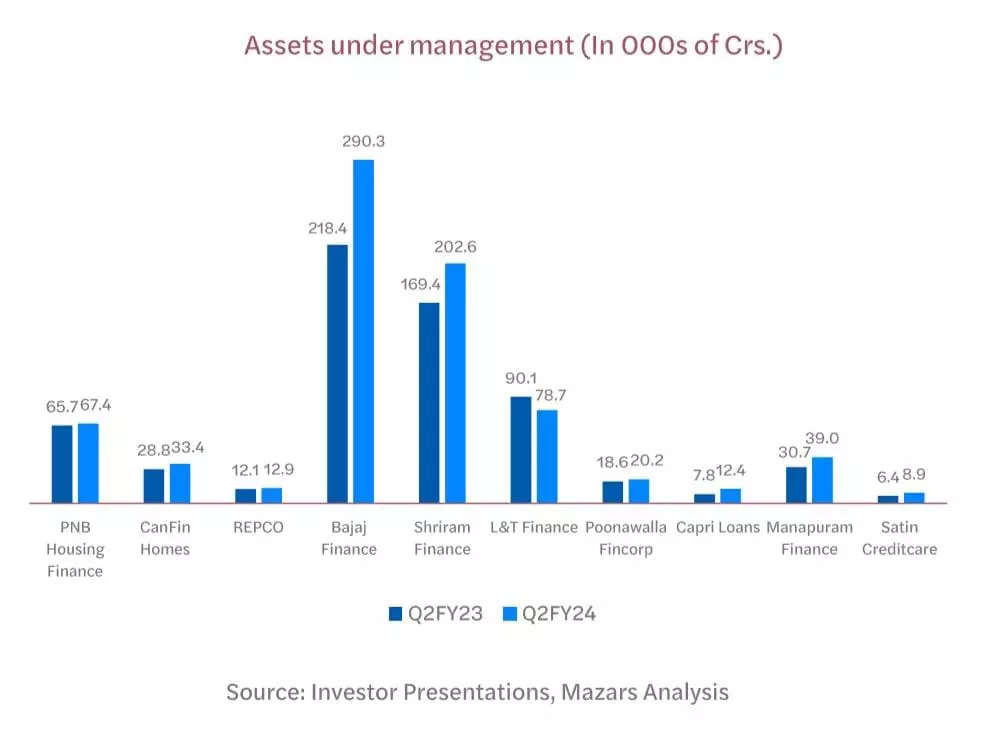

In the second quarter of FY24, top NBFCs managed Rs 7,65,753 crores in assets, up 18.2 per cent from Rs 6,47,855 crores in Q2 FY23. Capri Loans led with a 59.1 per cent AUM growth to Rs 12,358.5 crores, followed by Satin Creditcare and Bajaj Finance with 38.6 per cent and 32.9 per cent growth respectively, revealed a recent report by Mazars.

Top NBFCs saw a notable increase in average return on assets (ROA) from Q2 FY23 to Q2 FY24, rising by approximately 0.5% to reach around 3.5% in Q2 FY24.

In Q2 FY24, the average capital adequacy ratio for top NBFCs improved by 1.7%, reaching 29.7% from 28.0% in Q2 FY23. PNB Housing Finance saw the most significant increase, rising by 6.3% to 30.4%, followed by Capri Loans with a 6.2% improvement, highlighted the report.

Additionally, majority of the NBFCs saw an improvement in their GNPA ratio during Q2 FY24. PNB Housing Finance led with a 4.3% improvement compared to Q2 FY23, followed by REPCO with a 1.6% improvement.

Here is a list of top 10 NBFCs according to their assets under management (AUM) based on data by Mazars.

1) Bajaj Finance

Bajaj Finance managed to be on top consecutively in Q2 FY24 and as of Q2 FY23, with a total Assets Under Management (AUM) of Rs 290.3 thousand crores compared to Rs 218.4 thousand crores as of Q2 FY23. Bajaj Finance witnessed a year on year growth of about 32.9 per cent in Q2 FY24.

2) Shriram Finance

Shriram Finance came second in terms of AUM, recording about Rs 202.6 thousand crores as of Q2 FY24 compared to Rs 169.4 thousand crores in the same quarter previous year.

3) L&T Finance

L&T Finance witnessed a slight dip in its AUM, recording approximately Rs 78.7 thousand crores AUM compared to Rs 90.1 thousand crores in Q2 FY23. Even though there was a decline, L&T still maintained its position in the top three NBFCs in terms of AUM.

4) PNB Housing Finance

PNB Housing Finance witnessed a slight increase in its AUM year-on-year, recording about Rs 67.4 thousand crores in Q2 FY24 compared to Rs 65.7 thousand crores in the same quarter previous year.

5) Mannapuram Finance

Mannapuram Finance ranked fifth in terms of AUM, recording about Rs 39 thousand crores as of Q2 FY24 compared to Rs 30.7 thousand crores in the same quarter previous year.

ALSO READ: BFSI Year Ender 2023: Top 10 high valued FinTechs of this year

6) CanFin Homes

CanFin Homes witnessed an uptick in its AUM year-on-year, recording about Rs 33.4 thousand crores in Q2 FY24 compared to Rs 28.8 thousand crores in the same quarter previous year.

7) Poonawalla Fincorp

Poonawalla Fincorp witnessed a slight increase in its AUM year-on-year, recording about Rs 20.2 thousand crores in Q2 FY24 compared to Rs 18.6 thousand crores in Q2 FY23.

8) REPCO

REPCO witnessed almost no growth in its AUM in the second quarter of FY24. It recorded about Rs 12.9 thousand crores in Q2 FY24 compared to Rs 12.1 in the same quarter previous year.

9) Capri Loans

Capri Loans witnessed the most significant growth in AUM of approximately 59.1 per cent and reached Rs 12.4 thousand crores in Q2 FY24, up from Rs 7.8 thousand crores in Q2 FY23.

10) Satin Creditcare

Satin Creditcare followed Capri Loans’ remarkable jump with a growth of 38.6 per cent in its AUM, recording Rs 8.9 thousand crores in Q2 FY24 compared to Rs 6.4 thousand crores in the same quarter previous year. This brought Satin Creditcare in the 10th position of top 10 NBFCs in terms of AUM in Q2 FY24.