The Reserve Bank of India (RBI), which has prioritised growth over inflation for nearly two years, may face challenges in shifting its focus on price stability, despite Prime Minister Narendra Modi’s call for emphasizing growth.

Modi’s remarks came during an event commemorating 90 years of the RBI, where he urged the institution to prioritize rapid economic expansion while maintaining trust and stability.

The timing of Modi’s statement is notable as it precedes the Monetary Policy Committee (MPC) meeting scheduled to commence on Wednesday. The central bank had shifted its attention to inflation following the Russian invasion of Ukraine in February 2022, which led to supply-side constraints and upward pressure on prices.

Over the subsequent months, the six-member MPC increased the policy repo rate by 250 basis points to 6.5 percent. However, despite these hikes, the RBI struggled to meet its inflation mandate, with the average inflation rate remaining above 6 percent for three consecutive quarters in 2022.

Vigilant on inflation

Although the central bank has refrained from further repo rate increases for over a year, it remains vigilant against inflationary pressures, even as core inflation has moderated.

| Headline inflation, as measured by year-on-year changes in the all-India consumer price index (CPI), remained steady at 5.1 percent in February 2024. |

Meanwhile, core inflation eased to 3.4 percent, its lowest level in four years, indicating moderation across all sub-groups.The RBI has been steadfast in its efforts to bring inflation back to its target of 4 percent. However, the latest “State of the Economy” report highlights the shallow and short-lived nature of the winter easing of vegetable prices, with inflation momentum turning positive in February 2024. Consequently, the central bank maintains its stance of “withdrawal of accommodation,” signifying that monetary policy remains accommodative, with a need to gradually withdraw from such measures.

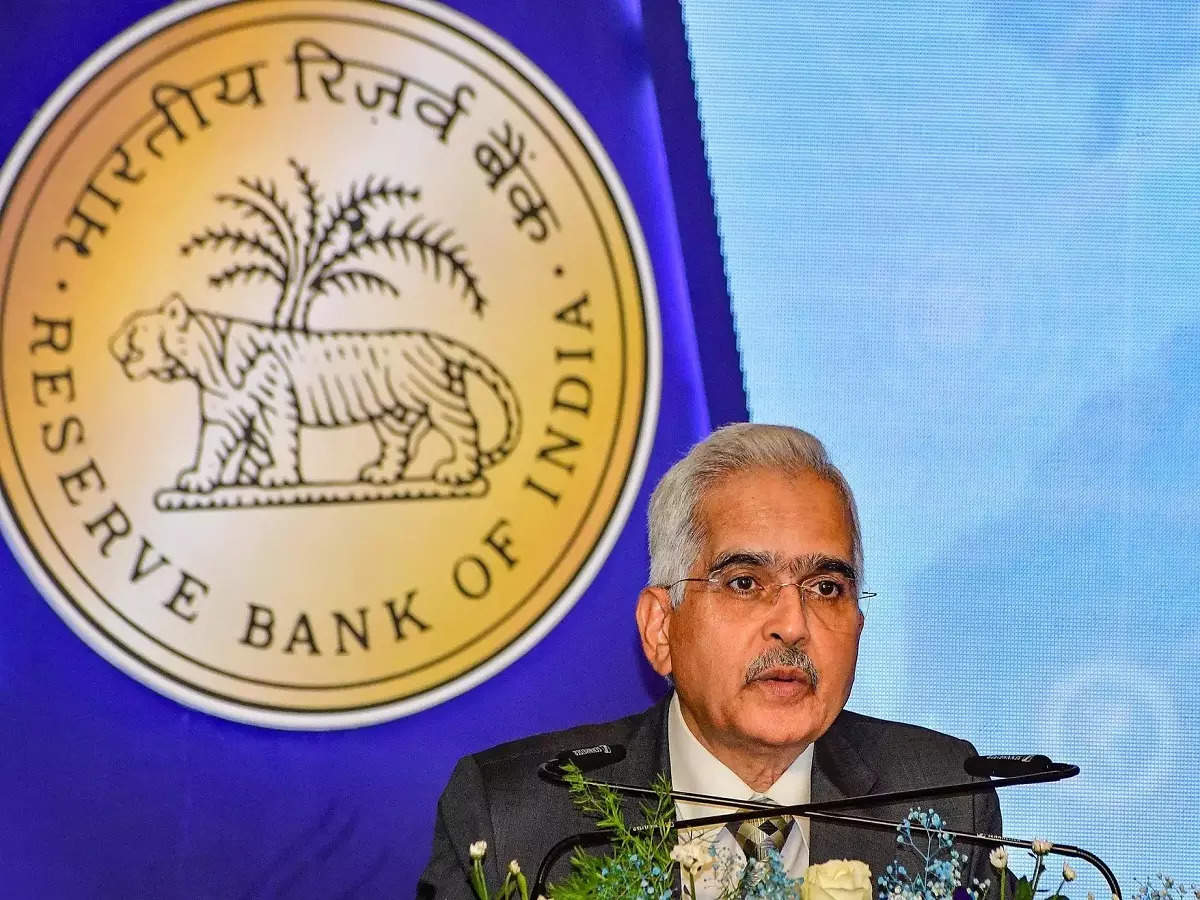

RBI Governor Shaktikanta Das reiterated this stance during the February policy announcement, emphasising the incomplete transmission of monetary policy and the need to address inflation persistently above the 4 percent target.

Economists suggest that the RBI’s stance may only change once it is confident that inflation will stabilize around the target consistently.

Looking ahead, the RBI has projected CPI inflation for 2024-25 at 4.5 percent, with varying rates for each quarter.

ETBFSI now has its WhatsApp channel. Join for all the latest updates.