A change in strategy has helped transform the GoodHaven Fund from a long-term underperformer into an outperformer since the end of 2019. The fund follows a concentrated-value approach and now has a four-star rating (out of five) in Morningstar’s Large Blend fund category.

Larry Pitkowsky, managing partner of GoodHaven Capital Management, based in Millburn, N.J., explained how this was achieved in an interview with MarketWatch.

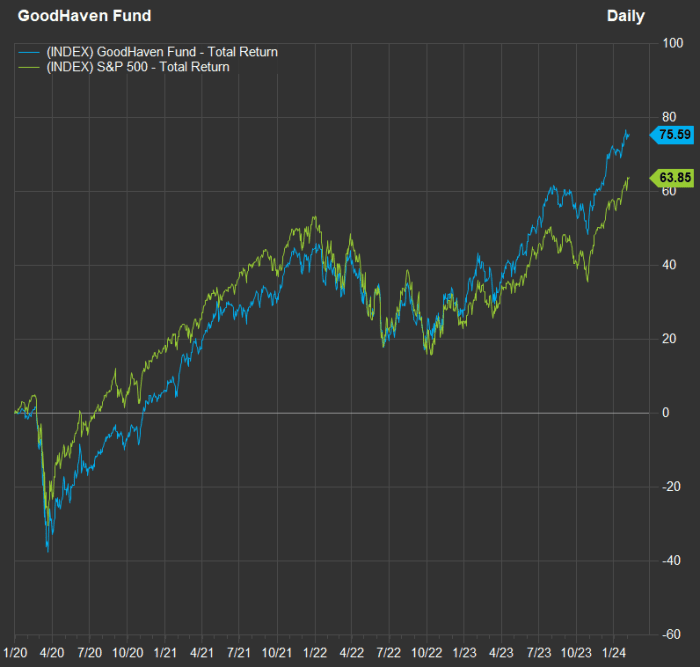

To begin, take a look at how the GoodHaven Fund performed, with dividends and capital-gains distributions reinvested, over a five-year period through 2019, compared with the S&P 500:

For five years through 2019, the GoodHaven Fund returned only 9.4%, while the S&P 500 returned 73.9%.

FactSet

Late in 2019, Pitkowsky led a series of changes in how the fund operated, including paying less attention to macroeconomic factors, moving on more quickly if investments aren’t working out well and holding on to successful companies longer, to avoid selling too early. He cited Microsoft Corp.

MSFT,

as an example of a stock he had parted ways with too early, and said an example of an industry and macro-based investment play that didn’t go well was a group of energy and materials stocks that were crushed when commodity prices dropped from mid-2014 and 2015 through early 2016.

“We like to own high return-on-capital companies” with good trajectories for growth, Pitkowsky said, “before everyone else has figured it out.”

He added: “We try to avoid structurally challenged businesses that might be statistically cheap.”

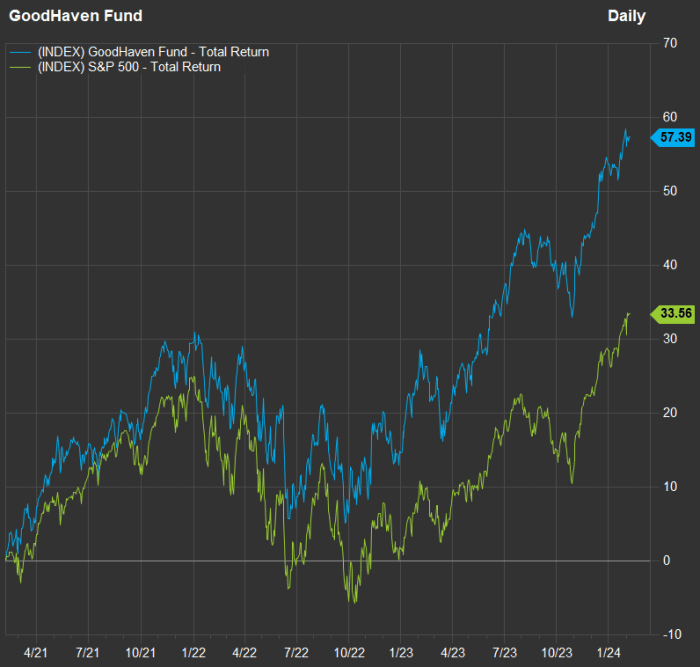

Now take a look at how the fund has performed against the S&P 500

SPX

since the end of 2019:

The GoodHaven Fund has outperformed the S&P 500 since changing its investment-selection process late in 2019.

FactSet

Narrowing further to a three-year chart through Feb. 6 sheds more light on the seesaw performance of the broad stock market, with an 18.1% decline for the S&P 500 in 2022 followed by a 26.3% return in 2023.

The GoodHaven Fund has had a smoother ride during the stock market’s up-and-down cycle over the past two years, leading to a much higher three-year return than that of the S&P 500.

FactSet

Fund holdings and comments about companies

GoodHaven Capital Management has about $340 million in assets under management, including separate client accounts and about $230 million in the fund.

As of Nov. 30, the fund’s portfolio was 29% in cash and short-term investments, in part because of an influx of new money from investors but also because Pitkowsky wants to keep money readily available to make purchases at attractive prices and to meet any redemption requests from the fund’s shareholders. At times the fund’s level of cash and short-term investments has been much lower.

Here are the fund’s top 10 stockholdings as of Nov. 30, making up 52% of its portfolio:

| Stock | Ticker | % of fund | Forward P/E |

| Berkshire Hathaway Inc. Class B |

BRK.B, |

11.2% | 22.0 |

| Alphabet Inc. Class C |

GOOG, |

7.0% | 21.1 |

| Builders FirstSource Inc. |

BLDR, |

6.6% | 14.6 |

| Bank of America Corp. |

BAC, |

5.4% | 10.3 |

| Devon Energy Corp. |

DVN, |

4.4% | 7.6 |

| Jefferies Financial Group Inc. |

JEF, |

4.2% | 11.1 |

| Exor N.V. |

EXO, |

4.2% | 7.6 |

| Lennar Corp. Class B |

LEN.B, |

3.5% | 9.6 |

| Progressive Corp. |

PGR, |

2.8% | 21.0 |

| KKR & Co. |

KKR, |

2.8% | 18.5 |

| Sources: GoodHaven Capital Management, FactSet | |||

Click on the tickers for more about each company, fund or index.

Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

The table includes forward price-to-earnings ratios for the stocks, based on Tuesday’s closing price and consensus earnings-per-share estimates for the next 12 months among analysts polled by FactSet. For comparison, the S&P 500 trades at a weighted forward P/E of 20.2.

Two “big wins” Pitkowsky cited when discussing the GoodHaven Fund’s recent outperformance were Builders FirstSource Inc.

BLDR,

and the Class B shares of Lennar Corp.

LEN.B,

a home builder that is trading at a low P/E, along with its entire industry group. We listed P/E ratios for 17 home builders in October, when most of them were very low. At that time, the S&P Composite 1500 Homebuilding subindustry group was trading at a weighted forward P/E of 7.6. The group now trades at a forward P/E of 10.2.

Pitkowsky believes both Builders FirstSource and Lennar have “plenty of growth ahead of them” and said he was also pleased that both companies have low levels of debt. “The big builders have become much better businesses,” he said.

Something else to consider is that Pitkowsky holds Lennar’s Class B shares, which trade at a forward P/E of 9.6 — a discount to the valuation of the company’s Class A shares

LEN,

which trade at a forward P/E of 10.3.

Lennar’s Class B shares have 10 times the voting rights as the Class A shares, but they trade at a lower P/E, probably because they are less liquid and are not included in the S&P 500, Pitkowsky said. “When we began to research [Lennar], we saw the super-voting shares traded at around a 20% discount to the non-super-voting shares,” he said, adding that the fund has benefited as the valuation gap has narrowed.

Another big winner for the fund has been Bank of America Corp., which Pitkowsky said was his largest purchase during the 12-month period that ended Nov. 30. Bank of America now trades at a forward P/E of 10.3, compared with a five-year average of 11.1 and a 10-year average of 11.3.

“[Bank of America’s] return on equity is a depressed 11%+,” he wrote in the November letter to GoodHaven Fund shareholders. But he likes the stock’s risk/reward potential for several reasons, including “recurring earnings from the nonbanking businesses.”

While lamenting what he now knows was an early sale of Microsoft shares, Pitkowky points to Alphabet Inc.

GOOGL,

GOOG,

as a strong holding he has stuck with since 2011.

Alphabet trades at the lowest P/E among the 10 largest companies in the S&P 500.

Pitkowsky said he remained comfortable with Alphabet as a large holding, in part because the company has become “more focused over the past year or two on re-engineering the cost base.” He added that the stock’s valuation “does not seem demanding” relative to Alphabet’s further growth potential.

Don’t miss: Is Meta now a value stock?