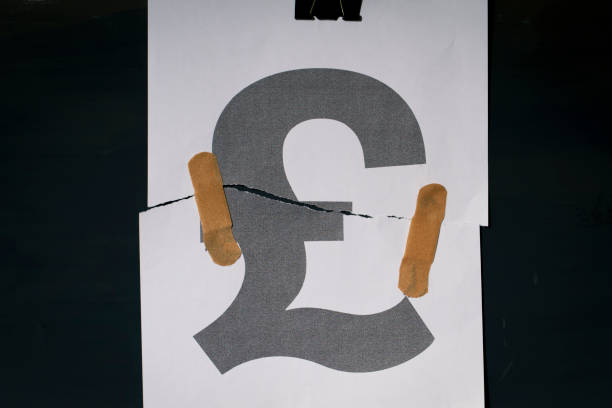

British Pound faced broad selloff today, continuing its decline in response to comments made last Friday by BoE Deputy Governor Dave Ramsden. Ramsden expressed he is now much less worried about inflation, and expects upcoming data to show significant slowdown in April. More importantly, he emphasized that UK inflation trends are likely to realign more closely with Eurozone rather than with the US.

The comments now set some expectation, contingent on April CPI data, monetary policy easing by BoE preceding similar moves by Fed and following ECB. This would place the August BoE meeting squarely in focus as a possible juncture for the initial rate cut.

Elsewhere in the currency markets, Euro is trailing as the second worst by some distance. Commodity currencies remain in pole position, supported by the strong rebound in risk sentiment, as seen in major European stock indexes and US futures. Dollar, Swiss Franc and Yen are trading in middle positions, bounded in tight range against each other. Attention in the currency markets is now turning to forthcoming PMI data from Australia, Japan, the Eurozone, the UK, and the US, which is expected to provide further direction.

Technically, GBP/AUD is one of the top movers for the day at this point. Immediate focus is now on 1.9111 support. Decisive break there should confirm that rebound from 1.8984 has completed at 1.9567 already. The corrective pattern from 1.9967 (2023 high) should have then started the third leg. Deeper fall would be seen back to 1.8584 support, or even further to 100% projection of 1.9967 to 1.8584 from 1.9567 at 1.8184 in the medium term.

In Europe, at the time of writing, FTSE is up 1.84%. DAX is up 0.79%. CAC is up 0.40%. UK 10-year yield is down -0.005 at 4.225. Germany 10-year yield is up 0.011 at 2.517. Earlier in Asia, Nikkei rose 1.00%. Hong Kong HSI rose 1.77%. China Shanghai SSE fell -0.67%. Singapore Strait times rose 1.53%. Japan 10-year JGB yield rose 0.0492 to 0.886.

Germany’s BDI expects production decline and stagnant exports this year

Germany’s industrial sector continues to faces another challenging year ahead, with Federation of German Industries (BDI) issuing a warning about the downturn in industrial production and the stagnation of exports for 2024. According to BDI’s latest forecasts, industrial production is anticipated to drop by -1.5% this year. Additionally, exports are expected to remain flat.

BDI President Siegfried Russwurm highlighted the persistent struggles of the German industry, which has not fully recovered from “cost and demand shocks,” driven by spikes in energy prices and inflation pressures.

Russwurm expressed concern over the long-term trend, noting that, despite some signs of a moderate recovery, the “overall production figures” have been following a “worrying downward trend” for several years.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2336; (P) 1.2402; (R1) 1.2437; More…

GBP/USD’s decline extends further to as low as 1.2301 so far today. Intraday bias stays on the downside for 161.8% projection of 1.2892 to 1.2538 from 1.2708 at 1.2207 next. On the upside, above 1.2391 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another fall.

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Fall from 1.2892 is seen as the third leg. Deeper decline would be seen to 1.2036 support and possibly below. But strong support should emerge from 61.8% retracement of 1.0351 to 1.2452 at 1.1417 to complete the correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Price Index M/M Apr | 1.10% | 1.50% | ||

| 01:15 | CNY | PBoC 1-y Loan Prime Rate | 3.45% | 3.45% | 3.45% | |

| 01:15 | CNY | PBoC 4-y Loan Prime Rate | 3.95% | 3.95% | 3.95% | |

| 12:30 | CAD | Industrial Product Price M/M Mar | 0.80% | 0.80% | 0.70% | 1.10% |

| 12:30 | CAD | Raw Material Price Index Mar | 4.70% | 2.90% | 2.10% | |

| 12:30 | CAD | New Housing Price Index M/M Mar | 0.00% | 0.10% | 0.10% | |

| 14:00 | EUR | Eurozone Consumer Confidence Apr P | -14 | -15 |