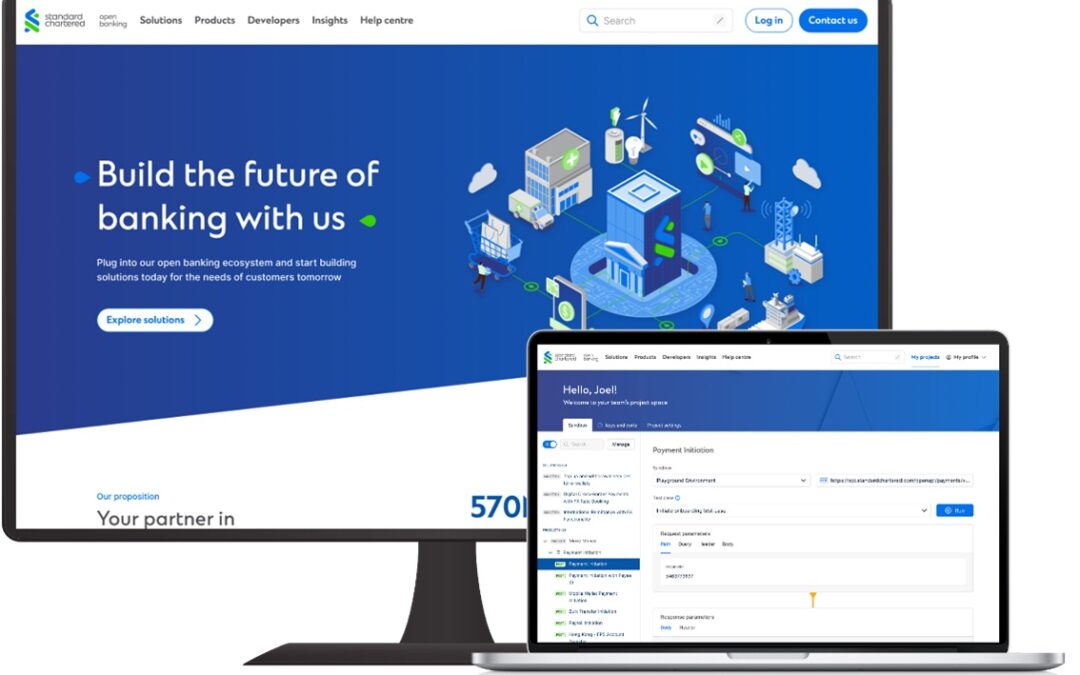

Standard Chartered today announced the launch of its new Open Banking Marketplace, a one-stop platform that enables both existing and prospective clients to discover, identify, and test application programming interfaces (APIs) that best meets their business objectives in a sandbox environment.

With the objective of streamlining business-to-bank collaboration, corporates who are keen to partner with the Bank in their digital transformation can benefit from a shorter discovery and implementation process, by allowing their developers to start coding and plugging into the Bank’s open banking ecosystem to simulate the experience almost immediately.

In embracing the future of banking, Standard Chartered has been focused on enhancing its open banking capabilities through the sharing and use of APIs. The Open Banking Marketplace builds on an earlier iteration of the Bank’s aXess platform that was launched in 2019 – which was part of a broader initiative targeted at the developer community to boost its open banking capabilities – and offers a richer user experience with the aim of accelerating open banking adoption by making it easier for corporates to tap into the applications required.

Besides the ability to access a growing suite of more than 100 ready-built API products from cash and FX to trade and securities, users of the platform can also enjoy other unique features such as:

- Browse and filter solutions tailored to their industry across 33 markets globally, including manufacturing, fintech, technology, e-commerce and more;

- Create a project space and conduct testing with their team in an upgraded simulator environment which allows them to write and test production-ready code; and

- Explore new developer guides such as API technology documents and tutorials on the Bank’s security protocols and authentication.

The Open Banking Marketplace also features past use cases and client stories specific to each API product, offering insights on replicable solutions and tangible outcomes that illustrate how Standard Chartered’s open banking solutions can provide value-add to businesses – especially useful for stakeholders beyond those in the developer community.

“Open banking has been a transformative force over the last decade, with APIs playing an important role in enabling corporates to build future-proof propositions that meet the needs of the evolving digital economy. What is needed to further its adoption is a shift in focus towards a better user experience – one that is less technically focused and offers simple, plug-and-play solutions,” said Mark Willis, Standard Chartered’s Global Head of API & Open Banking Ecosystems, Digital Channels & Data Analytics.