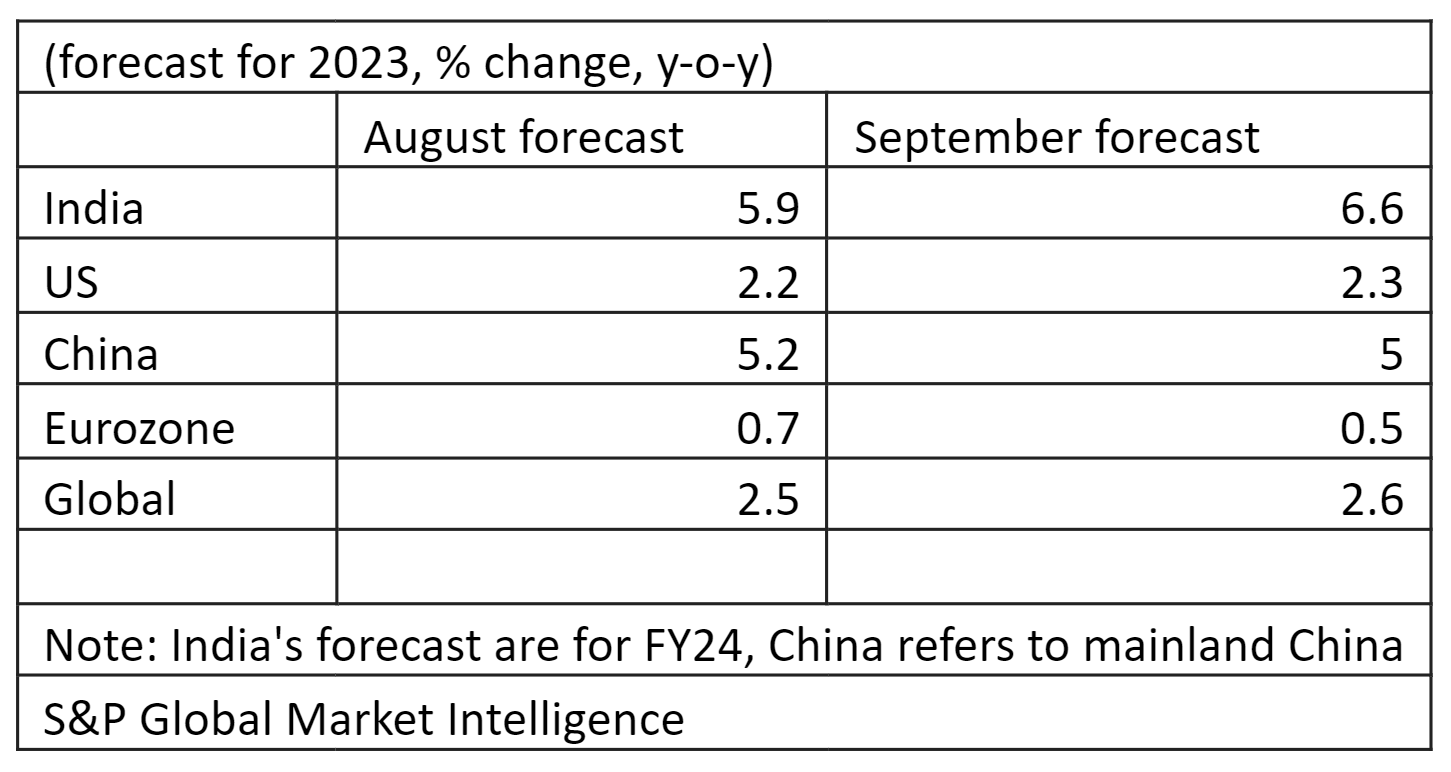

India’s growth forecast was revised upwards to 6.6% for FY24 on the back of solid growth in the April-June quarter, S&P Global Market Intelligence said on Monday, marking a sharp revision from the 5.9% growth the analytics firm projected in August.

But projected a sharp rise in inflation to 6% in 2023–touching RBI’s upper band target level–compared to 5.1% in August.

“India’s economic growth momentum was buoyant in the April-June quarter, growing at a pace of 7.8% year-on-year, boosted by robust growth in domestic demand,” said Rajiv Biswas, APAC Chief Economist at S&P Global Market Intelligence.

S&P is more optimistic than the Reserve Bank of India, which projects the economy to register 6.5% growth in the current fiscal, but pessimistic on the inflation front.

“There is still a risk of a severe El Nino weather event developing in late 2023 and into 2024, which could potentially result in drought conditions and push up prices for key agricultural commodities,” Biswas pointed out, noting a risk to outlook from the recent rebound in world oil prices.

For FY25, S&P noted that the Indian economy is likely to grow at 6.2%, compared with 6.1% projected in August, as global growth concerns weigh down growth.While the analytics firm was more optimistic about the global outlook in 2023, revising its growth upward to 2.6%, its 2024 forecast was revised downwards to 2.3% in its September update.

“The 2024 global growth forecast has been lowered again,” the note stated, highlighting that “downside risks include in?ation persistence, tighter ?nancial conditions and escalating geopolitical tensions.”

The firm pointed out that the recession in Europe was now a base case for the second half of 2023, whereas the US is to witness a marked slowdown, with risks to China’s growth.

Slower global growth is likely to weigh on India’s exports.

Inflation worries

For 2024, India’s inflation is projected to be a high 5.3%.

The global analytics firm envisions worsening inflation trends across countries and revised its global inflation forecast higher for 2023 and 2024.

“The near-term outlook for in?ation has deteriorated,” S&P said, pointing out higher crude oil prices and a rebound in prices of some non-energy industrial commodities.

“A prime concern remains sticky core in?ation rates, particularly for services, given generally tight labour market conditions and elevated wage and unit labour cost growth,” it further said.

The organisation forecasts global inflation to be a high 5.7% in 2023 and remain above 4% in 2024.

India’s inflation eased marginally to 6.8% in August from 7.4% in the previous month, and is likely to decline further on the back of easing tomato prices and a Rs 200 cut in LPG cylinder prices.

Experts indicate that high inflation will push the rate cut trajectory further. RBI’s Monetary Policy Committee is expected to hold the policy rate at 6.5% in its meeting in early October.

S&P Global Market Intelligence noted that advanced economies may follow a similar trajectory.

“Central bank rate cuts in advanced economies remain some way off. Our forecast remains that policy rate cuts in advanced economies are unlikely until mid-2024 given the challenging infationary environment,” the firm said.

Upward trajectory

- FY24 forecast revised upward by 0.7pp from August

- FY25 forecast also revised upward to 6.2%

- 2023 inflation forecast to be 6%, the RBI upper band

- Global growth outlook revised downward for 2024