Bond fund managers have so much cash they’re turning to the derivatives market to put it to work, pushing down the cost of protection against defaults close to levels that prevailed when central banks were just starting to raise interest rates.

The bets on tightening credit-default swap spreads are the latest sign of the overarching optimism that’s enveloped markets, where credit investors flush with cash have been buying up large amounts of new debt and pushing back the so-called maturity wall that was a major source of concern just six months ago. Money managers are using credit derivatives indexes like the Markit CDX North American Investment Grade Index to gain the exposure they want.

“CDX is a liquid way to get credit risk when cash bonds are harder to find,” said Scott Kimball, chief investment officer at Loop Capital Asset Management. “A significant amount of the recent tightening is institutions looking to put more money to work than there are bonds available.”

A “roll” of credit default swap contracts at the end of March should be a short-term boost for the credit derivatives index market and lead to outperformance, according to Fraser Lundie, head of fixed income at Federated Hermes. The roll, a release of new indexes tracking a refreshed basket of companies, effectively resets the maturity for so-called on-the-run contracts every six months and typically leads to an increase in the volume of trades.

“On the long side, it’s an opportunity to extend by six months and pick up extra spread,” Lundie said. “On the short side, the opposite is true and this extra cost may psychologically weigh on some investors, reconsidering the rationale to continue holding the negative view or adjusting its size.”

Mohammed Kazmi is among the investors using the synthetic indexes to express his bullish view on the junk bond market. Instead of buying individual bonds, the portfolio manager and chief strategist at Union Bancaire Privee uses contracts on the likes of CDX.HY and iTraxx Crossover indexes.

“We like them because of their liquidity but also from a valuation perspective. You’re currently paid to be in CDS versus cash,” he said in an interview, referring to the relatively wide level of the derivatives’ spreads compared with that of an equivalent cash bond.

CDS indexes are the most liquid instruments in the entire credit market, with hundreds of billions of dollars worth of contracts changing hands every month. Wagers on tighter spreads for high-grade contracts have sent the CDX IG and iTraxx Europe indexes to almost the lowest levels since the global financial crisis.

“If you’re a fund manager and you said, ‘I thought there was going to be a recession, now it doesn’t appear there’s going to be’, you’re just a forced buyer. Maybe it’s CDX, maybe it’s individual companies,” Jeffrey Klingelhofer, co-head of investments at Thornburg Investment Management, said of the market. “You feel like you can’t miss out on it any more.” Thornburg doesn’t currently trade CDX.

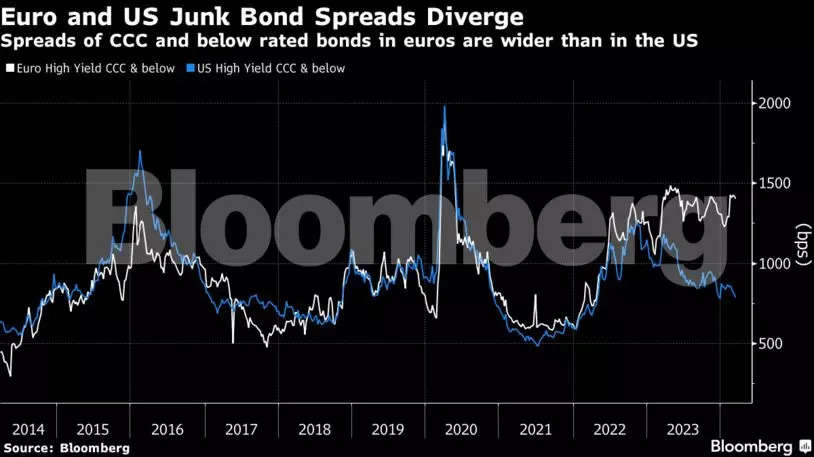

To be sure, the broader tightening masks some fragmentation in parts of the market. Euro-denominated bonds issued from firms rated CCC and below, which are at high risk of going bust, have missed out on the general rally. In addition, an S&P Global Ratings worldwide tracker of corporate failures in 2024 reached the highest year-to-date level since 2009, the ratings company said in a recent release.

Bank of America Corp. strategists Ioannis Angelakis and Barnaby Martin this week recommended using the CDS options “as a way to insulate from the notable market euphoria,” especially in high-grade credit.

Still, calls for wider default swap spreads in recent weeks have proven misplaced as credit kept rallying regardless. And with traders having already moderated their expectations of rate cuts this year, there is no obvious bogeyman left.

“The question for me is how much widening can you get while waiting to be invested?” Kazmi said. “What are the triggers for very large widening? I don’t see them on the horizon.”

What to Watch

About $25 billion to $30 billion of US high-grade bond sales are expected next week, with the bulk likely coming Monday and Tuesday ahead of the results of the Federal Reserve’s meeting.

In Europe, 64% of professionals surveyed expect over €30 billion ($32.7 billion) of sales in the coming week.

In the US, the Fed meeting on March 19-20 will bring an updated dot plot and guidance from Chair Jerome Powell on rate cut timing.

The UK will release its February CPI data on March 20. The Bank of England is expected to hold rates at its March 21 meeting.

In China, headline activity data due March 18 is likely to show a slowdown, but the reality is closer to stabilization. Chinese banks will likely leave loan prime rates unchanged at the March 20 fixing.

For an in-depth look at the data and events around the world that could impact markets in the coming week, see the Global Economy Week Ahead from Bloomberg Economics.

Week in Review

Less than a year ago, investors were gaming out what would happen when billions of dollars of bonds reached maturity dates, leaving borrowers potentially crushed by costly refinancings. Now, those fears are fizzling away, with companies rushing to sell debt to a buoyant market.

Low prices. Risky underwriting. Traditional lenders are trying everything to win M&A funding deals. And now they’re being asked to provide delayed draw term loans — previously a hallmark of private credit deals.

Buyout firm H.I.G. Capital is seeking $655 million of debt financing to help fund its potential purchase of mechanical and industrial cleaning company USA DeBusk.

New York Community Bancorp said it will book a gain after selling a portfolio of consumer loans with a net book value of $899 million as well as a co-op loan.

Morgan Stanley has tightened its spread targets for US corporate debt on stronger than expected economic growth and technicals, and sees demand continuing.

Cash-strapped developer China Vanke Co. has been fighting to avoid its first-ever default, and while investors’ fears of an imminent meltdown appear to be easing, its long-term prospects are less clear.

Banks may have less incentive to use synthetic risk transfers to manage their capital requirements as the US plans to change its proposed Basel III Endgame rules, and potentially completely remake them.

A $164 million holdback on a commercial mortgage-backed securities deal has drawn attention on Wall Street as a potential new X-factor risk in the $1 trillion market.

Banks led by Morgan Stanley are preparing to begin marketing $2.1 billion of senior secured notes to support the buyout of Truist Financial Corp.’s insurance business.

Potential bidders for Sanofi’s consumer health division are mulling debt packages of about €7.5 billion ($8.16 billion), which would make it one of the biggest leveraged buyout financings in recent years.

Enviva Inc., the world’s biggest supplier of wood pellets for generating electricity, filed for bankruptcy in Virginia, outlining a restructuring plan to cut debt by about $1 billion.

Discount retailer 99 Cents Only Store LLC is exploring a debt restructuring, and some bondholders have hired advisory firm Portage Point Partners for talks.