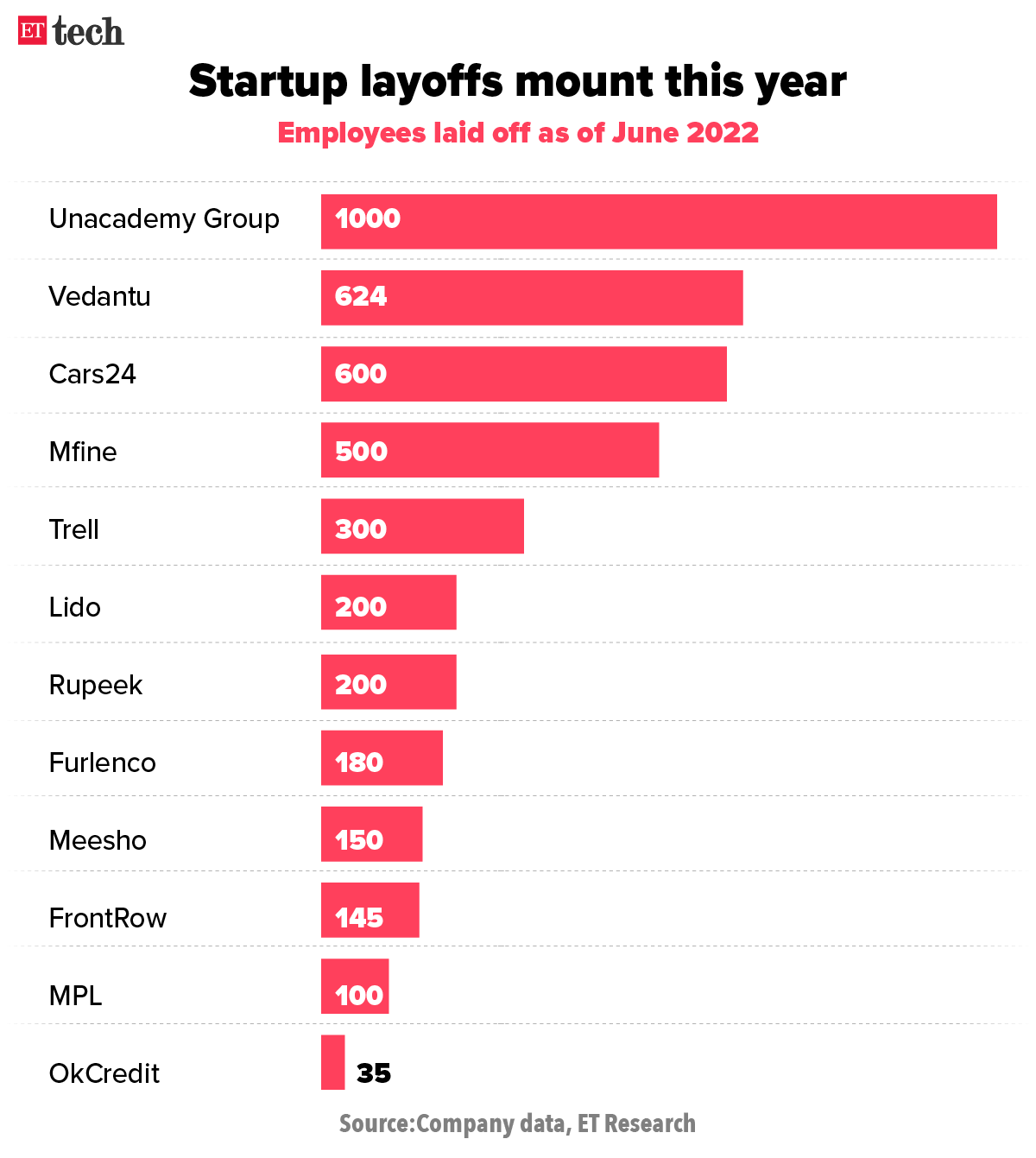

Bengaluru: Gold loans provider Rupeek has become the latest startup to fire employees, with the move impacting about 200 workers, according to multiple sources aware of the matter.

The retrenchment exercise is intended to cut costs, as global macroeconomic conditions continue to hurt Indian startups amid a slowdown in funding.

In a written communication to employees on Tuesday morning, Rupeek founder and chief executive Sumit Maniyar said the company had taken a “decision to part ways with 10-15% of Rupeek’s colleagues and friends.”

“Globally, all the emerging markets including India are facing an extraordinary situation that has been caused owing to rising inflation, a hike in US treasury rates, and the Russia-Ukraine war,” he said.

In an internal memo to staff, Maniyar added that the subdued macroeconomic environment has “compelled us to re-calibrate our strategy, relook at our costs and make our organization structure leaner, so as to support our sustenance and growth.”

“We conducted a thorough exercise and have decided to keep the right fitment of the workforce required, aligned with our revised strategic plans. This was definitely one of the most difficult processes that we as an organization had to go through,” he said.

Founded in 2015, Rupeek provides gold loans at consumers’ doorsteps. It currently operates in more than 35 cities and has disbursed over Rs 6,500 crore worth of loans since inception.

The company, which counts GGV Capital, Flipkart co-founder Binny Bansal and Bertelsmann India Investments as investors, had raised $34 million as part of a fresh funding in January. The latest round was led by Lightbox. In March 2021, VEF Ltd announced that it had invested $7 million in the gold loan provider.

“With deep regret, we have taken the difficult decision to part ways with 10-15% of the employees,” a spokesperson for Rupeek confirmed to ET. “We acknowledge the selfless contributions made by all the employees who are being impacted and we are committed to supporting them through this transition.”

Rupeek competes with the likes of Indiagold, which also provides digital gold services. Other players in the space include Ruptok Fintech as well as fintech unicorn BharatPe which provides gold loan services to its merchant partners.

For FY21, Rupeek narrowed losses from the previous year to Rs 156.4 crore. It had reported losses of Rs 487 crore in FY20. Revenue from operations grew to almost Rs 63 crore in FY21, from Rs 20.6 crore in the previous fiscal year.

With the US Fed hiking interest rates, several prominent venture capital firms including Beenext, Sequoia, Y Combinator and others have warned their portfolio founders of a slowdown and asked them to brace themselves for the ‘funding winter’.

These venture capitalists have advised startups to take a prudent view towards fundraising and increase their runway to survive the slowdown in funding.

Other Indian startups, which have recently undertaken layoffs include edtech ventures Unacademy, Vedantu, Lido Learning, and Frontrow; gaming startup Mobile Premier League; social commerce startup Meesho; healthcare platform, Mfine; and car retailer Cars24, among many others.

Last month, Unacademy founder Gaurav Munjal, whose company laid off over 1,000 on-roll and contractual staff recently, told employees in an email that “winter is here” and that cost-cutting would be the company’s key focus as funding would remain scarce for at least the next 12 to 18 months.