- Higher oil prices have led to higher inflationary expectations in the US via the breakeven rates.

- Recent rise in inflationary expectations coupled with recent “less dovish” Fed Speak from Fed officials Kashkari, and Bostic has revived the “higher for longer” interest rates environment.

- Higher commodities prices led by oil may see an uptick in US CPI data.

- Potential negative implication for S&P 500 as its recent steep rally from the October 2023 low has reached an extremely overbought technical level.

Last week, we witnessed several key events, economic data releases, and intermarket price action movements that may lead to a repositioning and rethinking of the earlier much hyped-up, Fed’s dovish pivot narrative that supported a resurgence of broad-based risk-on behaviour after the Fed’s FOMC monetary policy meeting in December last year.

Federal Reserve Bank of Minneapolis President Kashkari has joined the “less dovish outlier” camp together with his colleague, Fed Atlanta President Bostic who advocated the Fed should be more patient in cutting its Fed funds rate this year, and Kashkari has turned out to be the “most hawkish” official at this juncture as his public speech on last Thursday, 4 April stated that that interest rate cuts may not be needed in 2024 if progress on fighting inflation has stalled, especially if the US economy remains in a robust state.

This latest rhetoric and guidance from Fed officials Kashkari and Bostic have paled against Fed Chair Powell’s insistence that Fed funds rate cuts are likely to take place this year, and potentially three cuts before 2024 ends after the recently concluded FOMC meeting in March.

Less dovish Fed officials’ guidance and rosy March’s NFP have pushed back rate cuts expectations

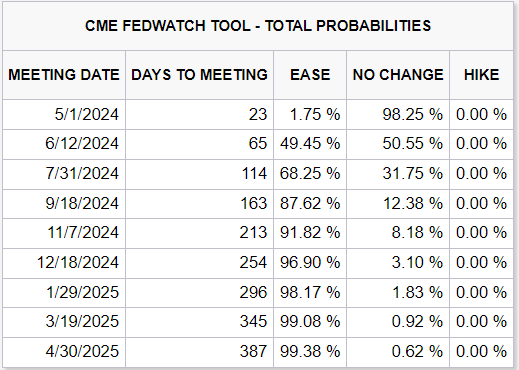

Fig 1: Probability of Fed funds rate outcome as of 8 Apr 2024 (Source: CME FedWatch Tool, click to enlarge chart)

Coupled with the latest red-hot US non-farm payroll jobs data for March that surpassed expectations significantly; +303K versus consensus of +200K, and above February’s print of +270K. Also, the upbeat March’s NFP data saw the highest number of jobs added in the past ten months.

All in all, the expectation of the first Fed rate cut has been dialled back again, right now market participants in the Fed funds rate futures market have pushed back the first interest rate cut in the US to occur in July’s FOMC with a probability of 68% (see Fig 1) while the probability of a rate cut in June FOMC has been reduced to 49% from an earlier chance of 76% right after the recent 20 March FOMC meeting based on data obtained from CME FedWatch Tool.

The crux is likely rising inflationary expectations due to higher WTI oil prices

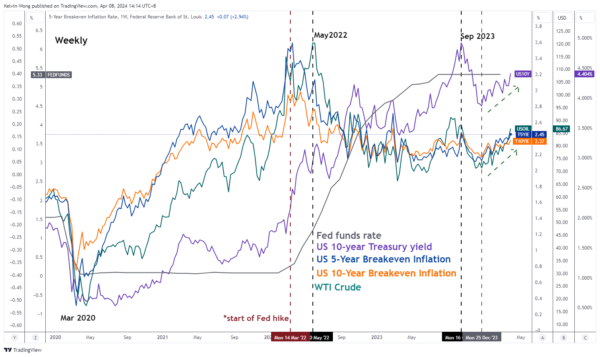

Fig 2: Correlation movements of US 5-year & 10-year breakeven inflation rates with WTI crude & US 10-year Treasury yield as of 5 Apr 2024 (Source: TradingView, click to enlarge chart)

Based on recent past data since the start of the latest Fed funds rate hike cycle that occurred in mid-March 2022, the rallies seen in both the US 5-year and 10-year breakeven inflation rates (in a nutshell, the breakeven rates are inferred as forward-looking 5-year and 10-year inflationary expectations from today based on market transacted prices derived from US Treasury Inflation-Protected Securities, TIPS) preceded the start of the interest rate hike cycle.

On a closer examination, the movement of West Texas crude oil (WTI) has a direct correlation with both the US 5-year and 10-year breakeven rates where three of them rose significantly in unison from November 2021 to February 2022 before the Fed hiked rates.

Right now, the 5-year and 10-year breakeven rates may have formed a medium-term bottom on 25 December 2023 as it rallied by 33 bps to 21 bps to 2.45% and 2.37% respectively in line with a rally of +24% seen in WTI crude oil which in turn also pushed up the US 10-year Treasury yield to a five-month high at 4.40% on last Friday, 5 April (see Fig 2).

Potential implications (1) – Higher US CPI may revive the higher for longer interest rates narrative

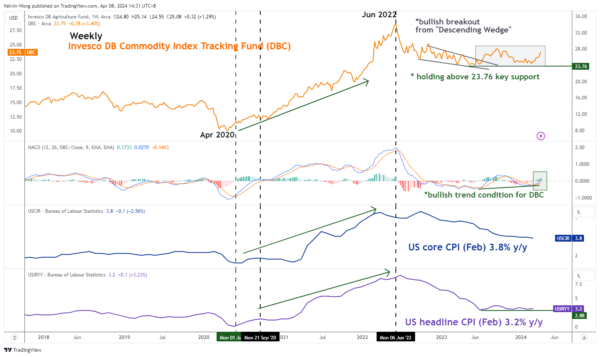

Fig 3: Invesco DB Commodity Index Tracking Fund major trend with US CPI as of 5 Apr 2024 (Source: TradingView, click to enlarge chart)

An important point to note is CPI data that gauges inflationary trends are lagging in nature as they are calculated based on prior month prices of a basket of selected goods and services.

Market-transacted prices of commodities are likely to be more forward-looking and can have a significant impact on the CPI-inflationary trends that manifest in the following months thereafter.

Headline inflation or primarily goods-based inflation (including food & energy) has a high direct linkage to prices of tradable commodities.

Using the Invesco DB Commodity Index Tracking Fund (DBC), a broad-based commodities futures exchange-traded fund with its highest weightage holding of 56% concentrated in energy-related futures and 21% (second highest) weightage in agriculture-related futures in conjunction with the trend movements of both the US headline and core CPI y/y rates to conduct an intermarket analysis (see Fig 3).

Based on historical price actions, movements seen in the DBC tend to lead over the headline and core CPI inflation trends. Before the prior significant upsurge in the US inflation rates from September 2020 to June 2022, the weekly MACD trend indicator of the DBC flashed a bullish crossover signal earlier in June 2020 that preceded the change of DBC’s major trend from bearish to bullish.

A new positive element has been detected in the most recent movement of the weekly MACD trend indicator of DBC where it has flashed out a bullish crossover condition and inched higher above its zero-centreline last week. These observations suggest a potential emergence of a major uptrend phase for DBC.

If history plays out again, the current positive momentum element inherent in the DBC may lead to at least a further potential medium-term upmove in DBC which in turn could translate to a possible uptick in inflationary pressures in the real economy in H2 2024 that may put the Fed dovish pivot narrative in jeopardy, and further reduces the expected number of Fed funds rate cut in 2024.

Potential implications (2) – Higher oil prices may trigger a multi-week corrective decline in the S&P 500

Fig 4: WTI crude major trend with S&P 500 as of 5 Apr 2024 (Source: TradingView, click to enlarge chart)

Fig 5: S&P 500 major trend as of 5 Apr 2024 (Source: TradingView, click to enlarge chart)

Based on correlation analysis, the prior major uptrend phase of WTI crude from April 2020 to May 2022 has led to adverse movement in the S&P 500 with a lead time as the S&P 500 shaped a medium-term multi-week corrective decline of -27% thereafter from January 2022 to October 2022.

A smaller scale rally in oil prices was also seen most recently in the late summer months of last year when WTI crude broke above its 200-day moving average and rallied from July 2023 to September 2023, and during this period, the S&P 500 shaped a corrective decline of -12%.

Interestingly, bullish momentum has resurfaced in WTI crude as it continued to rally for four weeks after it broke above its 200-day moving average again in late February 2024 within a potential major basing configuration that has now formed since March 2023 (see Fig 4).

In addition, the daily RSI momentum indicator of the S&P 500 has almost reached an extreme outbought level of 79.04 last seen on 13 January 2020 which increases the odds that a medium-term multi-week corrective decline may unfold next after a steep rally of +28% from October 2023 swing low (see Fig 5).

Watch the 5,280 key medium-term pivotal resistance, and a break below the 50-day moving average now acting as a support at around 5,090 may expose the next medium-term support of 4,800.