Markets

In yet another dull trading day the weak SEK (cf. below) and JPY stand out. The yen is not impressed by Ueda ramping up warnings. It began in Asian dealings, where the BoJ governor said that a policy response (i.e. rate hike) could be needed depending on the currency’s moves. Ueda said a weak JPY affects inflation and is therefore a key variable in the analysis. Finance minister Suzuki around the same time aired the usuals: that they are watching the market closely and will take all possible measures as needed. Well into European trading hours, Ueda said he’s seeing signs of a virtuous wage-price cycle strengthening. He also noted that should risks to the inflation outlook grow, it would be appropriate for the BoJ to increase rates at a faster pace. Ignoring all that, USD/JPY for a third day straight rises and pierces through the 155 barrier again with ease. This compared with a close last Friday at 153.05. Monday last week the pair hit 160 for the first time in 34 years, prompting an intervention by Japanese authorities. They returned to the market two days later. Moves this week once again show that unilateral interventions rarely have a lasting market impact. The dollar is overall better bid today, recovering some of the losses incurred in the wake of Friday’s sub-consensus payrolls and services ISM. The trade-weighted index rises towards 105.58, EUR/USD eases slightly to 1.0748. Sterling remains under pressure going into tomorrow’s potentially market-moving Bank of England meeting. EUR/GBP breaks above 0.86, a move we expected to happen in case the likes of governor Bailey indicate some decoupling from the Fed to walk a rate path more akin to the ECB. Leaping (and closing the week) beyond 0.8644 would be a technical sign of the pair looking to break loose from the monthslong stalemate.

Core bonds lost ground in a sign the recent rally is running out of steam. Technical charts are coming to the rescue here and there as well (e.g. the upward sloping trendline in the US and German 10-yr yield). Yields in the US add between 0.8 (2-yr) and 3.7 bps (30-yr). Bunds underperform, rising 3.4 (2-yr) to 5.3 bps (30-yr). Belgian ECB policymaker Wunsch said there’s room to cut this year but did not want to pre-commit to anything beyond June. Wunsch warned that risks to the inflation outlook remain, in particular around the trajectory of wage growth and inflation in wage-sensitive services. He also singled out the euro, which could weaken significantly amid diverging economic conditions and monetary policy between the euro area and US. Austrian member Holzmann hinted that follow-up action to a June cut, if any, is likely for September or December rather than July.

News & Views

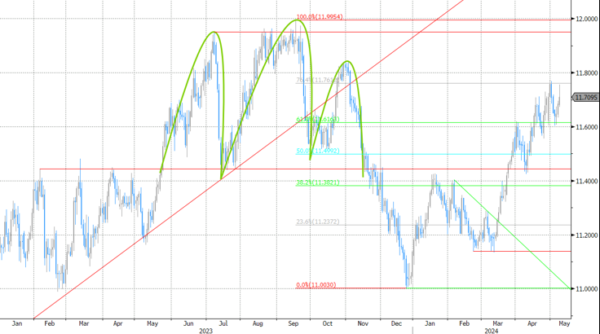

The Swedish Riksbank cut its policy rate by 25 bps to 3.75% today. Inflation is approaching the target while economic activity is weak, allowing the central bank to make monetary policy less restrictive. If the outlook for inflation still holds, the policy rate is expected to be cut two more times during the second half of the year. Gradual cuts are warranted given uncertainty around the outlook. Risks that may cause inflation to rise again are primarily linked to the strong US economy, the geopolitical tension and the krona exchange rate. The Swedish krona lost marginally ground after the decision with EUR/SEK approaching the 11.77 YTD high. Money markets discount the next 25 bps rate cut by the August meeting.

A new report by the Semiconductor Industry Association (SIA) and the Boston Consulting Group on the semiconductor supply chain forecasts significant improvements in the resilience of the supply chain in both the US and globally in coming years. US fab capacity is projected to increase by 203% by 2032, a tripling of US capacity. That will take the US share of the industry from currently 10% to 14%. The US will secure more than one-quarter (28%) of global capital expenditures between 2024-2032 – an estimated $646bn – an amount second only to Taiwan.

Graphs

USD/JPY: yen loses for a third day straight, ignoring Ueda warnings

EUR/SEK: Swedish crown loses ground in the wake of the Riksbank’s first rate cut since 2016

EUR/GBP breaks above 0.86 going into tomorrow’s Bank of England meeting

European 10y swap yield is close in finding a bottom after the recent retreat