The Reserve Bank of India (RBI) is observing the Financial Literacy Week (FLW) this year from February 26 to March 1, 2024.

The theme for this year’s RBI FLW is “Make a Right Start – Become Financially Smart” focussing especially towards the young adults and students.

The week-long programme envisioned by the RBI has been conducted every year since 2016 and it aims to inculcate healthy habits of financials among people.

This year is nothing different as it looks to promote financial literacy in young minds through educating them about the ideas of saving, budgeting, power of compounding, banking essentials and cyber hygiene.

Last year the theme of RBI FLW was “Good Financial Behaviour — Your Saviour” focussing on financial planning and digital financial services.

Savings and Compounding

This year, the Reserve Bank has released short videos on its YouTube channel promoting the importance of savings from a young age and how compounding interest builds up in the long run over the course of a few years after implementation of re-investing practices.

Education Loans

In another video, RBI informs about the education loan availability for young students who are completing their schooling and on the path of taking college admissions.

It emphasises on collateral free education loans of up to Rs 4 Lakhs and the period of loan recovery starting after a year of graduating from the college.

The RBI’s theme of “karo sahi shuruaat, bano vittiye smart” rings in during the end of the message.

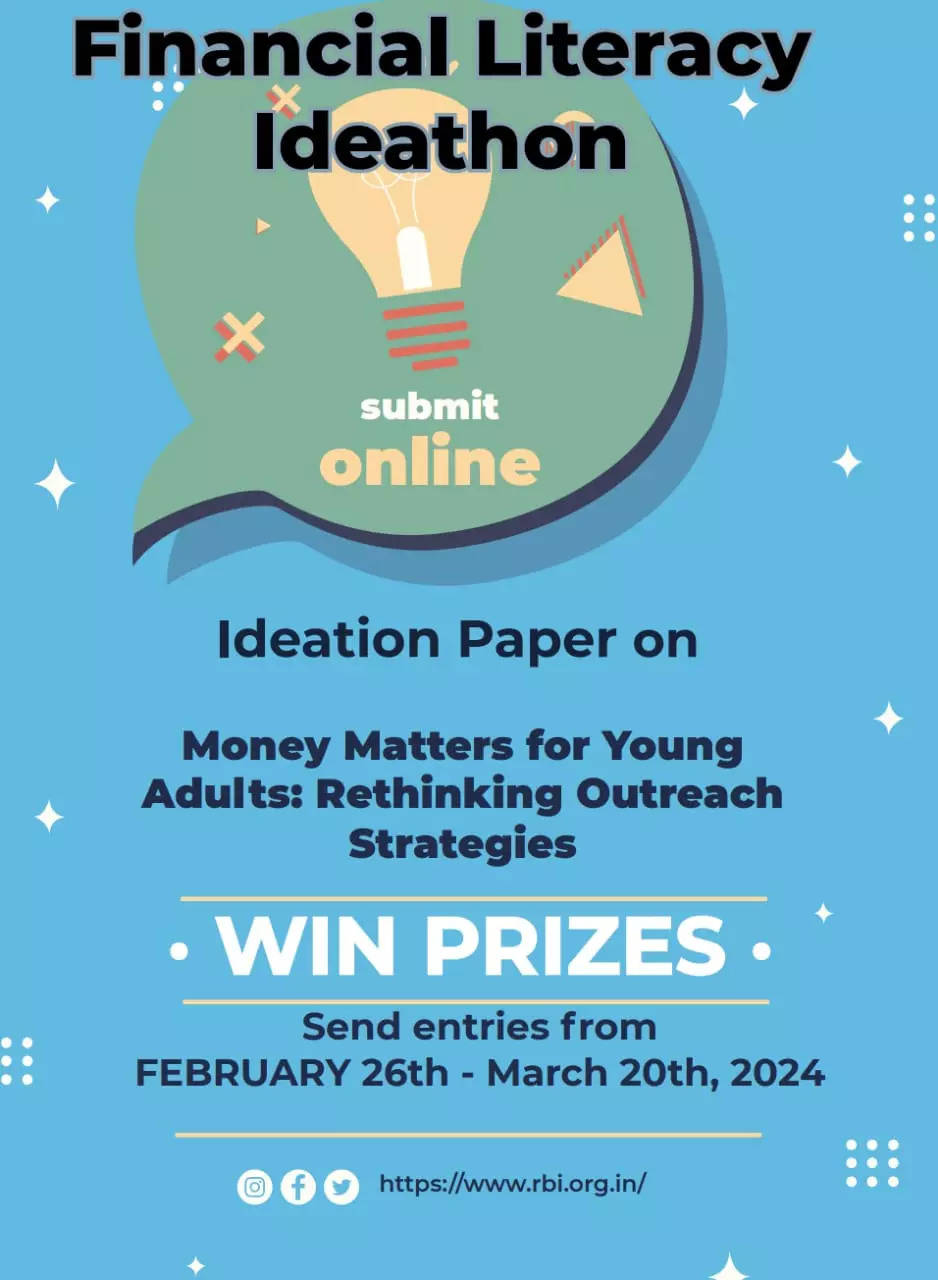

RBI Financial Literacy Ideathon 2024

On the lines of FLW, the RBI has also announced Financial Literacy Ideathon, which seeks to gather new, creative and imaginative ideas about ‘how to promote financial literacy’ from the postgraduate students.

It aims to propagate financial education to young students through the innovative strategies that the pg students suggest in the Ideathon.

RBI Financial Literacy Ideathon T&Cs

The applicants are required to submit a paper on “Money Matters for Young Adults: Rethinking Outreach Strategies”.

The 2000 word paper shall be accepted till 6 pm on March 20, 2024 in a pdf format.

The Ideation Paper should be original and plagiarism free and should be sent to flcfiddco@rbi.org.in with subject line “FLW 2024 Ideathon”.

The participant can win prizes for their ideas. The best of them all will win the First Prize of ₹1 lakh. The Second Prize is of ₹75,000 and the Third Prize amounts to ₹50,000.

RBI’s Financial Literacy Initiatives

The central bank has taken many steps to propagate financial literacy and to boost financial inclusion across the country. A few strategic and significant financial literacy measures are listed below:

– National Centre for Financial Education (NCFE): It has been set up to undertake basic financial education programmes and to develop suitable content for increasing financial literacy among the masses in India.

– National Strategy on Financial Education (NSFE-2025): NCFE, in partnership with regulators and stakeholders, has developed NSFE for 2020- 25 to enhance nationwide financial literacy, aligning with the vision of promoting financial inclusion. It looks to empower individuals across society to manage finances effectively and advocates for a multi-stakeholder approach.

– Integrating Financial Literacy into the Education System: With the help of several State Educational Boards and the central board, modules on financial education have been introduced in the school curriculum.

– Museums by RBI: Two museums have been set up by the RBI to educate the public about money, banking, and monetary history, thereby increasing awareness.

ETBFSI now has its WhatsApp channel. Join for all the latest updates.