WTI crude oil is extending its near term decline today on expectation of higher production and lower demand ahead. If WTI cannot reclaim 80 mark in short term, there is prospect of downside acceleration through 70 next.

In its latest report, the US Energy Information Administration revised its expectations for this year’s global oil and liquid fuels output upwards while reducing its demand forecasts.

Notably, it now anticipates that global oil and liquid fuels consumption will increase by 920k bpd to 102.84m bpd, a slight reduction from the previously forecasted growth of 950k bpd.

On the production side, total world crude oil and liquid fuels production is expected to rise by 970k bpd to 102.76m bpd, up from the earlier estimate of 850k bpd increase.

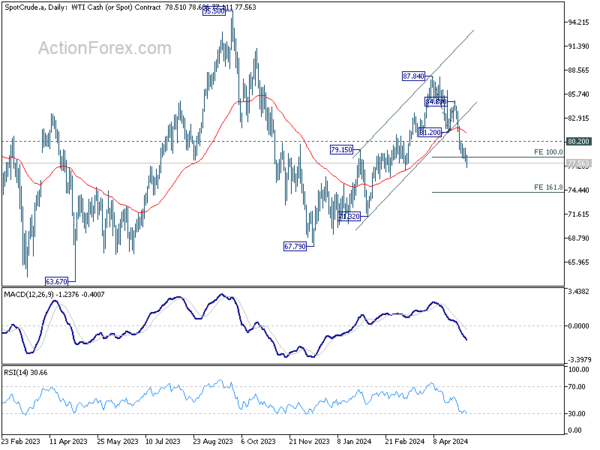

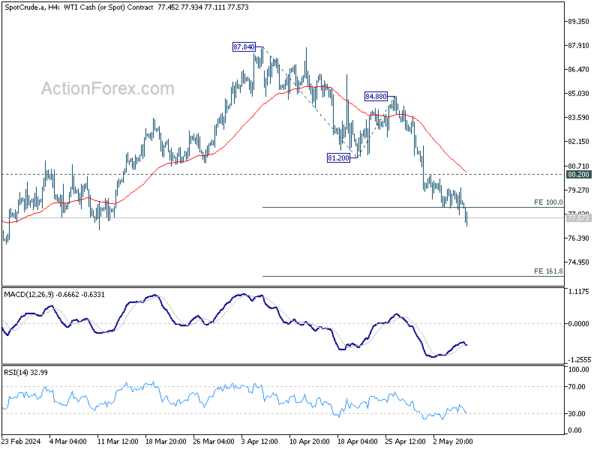

Technically, the break of 100% projection of 87.84 to 81.20 from 84.88 at 78.24 suggests WTI is probably ready for downside acceleration. Near term outlook will stay bearish as long as 80.20 resistance holds. Next target is 161.8% projection at 74.13.

More importantly, the fall from 87.84 is seen as the third leg of the pattern from 95.50. There is prospects of deeper decline through 67.79 towards 63.67 (2023 low) in the medium term.