U.S. Highlights

- Markets let out a sigh of relief as the Fed’s Summary of Economic Projections reaffirmed expectations for three rate cuts this year.

- The Fed’s forecast for the economy is interesting, as it implies above trend growth in each of the next three years – despite interest rates that remain in restrictive territory.

- Forecasts for healthy growth and some renewal in the housing market set the stage for next week’s personal income and expenditures report.

Canadian Highlights

- Canadian inflation showed significant improvement in February, with heavy discounting apparent across the consumer basket.

- The Bank of Canada’s (BoC’s) core inflation measures also decelerated, following other underlying inflation gauges lower.

- The BoC was encouraged by the improvement, but likely wants to see a continuation of recent trends before it decides to cut rates.

U.S. – Counting Cuts

Markets let out a sigh of relief as the Fed’s Summary of Economic Projections reaffirmed expectations for three rate cuts this year – rather than sending a more hawkish message by pulling back to two. In response, longer-term yields have extended their declines, with the 10-year Treasury down about 10 basis points (at the time of writing) since last Friday. Equities rallied on the news of easier policy, up just short of 1% after the projections were released.

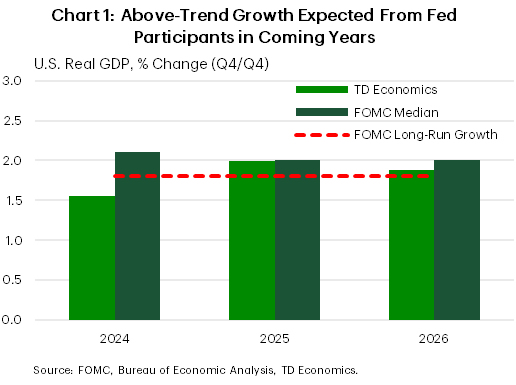

While avoiding sending an overtly hawkish signal, officials did upgrade both the economic outlook and expectations for the level of interest rates in 2025 and 2026. The forecast for the economy is interesting, as it implies above-trend growth in each of the next three years – despite interest rates that are in restrictive territory. Conversely, our forecast has the economy slowing in the latter half of 2024 as the cumulative effect of high rates and the drawdown of consumer savings begin to dent both job creation and spending (Chart 1).

Admittedly, the risks remain skewed to the upside for the economy, inflation and interest rates. The U.S. consumer has thus far shrugged off all expectations for a slowdown. Real expenditures grew at roughly three percent through the back half of 2023, and the labor market expanded by an average of 265k jobs (SAAR) in the three months through February. All of this has the first quarter of 2024 looking like it’s going to be another healthy period of expansion.

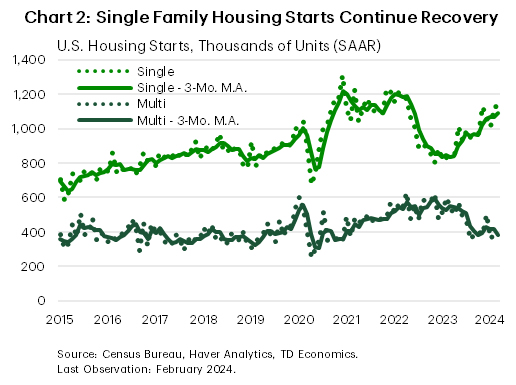

Even the housing sector, which has felt the brunt of a stagging rise in borrowing costs, has shown signs of life lately. Existing home sales and housing starts both left expectations in the rearview mirror. Moreover, the starts data reflect some rebalancing in the marketplace as single-family starts continue to grind higher adding units to a market starved for supply, while the multifamily segment slows down (Chart 2). Looking forward, increasing permitting activity suggests that there is some more room for improvement in housing construction.

Forecasts for healthy growth and some revival in the housing market set the stage for next week’s personal income and expenditures report. Markets will be on the lookout for signs that economic momentum carried through to February. Recall, January saw real spending contract, as weather weighed on economic activity, so a bounce-back is expected in February, with an accompanying uptick in headline inflation.

For policymakers, the focus will be on the core personal consumption expenditures (PCE) price deflator. Last month core prices gained 0.4% on the month. Expectations are for a 0.3% monthly advance in February. Remember, monthly price growth of below 0.2% is what is consistent with the 2.0% inflation target, so an upside surprise to prices would suggest a still significant amount of excess demand in the economy – an outcome we should all be used to by now.

Canada – CPIX Marks the Spot

Central bankers took the stage this week, but it was Canadian economic data that stole the show. A significant improvement in inflation for February and a weak reading on retail sales increased expectations for an earlier cut by the Bank of Canada (BoC). Adding to this was the release of the BoC’s March deliberations that confirmed the Bank is preparing to cut rates later this year. While the exact timing of the first rate cut is still uncertain, market pricing has rallied around June/July, matching expectations on timing for other major central banks.

The inflation reading this week showed a meaningful deceleration, with the headline measure remaining within the BoC 1% to 3% target band. But the big surprise was the heavy discounting on items like clothing, cell phone /internet plans, and food. For the latter, that was the first contraction in three years (seasonally adjusted)! As Deputy Governor Toni Gravelle said at a speech later in the week, this was “very encouraging”.

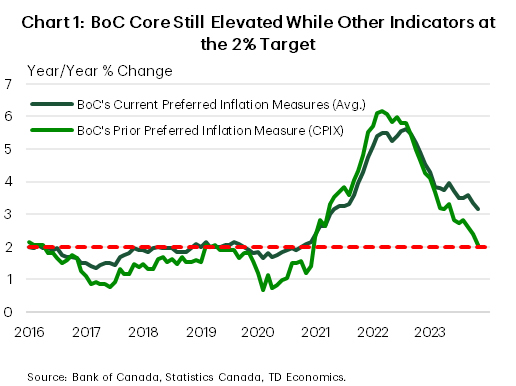

What was even more promising was the progress on the BoC’s preferred inflation metrics. While these have remained stubbornly high over the last few months, they too have started to ease and now sit just above the 3% band. These metrics are starting to follow other measures of inflation lower, including the Bank’s old preferred inflation measure, CPIX (Chart 1). This index excludes the eight most volatile inflation items such as mortgage interest costs. Importantly, this measure has now reached the BoC’s 2% target.

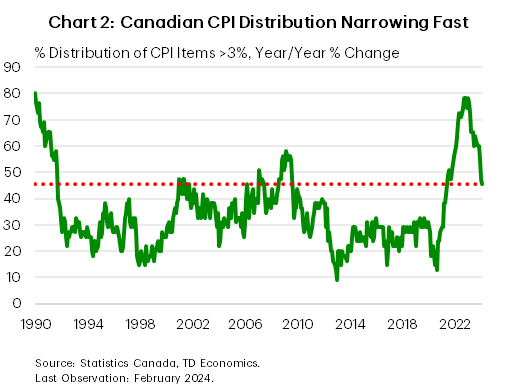

We have been arguing that the BoC should look outside of its preferred indicators of inflation, which are being influenced by structural issues related to shelter inflation. This is something the BoC has started to acknowledge. In recent communications, it has started to list a broad suite of inflation indicators that it will use to determine the state of underlying inflation. CPIX, as mentioned above, is one of them. But another measure that the Bank has started to rely on is the distribution of inflation. Here the BoC has stated that the percent of CPI items growing at 3% or more remains too high (Chart 2). It’s true that the distribution remains above 40%, which is more than the historical average of 35%. But we’d argue that it is getting close to more normal levels. The downward momentum in this index is apparent, and unless there is another supply-side shock to inflation, this measure will keep moving lower, bringing the slow moving BoC measures along with it.

This is why market pricing has become more entrenched around an earlier start to rate cuts. And even though the Deputy Governor showed more optimism than we have seen from other BoC speakers, expect the Bank to keep its cards a little closer to its chest over the coming month. The BoC doesn’t want the market to get any further ahead of itself, as it can’t afford to stoke a spring housing market boom. Rather, the BoC is likely to wait until the spring rush has started to abate before it communicates that it is ready for rate cuts.