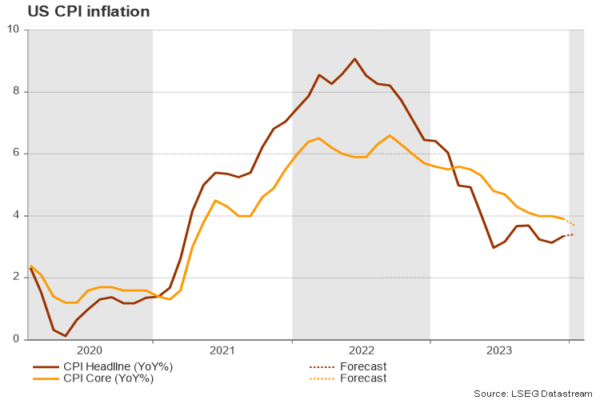

- Forecasts point to stable inflation, weaker core CPI

- Upside surprise is likely, as business indicators point to higher prices

US economy has a blockbuster performance

The US economy has left analysts speechless. Although the Fed has raised interest rates to the highest in four decades, the economy kept growing at a healthy pace in the last quarter of 2023 and six months after the central bank paused its tightening cycle.

The first data releases of the new year pointed to a soft landing or no landing at all. Nonfarm payrolls increased by 353k in January, and December’s reading was revised upwards by more than 100k. On the negative side, part-time jobs were mainly responsible for the increase in new job positions, but overall, the unemployment rate remained around record lows. On top of that, average hourly earnings continued to gain momentum for the third consecutive month and comfortably above the diminishing inflation rate, suggesting that consumers have enough purchasing power to fuel more demand for goods and services.

Retail sales for January could reflect the latest changes in spending habits on Thursday at 13:30 GMT. Analysts expect a monthly slowdown to 0.1% from 0.6% previously. The retail sales control group data, which excludes volatile items, could ease from 0.8% m/m to 0.5%.

Developments on the business front were encouraging, too. The ISM and S&P global business PMI readings expanded faster than analysts expected in January, reporting a notable increase in new orders and hiring. However, what caused a stir was a significant pickup in cost pressures in the services sector. The price index jumped by 7.3 points to 64.00 to the highest since March 2023, reminding investors that the fight against inflation is far from over.

How could CPI inflation data affect sentiment?

On Tuesday, investors will search for more clues on recent price tendencies when January’s CPI inflation data come into the public eye. Forecasts point to a stable headline CPI inflation of 3.4% y/y and a weaker core CPI of 3.7% y/y compared to 3.9% previously.

If forecasts materialize, investors may defend the May rate cut scenario. Note that the probability of a late spring rate cut declined to a toss-up following last week’s upbeat data. Hence, any surprise in the data could be a game changer for rate prospects, but perhaps a tweak in the total number of projected rate cuts could cause more volatility since investors remain confident that the Fed will deliver more than four 25 bps rate cuts despite the central bank projecting only three.

USD/JPY

In FX markets, weaker-than-expected CPI data could oppose the Fed’s wait-and-see stance over rate cuts, putting USDJPY under pressure. Still, from a technical perspective, only a clear close back below the 147.00-147.40 zone, where its 20-day simple moving average (SMA) is positioned, could raise new selling interest.

In the opposite scenario where inflation extends December’s upturn and, more importantly, the core CPI drifts higher too, investors might move the case of a rate cut from May to the summer. There are multiple risk events, from a potential wage-price spiral to rising geopolitical tensions affecting global trade routes, which could still lift business costs and therefore send positive price shockwaves to consumers throughout the year.

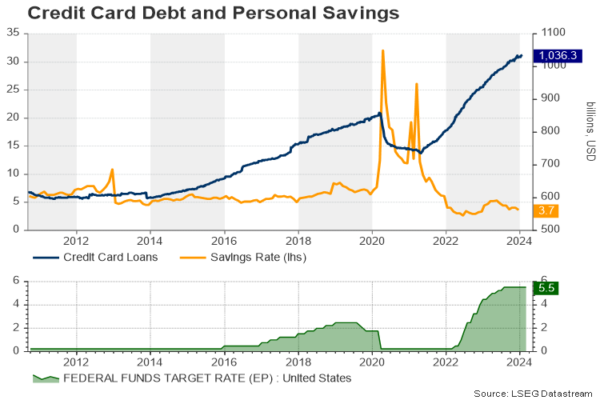

At the same time, the more persistent inflation is, the more fragile the economy can become to a potential downturn as households’ savings ratio is currently at the lowest since the 2007-2009 financial crisis. Moreover, the latest bank episode with the regional New York Community Bancorp revealed that the drop in commercial property values – partially on the back of remote jobs – could raise risks in the financial system. The Fed chief admitted that smaller banks could close or merge, but he added that the issue should be manageable, with the Treasury secretary Jannet Yellen backing that narrative too.

Nevertheless, talks of economic struggles could be a topic for another day. In the meantime, an upside surprise in CPI figures would justify the Fed’s guidance and bode well for the greenback, sending USDJPY above the 149.70 barrier and towards 151.00.