The stock market, as measured by the S&P 500 Index

SPX,

continued to move higher and deeper into overbought territory. A price was paid for that on December 20, when a small amount of selling turned into an avalanche, costing the benchmark U.S. index more than 70 points in just a couple of hours of trading. But that alone didn’t register many sell signals (a couple, which we will discuss below).

Moreover, there is a strong seasonal bullish end to the year — even in the worst year of 2018. So, the bulls are likely not done yet.

The all-time SPX highs (at 4816 intraday, and 4796 closing) are quite easily attainable now. SPX advanced to 4778 before the afternoon setback on December 20th. There isn’t any near-term support, since the last part of this rally occurred with such speed. Even the rising 20-day Moving Average is way down at 4630. There should be support in the 4540-4570 area, where SPX consolidated for a while in later November and early December.

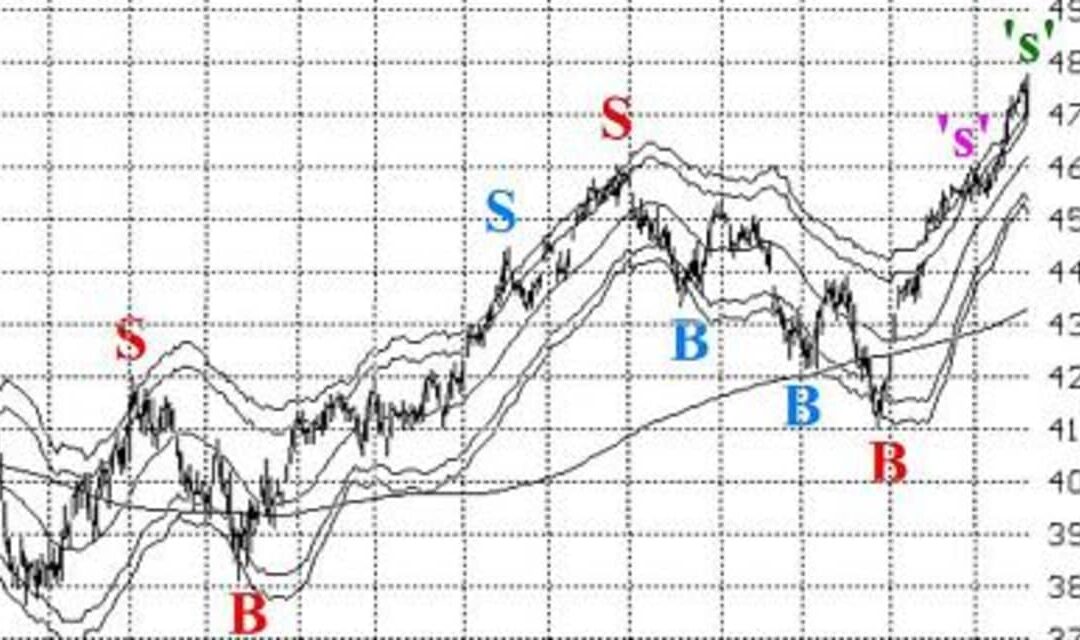

In falling back, a “classic” “modified Bollinger Band” (mBB) sell signal was issued at the close on December 20, since SPX closed below the +3σ Band. We do not trade those signals, though, since they are sometimes premature. The current “classic” signal is marked on green (‘s’) on the accompanying SPX chart. Note that there was a similar signal (marked in pink) in early December. That early December “classic” sell signal did not confirm into a McMillan Volatility Band (MVB) sell signal, which we would trade. So, it is not certain that this most recent “classic” sell signal will either.

Equity-only put-call ratios have continued to decline, moving towards the lower regions of their respective charts. Now, the weighted ratio has generated a new sell signal from a very overbought state. Even though the weighted chart has only curled upward for one day, the computer programs that we use to analyze these charts are “saying” that this is a confirmed sell signal. It is marked with a green “S” on the accompanying chart. The computer programs would be proven wrong if the weighted ratio dropped to a new relative low. Meanwhile, the standard ratio — while also overbought — isn’t quite as low on its chart, and so it remains on a buy signal for now.

Breadth has been very strong of late, and so one bad day in the market is not enough to generate sell signals from the breadth oscillators. Another day or two of negative breadth would generate those sell signals, but that is difficult to anticipate. So, these oscillators remain bullish for now.

In a related matter, Cumulative Volume Breadth (CVB) traded at a new all-time high. CVB is merely the daily running sum of the volume of advancing issues minus the volume of declining issues. In our case, the “issues” are our “stocks only” database — all stocks with listed options (more than 6,000 in all). When CVB makes a new all-time high, SPX typically follows and does the same thing a short while later. These signals have been very accurate in the past, but there was a complete dud last summer when CVB traded at a new all-time high on July 31st (2023).

New Highs have continued to dominate New Lows on the NYSE. Thus, this indicator remains bullish, and its buy signal remains intact.

VIX

VIX

VX00,

rose modestly when SPX sold off 70 points on the afternoon of December 20, so the trend of VIX buy signal remains in place. VIX would have to close above its declining 200-day Moving Average in order to stop out that buy signal. If would also be a negative warning sign if VIX were to enter “spiking” mode (an advance of at least 3.00 points over a three-day or shorter time period, using closing prices). It has not done that either.

“If January futures trade at a higher price than February futures, that would be an extremely negative warning sign. ”

The construct of volatility derivatives remains solidly bullish in its outlook for stocks. The December VIX futures have expired, so the January futures are the front month. Accordingly, we will be watching the relationship between January and February VIX futures. If January trades at a higher price than February, that would be an extremely negative warning sign. That is not nearly the case right now, but right before the large selloffs in February 2018 and February 2020, it was. So, this is something worth watching.

Finally, there is the issue of seasonality. The end of the year is generally a seasonally bullish time period, and it certainly has been so far this year. There is one important seasonal pattern to look for — the Santa Claus rally, as defined by the late Yale Hirsch. It encompasses the last five trading days of one year and the first two trading days of the next year. Generally, the market should rally over that time period (the average gain over the years has been about 1.2%). However, if the market does not rally over that seven-day period, it is a negative warning sign for stocks.

In summary, we are still maintaining a “core” bullish position. We have rolled our bullish positions up several times over the course of the large rally that has taken place since the end of October. We will continue to add other positions around the “core” position when confirmed buy or sell signals take place.

New recommendation: Santa Claus rally

Even though we have a position in IWM

IWM

calls to take advantage of the general bullish seasonality after Thanksgiving, we want to add a position to trade the often-powerful Santa Claus rally. NOTE: this is the “real” Santa Claus rally trading system as developed by the late Yale Hirsch, and not the general media hype about year-end trading in general.

At the close of today, Thursday, December 21st, Buy 2 SPY

SPY

Jan (5th) at-the-money calls. Roll the position up if the calls become at least 6 points in-the-money at any time. Sell the entire position at the close of trading on the second trading day of 2024: Wednesday, January 3.

New Recommendation: CVB buy signal

We noted in the Market Comment section that Cumulative Volume Breadth traded at a new all-time high. That is a signal that SPX will do the same. At this time, new all-time highs are about 80 SPX points away, so this is still a tradeable signal. We are going to take it, by buying a call with a strike near the all-time high of SPY.

Buy 1 SPY Feb (16th) 480 call

The entire premium is at risk here, since there really isn’t a stop-out for this trade.

Potential MVB sell signal

A “classic” mBB sell signal has occurred (see Market Comment section above), but we don’t trade those. Rather, we wait for the full confirmation of a McMillan Volatility Band (MVB) sell signal. That MVB sell signal will occur if SPX trades at 4670 at any time going forward. This whole process would be called off if SPX were to once again close above its +4σ Band.

IF SPX trades at 4670 or lower at any time, THEN Buy 1 SPY Feb (16th) at-the-money put. At this time, these puts are not extremely expensive, since VIX is still at low levels, and so we are not going to recommend a bear spread here, but rather just an outright put purchase.

If the trade is established, roll the put down every time it becomes 8 points in-the-money. The position would be stopped out if SPX subsequently closed back above its +4σ Band. The position would reach its “target” profit price if SPX trades at the -4 σ Band.

Follow-up action

All stops are mental closing stops unless otherwise noted.

We are using a “standard” rolling procedure for our SPY spreads: in any vertical bull or bear spread, if the underlying hits the short strike, then roll the entire spread. That would be roll up in the case of a call-bull spread or roll down in the case of a bear-put spread. Stay in the same expiration and keep the distance between the strikes the same unless otherwise instructed.

Long 1 SPY Dec (29th) 472 call: A spread was bought in line with the CBOE Equity-only put-call ratio buy signal. It has been rolled up several times, with December 14th being the most recent, when SPY first traded at 472. Roll the call up if it becomes at least 8 points in-the-money. We are holding without a stop for now.

Long 2 ES Jan (19th) 60 calls: We will hold this position as long as the weighted put-call ratio chart for ES

ES,

remains on a buy signal.

Long 4 XLP

XLP

Dec (29th) 70 calls: The stop remains at 70.

Long 1 SPY Dec (29th) 473 call: This position was initially a long straddle. It was rolled up, and the puts were sold. The calls were rolled up again on December 14. Continue to roll the call up if it becomes 8 points ITM. This is, in essence, our “core” bullish position.

Long 5 AVPT

AVPT,

Jan (15th) 8 calls: Raise the trailing closing stop to 8.10.

Long 2 TECH

TECH,

Jan (19th) 70 calls: We will hold as long as weighted put-call ratio is on a buy signal.

Long 4 KHC

KHC,

Jan (19th) 37.5 calls: Sell these calls now, since the put-call ratio has rolled over to a sell signal.

Long 2 IWM Jan (19th) 196 calls: This is our post-Thanksgiving seasonal position. We will hold without a stop, since this is a rather long seasonal bullish period extending through the first two trading days of 2024 (the last part of which begins at today’s close). We’ve rolled the call up three times, most recently on December 14. Roll up again if the call becomes 6 points in-the-money (i.e., at 202).

Long 1 SPY Feb (16th) 457 call and short 1 SPY Feb (16th) 477 call: This spread is based on the “New Highs vs. New Lows” buy signal. We will stop out of this position if New Lows on the NYSE exceed New Highs for two consecutive trading days. Otherwise, there is no price stop based on SPX.

Long 4 UNM

UNM,

Mar (15th) 45 calls: We will hold this position as long as the weighted put-call ratio of UNM remains on a buy signal.

We were not able to buy the Griffon

GFF,

) April 50 straddles at our recommended price last week, so we are canceling that recommendation now.

All stops are mental closing stops unless otherwise noted.

Send questions to: lmcmillan@optionstrategist.com.

Lawrence G. McMillan is president of McMillan Analysis, a registered investment and commodity trading advisor. McMillan may hold positions in securities recommended in this report, both personally and in client accounts. He is an experienced trader and money manager and is the author of the best-selling book, Options as a Strategic Investment. www.optionstrategist.com

©McMillan Analysis Corporation is registered with the SEC as an investment advisor and with the CFTC as a commodity trading advisor. The information in this newsletter has been carefully compiled from sources believed to be reliable, but accuracy and completeness are not guaranteed. The officers or directors of McMillan Analysis Corporation, or accounts managed by such persons may have positions in the securities recommended in the advisory.

More: Chasing the Santa rally? Look out below!