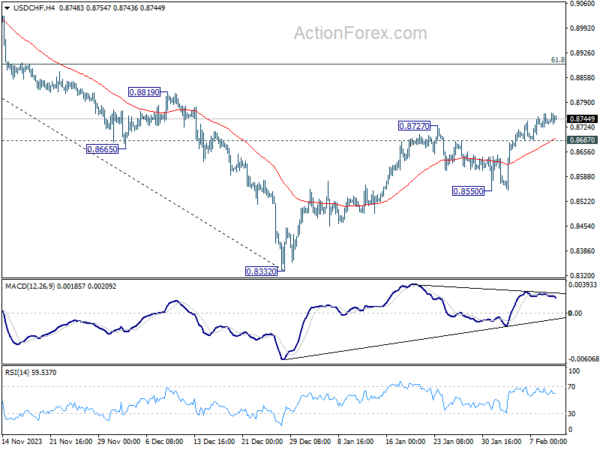

USD/CHF’s rise from 0.8332 resumed by breaking 0.8727 resistance last week. Initial bias stays on the upside this week despite loss of upside momentum. Next target is 61.8% retracement of 0.9243 to 0.8332 at 0.8995. On the downside, below 0.8687 minor support will turn intraday bias neutral first. But near term outlook will stay cautiously bullish as long as 0.8550 support holds.

In the bigger picture, there is prospect of medium term bottoming at 0.8332 considering possible bullish convergence condition in W MACD, and the support from 0.8317 long term fibonacci support. Sustained trading above 55 D EMA (now at 0.8681) will affirm this case, and bring stronger rise back towards 0.9243 resistance, even as a corrective move.

In the long term picture, price action from 0.7065 (2011 high) are seen as a corrective pattern to the multi-decade down trend from 1.8305 (2000 high) . Strong rebound from 61.8% retracement of 0.7065 to 1.0342 (2016 high) will start the third leg as a medium term rally. But there will be no sign of long term reversal until firm break of 38.2% retracement of 1.8305 to 0.7065 at 1.1359.