Sterling is having a volatile trading day, initially gaining ground after UK CPI data which indicated slower pace of disinflation than anticipated. Despite this, the currency struggled to maintain its momentum as the data did not substantially alter the broader expectation that BoE) will delay interest rate cuts until at least late summer. The lack of significant decline in services inflation particularly underscored ongoing price pressure challenges, reinforcing the view that it is premature for a more optimistic stance on monetary easing.

In the broader currency market, New Zealand Dollar is currently the strongest performer of the day, buoyed by supportive Q1 CPI readings that suggest sustained inflationary pressures, which may delay any rate cuts by RBNZ. Following closely behind, Australian Dollar ranked as the second strongest, with traders positioning ahead of the upcoming employment data expected to influence further movements. Dollar is the weakest one, as it began to retract some of its recent gains. Japanese Yen and Canadian Dollar also underperformed, while Euro and Swiss Franc held middle positions in the trading spectrum.

Technically, AUD/NZD hits 1.0860 support today but recovered briefly. The preferred case is still that rise from 1.0567 has completed at 1.0952, just ahead of medium term falling trend line. Break of 1.0860 support will strengthen this bearish view, and bring deeper fall through 55 D EMA, as another falling leg of the sideway pattern from 1.1085. Upcoming Australian employment data could be a catalyst for this anticipated movement.

In Europe, at the time of writing, FTSE is up 0.66%. DAX is up 0.47%. CAC is up 1.30%. UK 10-year yield is up 0.0015 at 4.306. Germany 10-year yield is up 0.0004 at 2.492. Earlier in Asia, Nikkei fell sharply by -1.32%. Hong Kong HSI rose 0.02%. China Shanghai SSE rose 2.14%. Singapore Strait Times rose 0.32%. Japan 10-year JGB yield closed flat at 0.887.

Eurozone CPI finalized at 2.4% yoy, core CPI at 2.9% yoy

Eurozone CPI was finalized at 2.4% yoy in March, down from February’s 2.6% yoy. CPI core (energy, food, alcohol & tobacco) was finalized at 2.9% yoy, down from prior month’s 3.1% yoy.

The highest contribution to annual Eurozone inflation rate came from services (+1.76 percentage points, pp), followed by food, alcohol & tobacco (+0.53 pp), non-energy industrial goods (+0.30 pp) and energy (-0.16 pp).

EU CPI was finalized at 2.6% yoy, down from prior month’s 2.8% yoy. The lowest annual rates were registered in Lithuania (0.4%), Finland (0.6%) and Denmark (0.8%). The highest annual rates were recorded in Romania (6.7%), Croatia (4.9%), Estonia and Austria (both 4.1%). Compared with February, annual inflation fell in thirteen Member States, remained stable in four and rose in ten.

UK CPI slows less than expected to 3.2% yoy in Mar

UK CPI slowed from 3.4% yoy to 3.2% yoy in March, above expectation of 3.1% yoy. CPI core (excluding energy, food, alcohol and tobacco) decelerated from 4.5% yoy to 4.2% yoy, above expectation of 4.1% yoy. CPI goods slowed from 1.1% yoy to 0.8% yoy. CPI serviced eased marginally from 6.1% yoy to 6.0% yoy. For the month, CPI rose 0.6% mom.

New Zealand’s CPI eases to 4.0% yet exceeds target, driven by housing costs

New Zealand CPI rose 0.6% qoq in Q1, while annual inflation rate decelerated from 4.7% yoy to 4.0% yoy. This marks the lowest annual inflation rate since Q2 2021 but still remains above RBNZ’s target band of 1-3%.

The most significant pressure on the annual inflation rate came from the housing and household utilities sector. Record increases in rent, which rose by 4.7% yoy, along with 3.3% yoy rise in the construction costs of new houses and 9.8% yoy hike in rates, were the primary drivers behind the sustained inflationary pressures.

In terms of inflation categories, there was a notable divergence between non-tradeable and tradeable inflation. Non-tradeable inflation, which includes goods and services that do not face foreign competition and thus reflect domestic supply and demand conditions, slightly decreased from 5.9% yoy to 5.8% yoy.

In contrast, tradeable inflation, which is influenced by foreign markets and includes goods and services that compete with foreign imports, experienced a more significant slowdown from 3.0% yoy to 1.6% yoy.

Australia’s Westpac leading index indicates sub-trend growth to continue

Australia’s economic outlook appears subdued for the remainder of 2024, according to the latest data from Westpac’s leading index, which fell from -0.03% to -0.23% in March. This decline signals continuation of “sub-trend” growth, as characterized by Westpac, suggesting that the economic performance may not reach the usual growth standards expected within the country.

Westpac projected that Australia’s GDP growth will remain modest at of 1.6% for 2024. This follows a similarly soft performance in 2023, where GDP grew only by 1.5%. Such figures are notably below the typical “trend” growth rate of around 2.5%.

Looking ahead, the focus shifts to the upcoming Q1 CPI data, set to be released on April 24. Westpac anticipates that this report will show deceleration in inflation to 3.5%, a development that could reinforce RBA confidence that inflation is on path back to target range of 2-3%.

However, the decision for RBA to shift to a more definitively “on hold” stance regarding interest rates will hinge on the specifics of the price updates and a broader assessment of risks.

Japan’s export rises 7.3% yoy in Mar, fourth month of growth

Japan’s exports marked the fourth consecutive month of growth with a 7.3% yoy increase to JPY 9470B in March, slightly surpassing expected 7.0%. This growth was largely fueled by robust performances in automotive and semiconductor & electronic parts, which reported gains of 7.1% yoy and 11.3% yoy respectively. T

Regionally, exports to China accelerated to 12.6% yoy, from just 2.5% yoy in the previous month. However, exports to the US and Europe saw a slowdown, growing at 8.5% and 3.0% respectively.

Import contracted -4.9% yoy to JPY 9103B, which was slightly better anticipated -5.1% yoy. Overall trade balance for March showed a surplus of JPY 366.5B.

In seasonally adjusted term, exports rose 2.6% mom to JPY 8768B. Imports rose 3.9% mom to JPY 9470B. Trade balance came in at JPY -701B.

GBP/USD Mid-Day Outlook

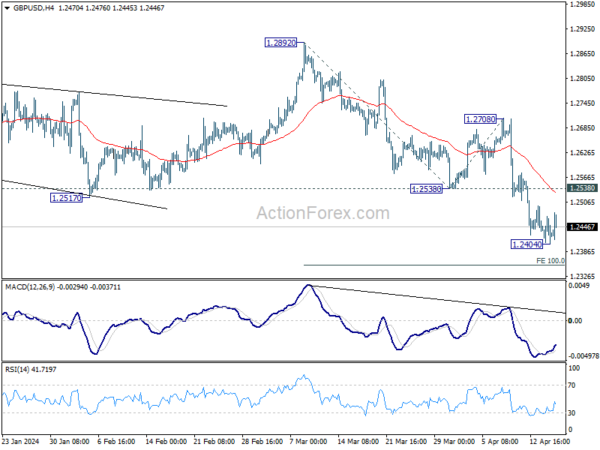

Daily Pivots: (S1) 1.2397; (P) 1.2435; (R1) 1.2463; More…

Intraday bias in GBP/USD remains neutral and outlook is unchanged. Consolidation from 1.2402 is extending, but upside of recovery should be limited by 1.2538 support turned resistance to bring another fall. On the downside, firm break of 1.2404 will resume the decline from 1.2892 to 100% projection of 1.2892 to 1.2538 from 1.2708 at 1.2354. Firm break there will target 161.8% projection at 1.2207 next.

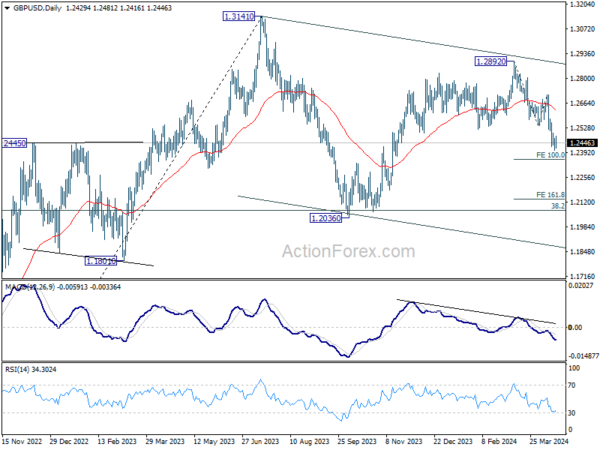

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Fall from 1.2892 is seen as the third leg. Deeper decline would be seen to 1.2036 support and possibly below. But strong support should emerge from 61.8% retracement of 1.0351 to 1.2452 at 1.1417 to complete the correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | CPI Q/Q Q1 | 0.60% | 0.60% | 0.50% | |

| 22:45 | NZD | CPI Y/Y Q1 | 4.00% | 4.70% | ||

| 23:50 | JPY | Trade Balance (JPY) Mar | -0.70T | -0.28T | -0.45T | -0.57T |

| 01:00 | AUD | Westpac Leading Index M/M Mar | -0.10% | 0.10% | ||

| 06:00 | GBP | CPI M/M Mar | 0.60% | 0.60% | ||

| 06:00 | GBP | CPI Y/Y Mar | 3.20% | 3.10% | 3.40% | |

| 06:00 | GBP | CPI Core Y/Y Mar | 4.20% | 4.10% | 4.50% | |

| 06:00 | GBP | RPI M/M Mar | 0.50% | 0.80% | ||

| 06:00 | GBP | RPI Y/Y Mar | 4.30% | 4.20% | 4.50% | |

| 06:00 | GBP | PPI Input M/M Mar | -0.10% | 0.00% | -0.40% | 0.30% |

| 06:00 | GBP | PPI Input Y/Y Mar | -2.50% | -2.70% | -2.20% | |

| 06:00 | GBP | PPI Output M/M Mar | 0.20% | 0.20% | 0.30% | |

| 06:00 | GBP | PPI Output Y/Y Mar | 0.60% | 0.40% | ||

| 06:00 | GBP | PPI Core Output M/M Mar | 0.30% | 0.20% | 0.10% | |

| 06:00 | GBP | PPI Core Output Y/Y Mar | 0.10% | 0.20% | 0.30% | 0.20% |

| 09:00 | EUR | Eurozone CPI Y/Y Mar F | 2.40% | 2.40% | 2.40% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Mar F | 2.90% | 2.90% | 2.90% | |

| 14:30 | USD | Crude Oil Inventories | 1.6M | 5.8M | ||

| 18:00 | USD | Fed’s Beige Book |