from 1.2612 at 1.3173, which is slightly above 1.3141 key medium...

Sunset Market Commentary

Markets Some segments of the US yield curve disinverted in the wake of the Trump shooting. The presidential candidate’s odds to win the November election have increased as a result. His pro-business (for the US at least) agenda is seen as a boost to the economy as...

News of the Week (July 15—19): EURGBP Outlook!

The EURGBP, representing the exchange rate between the Euro and the British Pound, is a key measure of economic interplay between the Eurozone and the United Kingdom. The Euro’s value is primarily influenced by the financial policies and performance of the Eurozone...

A Clearer Shape of a Long-Term Dollar Decline

While Trump’s rise to power is widely seen as a positive for the dollar, the dollar index hit a one-month low on Monday as it continues to rebound from the Fed’s latest softening tone and inflation slowdown. The impact of Trump’s policies on the dollar is largely...

Bullish Pound Eyes $1.30 Ahead of UK Inflation Test

June CPI numbers the highlight of this week’s UK data flurry Could the Bank of England cut interest rates next month? Pound undeterred as it extends July gains Job stats and retail sales to follow Wednesday’s CPI report (06:00 GMT) On target Inflation in the UK peaked...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8927; (P) 0.8949; (R1) 0.8966; More… Intraday bias in USD/CHF is neutral for the moment, but further fall is expected with 0.9000 resistance intact. Below 0.8914 will target 0.8825 low. Break of 0.8825 will target 50% retracement of 0.8332 to...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 157.03; (P) 158.24; (R1) 159.12; More… USD/JPY’s fall from 161.94 is seen as correcting the whole five-wave rally from 140.25. Deeper decline is in favor and sustained trading below 55 D EMA (now at 157.67) will affirm this bearish case. Next target...

Calm Markets Await Powell’s Insights on Disinflation and Rate Cuts

Global financial markets lack clear direction today. Major European stock indexes are trading slightly lower, while US futures indicate a modestly higher open. Investors are unfazed by the assassination attempt on former US President Donald Trump, maintaining a calm...

GBP/USD Outlook: Cable Holding Near 1.3000 Barrier Ahead of Powell’s Speech

Cable keeps form tone on Monday and hit new yearly high, trading just ticks under psychological 1.30 barrier. The pair advanced strongly in past two weeks and bulls may start to lose traction on facing headwinds from 1.30 resistance, as daily studies are overbought,...

Gold’s Rally Stalls at 7-Week High

Gold jumped to its highest level since May 22 last week But fails to extend rally, trading flat in past couple of sessions Despite latest weakness, oscillators remain positively tilted Gold has been experiencing solid gains since late June, with the break above its...

Oil Price Update – Oil Prices Hold Firm as Chinese Demand Concerns Rise

Oil prices remain stable despite a turbulent weekend and a strong US dollar. Chinese economic data, including disappointing GDP growth and declining refinery output, raises concerns about oil demand. The focus shifts from supply concerns in the US to demand worries in...

NZ Dollar Dips After Soft Services PMI

The New Zealand dollar has started the trading week in negative territory. NZD/USD is trading at 0.6097 in the European session, down 0.35% on the day at the time of writing. New Zealand Services PMI slips The week started on a sour note in New Zealand as the Services...

EURUSD Jumps to a Fresh 1-month High

EURUSD edges higher after break above SMAs The pair advances to its highest level since June 4 Oscillators suggest that bullish forces are strengthening EURUSD has been in a steady uptrend after the bullish breakout from its downward sloping trendline in place since...

Japanese Yen Surges Amidst Potential Interventions

The Japanese yen showed significant strength against the US dollar late last week, with the USD/JPY pair currently stabilizing around 157.86. This marks the lowest level for the currency pair in nearly a month. The yen’s recent surge is attributed to widespread market...

Copper (HG_F) Elliott Wave : Buying the Dips at the Equal Legs Zone

In this technical article we’re going to take a quick look at the Elliott Wave charts of Copper (HG_F) commodity , published in members area of the website. As our members know, Copper has recently given us correction against the October 2023 low. The commodity...

Eurozone industrial productions falls -0.6% mom in May, EU down -0.8% mom

Eurozone industrial production fell -0.6% mom in May, better than expectation of -1.0% mom. Production decreased by -1.0% for intermediate goods, 1.2% for capital goods, and 1.8% for durable consumer goods. Production increased by 0.8% for energy, and 1.6% for...

Bitcoin Once Again Above $60k

Analysing the long-term BTC/USD chart from 16th May, we constructed a “roadmap” for Bitcoin’s price, resembling an expanding fan consisting of a median and support levels below it, and resistance levels above it. Reviewing the BTC/USD chart last time (9 thJuly), we...

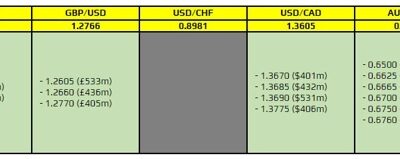

FX option expiries for 15 July 10am New York cut

There are a couple to take note of, as highlighted in bold.The first ones are for EUR/USD, centered closely in and around the 1.0900 mark. The ones at the figure level are quite huge in size, so they could act as a magnet on price action for the session ahead. That at...

Weaker China GDP Dampens Sentiment; ECB and Global Inflation Data Highlight the Week

Asian markets began the week with a cautious tone, as weaker-than-expected GDP growth from China dampened investor sentiment, even though the selloff in stocks has been limited. Today’s set of data, coupled with recent weak PMI readings, points to broader deceleration...

Gold as an Investment: Detailed Analysis and Price Forecasts for 2025-2050

Since ancient times, gold has remained a crucial element of global economies. Its unique properties have made it not only valuable as jewellery but also a reliable means of preserving wealth. Today, this metal constitutes a significant part of both investor portfolios...

Summary 7/15 – 7/19

Monday, Jul 15, 2024 Tuesday, Jul 16, 2024 Wednesday, Jul 17, 2024 Thursday, Jul 18, 2024 Friday, Jul 19, 2024 The post Summary 7/15 – 7/19 appeared first on Action Forex.

June Inflation Report and BOS Survey Set the Stage for BoC’s Next Rate Cut

The Bank of Canada’s quarterly Business Outlook Survey (BOS) and June’s inflation data will be the last major data releases before the BoC’s next interest rate announcement on July 24. We expect a slowdown in inflation after an upside surprise in May and for the BOS...

EUR/CHF Weekly Outlook – Action Forex

EUR/CHF’s late breach of 0.9754 resistance last week suggests that rise from 0.9476 is resuming. Initial bias is back on the upside this week. Further rally would be seen to retest 0.9928 high. On the downside, however, break of 0.9677 will turn bias to the downside...

EUR/AUD Weekly Outlook – Action Forex

EUR/AUD’s consolidation from 1.5996 continued last week and outlook is unchanged. Initial bias stays neutral this week first. While another recovery cannot be ruled out, further decline is expected as long as 1.6211 resistance holds. Break of 1.5996 will resume larger...

Dollar Plummets as Markets Brace for Double or Even Triple Fed Rate Cuts This Year

Dollar weakened broadly last weeks market expectations on Fed’s policy path shifted dramatically. The June US CPI report continued the narrative painted by the previous week’s Non-Farm Payroll data, both suggesting further cooling in economic activity and easing price...

EUR/GBP Weekly Outlook – Action Forex

EUR/GBP’s late break of 0.8396 support suggests that larger down trend is resuming. Initial bias remains on the downside this week. Next near term target is 61.8% projection of 0.8619 to 0.8396 from 0.8498 at 0.8360. Firm break there could prompt downside acceleration...

GBP/JPY Weekly Outlook – Action Forex

GBP/JPY retreated sharply after edging higher to 208.09 last week. Considering bearish divergence condition in 4H MACD, a short term top should be in place. Deeper pullback could be seen through 203.82 temporary low. But downside should be contained by 38.2%...

USD/CAD Weekly Outlook – Action Forex

USD/CAD edged lower to 1.3588 last week but recovered after hitting 1.3589 support. Initial bias remains neutral this week first. On the downside, firm break of 1.3589 will extend the corrective pattern from 1.3845 and target 100% projection of 1.3845 to 1.3589 from...

AUD/USD Weekly Report – Action Forex

AUD/USD’s rally from 0.6361 continued last week and outlook is unchanged. Initial bias stays on the upside this week for 61.8% projection of 0.6361 to 0.6713 from 0.6619 at 0.6837. Decisive break there could prompt upside acceleration through 0.6870 resistance to 100%...

GBP/USD Weekly Outlook – Action Forex

GBP/USD’s strong break of 1.2859 resistance last week confirmed resumption of rally from 1.2298. Initial bias stays on the upside this week. Next target is 100% projection of 1.2298 to 1.2859 from 1.2612 at 1.3173, which is slightly above 1.3141 key medium term...

USD/JPY Weekly Outlook – Action Forex

USD/JPY’s sharp decline last week confirmed short term topping at 161.94. Considering bearish divergence condition in D MACD, fall from 161.94 is likely corrective whole five-wave rally from 140.25. Risk will stay on the downside as long as 160.25 support turned...

EUR/USD Weekly Outlook – Action Forex

EUR/USD’s rally continued last week and hit as high as 1.0910. Initial bias stays on the upside this week. Firm break of 1.0915 will resume howl rise from 1.0601 to 100% projection of 1.0601 to 1.0915 from 1.0665 at 1.0979. On the downside, below 1.0859 minor support...

USD/CHF Weekly Outlook – Action Forex

USD/CHF’s fall from 0.9049 continued last week despite interim recovery. As noted before, rebound from 8825 should have completed after rejection by channel resistance. Deeper decline is expected as long as 0.9000 resistance holds, to 0.8825 low. Break of 0.8825 will...

EUR/JPY Weekly Outlook – Action Forex

EUR/JPY fell sharply after edging higher to 175.41 last week. Considering bearish divergence condition in 4H MACD, a short term top should be in place. Deeper correction cannot be ruled out. But for now, downside should be contained by 170.87 and bring rebound, to set...

Weekly Economic & Financial Commentary: Balanced Risks Drive the FOMC Closer to a September Rate Cut

Summary United States: Fed’s Challenge: Making Sure Fire Is Out vs. Water Damage We learned this week that CPI declined in June and core prices rose at the slowest clip since early 2021. With the inflation target in sight, Fed policymakers are taking stock of...

The Weekly Bottom Line: U.S. – Inflation Cooling

U.S. Highlights U.S. inflation eased by more than expected in the month of June, raising the likelihood of a September rate cut. Small business confidence continued to edge higher in June, though several forward-looking indicators suggests some softening in the months...

The Week Ahead – ECB Spotlight as Fed Rate Speculations Drive Market Shifts

US inflation data caused a significant selloff in US mega-cap tech stocks and a shift towards riskier areas of the market. The ECB interest rate decision is expected to bring no change, but the bank lending survey may shed light on the impact of higher rates on the...

Market Analysis: GBP/USD Eyes 1.3000 While EUR/GBP Struggles

GBP/USD is gaining pace above the 1.2900 resistance. EUR/GBP declined and is now consolidating losses above the 0.8400 region. Important Takeaways for GBP/USD and EUR/GBP Analysis Today The British Pound is attempting a fresh increase above 1.2950. There is a key...

Nasdaq 100 Index Fell Despite Positive Inflation News

Yesterday, Consumer Price Index (CPI) values were published, indicating a slowdown in the rate of inflation in the USA. According to ForexFactory: → CPI month-on-month: actual = -0.1%, forecast = 0.1%, previous month = 0.0%; → CPI year-on-year: actual = 3.0%, forecast...

NZ Dollar Edges Higher Despite Soft Mfg. Data

The New Zealand dollar is slightly higher on Friday. NZD/USD is trading at 0.6110 in the European session, up 0.24% on the day at the time of writing. New Zealand dollar showing big swings It has been a volatile few days for the New Zealand dollar. On Wednesday,...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 156.97; (P) 159.37; (R1) 161.30; More… No change in USD/JPY’s outlook. Deeper decline is expected with 160.25 support turned resistance intact. Fall from 161.94 is seen as corrective the five-wave rally from 140.25. Sustained break of 55 D EMA (now...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8919; (P) 0.8961; (R1) 0.9007; More… No change in USD/CHF’s outlook as further decline is expected with 0.9000 resistance intact. Deeper decline would be seen to 0.88825 support. Fall from 0.9223 should be in progress with near term channel...

EUR/USD Outlook: Bulls Hold Grip for Further Advance

EURUSD continues to trend higher, with minimal negative impact from hotter than expected US PPI data (Jun 0.2% m/m vs 0.1% f/c and 0.0% in May). The latest bull-leg extends into third straight and day pressuring Thursday’s post US CPI spike high (1.0898) which guards...

Week Ahead – ECB Set to Hold Rates, Plethora of Data on the Way

ECB is not expected to cut in July but will it signal one for next meeting? Retail sales will be the main highlight in the United States UK CPI report will be vital for BoE’s August decision China GDP data to kickstart busy week ECB meets amid sticky inflation The...

A September Fed Rate Cut Could Lead to Easing Spree During end-2024

Market prices in at least two rate cuts from Fed ECB, BoE expected to follow suit despite divergent economic conditions SNB and BoC could ease further; RBNZ possibly close to a summer rate cut BoJ and RBA could surprise with rate hikes during 2024 We are halfway into...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2858; (P) 1.2903; (R1) 1.2960; More… Intraday bias in GBP/USD remains on the upside for the moment. Decisive break of 61.8% projection of 1.2298 to 1.2859 from 1.2612 at 1.2959 would prompt upside acceleration through 1.3141 resistance to 100%...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0829; (P) 1.0864; (R1) 1.0904; More…. No change in EUR/USD’s outlook and intraday bias stays on the upside for retesting 1.0915 resistance. Decisive break there will resume whole rally from 1.0601 and target 100% projection of 1.0601 to 1.0915...

Dollar Softens Post-PPI Release, Yet Selling Momentum Remains Limited

Dollar is under some selling pressure in early US session despite stronger-than-expected PPI readings. However, downside momentum of the greenback is relatively limited. The post-CPI selloff yesterday did not gain significant traction, partly because stock markets...

US PPI rises 0.2% mom, 2.6% yoy, largest annual advance in more than a year

US PPI for final demand rose 0.2% mom in June, slightly above expectation of 0.1% mom. PPI rose 2.6% yoy for the 12 months ended in June, above expectation of 2.2% yoy. That’s also the largest annual advance since March 2023. PPI less foods, energy, and trade services...

Analysis of USD/JPY: Was There an Intervention?

Yesterday’s news of slowing inflation in the US sharply weakened the dollar, anticipating the Federal Reserve’s monetary easing. In the first 15 minutes after the data release: → EUR/USD rose by approximately 0.45% to the psychological level of 1.09; → GBP/USD...

Corporates Have Weighed in on Crypto Once Again

Market picture The crypto market capitalisation fell by 0.8% in 24 hours to $2.11 trillion. An attempt to strengthen the market’s offensive on news about inflation in the US attracted new sellers, which this time can easily be linked to the similar dynamics of the...

USD/JPY Stabilizes After Massive Slide

The Japanese yen has edged lower on Friday, after posting huge gains a day earlier. USD/JPY is trading at 159.16 in the European session, up 0.26% on the day at the time of writing. Japanese yen soars – soft US inflation or intervention? The US dollar was down against...

Cliff Notes: Shifting Risks and Rhetoric

Key insights from the week that was. The July Westpac-MI Consumer Sentiment Survey confirmed that households remain downbeat, with the headline index falling 1.1% to 82.7. The latest update continues to speak to a challenging context, characterised by a resurgence in...

GBPJPY Hits 20-Day SMA After Multi-Year High

GBPJPY may start bearish correction Stochastics move down; RSI ticks up GBPJPY suffered significant losses following an aggressive rally to the multi-year high of 208.10. The pair found immediate support at the 20-day simple moving average (SMA) of 203.80, keeping the...

XAU/USD: Gold May Rally Further After US CPI Data Boosted Bets for September Fed Rate Cut

Gold price eases from new seven-week high on Friday morning, as traders took some profits from Thursday’s 1.9% post-US CPI data rally. The yellow metal received fresh boost from cooler than expected US inflation, which boosted bets (93% from 70% before the data) for...

Japanese Yen Surges: Potential Intervention Amid Inflation Shocks

The USD/JPY pair experienced a significant drop to 159.06, driven by sharp declines following the release of unexpectedly low US inflation figures and potential interventions from Japanese authorities. On Thursday, the pair plunged nearly 3%, prompted by US inflation...

USDCAD Trades Sideways as 200-SMA Provides Support

USDCAD is rangebound in the past few sessions The 200-day SMA caps the pair’s downside Momentum indicators are negatively tilted USDCAD had been hovering around its 50-day simple moving average (SMA) for the past two months, appearing incapable of clearing this...

FX option expiries for 12 July 10am New York cut

There are a couple to take note of, as highlighted in bold.The first being for EUR/USD at the 1.0850 level. That could be a bit of a magnet for price action and if anything else, limit any major pullback to the gains from yesterday. That is before the expiries roll...

Yen’s Sharp Rally Pauses, Japan Declines to Confirm Intervention

Japanese Yen is currently the best performer of the week, bolstered by alleged intervention by Japanese authorities overnight. Both Finance Minister Shunichi Suzuki and outgoing top currency official Masato Kanda declined to confirm whether Japan had intervened, with...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 161.38; (P) 161.59; (R1) 161.93; More… USD/JPY declines sharply in early US session and breaks 160.25 support decisively. Considering bearish divergence condition in D MACD, fall from 161.49 might already be correcting the whole five-wave rally from...

US: Inflationary Pressures Cool Faster than Expected in June, Bolstering Case for September Rate Cut

The Consumer Price Index (CPI) fell 0.1% month-on-month (m/m), below the consensus forecast calling for a modest 0.1% gain. On a twelve-month basis, CPI edged lower by 0.3 percentage points to 3.0%. Lower energy prices – largely attributed to a 3.7% decline in...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8973; (P) 0.8987; (R1) 0.9011; More… USD/CHF’s decline from 0.9049 resumed by breaking through 0.8942 support and intraday bias remains is back on the downside for retesting 0.8825. Fall from 0.9223 should be in progress with near term channel...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2800; (P) 1.2825; (R1) 1.2872; More… GBP/USD’s rally continues today and intraday bias stays on the upside for 61.8% projection of 1.2298 to 1.2859 from 1.2612 at 1.2959. Decisive break there would prompt upside acceleration through 1.3141 to 100%...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0817; (P) 1.0824; (R1) 1.0838; More…. EUR/USD’s rise from 1.0665 resumed by breaking through 1.0844 temporary top and intraday bias is back on the upside for 1.0915 resistance. Firm break there will resume whole rally from 1.0601 and target 100%...

AUD/USD Mid-Day Report – Action Forex

Daily Pivots: (S1) 0.6735; (P) 0.6744; (R1) 0.6755; More... Intraday bias in AUD/USD remains on the upside as current rally continues to 61.8% projection of 0.6361 to 0.6713 from 0.6619 at 0.6837. Decisive break there could prompt upside acceleration through 0.6870...

EUR/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 174.50; (P) 174.83; (R1) 175.45; More… EUR/JPY’s strong break of 173.50 support suggests that a short term top was formed at 175.41, on bearish divergence condition in 4H MACD. But there is no clear sign of trend reversal yet. While deeper pullback...

ECB Preview – Holiday Season

The ECB meeting next week is expected to be largely a stock taking meeting and not a place to send new policy signals. The meeting by meeting and data dependent approach is clear and Lagarde has highlighted that the profit, wages and productivity data will be key,...

EUR/GBP Technical: Make the Pound Great Again

EUR/GBP has resumed its downward trajectory since the start of the year, now trading close to a 2-year low at 0.8320. Unfavourable political environment in France versus a newly formed Labour-led UK government that favours pro-growth policies may see further...

June CPI: September Rate Cut Incoming

Summary This morning’s CPI report was arguably the most encouraging one the FOMC has received since it began its inflation fight nearly two and a half years ago. Consumer prices declined by 0.1%, led lower by a drop in energy prices and a modest increase in food...

GBP/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 206.68; (P) 207.25; (R1) 208.34; More… GBP/JPY’s steep decline and strong break of 206.12 support suggest that a short term top is formed at 208.09, on bearish divergence condition in 4H MACD. While deeper decline cannot be ruled out, downside...

Fed Sep Cut Now Realistic after US CPI; Japan Intervenes to Boost Yen?

Dollar tumbled sharply in early US session following lower-than-expected consumer inflation readings. Headline CPI showed its first month-over-month decline since early 2023, while core CPI annual rate unexpectedly slowed to its lowest level since April 2021. Now, a...

US initial jobless claims falls to 222k vs exp 239k

US initial jobless claims fell -17k to 222k in the week ending July 6, below expectation of 239k. Four-week moving average of initial claims fell -4k to 233.5k. Continuing claims fell -4k to 1852k in the week ending June 29. Four-week moving average of continuing...

GBP/USD: Stronger than Expected UK GDP Numbers Lift Cable to Four-Month High

Cable hit new four-month high in European trading on Thursday, lifted by better than expected UK May GDP numbers, which poured cold water on expectations for BoE rate cut next month. Fresh strength broke through pivotal barriers at 1.2846/60 (200WMA/former top June...

Pound on the Offensive – Action Forex

Positive news for the Pound, beyond the fact that England will play in the Euro-24 final. The monthly estimate showed that the economy grew by 0.4% in May (twice as much as expected) and that growth in the last three months accelerated to 1% year-on-year. That’s the...

Market Analysis: EUR/USD Jumps, USD/JPY Bulls Seem Unstoppable

EUR/USD is climbing higher above the 1.0800 level. USD/JPY surged above the 160.00 and 161.40 resistance levels. Important Takeaways for EUR/USD and USD/JPY Analysis Today The Euro started a decent increase above the 1.0780 pivot level. There is a key bullish trend...

Markets Awaiting US Inflation Data: What is the Probability of Trend Reversals?

The major currency pairs are in a holding pattern following the release of the latest US labour market data and Jerome Powell’s testimony before Congress. The Fed Chair noted that the Federal Reserve has made “significant progress” in its mission to combat inflation,...

Crypto Lacks Bulls – Action Forex

Market picture It seems that all the market bulls have moved on to US and Japanese equities, avoiding cryptocurrencies. The cryptocurrency market failed to break out of its consolidation, and its capitalisation rolled back 1.3% to $2.13 trillion, inside the range from...

USD/CAD Price Outlook: 200-day MA Holds Ahead of US CPI Release

USD/CAD has been range-bound, reflecting US Dollar Index consolidation and potential rate differential between Canada and the US. Canada’s volatile inflation and struggling labor market increase pressure on the Bank of Canada (BoC). USD/CAD is positioned between key...

AUDUSD Posts a Fresh 6-month High

AUDUSD breaks decisively above sideways pattern The price jumps to its highest since January 2024 Oscillators are flagging overbought conditions AUDUSD had been trading in a neutral range for more than two months, unable to adopt a clear directional impetus. However,...

Japanese Yen Faces Continued Decline Amid Interest Rate Differentials

The USD/JPY pair has risen to 161.65, with the market cautious ahead of today’s US consumer price index release. Despite this, the yen remains weakened by the significant interest rate differential between the Bank of Japan (BoJ) and the Federal Reserve. Earlier this...

Dollar Mixed with Inflation Data on Deck; Sterling Maintains Lead

Dollar weakened notably against Sterling and Aussie overnight, but held steady against other currencies. Market focus is now on the upcoming US consumer inflation data, with expectations of a slowdown in the headline CPI and steady core CPI. Fed Chair Jerome Powell’s...

FX option expiries for 11 July 10am New York cut

There are just a couple to take note of on the day, as highlighted in bold.The first being for USD/CHF at the 0.8950 level. It isn't one that holds any technical significance but could hold any downside pressure as it coincides with the weekly pivot. The ceiling for...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8965; (P) 0.8978; (R1) 0.8991; More… USD/CHF is staying in range of 0.8942/9049 and intraday bias remains neutral. As noted before, rebound from 0.8825 could have completed at 0.9049, after rejection by falling channel resistance. Below 0.8942...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 160.85; (P) 161.18; (R1) 161.63; More… USD/JPY is still staying in range below 161.95 and intraday bias remains neutral. Further rally is expected with 160.25 minor support intact. On the upside, break of 161.94 will resume larger up trend to 61.8%...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2768; (P) 1.2797; (R1) 1.2815; More… Intraday bias in GBP/USD remains neutral as consolidation continues below 1.2845. Further rally is expected as long as 55 4H EMA (now at 1.2752) holds. Firm break of 1.2859 will resume the rally from 1.2298 and...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0802; (P) 1.0824; (R1) 1.0845; More…. Intraday bias in EUR/USD remains neutral as consolidation continues below 1.0844. Further rally is in favor as long as 55 4H EMA (now at 1.0789) holds. On the upside, above 1.0844 will resume the rebound from...

New Zealand Dollar Takes a Tumble After RBNZ’s Dovish Tone

The New Zealand dollar is sharply lower on Wednesday. NZD/USD is trading at 0.6081 in the European session, down 0.72% on the day at the time of writing. RBNZ’s dovish tone raises rate cut expectations The Reserve Bank of New Zealand held the cash rate at 5.50% at...

AUD/NZD: Kiwi Torpedoed by Surprise Dovish Tilt from RBNZ

The Kiwi is the worst intraday performer among the major currencies as it slumped to a 4-week low against the US dollar. A dovish tilt in the latest RBNZ monetary policy statement has triggered a narrowing of the yield discount between the 2-year Australian and New...

Weak Inflation in China Clears the Way for Global Easing

China’s consumer inflation slowed from 0.3% y/y to 0.2% instead of the expected acceleration to 0.4%, bringing investors’ attention back to weak demand. Meanwhile, manufacturing price deflation slowed from -1.4% y/y to -0.8% y/y, staying in negative territory for the...

GBPAUD Holds Above Key Support Area

GBPAUD consolidates above key support zone RSI and MACD detect negative momentum But a break below 1.8900 is needed to darken the outlook A rebound above 1.9350 may invite more bulls GBPAUD has been trading in a consolidative manner lately staying above the key...

UK Data Eyed as Pound Celebrates Labour Win

Monthly GDP and production figures for June on tap Strong data might hurt August rate cut expectations Pound flirts with $1.28 ahead of Thursday’s release (06:00 GMT) Uptick in GDP expected The UK economy got off to a solid start this year, emerging strongly from a...

Sunset Market Commentary – Action Forex

Markets In today’s extremely dull trading session, some volatility in the New Zealand dollar, Norwegian krone and Czech koruna are keeping us somewhat entertained. You’ll find the latter two in the section down below. NZD is under pressure (NZD/USD 0.6078) following...

BoE’s Pill warns of uncomfortable strength in underlying inflation

In a speech today, BoE Chief Economist Huw Pill highlighted that while it is “welcome news” that the UK’s headline CPI returned to 2% in May, it is crucial for the inflation target to be achieved on a “lasting and sustainable basis.” He emphasized three key indicators...

RBNZ Dovishness Hits Kiwi – Action Forex

The Reserve Bank of New Zealand kept its benchmark interest rate at 5.5% for the eighth consecutive meeting, which was in line with analyst expectations. However, the central bank’s comments were softer than expected, dragging down NZDUSD by around 1% to 0.6070, a low...

Yen Weakness Persists in Calm Trading; Dollar Range-Bound

Yen continues its extended selloff today, except against New Zealand Dollar, in an otherwise subdued forex market. Reports indicate that BoJ may lower its economic growth forecasts for this year at its meeting later in July, while predicting that inflation will hover...

Fed Chair Explicitly Said He Didn’t Intend to Give Any Rate Timing Signals

Markets Fed Chair Powell before Congress yesterday reiterated that the US economy is coming into better balance. It made considerable progress toward the Fed’s 2% target. The labour market has cooled but remains strong. Even so, data still have to provide the MPC...

Crypto Market Looks to Return to Growth

Market Picture According to the sentiment index, the cryptocurrency market remains in a state of fear at 28. Still, market capitalisation rose for the second day in a row as lower prices attracted buyers. Capitalisation rose 1.9% to $2.16 trillion, surpassing previous...

NZD/USD Outlook: Kiwi Dollar Down 1% on Dovish RBNZ

NZDUSD was sharply lower during Wednesday morning (down almost 1% for the session) deflated by the Reserve Bank of New Zealand’s dovish stance. The central bank left interest rates unchanged at 5.5%, as widely expected, but signaled that the door for possible rate cut...

Analysis of NZD/USD: “Kiwi” Sharply Fell After Central Bank’s Decision

The Reserve Bank of New Zealand (RBNZ) kept the interest rate unchanged at 5.5% on Wednesday. The decision to maintain the interest rate was anticipated. However, market participants noted a shift in the tone of the RBNZ’s official statements. In May, the bank...

USDJPY Reapproaches Multi-Year Highs – Action Forex

USDJPY edges higher after the pullback from 38-year high pauses The risk of a Japanese intervention is active at current levels Momentum indicators provide overbought signals USDJPY experienced a minor setback from its 38-year high of 161.95, which quickly came to a...

NZDUSD Tumbles After RBNZ’s Decision

NZDUSD finds support at 200-day SMA Prices have been heading lower over the last month Stochastics and RSI keep downside move NZDUSD is posting notable losses after the RBNZ’s policy decision to leave interest rates unchanged at 5.5%. The pair is pausing its decline...

Is It Time for Gold to Emerge Above Key Resistance?

Gold trades higher, but withing a broader sideways range RSI and MACD imply strengthening upside momentum A break above 2388 could add to the bullish case A dip below 2340 may allow declines within the range Gold is moving higher today, after hitting support near the...

Gold Prices Rise Amid Anticipation of Fed Rate Cut

Gold prices continue to experience an upward trend, reaching 2368 USD per troy ounce, fuelled by growing market anticipation of a potential rate cut by the US Federal Reserve. As investors focus on upcoming US inflation data, gold remains a focal point of investment...

NZD Tumbles on RBNZ Rate Cut Hints; Markets Largely Ignore Fed’s Powell

New Zealand Dollar plunged sharply after RBNZ’s more dovish than expected statement caught the market off guard. RBNZ’s indication of potential future rate cuts was unexpected, even though it’s not a hint on an imminent move. The central bank’s timing of this shift in...

FX option expiries for 10 July 10am New York cut

There are a couple to take note of, as highlighted in bold.The first ones are for EUR/USD at 1.0770-75. However, the expiries do not hold much technical significance with key support still seen at around 1.0795-00 currently. That coincides with the confluence of the...

Crypto Bargain-Hunters Are Back – Action Forex

Market picture Bargain hunters are showing themselves in full force in crypto. Cryptocurrency market capitalisation rose 3.6% in 24 hours to $2.11 trillion, climbing back to the top of the range of the past five days. It will take the market to rise another 2% before...

XAU/USD Analysis: Gold Price Falls from Six-Week High

As shown by the XAU/USD chart, on Friday, 5 July, the price of gold rose above the $2390 level for the first time since 22 May. According to Reuters, this increase occurred following the release of key US employment data, which indicated a softening labour market,...

DAX Elliott Wave: Buying the Dips at the Blue Box Area

Hello fellow traders. In this article we’re going to take a quick look at the Elliott Wave charts of DAX published in members area of the website. As our members know DAX is showing impulsive bullish sequences and we are keep favoring the long side. Recently we got a...

GBP/USD Outlook: Bulls Pause ahead of Powell

Cable is holding within a narrow range under new multi-week high during European trading on Tuesday, as markets await today’s key event – the testimony of Fed Chair Powell. Long upper shadow of Monday’s daily candle and overbought conditions on daily chart suggest...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0802; (P) 1.0824; (R1) 1.0845; More…. Intraday bias in EUR/USD remains neutral for consolidations below 1.0844 temporary top. Further rally is in favor as long as 55 4H EMA (now at 1.0783) holds. On the upside, above 1.0844 will resume the rebound...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2785; (P) 1.2815; (R1) 1.2838; More… Intraday bias in GBP/USD remains neutral for consolidation below 1.2845. Further rally is expected as long as 55 4H EMA (now at 1.2743) holds. Firm break of 1.2859 will resume the rally from 1.2298 and target...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8954; (P) 0.8966; (R1) 0.8987; More… Intraday bias in USD/CHF stays neutral for the moment. As noted before, rebound from 0.8825 could have completed at 0.9049, after rejection by falling channel resistance. Below 0.8942 will bring deeper fall to...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 160.28; (P) 160.84; (R1) 161.35; More… Intraday bias in USD/JPY stays neutral at this point. Further rally is expected with 160.25 minor support intact. On the upside, break of 161.94 temporary top will resume larger up trend to 61.8% projection of...

Euro Shrugs as Investor Confidence Tumbles

The euro is showing little movement on Tuesday. EUR/USD is trading at 1.0819, up 0.05% on the day. The eurozone Sentix Investor Confidence index resumed its losing ways on Monday. The index slid to -7.3 in July, after a 0.3 gain in June. Prior to the June reading, the...

NZD Edges Lower Ahead of RBNZ Decision

The New Zealand dollar is steady on Tuesday. NZD/USD is trading at 0.6115, down 0.16% in the European session at the time of writing. The New Zealand dollar looked sharp last week against the slumping US dollar, climbing 0.88%. Reserve Bank expected to hold rates...

Fed’s Powell highlights risks beyond elevated inflation

In his prepared remarks for the semiannual testimony to Congress, Fed Chair Jerome Powell reiterated that it is not appropriate to cut interest rate until there is “greater confidence” that inflation is moving sustainably toward 2%. Nevertheless, He noted that recent...

Sunset Market Commentary – Action Forex

Markets European markets were captured in an indecisive trading pattern yesterday, in the wake of the surprise win of the left alliance in the French elections. Spreads of France (and other peripheral EMU countries) initially tightened marginally as none of the...

Markets Await Fed Powell’s Insights, RBNZ on Deck

As US session kicks off, Dollar is trading mildly higher, with traders eagerly anticipating Fed Chair Jerome Powell’s two-day semiannual testimony before Congress. The key questions looming over the markets are whether the Fed will initiate interest rate cuts in...

Australian Dollar Drifting After Mixed Confidence Data

The Australian dollar continues to show little movement this week. AUD/USD is trading at 0.6638 in the European session, up 0.02% on the day. Australia released mixed confidence indicators earlier today while there are no US economic releases. Federal Reserve Chair...

Gold Technical: Further Drift Down in 10-year UST Real Yield Supports Bullish Narrative in Gold

Recent rebound in WTI crude has remained below US$90/barrel which in turn led to a softening of inflationary expectations via the breakeven rates. A further downward drift in the 10-year US breakeven rate may a further drop in the 10-year US Treasury real yield. Lower...