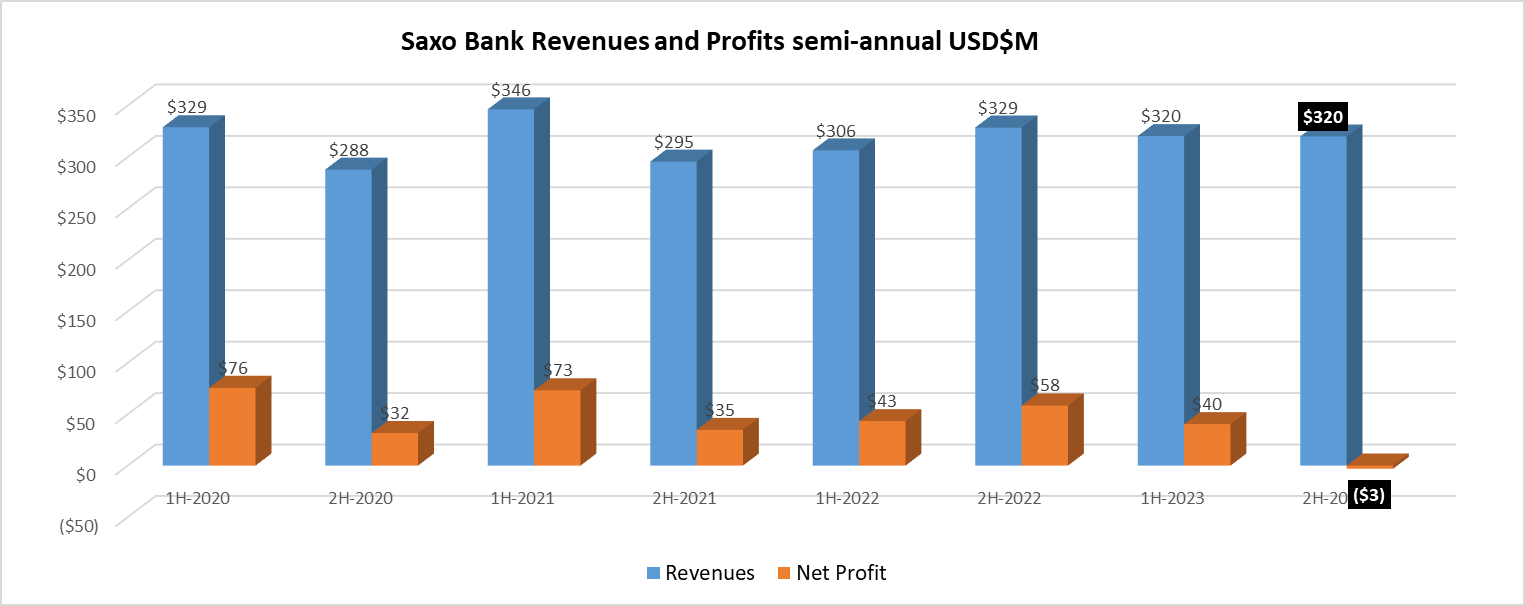

Copenhagen based Retail FX and CFDs broker Saxo Bank has released its 2023 Annual Report, indicating a fairly steady second-half-of-the-year, but falling profitability at the company.

Revenues at Saxo Bank came in at DKK 2.239 billion (USD $320 million) in the second half of 2023, virtually identical to the first half of the year (DKK 2.242 billion). However on the bottom line Saxo posted a net loss of DKK 22 million ($3 million) in the July-to-December 2023 period, versus a profit of DKK 282 million in the first half of the year. The loss was due mainly to a write-down of software, and a negative impact of DKK 94 million from the divestment of the Saxo Geely Tech Holding joint venture.

For the full year 2023, Revenues at Saxo Bank came in at DKK 4.481 billion ($640 million), up 1% from 2022, and the company posted Net Profit of DKK 260 million ($37 million), down 63% from the previous year.

Looking a little deeper at Saxo Bank’s numbers, the company’s results in 2023 were helped by the higher interest rate environment, with Net Interest Income of DKK 2.0 billion comprising 45% of overall Revenues, versus just 32% in 2022. Saxo’s Net Fee and Commission Income from its core trading business fell in 2023 to DKK 1.31 billion from 1.55 billion the previous year, as client trading volumes at Saxo Bank fell slightly in 2023 from 2022 levels.

Saxo Bank abandoned at attempt to go public in late 2022 via a merger with Euronext Amsterdam listed special purpose acquisition company, which would have provided liquidity to the company’s two largest outside shareholders, China’s Geely Group (49.9%) and Finland’s Sampo (19.8%).

Commenting on the results, Kim Fournais, CEO and founder of Saxo Bank, said:

“In 2023, we have made further progress in building a more competitive, resilient, and relevant Saxo. We reached a record of more than 1.1 million end clients with assets exceeding DKK 745 billion. A key factor in attracting new clients and increasing the client assets was the introduction of our innovative interest rate model. This model allows clients to earn leading market interest rates on their uninvested cash without the usual restrictions, like lock-up periods.

“2023 also marked Saxo Bank’s appointment as a Systemically Important Financial Institution (SIFI). It is a responsibility we embrace with humility and determination, and it underlines our commitment to being a trustworthy, prudent, and compliant partner to our clients and partners, and to the societies in which we operate.

“The strategic focus remains unchanged with a continued emphasis on growing the number of clients and client assets, and on enhancing the product and platform offering to the benefit of our clients as well as focusing on our core markets. At the beginning of this year, we announced significant price cuts across markets to improve competitiveness and further empower investors to make more of their returns. The reduction in prices and fees is making it increasingly straightforward and appealing to diversify among different asset classes, a key component of a robust and successful investment portfolio.”

Saxo Bank’s 2023 Annual Report can be downloaded here (pdf).