Summary

Real GDP grew at only a 1.6% annualized pace in Q1, held back by trade and inventories. Consumer spending in the service sector is not slowing, in fact, it is ramping up at a rate seldom seen in the past 20 years. That is problematic as core PCE prices are picking up again in defiance of higher rates.

Not the Droids You’re Looking For

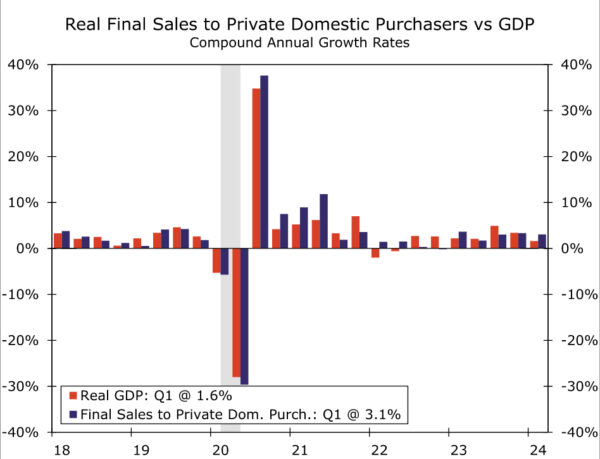

It is tempting to see today’s miss in GDP as a welcome indication that curiously strong growth is at last giving way to the inevitable gravity of higher rates and thus the first bit of data needed to warrant eventual rate cuts by the Federal Reserve. Despite the fact that headline growth came in almost a full percentage point below expectations, we see little in today’s report that will warrant much legitimate justification for a softer monetary policy stance.

After an unsettling headline miss, the picture that emerges from the details in today’s GDP report is actually more of the same in terms of the factors that are standing in the way of a lower rate environment.

Consumers are still spending, they are just prioritizing activities in the service sector. Spending on non-durable goods stalled in the quarter while outlays on big-ticket durable goods items contracted at a 1.2% annualized rate. That was not nearly enough to offset the much larger services category, where consumers spared no expense in the first quarter. Like a relief pitcher in the late innings, services spending came in throwing heat in the first quarter with a blistering 4.0% annualized growth rate—the fastest surge in consumer services spending since the stimulus-fueled binge in 2021. Excluding 2020 & 2021, services has only come in above 4.0% three times in the last two decades (once in 2014 and twice in 2004). Higher rates are intended to cool consumer demand; the trouble for the Fed is: it’s not working.

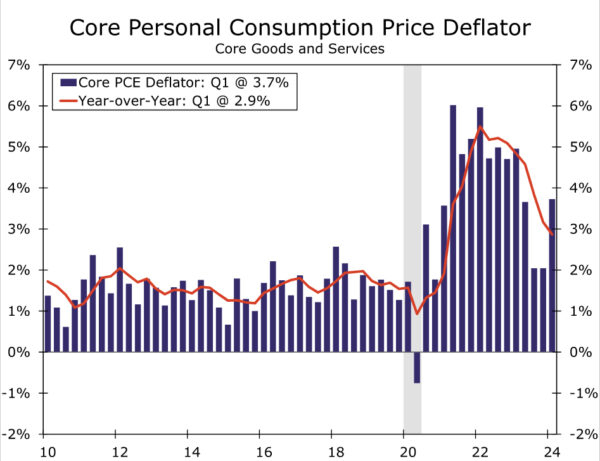

The core PCE deflator rose at a 3.7% annualized rate in Q1, a notable acceleration after a sharp slowing the prior two quarters (chart). This data implies a strong 0.4% increase in March core PCE, set to be released tomorrow. Services excluding energy and housing rose at a 5.1% annualized rate in Q1, the fastest in a year.

While higher rates may be restraining spending on goods that may be exposed to higher borrowing costs, households keep pulling out all the stops to keep spending. Real disposable income rose at a slower rate in the first quarter, but remained positive and households are saving less of that income on a monthly basis. The personal saving rate slipped to 3.6% during the quarter, which marks the lowest rate at which households have saved since the end of 2022.

So why the long face? Why was the headline number so weak? Partly because there was a significant drag from trade. Net exports exerted a drag of 0.86 percentage points on the headline number. Without that drag, the headline number would have come in precisely in line with consensus estimates. While goods spending is weak, businesses are playing it smart by not importing too much in the way of goods. Goods imports subtracted about three quarters of a percent from growth in the first quarter which swamped only tepid growth in exports during the same period.

Businesses also look to be managing inventory levels fairly well. Real private inventories rose by $35.4 billion in Q1, but since they rose at a slower pace than in the fourth quarter of last year, they again resulted in a drag on headline growth, subtracting 0.35 percentage points from GDP last quarter.

In looking through some of these volatile factors, underlying growth remained quite solid in the first quarter. Real final sales to domestic private purchasers, which strips away net exports, inventories and government investment and gets at the underlying trend in domestic demand, rose at a 3.1% annualized rate during the quarter. The last three quarterly prints for this measure have all come in at 3.0% or higher, signaling healthy and stable growth. Don’t underestimate this economy.