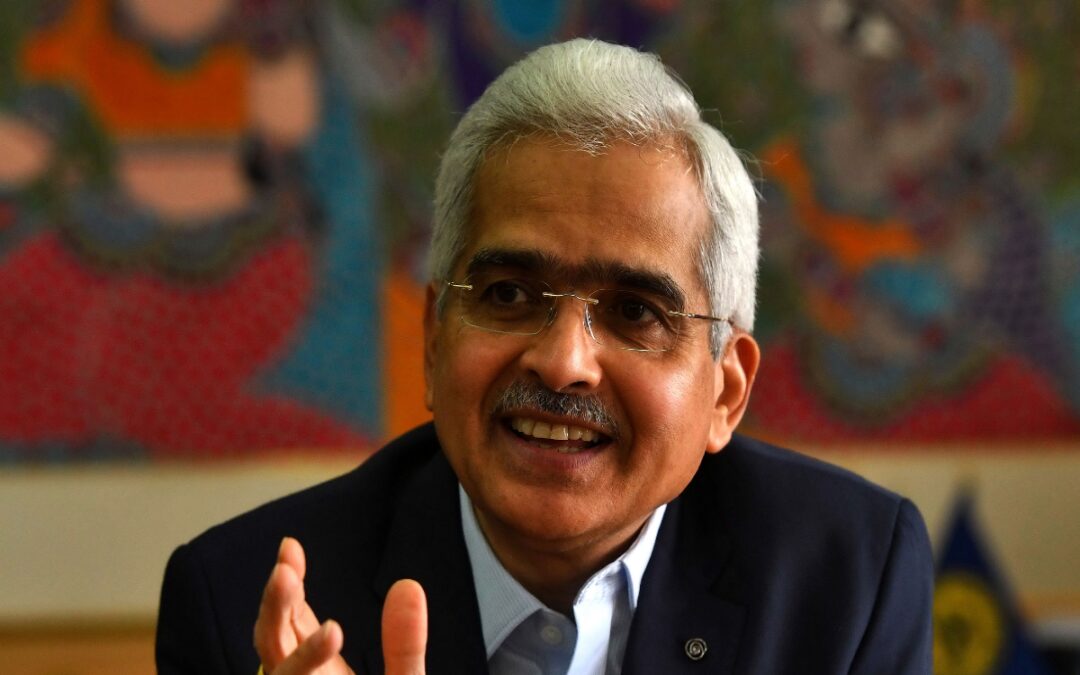

Reserve Bank of India (RBI) Governor Shaktikanta Das, while unveiling the outcomes of the first bimonthly Monetary Policy Committee (MPC) meeting of FY25, characterized inflation as the prominent challenge, referring to it as “the elephant in the room.” He indicated optimism by suggesting that inflation (elephant) appears to be reverting to the desirable threshold (forest) of 4 per cent.

During his address, Governor Das remarked, “The elephant in the room was CPI inflation. The elephant has now gone out for a walk and appears to be returning to the forest.”

Das highlighted the downward trajectory of inflation, underpinned by favorable base effects. However, he acknowledged the persistent pressure from service prices which has sustained the key indicator at a heightened level compared to the stipulated targets.

The RBI endeavors to maintain inflation within a band of 2-6 percent, with a preferred target of 4 percent (+/- 2 percent).

“As the central banks navigate the last mile of disinflation, financial markets are responding to changing perceptions on the timing and pace of monetary policy trajectories. Equity markets are rallying, while sovereign bond yields and the US dollar are exhibiting bidirectional movements. Gold prices have surged on safe haven demand,” Das elaborated, shedding light on the intricate dynamics influencing monetary policy decisions and market sentiments.

Food inflation a worry for easing inflation

The headline inflation for January-February 2024 has shown a decline to 5.1 per cent, down from 5.7 per cent recorded in December. However, the erratic movement in food prices continues to contribute to inflation uncertainties.

“Headline inflation has eased from its December peak; nevertheless, the persistent pressure from food prices is impeding the ongoing disinflation process, presenting obstacles to achieving the target,” Das said.

Also Read: RBI MPC keeps repo rate unchanged at 6.5 per cent for the 7th time in a row

Following a correction in January, food inflation climbed to 7.8 per cent in February, primarily influenced by vegetables, eggs, meat, and fish.

Meanwhile, fuel prices sustained a deflationary trend for the sixth consecutive month in February. The core Consumer Price Index (CPI), excluding food and fuel, witnessed disinflation, dropping to 3.4 per cent in February. This figure marks one of the lowest levels in the current CPI series, with both goods and services components experiencing a decline in inflation.

Additionally, the Monetary Policy Committee (MPC) observed that domestic economic activity has demonstrated resilience, buoyed by robust investment demand and optimistic business and consumer sentiments.

Also Read: RBI leaves inflation projection for FY25 unchanged at 4.5% as ‘elephant’ out for a walk

The unforeseeable disruptions stemming from adverse climate events impacting agricultural output, alongside geopolitical tensions with potential spillovers to trade and commodity markets, introduce uncertainties into the economic outlook, Das said in his addresss.

Governor Das emphasized, “The MPC remains steadfast in its dedication to aligning inflation with the target. Ensuring enduring price stability lays a robust groundwork for a period of robust growth. Additionally, the MPC is committed to prioritizing the withdrawal of accommodation to facilitate a gradual alignment of inflation with the target, while concurrently supporting economic growth.”

Inflation forecast unchanged

In its April meeting, the MPC left its inflation forecast for this fiscal year unchanged at 4.5 per cent assuming normal monsoon, even as the country braces for a scorching summer amid a spike in crude oil prices and persisting worries about supply chain due to the Red Sea crisis.

In February, India’s retail inflation remained largely unchanged at 5.09 per cent compared with 5.10 per cent owing to higher food prices that sparked economists to believe that the policy rate-setting panel will leave key rates unchanged in April.

Food inflation rate in February quickened to 8.7 per cent from 8.3 per cent in the previous month, driven by a rise in vegetable inflation to a seven-month high of 30.2 per cent, compared to 27.1 per cent earlier.

Repo rate, GDP forecast

The committee on Friday decided to keep the repo rate unchanged at 6.5 per cent for the seventh consecutive time with focus on ‘withdrawal of accommodation’ stance.

The GDP growth forecast for FY25 was kept unchanged at 7 per cent while projecting a positive outlook for the ongoing fiscal.