Global financial markets are trading with a risk-on sentiment today, starting from the Asian session and continuing through the European and early US sessions. However, gains in stocks have been relatively limited, partly constrained by recovery in benchmark treasury yields, and partly capped by low trading activity.

In the currency markets, positions have shifted somewhat from earlier in the day. While Kiwi stay as the weakest, Aussie is now the second worst, followed by Yen. Dollar, Swiss Franc, and Sterling are the stronger ones. Canadian Dollar and Euro are positioning in the middle.

In Europe, at the time of writing, FTSE is up 0.06%. DAX is up 0.33%. CAC is up 0.46%. UK 10-year yield is up 0.0334 at 4.165. Germany 10-year yield is up 0.015 at 2.534. Earlier in Asia, Nikkei rose 0.73%. Hong Kong HSI rose 0.42%. China Shanghai SSE rose 0.54%. Singapore Strait Times rose 0.02%. Japan 10-year JGB yield rose 0.0276 at 0.980.

Fed’s Barr: Not confident to start easing monetary policy yet

Fed Vice Chair Michael Barr stated in a speech today that while inflation has decreased from its peak of 7.1% to 2.7%, it is “not yet all the way to 2% target. He noted that inflation readings for the first quarter were “disappointing,” as highlighted in FOMC’s recent statement.

“These results did not provide me with the increased confidence that I was hoping to find to support easing monetary policy by reducing the federal funds rate,” Barr noted. He added that Fed’s restrictive policy would need “some further time to continue to do its work” in bringing inflation down.

Fed’s Bostic: Maybe only one rate cut this year

Atlanta Fed President Raphael Bostic stated in a BloombergTV interview today that it will take time before the Fed is confident that inflation will return to 2%. He reiterated his stance that “nothing has changed” regarding his view that perhaps only one rate cut will be necessary this year.

He noted that inflation data for the first part of the year has been “very bumpy,” reflecting a slow but gradual slowdown in economic activity. Bostic mentioned that business leaders report a gradual slowdown in their operations, with pricing power weakening.

“I do think that our new steady state is likely to be higher than what people have known over the last decade — maybe back to where we were in the 1990s and 2000s, but we’ll just have to see,” Bostic added, suggesting a shift in the long-term inflation outlook compared to recent years.

BoE’s Broadbent: Summer rate cut possible

In a speech today, BoE Deputy Governor Ben Broadbent indicated that if current forecasts hold, which suggest that monetary policy will need to become “less restrictive at some point”, a rate cut could occur “over the summer”.

Broadbent noted that the direct impact of the pandemic and the war on inflation has now diminished. What remains are the “more persistent second-round effects” on domestic inflation stemming from these earlier shocks.

He emphasized the uncertainty surrounding how long these effects will persist. While a symmetrical process might suggest a quick unwinding within the next year, the Committee has consistently judged that the process is likely to be “asymmetric”. As stated in recent Monetary Policy Reports, “second-round effects in domestic prices and wages will take longer to unwind than they did to emerge.”

ECB’s Kazaks: June rate cut likely, future moves data dependent

ECB Governing Council member Martins Kazaks indicated in a Bloomberg Adria interview that the central bank is nearing its 2% inflation target, paving the way for interest rate cuts. However, he emphasized that any reduction in rates should be “cautious” and “gradual,” and that the process should not be rushed.

“From today’s perspective, it’s quite likely June is going to be the time when we start the rate cuts,” Kazaks noted. However, he stressed the importance of relying on incoming data for decisions beyond June, stating, “After June, going forward, let’s see again the data.”

Kazaks highlighted the ECB’s approach of making decisions on a meeting-to-meeting basis, based on the latest economic data. He described this strategy as “an appropriate one so far,” given the high levels of uncertainty.

China holds rates steady amidst property sector support measures

China kept its benchmark lending rates unchanged at today’s monthly fixing, aligning with market expectations. One-year Loan Prime Rate remained at 3.45%, while Five-year LPR stayed at 3.95%. This decision follows the People’s Bank of China’s move last week to maintain a key policy rate at 2.50% while rolling over maturing medium-term lending facilities.

Additionally, China announced on Friday a series of measures to stabilize its crisis-hit property sector, including the central bank facilitating CNY 1T in extra funding and easing mortgage rules. This strong supportive policy rollout has increased the likelihood of further monetary easing in the coming months.

Some economists now expect one or two cuts to LPR later this year, alongside a reduction in the reserve requirement ratio. These anticipated measures aim to bolster the property sector and sustain economic growth amid ongoing challenges.

EUR/USD Mid-Day Outlook

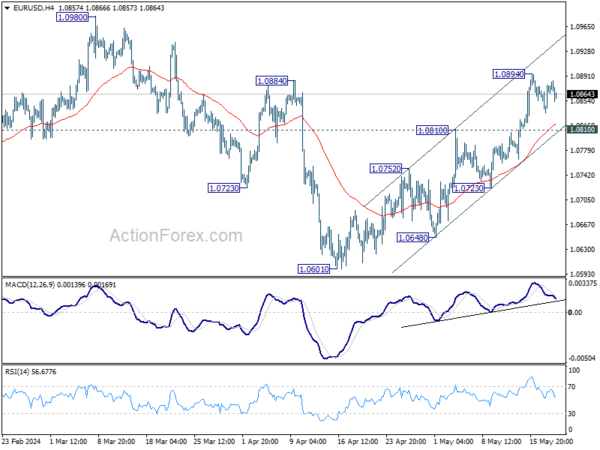

Daily Pivots: (S1) 1.0844; (P) 1.0861; (R1) 1.0886; More…

EUR/USD is staying in consolidation below 1.0894 and intraday bias stays neutral. Further rally is expected as long as 1.0810 resistance turned support holds. Break of 1.0894 will resume the rise to 1.0980 resistance. Decisive break there will confirm that whole fall from 1.1138 has completed at 1.0601 already.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern. Fall from 1.1138 is seen as the third leg and could have completed. Firm break of 1.1138 will argue that larger up trend from 0.9534 (2022 low) is ready to resume through 1.1274 high. On the downside, break of 1.0601 will extend the corrective pattern instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:15 | CNY | PBoC 1-y Loan Prime Rate | 3.45% | 3.45% | 3.45% | |

| 01:15 | CNY | PBoC 5-y Loan Prime Rate | 3.95% | 3.95% | 3.95% | |

| 04:30 | JPY | Tertiary Industry Index M/M Mar | -2.40% | 0.10% | 1.50% |