As US session gets underway, Yen and Dollar remain the weakest links in the currency markets, reflecting a broader trend of risk appetite among investors. All eyes are now on whether the US stock market can extend its record-setting run. In particular, there is anticipation that NASDAQ could catch up and achieve a new historical high. Meanwhile, there’s prospect for Yen and Dollar to swap their positions before the week closes, contingent upon extended retreat US treasury yields.

Meanwhile, Euro presents a mixed picture following the latest German Ifo business survey, which underscored the persistent sluggish sentiment within Europe’s largest economy. Despite stabilization, the economic outlook remains tepid at best. Additionally, a series of remarks from ECB officials aimed at tempering expectations for an early rate cut seems to have had limited impact on market sentiment, suggesting that investors may be looking beyond immediate policy signals.

Sterling, on the other hand, is finding some strength, especially against Euro, buoyed by overall positive risk sentiment. Australian dollar and New Zealand dollar are also benefiting from the prevailing risk-on environment, though Canadian dollar is noticeably trailing.

In Europe, at the time of writing, FTSE is up 0.06%. DAX is up 0.06%. CAC is up 0.63%. UK 10-year yield is down -0.028 at 4.087. Germany 10-year yield is down -0.034 at 2.407. Earlier in Asia, Japan was on holiday. Hong Kong HSI fell -0.10%. China Shanghai SSE rose 0.55%. Singapore Strait Times fell -1.18%.

ECB’s Lagarde watches Q1 wage talks for clues on lasting disinflation

ECB President Christine Lagarde described Q4 wage figures as “obviously encouraging numbers”. However, she underscored the importance of caution, stating that the Governing Council needs to gain “more confidence” in the sustainability of the disinflationary process currently underway.

Lagarde also pointed to ongoing wage negotiations across various sectors and employee groups, expected to conclude in Q1, with data becoming available in May. The outcomes of these negotiations are anticipated to be a critical factor in the ECB’s assessment of the inflationary outlook.

“Those numbers will — especially if they continue to be encouraging — will be important for us to assess going forward in order to reach confidence,” Lagarde remarked in a press conference today.

ECB’s Nagel: Rate cut may be tempting, but it’s not time yet

In the annual report from Bundesbank, ECB Governing Council member Joachim Nagel emphasized the importance of caution and patience. “Even though it may be very tempting, it is too early to cut interest rates. This is because the price outlook is not yet clear enough,” Nagel stated.

Furthermore, Nagel’s call for perseverance reflects an understanding of the challenges inherent in steering monetary policy towards achieving price stability. “We should not let ourselves stray away from the path we have embarked on,” he advised, emphasizing the need for consistency and resilience in ECB’s policy stance.

Holzmann: ECB’s monetary policy often trails behind Fed’s

In an interview with Bloomberg TV, ECB Governing Council member Robert Holzmann pointed out that historically, ECB tends to follow Fed’s policy adjustments with a delay, typically around half a year.

“Typically the Fed always in the last few years has always gone first by about half a year so I would assume, ceteris paribus, as things are, that we would also follow with delay,” he stated, indicating a likelihood that ECB would not preempt Fed in cutting its policy rates.

The Governing Council member also highlighted ongoing inflation risks, particularly from geopolitical tensions affecting shipping routes in the Red Sea. Holzmann cautioned that these factors could contribute to persistent inflationary pressures.

He specifically mentioned the possibility of an escalation in the Red Sea conflict affecting oil prices, a scenario that, while slim, poses a real risk to inflation and economic stability.

Holzmann also expressed skepticism towards market expectations for significant policy easing in Eurozone this year. He warned that market bets for 90 basis points of easing “may be much too high”.

ECB Survey: Consumer inflation expectations for next tear rise to 3.3%

ECB’s Consumer Expectations Survey for January showed that inflation expectations for the upcoming year have seen a slight uptick, increasing by 0.1% to 3.3%, while the forecast for three years ahead remains steady at 2.5%.

On a more optimistic note, the survey indicates a slight improvement in expectations for economic growth over the next year. The mean expectation for economic growth has become less negative, adjusting from -1.3% to -1.1%.

Furthermore, the expected mean unemployment rate for the next 12 months shows a slight decrease, moving from 10.8% to 10.6%.

German Ifo edges up to 85.5, stabilizing at a low level

German Ifo Business Climate ticked up from 85.2 to 85.5 in February, matched expectations. Current Assessment Index is unchanged at 86.9, a touch below expectation of 87.0. Expectations Index rose slightly from 83.5 to 84.1, above expectation of 83.8.

By sector, manufacturing fell from -15.8 to -17.4. Services rose from -4.8 to -4.1. Trade fell from -29.7 to -30.87. Construction rose from -35.8 to -35.4.

Ifo said that the German economy is “stabilizing at a low level”.

New Zealand’s retail woes deepen with eighth consecutive quarterly decline

New Zealand’s retail sales volumes dropped by -1.9% qoq, a figure far below the expected decline of -0.2% qoq. This also marked the eighth consecutive quarter of contraction. Excluding auto sales, the decline was marginally less severe but still substantial at -1.7% qoq, again well below the anticipated -0.1% qoq decrease.

Melissa McKenzie, business financial statistics manager, highlighted the extent of the downturn, noting that “Ongoing falls in retail activity over the last two years were marked by a fall in most industries in the December quarter.”

The contraction in retail sales was widespread, with 14 out of 15 retail industries reporting lower sales volumes compared to the previous quarter. The most significant downturns were observed in motor vehicle and parts retailing, which fell by -2.5%, food and beverage services, which saw a -2.4% decline, and fuel retailing, which dropped by -3.6%.

In terms of retail sales value, there was a qoq decrease of -1.5%, with ten of the sixteen regions experiencing lower seasonally adjusted sales values.

GBP/USD Mid-Day Outlook

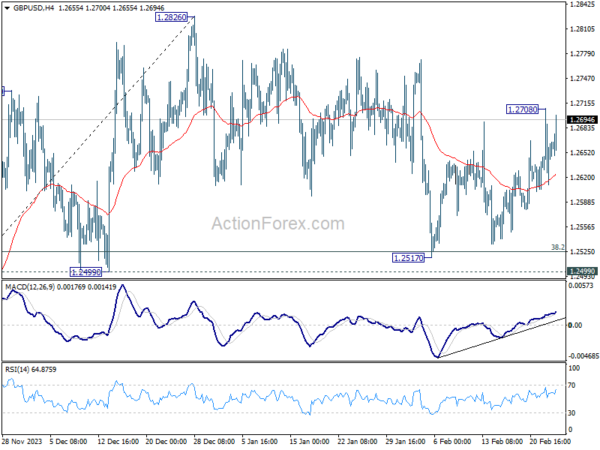

Daily Pivots: (S1) 1.2612; (P) 1.2661; (R1) 1.2710; More…

GBP/USD bounces notably today but stays below 1.2708. Intraday bias remains neutral first. On the upside, break of 1.2708 resistance will indicate that correction from 1.2826 has completed. Intraday bias will be back on the upside for retesting 1.2826. Nevertheless, decisive break of 1.2499 will argue that whole rise from 1.2036 has completed and turn near term outlook bearish.

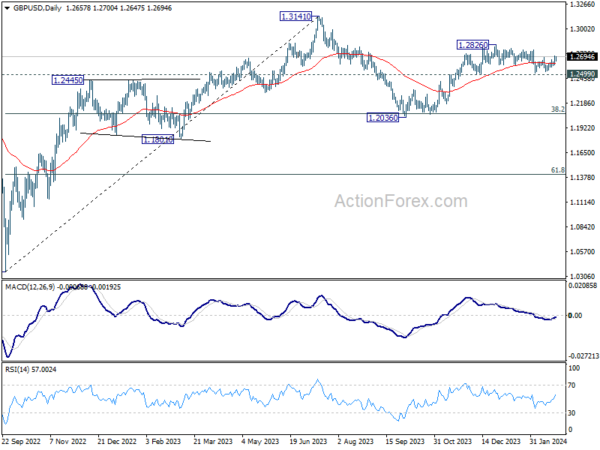

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg, which could be still in progress. But upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2499 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Retail Sales Q/Q Q4 | -1.90% | -0.20% | 0.00% | -0.80% |

| 21:45 | NZD | Retail Sales ex Autos Q/Q Q4 | -1.70% | -0.10% | 1.00% | 0.40% |

| 00:01 | GBP | GfK Consumer Confidence Feb | -21 | -18 | -19 | |

| 07:00 | EUR | Germany GDP Q/Q Q4 F | -0.30% | -0.30% | -0.30% | |

| 09:00 | EUR | Germany IFO Business Climate Feb | 85.5 | 85.5 | 85.2 | |

| 09:00 | EUR | Germany IFO Current Assessment Feb | 86.9 | 87 | 87 | 86.9 |

| 09:00 | EUR | Germany IFO Expectations Feb | 84.1 | 83.8 | 83.5 |