U.S. Highlights

- The Federal Reserve held the policy rate steady this week and signaled that rates will likely remain higher for longer.

- The U.S. jobs engine slowed in April, adding 175k jobs. The unemployment rate rose modestly to a still low 3.9%.

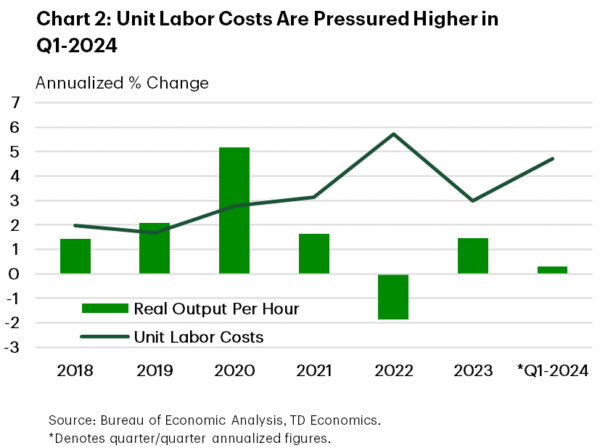

- Last year’s productivity surge has come to an end. Productivity growth slowed to a stall speed in Q1, while unit labor costs turned sharply higher.

Canadian Highlights

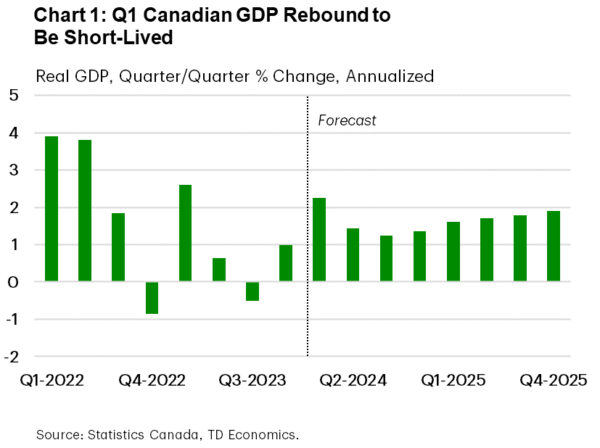

- The Canadian economy continued to grow in February, but the momentum after January’s surge is beginning to wane. Still, first quarter GDP growth is on pace for a sturdy print.

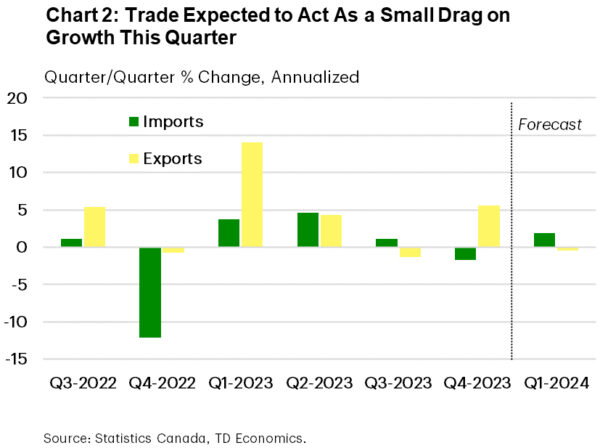

- Trade data confirms that strength this quarter will be short-lived, with net trade posing a headwind to Q1 growth.

- The debate between a Bank of Canada rate cut in June or July cut rages on. We think a July cut is supported by fundamentals.

U.S. – Holding Steady for Longer

It was a very busy week on the economic data calendar, but the two headliners were a pulse check on the state of the labor market and the Federal Reserve’s interest rate announcement. Policymakers delivered no surprises this week, with the FOMC voting unanimously to hold the policy rate steady at the current target range of 5.25% – 5.5%. The same can’t be said for April’s employment report, which showed job growth coming in handily below expectations. Financial markets greeted the news positively, with the S&P 500 recouping its losses from earlier in the week, while the 10-year Treasury yield was down 14-bps to 4.53% at the time of writing.

It’s not that long ago that investors were expecting the first rate cut to come at this very meeting. But after three months of hotter-than-expected inflation readings, the FOMC appears to be on hold indefinitely, as it looks for “greater confidence that inflation is moving sustainability back towards 2%”. What exactly that means remains to be seen, but it will likely require a further rebalancing in the labor market, which ultimately leads to more sustained downward pressure on wage growth.

From that perspective, April’s jobs data was a Goldilocks report. Non-farm payrolls rose by 175k while the unemployment rate ticked up to 3.9%. Importantly, average hourly earnings cooled more than expected, with the 12-month change slipping to a near three-year low of 3.9% (Chart 1).

While the softening in wage growth will come as welcome news for Fed officials, it needs to be weighed against other measures of employee compensation, particularly the Employment Cost Index – the Fed’s preferred wage measure – which showed an unexpected acceleration. Moreover, after rising by a robust 1.5% in 2023, growth in non-farm productivity slipped to a near stall speed in Q1. Taken alongside last quarter’s uptick hourly compensation, unit labor costs (ULC) also rose sharply higher (Chart 2). This has important implications for inflation. ULC can best be thought of as a productivity adjusted cost of labor, making it a useful gauge on the extent to which the nominal pace of compensation growth is running above (or below) what would be consistent with achieving 2% inflation. However, with the Q1 reading not only turning higher but also running at an annualized rate that’s more than double where it should otherwise settle, provides yet another signal that progress on the inflation front has indeed stalled.

In the press conference following the release of the FOMC statement, Chair Powell noted that while ongoing progress is “not assured” he still expects that over the course of the year “inflation will move back down”. But Powell also emphasized that he’s become less confident in that forecast. Moreover, when asked if today’s rates were “sufficiently restrictive” Powell instead described them as only “restrictive”. While the Chair said further rate hikes are “unlikely”, the refusal to characterize today’s stance as sufficiently restrictive is an implicit acknowledgment that further policy firming cannot be ruled out. At this point, we view this as highly unlikely. But given the economy’s sustained strength alongside the recent stalling on inflation, we now expect the Fed to remain on hold until December.

Canada – A GDP Growth Blip

Canadian markets took their cue from events south of the border this week as the Federal Reserve policy meeting and payrolls data took center stage. The two and ten-year Canada yields fell by around 15 basis points (bps), while the CAD finished the week flat after being down almost one cent to the U.S. Dollar mid-week. The dovish messaging from the Fed trumped Canada’s weaker-than-expected economic growth report for February which saw GDP advance at a below-consensus 0.2% month-on-month (m/m).

Even though February growth disappointed expectations, it still builds on the robust growth from January. It also firms estimates that first-quarter GDP will come in stronger (at between 2-2.5%) than what was expected earlier this year. It is important to contextualize Canadian GDP growth over the first two months of the year. On one hand, growth over January and February was the strongest over a two-month period since exactly a year ago. However, the more important takeaway is that guidance for flat GDP in March signals that this rebound is unlikely to last. March’s soft handoff into Q2 suggests the re-emergence of weaker, below-trend growth patterns (Chart 1). Overall, Canada’s economy has weathered high interest rates relatively well, which has allowed the BoC to keep interest rates elevated to fight the last leg of the inflation battle.

Trade data for the month of March also confirms that the healthy growth expected in the first quarter growth will likely be short-lived. As we’ve seen in the past several quarters, net trade has been a major swing factor on the expenditure-side GDP readings. A sharp reversal in export volumes for March coupled with trade revisions for February now put net trade tracking as a headwind to growth (Chart 2).

As the dust settles on this week’s events, markets are slightly favouring the first BoC cut to occur at their next meeting in June. The Bank continues to acknowledge that they are growing more confident that inflation is on sustainable path back to 2 percent. We think the BoC can justify cutting rates in July based on economic fundamentals and will allow the Bank more time to analyze domestic data prints to confirm trends are durable. At the same time, the resilience in the U.S. economy has the Fed in no rush to lower policy rates–we’ve penciled in the first U.S. rate cut to take place in December.

We are now at a crossroads where a divergence between Canadian and U.S. interest rates could put further downward pressure on the Canadian dollar. Macklem’s remarks this week reiterated that policy setting in Canada is independent of U.S. developments despite the ties between the two countries. In any event, while the BoC may cut slowly at the beginning, we expect the Bank to accelerate the pace towards the end of this year. This would match when we think the Fed will be comfortable cutting rates, limiting policy rate differentials and keeping a floor under the loonie.