Japanese Yen continues to weaken, accelerating its decline in today’s Asian session and edging closer to a multi-decade low against Dollar. The market appears to be gaining confidence that Japan will not intervene at this stage, despite the steep and extended depreciation. But the country’s approach to currency intervention remains shrouded in typical discretion. So, it’s “never say never” regarding the timing of intervention.

Still, it should be noted that top Japanese officials have previously attributed part of Yen’s weakness to the divergent monetary policies between Japan and other major economies. BoJ remains cautious, with even the most optimistic officials suggesting a wait until early next year’s wage negotiations to gauge the sustainability of the 2% inflation target. That’s a clear prerequisite to loose policy exit. Hence, Yen’s bearish trend is unlikely to change before that.

In the broader currency market, Canadian Dollar trails Yen as the second weakest, followed by Swiss Franc. On the other hand, New Zealand Dollar leads as the strongest, with Sterling and Australian Dollar also showing robustness. Euro and Dollar are showing mixed performance.

As the week progresses, the focus will shift back to key economic data, particularly CPI figures from US the UK, which are expected to influence market sentiment and central bank policies significantly.

Technically, CHF/JPY’s pull back from 168.39 appears to be finished already, ahead of 55 EMA. The shallow fall is likely just a correction to the rise from 159.95 to 168.39 only. Immediate focus is now on 168.39. Decisive break there will resume larger up trend. Next target is 38.2% projection of 140.21 to 166.57 from 159.95 at 170.01. Firm break there could prompt upside acceleration to 61.8% projection at 176.24 next.

In Asia, at the time of writing, Nikkei is down -0.05%. Hong Kong HSI is up 0.01%. China Shanghai SSE is down -0.07%. Singapore Strait Times is down -0.91%. Japan 10-year JGB yield is up 0.026 at 0.884.

Japan’s wholesale inflation eases to 0.8% yoy, continued downward trend

Japan’s corporate goods price index, a key indicator of wholesale inflation, exhibited a significant slowdown in October, underscoring a continued trend of easing price pressures.

The index increased by just 0.8% yoy, falling short of the anticipated 0.9% yoy and marking its first dip below 1% since February 2021. This latest figure also represents the 10th consecutive month of slowing wholesale inflation.

The deceleration in the CGPI can be largely attributed to decreases in the prices of specific commodities. Notably, costs for wood, chemical, and steel products experienced declines, reflecting the broader impact of reduced global commodity prices.

Export price index saw an uptick from 0.5% yoy to 1.0% yoy. Import price index showed a lesser decline, moving from -15.5% yoy to -12.5% yoy.

RBA’s Kohler warns of bumpy road ahead in tackling inflation

In a speech, Marion Kohler, Acting Assistant Governor of RBA, remarked that decline in inflation is expected to be a “more gradual process than previously thought.”

This outlook stems from the current economic environment characterized by “still-high level of domestic demand” and “strong labour” alongside other cost pressures. These factors contribute to the prediction that inflation will hover just below 3% by the end of 2025.

The Assistant Governor pointed out that the recent trend of declining inflation has primarily been “driven by lower goods price inflation.” In stark contrast, “domestically sourced inflation” – especially in the services sector – has shown resilience, being “widespread and slow to decline.”

Kohler also underscored the nuanced challenges in the next phase of controlling inflation, which she anticipates to be “more drawn out than the first.” This outlook aligns with experiences in other advanced economies that have faced similar inflationary patterns.

Furthermore, she cautioned about the potential for unforeseen challenges, citing the recent increase in fuel prices as an example of supply shocks that could unpredictably influence headline inflation.

Kohler emphasized the uncertain nature of the journey ahead in managing inflation, stating, “the road ahead could be bumpy.”

New Zealand BNZ services fell to 48.9, contraction with economic angst

New Zealand’s BusinessNZ Performance of Services Index experienced a notable dip in October, falling from 50.6 to 48.9, a level indicative of contraction in the sector. This decline also positions the index well below its long-term average of 53.5.

Activity and sales experienced a significant drop, moving from 50.9 to 47.4. There was also a downturn in employment, which decreased from 50.5 to 49.3. New orders and business fell as well,from 53.9 to 51.9. On a more positive note, stocks and inventories saw an increase, rising from 48.0 to 51.1, and supplier deliveries edged up slightly from 49.7 to 49.8.

Despite these declines, the proportion of negative comments in October decreased to 58.2%, a reduction from 61.8% in September and 63.9% in August, indicating a slight improvement in business sentiment.

BNZ Senior Economist Craig Ebert said that “combined, the PSI (48.9) and PMI (42.5) paint a picture of economic angst. This counsels caution around GDP for Q3, after it posted a surprising gain of 0.9% in Q2”.

US CPI Data in Focus: A Test of Fed’s Insufficient Confidence in Disinflation Progress

A slew of significant economic data releases are scheduled for the week. A major focal point will be US CPI. Market expectations are set for deceleration in headline CPI from 3.7% yoy to 3.3%, while core CPI is anticipated to hold steady at 4.1% yoy.

This data comes under the microscope following remarks from Fed Chair Jerome Powell last week. Powell expressed that Fed is “not confident” about whether the current monetary policy is “sufficiently restrictive” to bring inflation down to the 2% target. His concerns echo the global sentiment that the final leg of the disinflation journey is often the most challenging.

Adding to the intrigue, University of Michigan’s report last Friday revealed an uptick in year-ahead inflation expectations to a seven-month high of 4.4%, a significant jump from the previous readings of 4.2% in October and 3.2% in September. Notably, long-term inflation expectations have also escalated to 3.2%, marking the highest point since 2011.

Should the upcoming US CPI report deliver any unexpected upside surprise, it could heavily tilt the scales towards at least one more rate hike by Fed before the end of the tightening cycle.

Alongside CPI, US retail sales data will also be under scrutiny, offering insights into consumer behavior amidst the dual challenges of high inflation and elevated interest rates.

Across the Atlantic, UK CPI is another critical data point, with expectations pointing to a significant slowdown in headline reading from 6.7% yoy to 4.7% yoy, and core CPI anticipated to decrease from 6.1% yoy to 5.7%.

UK’s disinflation process is clearly lagging other major economies. BoE Chief Economist Huw Pill recently suggested a strategy of maintaining current interest rates for an extended period to effectively combat inflation. This approach is likely to persist, barring any dramatic spikes in inflation figures. More intensify debate would start when disinflation finally approaches the “last mile”.

Additional data releases such as UK job data, retail sales, German ZEW economic sentiment, and Japan’s GDP will also be closely monitored. For Australia, employment report is due, but its impact might be overshadowed by crucial data from China, including industrial production and retail sales, which hold significant implications for the Australian economy.

Here are some highlights for the week:

- Monday: New Zealand BNZ services index; Japan PPI, machine tool orders.

- Tuesday: Australia Westpac consumer sentiment, NAB business confidence; UK employment; Swiss PPI; Eurozone GDP revision; Germany ZEW economic sentiment; US CPI.

- Wednesday: Japan GDP; Australia wage price index; China industrial production, retail sales, industrial production; UK CPI; Eurozone industrial production, trade balance; Canada manufacturing sales, wholesale sales; US retail sales PPI, Empire state manufacturing, business inventories.

- Thursday: Japan machine orders, trade balance; Australia employment; Japan tertiary industry index; Italy trade balance; Canada housing starts; US jobless claims, Philly Fed survey, import prices, industrial production, NAHB housing index.

- Friday: New Zealand PPI; UK retail sales; Eurozone current account, CPI final; Canada IPPI, RMPI; US building permits and housing starts.

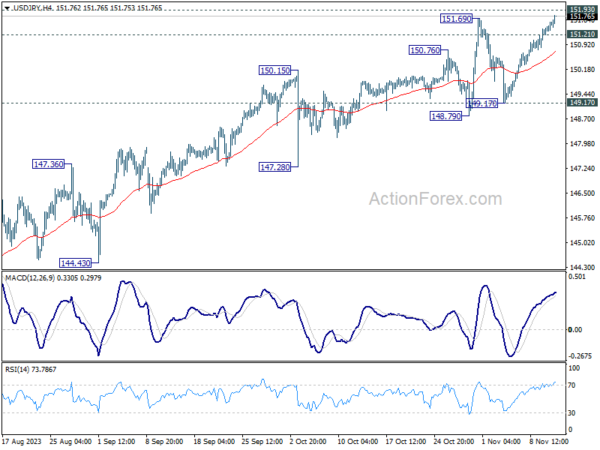

USD/JPY Daily Outlook

Daily Pivots: (S1) 151.30 (P) 151.45; (R1) 151.68; More…

As USD/JPY’s rise from 149.17 extends, immediate focus is now on 151.93 key resistance. Decisive break there will confirm resumption of long term up trend. Next target will be 157.69 projection level. On the downside, below 151.21 minor support will turn intraday bias neutral first. But near term outlook will stay bullish as long as 149.17 support holds, even in case of deep retreat.

In the bigger picture, immediate focus is now on 151.93 resistance (2022 high). Rejection by 151.93, followed by sustained break of 145.06 resistance turned support will argue that rise from 127.20 has completed, and turn outlook bearish for 137.22 support and below. However, sustained break of 151.93 will confirm resumption of long term up trend. Next target will be 61.8% projection of 102.58 (2021 low) to 151.93 from 127.20 at 157.69.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PSI Oct | 48.9 | 50.7 | ||

| 23:50 | JPY | PPI Y/Y Oct | 0.80% | 0.90% | 2.00% | 2.20% |

| 06:00 | JPY | Machine Tool Orders Y/Y Oct P | -20.60% | -11.20% | ||

| 10:00 | EUR | EU Economic Forecasts |