Provider of payment services Worldline today announced its 2023 annual results.

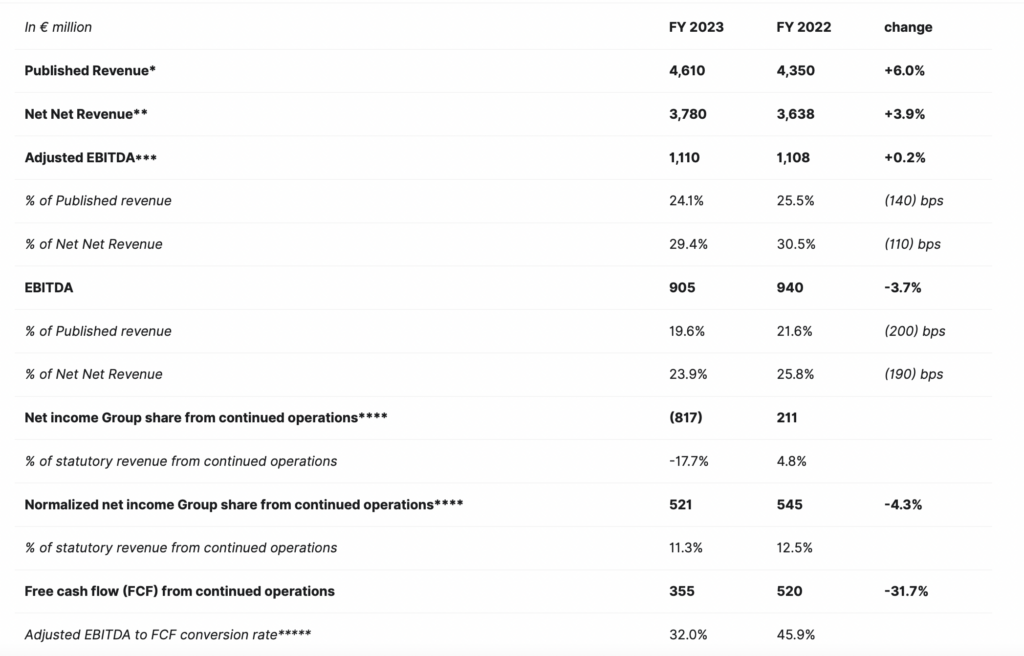

Worldline’s FY 2023 revenue reached €4,610 million, representing 6.0% revenue organic growth, in line with the revised guidance provided in October 25,2023.

Merchant Services (€3,325 million revenue, +8.9% organic growth) experienced a contrasted performance between a good first half and a second half of the year. This was due in particular to the economic and consumption slowdown in Europe, which further deteriorated during the fourth quarter versus the third quarter, and to the impact of announced online merchants termination which represented circa €30 million impact in H2 2023.

Financial Services performance (€ 944 million revenue, 1.3% organic decline) reflected the low conversion of pipeline opportunities, which was partially offset by the good resilience of Issuing activities.

Mobility & e-Transactional Services (€ 342 million revenue, +0.1% organic growth) achieved a stable performance driven by a good underlying growth in e-Ticketing.

Group’s Adjusted EBITDA reached €1,110 million in FY 2023, stable in absolute value compared to FY 2022 and representing 24.1% of revenue, in line with the revised objective of the year.

Net income Group share from continued operations was € -817 million, mainly impacted by the € 1,147 million goodwill impairment mostly materialized in Merchant Services, based on conservative assumptions reflecting the change in valuation paradigm in the payments’ Industry. On a Normalized basis (excluding unusual and infrequent items, Group share, net of tax) reached € 521 million, stable in absolute value versus 2022.

Normalized basic and diluted EPS were both € 1.85 in FY 2023. At December 31, 2023, there were no potentially dilutive instruments contrary to 2022 when the potentially dilutive instruments were stock-options and convertible bonds.

Group Net debt amounted to € 1,811 million at the end of 2023, down by circa €400 million compared with 2022. It represents a Group leverage ratio of 1.6x to adjusted EBITDA.