- US GDP, core PCE and PMIs the next tests for the dollar

- Investors await BoJ for guidance about next rate hike

- EU and UK PMIs, as well as Australian CPIs also on tap

- Earnings season heats up as tech giants report

Will US data throw more Fed rate cuts off the table?

The dollar staged a strong recovery the last couple of weeks, with the bulls being encouraged to initiate long positions as soon as the US CPI data revealed that inflation in the world’s largest economy reaccelerated in March.

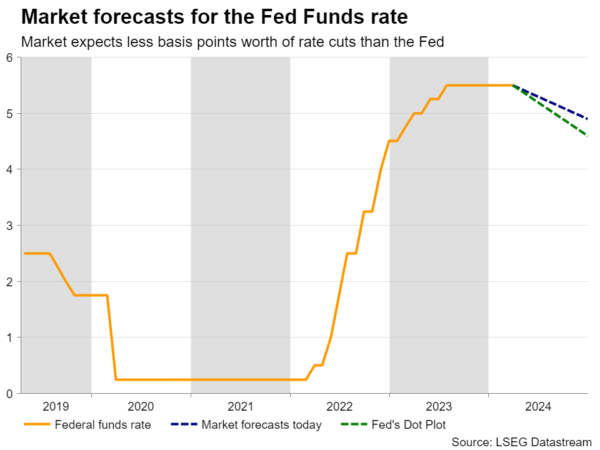

With several Fed policymakers, including Chair Powell, signaling in the aftermath of the release that there is no urgency to ease monetary policy soon, and with retail sales coming in much stronger than expected on Monday, investors further reduced the amount of rate cuts they expect for this year. They are now expecting interest rates to be lowered by only 42bps, far fewer than the Fed’s own projections of 75.

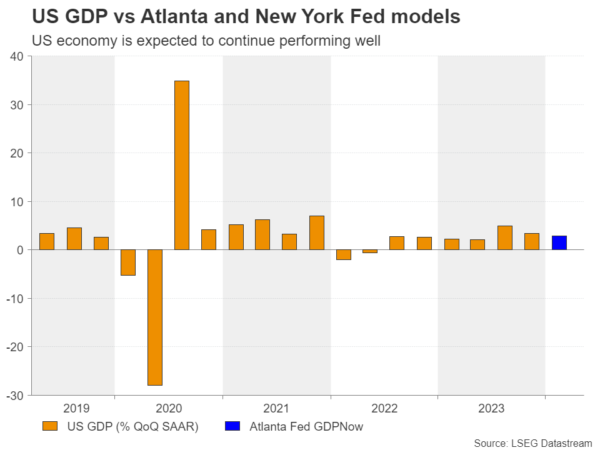

Attention next week is likely to fall on the first estimate of GDP for Q1 on Thursday, as well as on the core PCE index for March on Friday. The world’s largest economy grew 3.4% q/q SAAR in the last three months of 2023 and according to the Atlanta Fed GDPNow model, it continued to fare strongly, growing by 2.9% in Q1. As for the core PCE index, the Fed’s favorite inflation metric, the stickiness in consumer prices for the month likely tilts the risks to the upside. The preliminary S&P Global PMIs for April are also coming out on Tuesday and market participants will get a glimpse of how the US economy has entered Q2.

Another week packed with strong US data may weigh more on Fed rate cut expectations, and the question could well change from how many basis points could the Fed cut to whether it will cut at all this year. Such a development is is likely to allow the US dollar to continue marching north.

BoJ meets amid intervention alerts

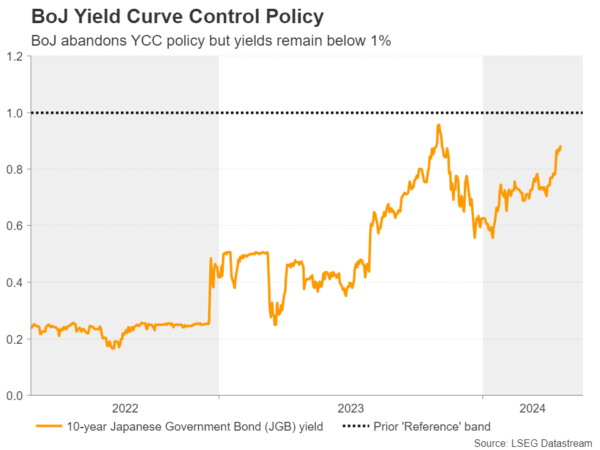

Another major event on next week’s agenda is Friday’s Bank of Japan (BoJ) decision. When they last met, Japanese officials decided to end years of negative interest rates, raising them by 10bps, and abolished its yield curve control policy.

That said, with the Bank saying that they will continue buying bonds with broadly the same amounts as before, and with Governor Ueda noting that they will maintain accommodative policy conditions, investors continued to believe that any subsequent hikes will be very gradual and slow.

Since then, despite the market bringing forward the timing of a second hike and assigning an 86% chance to July, the yen continued to tumble, triggering intense intervention warnings by Japanese officials. That didn’t stop the yen’s slide either, with dollar/yen getting very close to the 155.00 level this week.

Commenting on the yen’s fall, Governor Ueda recently said that the central bank would not directly respond to currency moves, brushing aside speculation that the yen’s tumble could force them to hike sooner, although he added that if inflation continues to accelerate, another hike is likely later this year.

With all that in mind, and with inflation picking up notably since the BoJ’s last gathering, investors may be on the lookout for hints on whether a hike during summer months is indeed more likely now. This means that another dovish appearance could result in further yen selling, increasing dramatically the chances for intervention if Japanese authorities do not step in even before of course.

Traders may get an idea of where inflation is headed in April a few hours ahead of the meeting, when the Tokyo CPIs are scheduled to be released.

Euro and pound traders await PMIs

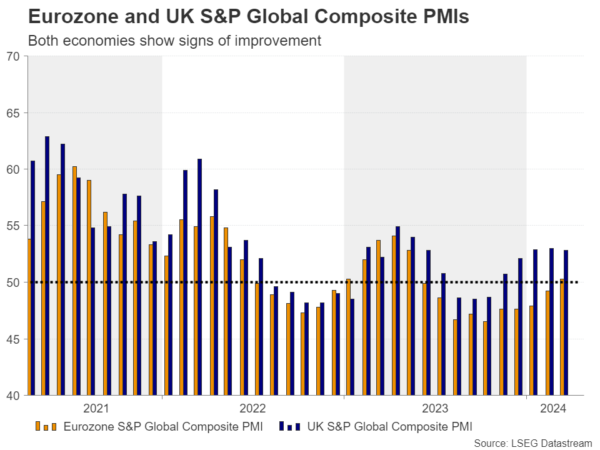

Apart from the flash S&P Global PMIs for the US, the Eurozone and UK prints will also be released on Tuesday.

At its latest gathering last week, the European Central Bank (ECB) kept interest rates untouched but sent clearer signals that it may start lowering interest rates soon, with reports after the decision saying that policymakers still expect the first quarter-point reduction in June.

As for the Bank of England (BoE), following this week’s better than expected jobs data and the higher-than-forecast inflation prints, a 25bps rate cut is fully priced in for September.

Both the Eurozone and UK economies have been showing some signs of improvement lately, at least according to their recent PMI numbers, but inflation in both areas seems to be headed towards the ECB’s and BoE’s objectives. Thus, even if these releases surprise to the upside, market expectations with regards to the ECB’s and BoE’s actions are unlikely to be dramatically altered and thereby, the euro and the pound are unlikely to stage a strong comeback against the almighty greenback.

Does Australia’s inflation continue to slow?

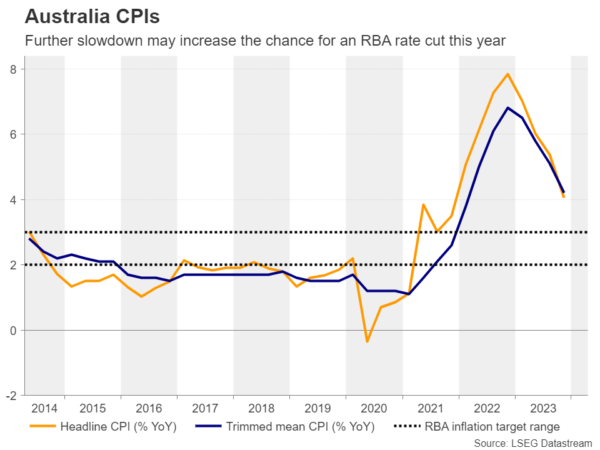

In Australia, although there is a nearly 10% chance for a rate cut by the RBA at its upcoming gathering in May, a quarter-point reduction is not fully priced in for this year. With the Bank not giving clear indications of where it may be headed next, aussie traders will pay close attention to Wednesday’s CPI data for signs of whether inflation continues to slow.

The monthly seasonally adjusted y/y rate rebounded somewhat in March, but this was after it declined notably in February from January, which means that, overall, inflation may have continued cooling in Q1. This could increase the likelihood for a 25bps RBA rate cut by December.

Tech earnings enter the spotlight as well

On Wall Street, all three of its major indices have been in a corrective phase lately due to increasing tensions in the Middle East and due to the diminishing Fed rate cut expectations.

That said, besides those two major themes, equity investors are likely to also keep their attention locked on the earnings season as several high-growth tech giants announce their results next week. On Tuesday, the spotlight will fall on Alphabet and Tesla, while on Wednesday, it will be Meta’s turn. On Thursday, the torch will be passed to Microsoft and Amazon.