Around 10 smallcap schemes with larger assets under management (AUM) could be affected after Sebi told mutual funds to protect the interest of investors of smallcap and midcap schemes , according to a report by Fisdom Research.

These smallcap schemes could be at risk as they have lesser exposure to large stocks, cash and cash equivalents (including T-bills), and higher exposure to stocks from the Nifty Microcap 250 Index.

HDFC SmallCap Fund, which manages assets of around Rs 28,600 crore, has 3.7% largecap exposure and around 9.9% cash exposure. The scheme holds a higher exposure to microcaps at around 18%.

Axis SmallCap Fund, which manages assets of Rs 19,530 crore, has 2.3% exposure towards largecap, 8.2% cash exposure and 9% exposure towards microcap.

Also Read | Retail frenzy creates Rs 17,500-crore confusion for smallcap fund managers

HSBC SmallCap Fund and DSP SmallCap Fund, with AUM of Rs 13,000 crore each are also on the list. The schemes have around 15-22% exposure to microcap stocks. Franklin India Smaller Companies Fund has around 3.2% largecap exposure, 6% cash exposure and 16% exposure to microcap stocks.

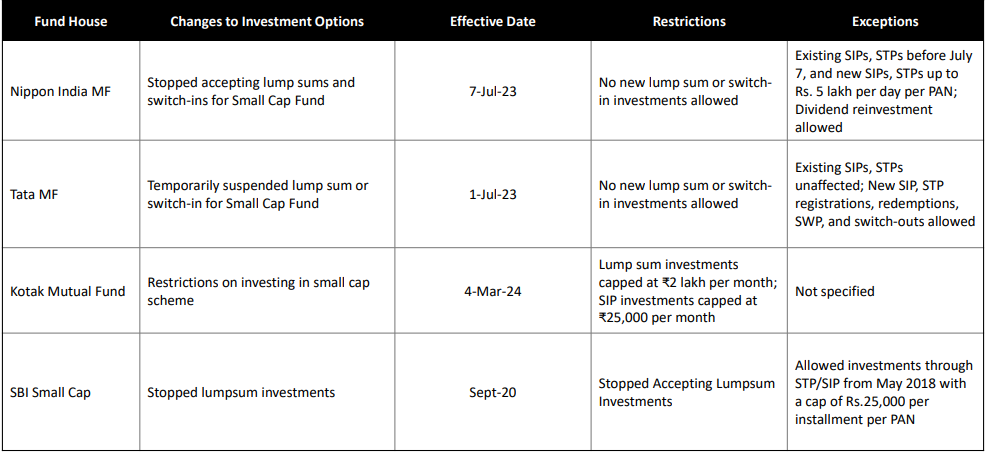

Three schemes – Nippon India SmallCap Fund, SBI SmallCap Fund, and Kotak SmallCap Fund – also feature on the list. To be noted, these funds already have restrictions in place regarding flows.

Among these 10 smallcap schemes, Quant SmallCap Fund holds the largest exposure to largecaps of around 21%.

Among midcap funds, Quant MidCap Fund and LIC MF Midcap Fund have the highest exposure to largecaps of around 24%.

According to the report, the invested universe for the midcap category has grown reasonably while the same has grown at a much faster pace for the smallcap category.

According to the portfolio as on January 31, 2024, around 510 distinct smallcap stocks are held by the smallcap category which has increased from 346 in December 2019. However, in the midcap category around 139 distinct midcap companies are held by the midcap category.

Smallcap funds have added four new stocks in the portfolio in January 2024 and the midcap funds have reduced only one stock from the portfolio.

Quantum SmallCap Fund has the highest cash as a percentage of total AUM of around 20.2%, followed by SBI SmallCap Fund with 16% cash.

Also Read | These 5 small cap schemes offer over 25% in 5 years

SBI Magnum Midcap Fund has the highest allocation in cash as a percentage of total AUM of around 8%.

The smallcap category has observed consistent and high inflows from the last three financial years. The category has witnessed total inflows of Rs 37,360 crore in FY24 (till January 2024) against Rs 22,103 crore inflows in FY23 and Rs 10,144 crore inflows in FY22.

The inflows in the midcap category were recorded at Rs 19,400 crore in FY24 (till January 2024) as against Rs 20,205 crore in FY23 and Rs 16,308 crore in FY22.

In FY21, smallcap and midcap categories witnessed outflows of Rs 3,035 crore and Rs 3,747 crore, respectively.