In a surprising move, SNB announced a -25bps cut in its policy rate, bringing it down to 1.50%. This decision also introduced a tiered system for the remuneration of banks’ sight deposits held at SNB. Deposits up to a specified threshold will earn interest at the policy rate, while those exceeding this limit will attract only 1.0% higher rate. Furthermore, SNB affirmed its readiness to intervene in the foreign exchange market if deemed necessary.

The rationale behind the rate cut, as outlined by the SNB, is the “effective” management of inflation over the past two and a half years, which has allowed inflation rates to settle below the 2% mark for several months. This achievement aligns with the SNB’s definition of price stability and sets the stage for a conducive economic environment in the foreseeable future.

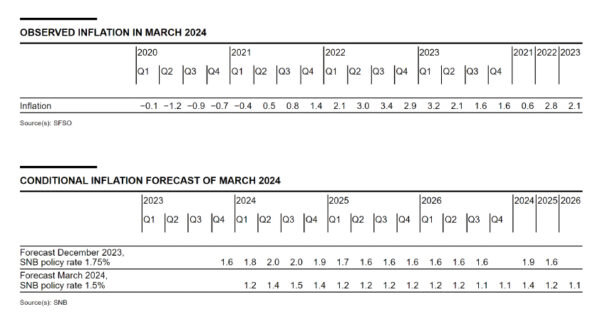

The new conditional inflation forecasts are revised sharply lower even with a lower policy rate. SNB project a modest increase in inflation from 1.2% in Q1 to 1.5% in Q2 of this year, followed by a decline to 1.2% in Q1 2025, and a further decrease to 1.1% in the second half of 2026.

Full SNB statement here.