Multi-asset investment specialist Saxo Bank in participation with Euronext and Susquehanna, have introduced a new offering that significantly enhances the trading landscape: 0DTE (Zero Days To Expiry) options on the French CAC 40 stock index.

This development opens up new possibilities for traders interested in capitalizing on the volatility of the stock market within the same trading day. With this addition, Saxo broadens the array of trading strategies available to its clients, highlighting its commitment to providing sophisticated financial instruments to a diverse trader base.

0DTE (Zero Days To Expiry) options are financial instruments that expire on the same day they are traded, offering a unique opportunity for traders to leverage short-term market movements. Here are the core advantages:

Flexibility and Precision: 0DTE options enable traders to respond quickly to intra-day volatility, offering unparalleled control over their trading strategies.

- Cost-Effective: With lower premiums than longer-term options, 0DTE options allow for diversified strategies without a significant investment, making them accessible to a wide range of traders.

- Risk Management: They provide an effective tool for mitigating daily market risks, ideal for hedging against specific events that might affect the CAC 40 index.

- Profit Opportunities: These options are perfect for taking advantage of the liquidity and volatility in the market, especially during significant economic or geopolitical events.

- Broad Accessibility: Saxo’s introduction of 0DTE options on the CAC 40 index opens up complex trading strategies to traders of all experience levels, democratizing access to innovative trading tools.

In essence, 0DTE options introduced by Saxo Bank for the CAC 40 index present a strategic, flexible, and cost-effective tool for modern traders aiming for precision and efficiency in their trading activities.

Accessing CAC 40 Daily Options on Saxo Platforms

- Open the SaxoTraderGo Platform: Start by logging into your Saxo account, as you would normally do.

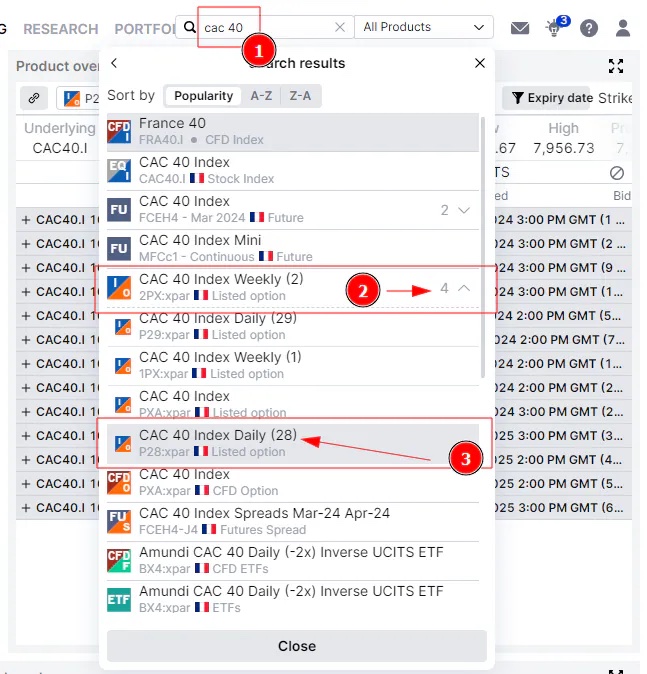

- Search for the CAC 40 Index: Use the search bar at the top of the platform, as shown in the screenshot, and type in “CAC 40”. The search bar is identified by a magnifying glass icon and is located near the top of the screen.

- Review the Search Results: After entering “CAC 40”, the platform will display a list of related products and instruments. You’ll see various listings under ‘Product overview’, which includes indices, futures, and options related to CAC 40.

- Select Daily Options: Look for the entries labeled “CAC 40 Index Daily”. These are the daily options you are interested in. They are typically listed with the day’s date for clarity, such as “CAC 40 Index Daily (29)” for options expiring on the 29th.

- Choose an Option to Trade: Click on the specific daily option you wish to trade. For example, if you want to trade the option expiring on the 28th, select “CAC 40 Index Daily (28)” from the list.

- Examine the Option Details: Upon selecting a daily option, you’ll be able to see the expiry time, which is crucial for 0DTE options. Make sure the expiry time matches your trading strategy and desired time frame.

- Initiate the Trade: Once you’ve identified the correct daily option, click on it to access the options chain. In the options chain, you can either click directly on a specific bid or ask price to open an order ticket for a straightforward transaction, or right-click to select an options strategy if you’re looking to place a more advanced combination order. The options chain provides a detailed view of all available strike prices and their respective bid and ask quotes, allowing you to make informed decisions and execute trades efficiently.

Remember, the availability of daily options and their details may vary each trading day, so it is essential to verify the date and expiry time for the options you are interested in trading.