Forex

AHCO TUESDAY DEADLINE: ROSEN, LEADING TRIAL ATTORNEYS, Encourages AdaptHealth Corp. Investors to Secure Counsel Before Important December 26 Deadline in Securities Class Action – AHCO

NEW YORK, Dec. 24, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of common stock of AdaptHealth Corp. (NASDAQ: AHCO) between (1) August 4, 2020 and February 27, 2023, both dates inclusive (the “Class Period”) and/or...

ROSEN, TRUSTED INVESTOR COUNSEL, Encourages ACELYRIN, INC. Investors with Losses to Secure Counsel Before Important Deadline in Securities Class Action – SLRN

NEW YORK, Dec. 24, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of ACELYRIN, INC. (NASDAQ: SLRN) between May 4, 2023 and September 11, 2023, both dates inclusive (the “Class Period”), of the important...

LOVESAC ALERT: Bragar Eagel & Squire, P.C. Reminds Investors that a Class Action Lawsuit Has Been Filed Against Lovesac Company and Encourages Investors to Contact the Firm

NEW YORK, Dec. 24, 2023 (GLOBE NEWSWIRE) — Bragar Eagel & Squire, P.C., a nationally recognized stockholder rights law firm, reminds investors that a class action lawsuit has been filed against Lovesac Company (“Lovesac” or the “Company”) (NASDAQ: LOVE) in the...

ROSEN, A LEADING INVESTOR RIGHTS LAW FIRM, Encourages ChargePoint Holdings, Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – CHPT

NEW YORK, Dec. 24, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of ChargePoint Holdings, Inc. (NYSE: CHPT) between June 1, 2023 and November 16, 2023, both dates inclusive (the “Class Period”), of the...

BAORUI’s Ecological Feast: Diverse Integration, Paving the Way for a New Financial Era

New York, NY, Dec. 25, 2023 (GLOBE NEWSWIRE) — Recently, BAORUI Exchange officially announced its new strategic ecological layout. This significant move indicates that BAORUI is embarking on the path of technological and financial ecological integration, striving to...

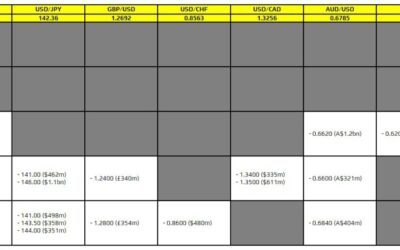

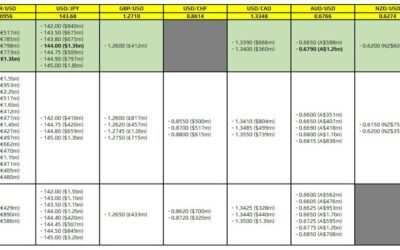

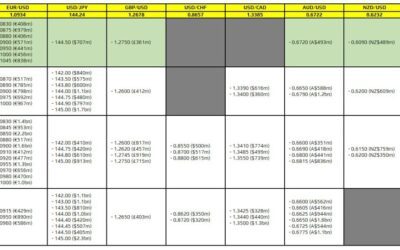

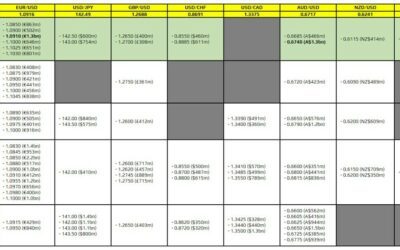

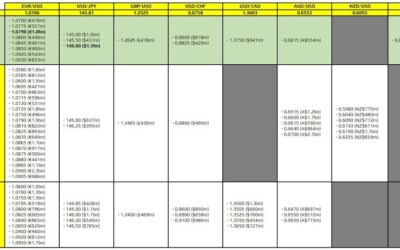

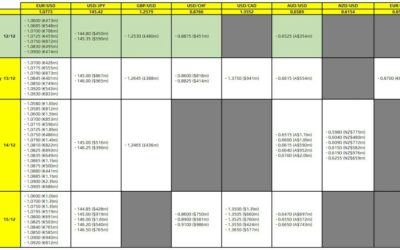

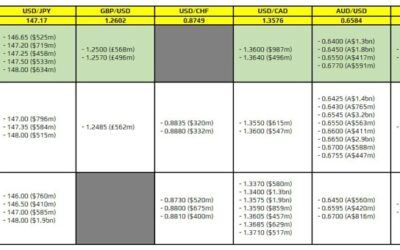

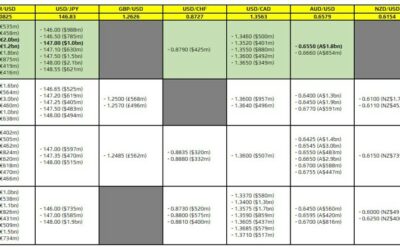

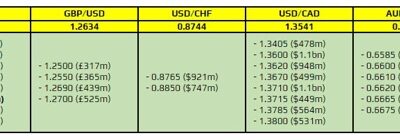

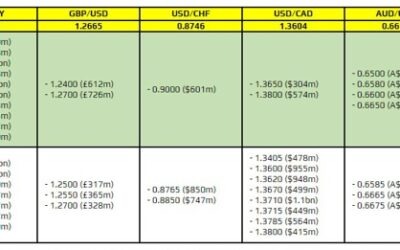

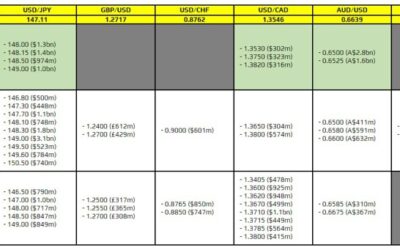

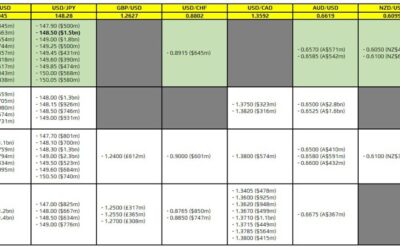

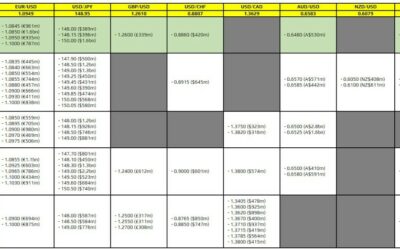

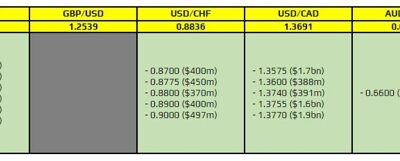

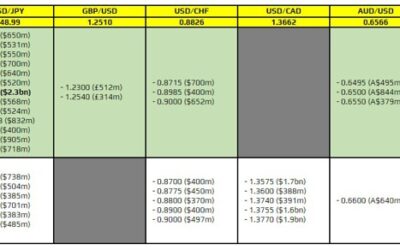

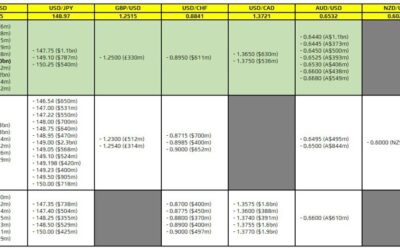

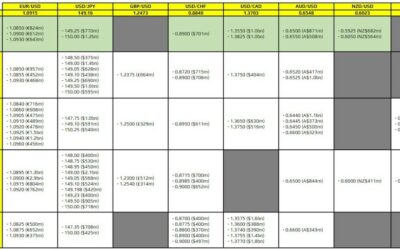

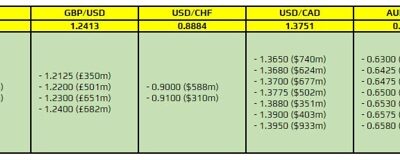

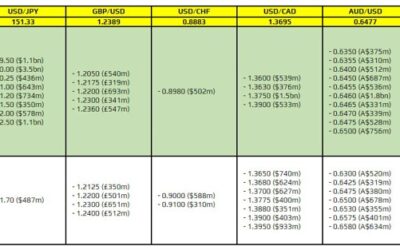

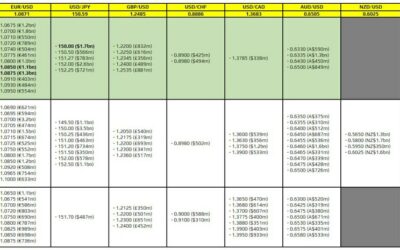

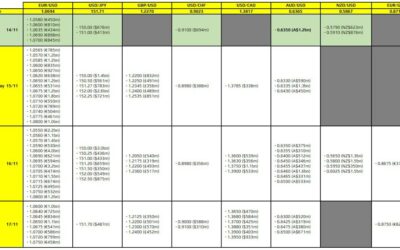

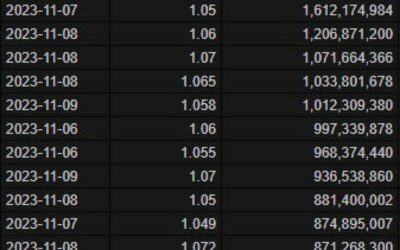

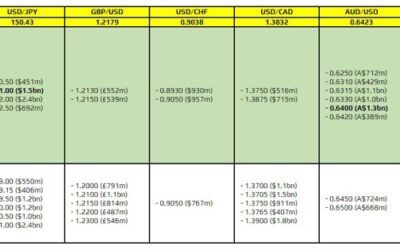

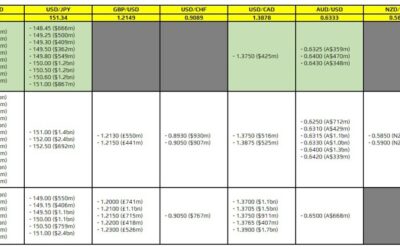

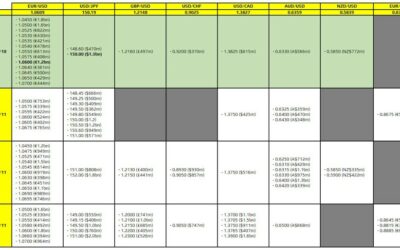

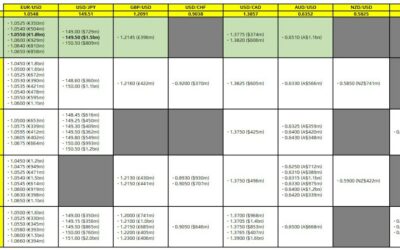

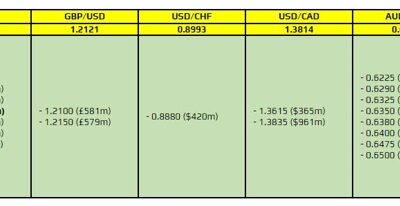

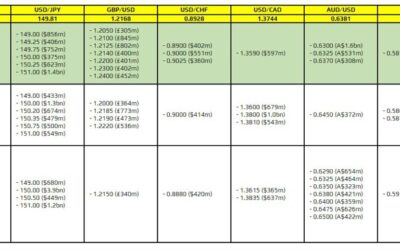

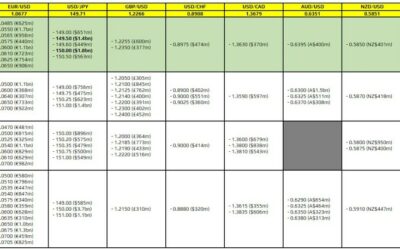

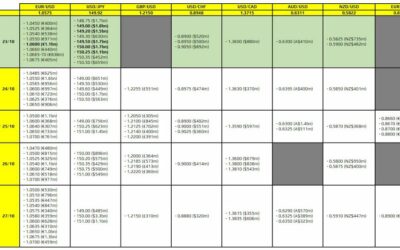

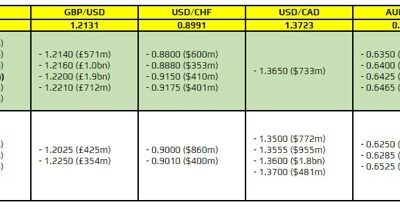

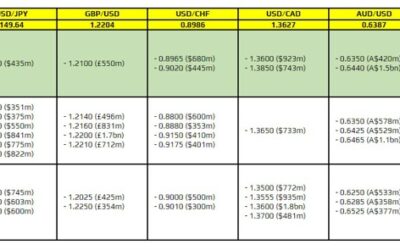

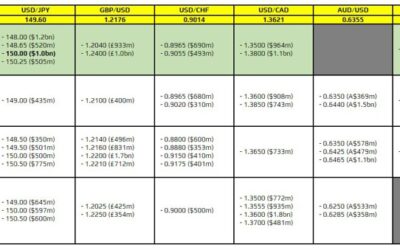

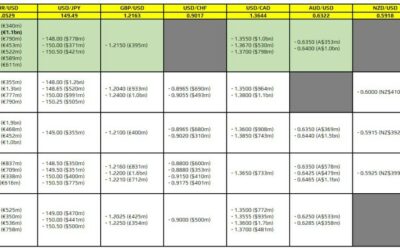

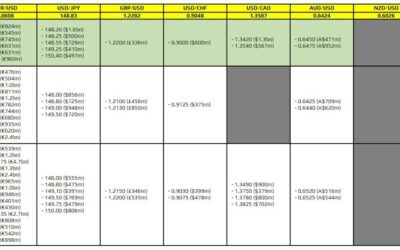

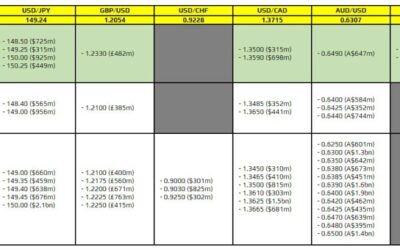

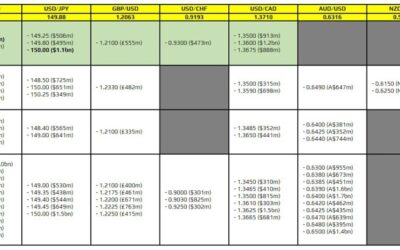

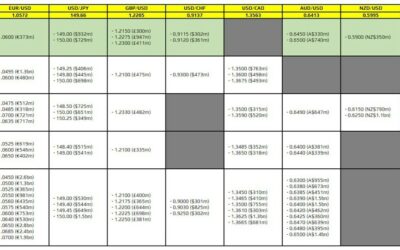

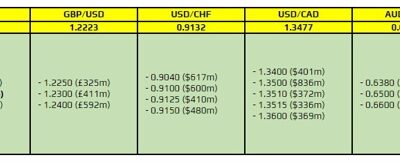

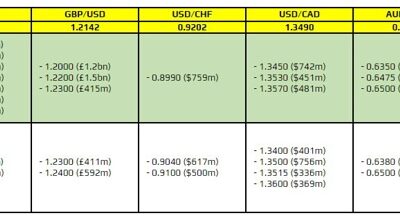

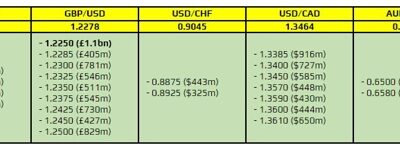

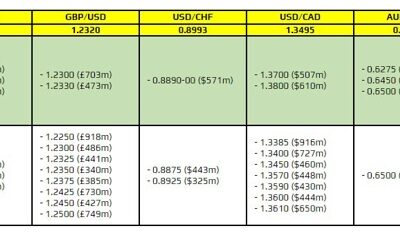

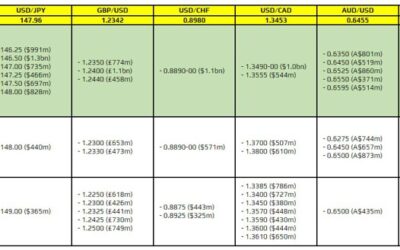

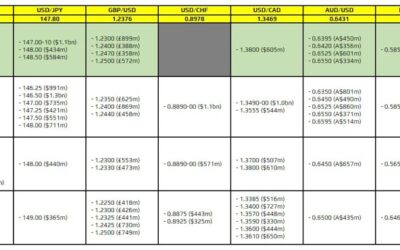

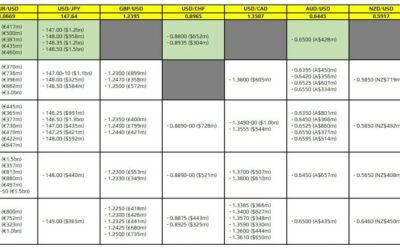

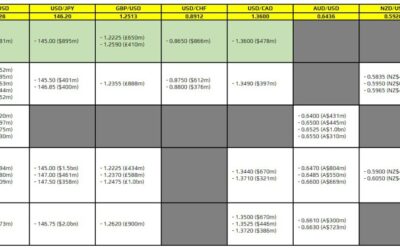

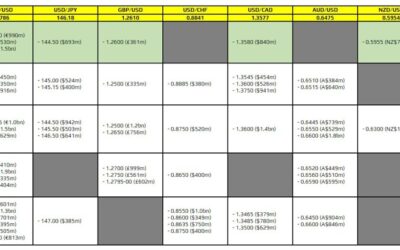

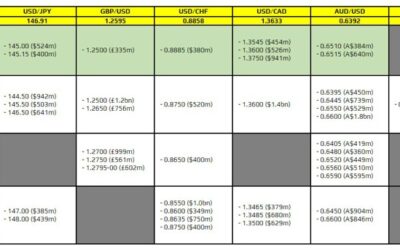

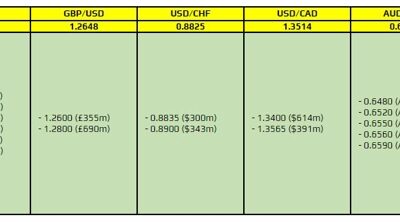

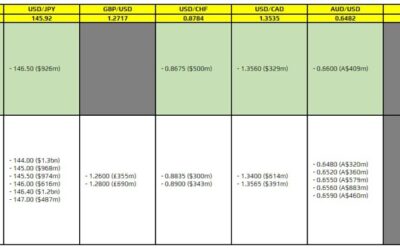

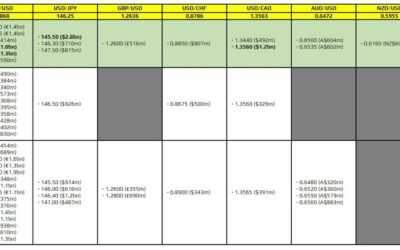

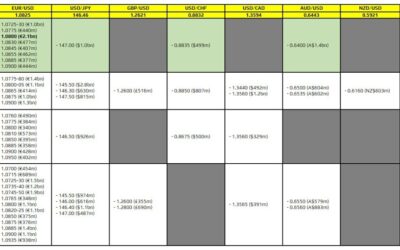

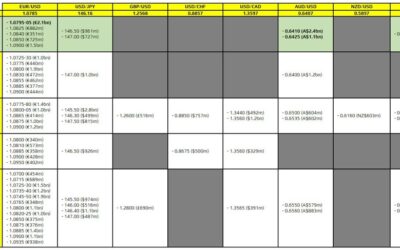

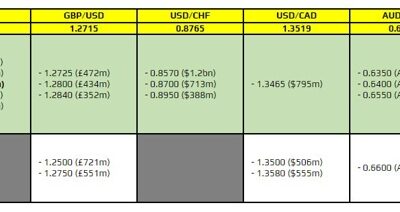

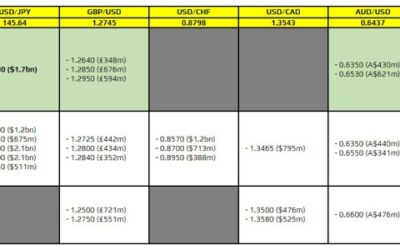

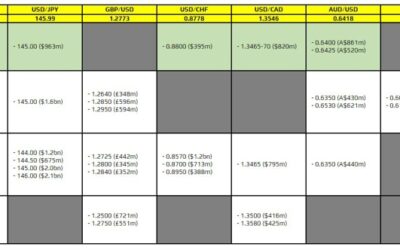

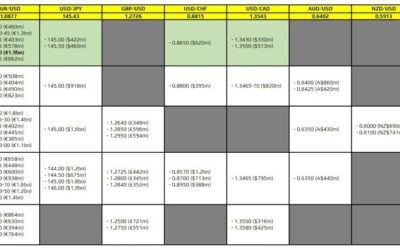

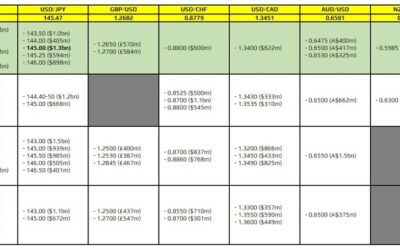

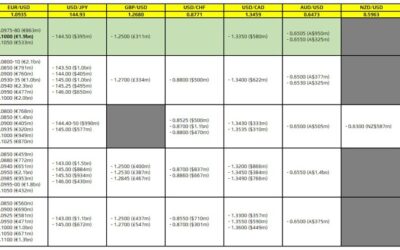

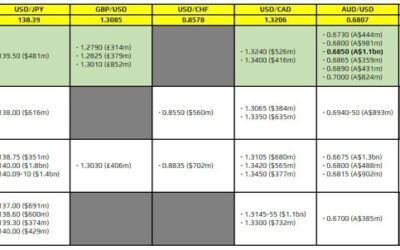

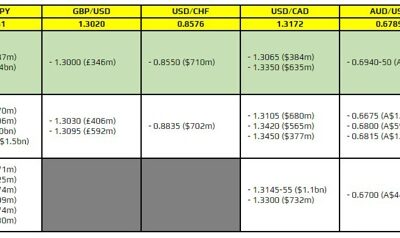

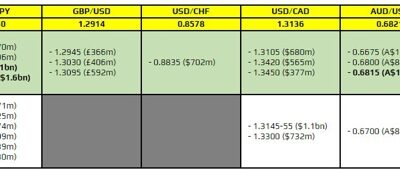

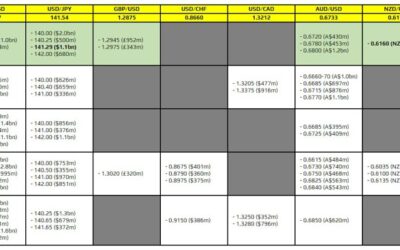

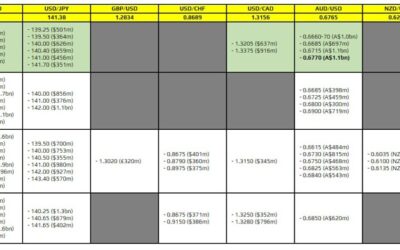

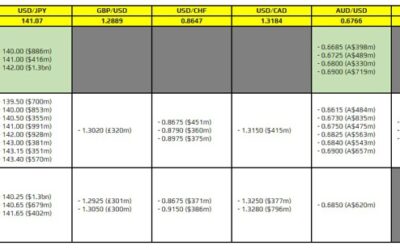

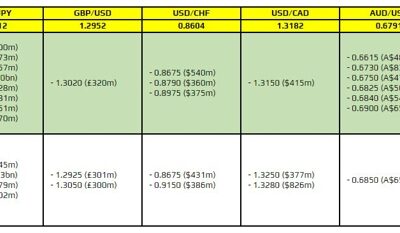

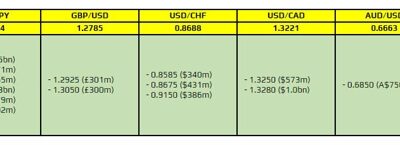

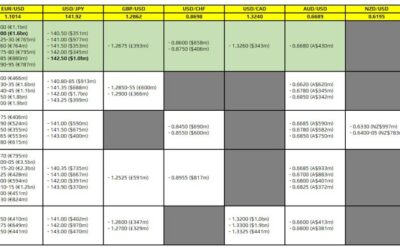

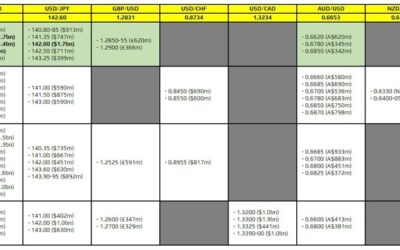

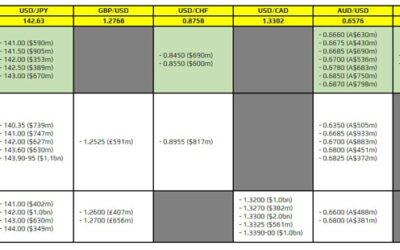

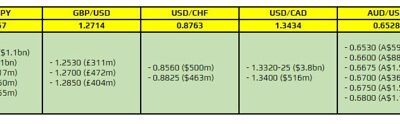

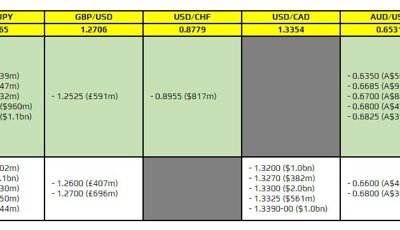

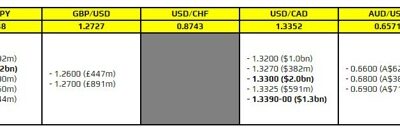

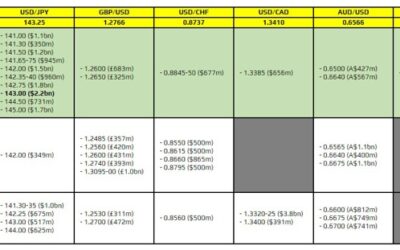

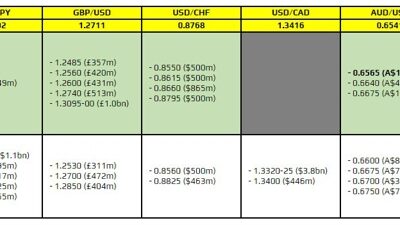

FX option expiries for 25-29 December 10am New York cut

It is a holiday-stricken week in markets and even with it being a busier December than usual this year, the final trading week of the year should be a quiet one with little to work with in general. There's not much use trying to pinpoint anything to be a factor during...

ROSEN, LEADING TRIAL ATTORNEYS, Encourages Mercury Systems, Inc. Investors with Losses to Secure Counsel Before Important Deadline in Securities Class Action – MRCY

NEW YORK, Dec. 24, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, announces the filing of a class action lawsuit on behalf of purchasers of common stock of Mercury Systems, Inc. (NASDAQ: MRCY) between December 7, 2020 and June 23, 2023,...

ROSEN, TOP RANKED GLOBAL COUNSEL, Encourages Barclays PLC Investors to Secure Counsel Before Important January 2 Deadline in Securities Class Action First Filed by the Firm – BCS, BCLYF

NEW YORK, Dec. 24, 2023 (GLOBE NEWSWIRE) — WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of the securities of Barclays PLC (NYSE: BCS) (OTC: BCLYF) between July 22, 2019 and October 12, 2023, both dates inclusive (the “Class Period”), of...

USD/JPY Price Analysis: Investors on Edge Ahead of US Inflation

The US inflation scenario is now leaning towards lower levels. The dollar index is poised for a weekly loss of approximately 0.73%. Data revealed a 2.5% year-on-year increase in Japan’s core consumer prices for November. Friday’s USD/JPY price analysis was bearish,...

ROSEN, A TOP RANKED LAW FIRM, Encourages Generac Holdings Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – GNRC

NEW YORK, Dec. 23, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of common stock of Generac Holdings Inc. (NYSE: GNRC) between May 3, 2023 and August 3, 2023, both dates inclusive (the “Class Period”), of the...

ROSEN, LEADING INVESTOR COUNSEL, Encourages General Motors Company Investors to Secure Counsel Before Important Deadline in Securities Class Action – GM

NEW YORK, Dec. 23, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of General Motors Company (NYSE: GM) between February 2, 2022 and October 26, 2023, both dates inclusive (the “Class Period”), of the...

ROSEN, TOP RANKED INVESTOR COUNSEL, Encourages National Instruments Corporation Investors to Secure Counsel Before Important Deadline in Securities Class Action – NATI

NEW YORK, Dec. 23, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, reminds sellers of common stock of National Instruments Corporation (NASDAQ: NATI) between May 25, 2022 and January 17, 2023, both dates inclusive (the “Class Period”),...

ROSEN, A TOP RANKED LAW FIRM, Encourages Fisker Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – FSR

NEW YORK, Dec. 23, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of Fisker Inc. (NYSE: FSR) between August 4, 2023 and November 20, 2023, both dates inclusive (the “Class Period”), of the important...

SPWR 3-DAY DEADLINE ALERT: Hagens Berman Encourages SunPower (SPWR) Investors with Substantial Losses to Contact Firm’s Attorneys Before Dec. 26th Deadline in Securities Class Action Over Bookkeeping Fraud

SAN FRANCISCO, Dec. 23, 2023 (GLOBE NEWSWIRE) — Hagens Berman urges SunPower Corporation (NASDAQ: SPWR) investors who suffered substantial losses to submit your losses now. Class Period: Mar. 9, 2023 – Oct. 24, 2023Lead Plaintiff Deadline: Dec. 26, 2023Visit:...

ROSEN, NATIONAL TRIAL LAWYERS, Encourages EHang Holdings Limited Investors to Secure Counsel Before Important Deadline in Securities Class Action Commenced by the Firm – EH

NEW YORK, Dec. 23, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of the securities of EHang Holdings Limited (NASDAQ: EH) between January 20, 2022 and November 6, 2023, both dates inclusive (the “Class Period”), of...

ROSEN, LEADING INVESTOR COUNSEL, Encourages Dollar General Corporation Investors with Losses to Secure Counsel Before Important Deadline in Securities Class Action – DG

NEW YORK, Dec. 23, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of common stock of Dollar General Corporation (NYSE: DG) between May 28, 2020 and August 30, 2023, both dates inclusive (the “Class Period”), of the...

GBP/USD Shrugs After Mixed UK Data

UK retail sales jump 1.3%, GDP contracts by 0.1% US to release PCE Price Index on Friday The British pound is drifting on Friday. In the European session, GBP/USD is trading at 1.2701, up 0.08%. UK retail sales rebound but GDP contracts UK retail sales jumped 1.3% in...

Canadian Dollar Powers Higher, GDP Next

Friday’s economic releases: Canadian GDP US PCE Price Core Index The Canadian dollar is showing limited movement on Friday. In the European session, USD/CAD is trading at 1.3276, down 0.05%. We could see stronger movement in the North American session, with the...

Solana and Bitcoin Failing to Storm Milestone

Market picture Crypto market capitalisation was climbing to $1.67 trillion on Friday morning – a new high since May 2022. However, very quickly, the market was hit by another wave of profit-taking, which has become commonplace over the past fortnight. Bitcoin is once...

USDCHF Hits 2023 Floor – Action Forex

USDCHF tests July’s eight-year low Sellers might stay in power, but not for long Core PCE inflation due at 13:30 GMT It was another bearish week for USDCHF, with the price fully retracing its July-September upleg to reach July’s eight-year low of 0.8551. There is...

US PCE slows to 2.6% in Nov, core PCE down to 3.2%, miss expectations

US personal income rose 0.4% mom or USD 81.6B in November, matched expectations Personal spending rose 0.2% mom or USD 46.7B, below expectation of 0.3% mom. PCE price index fell -0.1% mom, below expectation of 0.0% mom. Core PCE price index (excluding food and...

Seven tech stocks that can broaden your exposure beyond the ‘Magnificent Seven’ in 2024

During the bull market of 2023, the “Magnificent Seven” stocks have dominated financial media coverage, and rightly so, but investors might want to gain exposure to other important “quality” tech-related names.Read Full Story Latest posts by Market Watch (see...

US durable goods orders rises 5.4% in Nov, ex-transport up 0.5%

US durable goods orders rose 5.4% mom to USD 295.4B in November, above expectation of 2.7% mom. Ex-transport orders rose 0.5% mom to 187.6B, above expectation of 0.2% mom. Ex-defense orders rose 6.5% mom to USD 279.6B. Transportation equipment rose 15.3% mom to USD...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8536; (P) 0.8587; (R1) 0.8614; More…. USD/CHF’s decline continues today and falls through 0.8551 support without noticeable recovery. Longer term down trend is resuming. Intraday bias remains on the downside for 100% projection of 0.9111 to 0.8665...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 141.57; (P) 142.60; (R1) 143.14; More… USD/JPY is still bounded in consolidation from 140.94 and intraday bias stays neutral. Also, outlook will remain bearish as long as 146.58 resistance holds. Firm break of 140.94 will resume the whole fall from...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2636; (P) 1.2666; (R1) 1.2720; More… GBP/USD is still bounded in range below 1.2793 and intraday bias remains neutral at this point. Further rally is still expected as long as 1.2499 support holds. . On the upside, firm break of 1.2793 will resume...

World Premiere: DOOGEE S41 Max and S41 Plus Elevat Rugged Phone Technology to New Heights

NEW YORK, NY, Dec. 23, 2023 (GLOBE NEWSWIRE) — DOOGEE, at the forefront of innovation in rugged and smart devices, proudly presents its latest breakthrough – DOOGEE S41 Series (S41 Max & S41 Plus). Packed with these incredible models, S41 Max, and S41 Plus, DOOGEE...

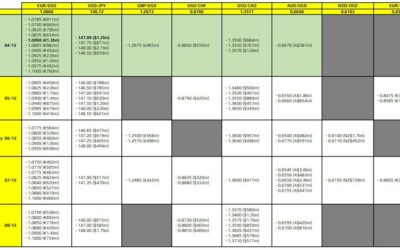

Summary 12/25 – 12/29

Monday, Dec 25, 2023 Tuesday, Dec 26, 2023 Wednesday, Dec 27, 2023 Thursday, Dec 28, 2023 Friday, Dec 29, 2023 The post Summary 12/25 – 12/29 appeared first on Action Forex.

ROSEN, LEADING INVESTOR COUNSEL, Encourages The Lovesac Company Investors with Losses to Secure Counsel Before Important Deadline in Securities Class Action – LOVE

NEW YORK, Dec. 22, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, announces the filing of a class action lawsuit on behalf of purchasers of securities of The Lovesac Company (NASDAQ: LOVE) between March 30, 2023 and August 16, 2023,...

The Weekly Bottom Line: A Healthy Dose of Holiday Cheer’

U.S. Highlights Lower borrowing costs are showing up in the housing market with existing home sales rising modestly in November for the first time in five months. Housing starts also jumped to a nineteen-month high on the month. Personal spending remained solid in...

Saxena White P.A. Files New Securities Fraud Class Action Against Inspire Medical Systems, Inc.

BOCA RATON, Fla., Dec. 22, 2023 (GLOBE NEWSWIRE) — Saxena White P.A. has filed a securities fraud class action lawsuit (the “Class Action”) in the United States District Court for the District of Minnesota against Inspire Medical Systems, Inc. (“Inspire Medical” or...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0960; (P) 1.0986; (R1) 1.1038; More… EUR/USD’s rally from 1.0447 resumed by breaking through 1.1016 resistance. Intraday bias is back on the upside. Further rally should be seen to retest 1.1274 high. Strong resistance should be seen from there to...

What is the Best Local Liquor Store in Lone Tree, Colorado? The Answer Will Surprise You.

Total Wine & More: The Premier (Local) Liquor Store in Lone Tree, Colorado and Centennial, ColoradoIn the bustling cities of Lone Tree and Centennial, Colorado, Total Wine & More stands out as a beacon for liquor enthusiasts and casual buyers alike. Walking...

Canada’s Economy Flatlined Again in October, Likely Advanced in November

The Canadian economy registered a third consecutive month of effectively no growth on a month-on-month (m/m) basis in October. This print comes in below Statistics Canada’s advanced guidance and market expectations for a 0.2% m/m gain. The flash estimate for November...

Veradigm Sued for Securities Law Violations; Investors Should Contact Block & Leviton for More Information

BOSTON, Dec. 22, 2023 (GLOBE NEWSWIRE) — A class action lawsuit has been filed against Veradigm, Inc. (NASDAQ: MDRX) for securities law violations. Investors who purchased shares and have lost money are encouraged to contact the firm to learn more about how they might...

U.S. Consumer Spending Up but Inflation Down in November

Personal income grew 0.4% month-on-month (m/m) in November, an acceleration from October’s 0.3% gain and in line with market expectations. Accounting for inflation and taxes, real personal disposable income rose 0.4% m/m, up from 0.3% previously. Personal consumption...

Veradigm (MDRX) CEO and CFO Ousted Amid Class Action Lawsuit Alleging Accounting Fraud- Hagens Berman

HAGENS BERMAN, NATIONAL TRIAL ATTORNEYS, Encourages MDRX Investors with Substantial Losses to Contact FirmSAN FRANCISCO, Dec. 22, 2023 (GLOBE NEWSWIRE) — Hagens Berman urges Veradigm Inc. (NASDAQ: MDRX) investors who suffered substantial losses to submit your losses...

Forward Guidance: December Jobs Data to Add to Evidence that Interest Rates Are High Enough

Forward Guidance will be on vacation next week, with the next edition to come January 5th, 2024. Happy Holidays! The holiday week ahead is empty of major economic data releases, but the new year will kick off with a fresh set of high profile Canadian and U.S. labour...

Illumina (ILMN) Forced to Divest GRAIL, While Investor Class Action Now Alleges An Expanded Fraudulent Period – Hagens Berman

HAGENS BERMAN Encourages ILMN Investors with Substantial Losses to Contact Firm’s AttorneysSAN FRANCISCO, Dec. 22, 2023 (GLOBE NEWSWIRE) — Hagens Berman urges Illumina, Inc. (NASDAQ: ILMN) investors who suffered substantial losses to submit your losses now. The...

Week Ahead – Markets Wind Down for Holidays, Mind the Liquidity Gap

Quiet week ahead as FX markets enter holiday season Spotlight will fall mostly on some Japanese releases Most importantly, liquidity will be in short supply Yen awaits Bank of Japan signals Another devastating year for the Japanese currency is coming to an end....

Dollar Falters on Soft PCE Inflation Data, Sterling Rises on Retail Sales

Fresh selloff is seen in Dollar in early US session after lower than expected headline and core PCE inflation readings. While another month of progress might still be insufficient to prompt Fed for an early rate cut, at least, things are heading in the right...

Volcon Stag Manufacturing Update December 2023

Volcon Stag Manufacturing Update December 2023 Volcon Stag LTD in manufacturing facility.AUSTIN, Texas, Dec. 22, 2023 (GLOBE NEWSWIRE) — Volcon Inc. (NASDAQ: VLCN) (“Volcon” or the “Company”), the first all-electric, off-road powersports company, today provided an...

Canada GDP unchanged for the third month in Oct

Canada’s GDP was essentially unchanged for a third consecutive month in October, below expectation of 0.2% mom growth. Services producing industrial edged by 0.1% mom while goods-producing industries were essentially unchanged. The 20 industrial sectors evenly split...

Butler Hall Capital LLC has issued an open letter to FC’s board of directors regarding opportunities to maximize shareholder value

Believes FC Should Initiate a Strategic Review for the Education Division, Which Could be Worth $200mm to a Strategic BuyerA Sale of the Education Division in Conjunction with a Significant Step-Up in Buybacks, Could Drive 50% Accretion to FC’s FCF/share and Yield a...

Yen Steady as Japanese Inflation Dips

Japanese core inflation falls to 2.5%, as expected US to release PCE Price Index on Friday The Japanese yen is showing little movement on Friday. In the European session, USD/JPY is trading at 142.03, down 0.06%. Japanese core inflation eases to 2.5% Japan’s Core CPI,...

INE Wraps Up 2024 With New Awards, Recognized as Top Training Provider by G2

Cary, NC, Dec. 22, 2023 (GLOBE NEWSWIRE) — As 2024 draws to a close, INE, the leading provider of cybersecurity and networking technical training and certifications, is celebrating a long list of accolades from industry-leading organizations including G2, Training...

GBPJPY Rotates Lower After Rejection at 50-day SMA

GBPJPY moves without direction in the past two weeks The 50- and 200-day SMAs curb upside and downside, respectively RSI and MACD are deep in their negative zones GBPJPY had been in a prolonged uptrend since January, posting an eight-year high of 188.64 on November 24...

Brunswick Corporation recognizes winners of Employee Sustainability Leadership Awards

METTAWA, Ill. , Dec. 22, 2023 (GLOBE NEWSWIRE) — Brunswick Corporation (NYSE: BC), the world’s largest marine technology company, recently announced its annual Sustainability Leadership Awards which celebrate the Company’s commitment to sustainable, responsible...

USD Weakness Continues Ahead of Holidays

In focus today The most important data release today will be the US November Personal Consumption Expenditures (PCE). Consensus expects Core PCE inflation to have remained steady in m/m SA terms at +0.2%. Earlier CPI and retail sales data hinted that private...

Tumor Ablation Market Size to Reach USD 2.3 Billion, at a 6.9% CAGR By 2031 – Transparency Market Research Inc.

The market for tumor ablation is growing as cancer is becoming more common.Wilmington, Delaware, United States, Dec. 22, 2023 (GLOBE NEWSWIRE) — Transparency Market Research Inc. –The global tumor ablation market was projected to attain US$ 1.3 billion in 2022. It is...

USDCAD Slips to Almost 5-Month Low

USDCAD continues the sell-off in short-term 20- and 200-day SMAs post death cross USDCAD plummeted to a fresh almost five-month low earlier today, continuing the sharp selling interest that started from the 13-month high of 1.3900. Technically, the 20- and the 200-day...

North America and Europe Luxury Interior Fabric Industry Outlook for (2024 to 2034) | Future Market Insights, Inc.

Rising Prospects for Luxury Real Estate Business, Inducing Higher Sales of Luxury Interior Fabric Industry Analysis in North America and Europe, Reach at a US$ 9,524.30 Million by 2034NEWARK, Del, Dec. 22, 2023 (GLOBE NEWSWIRE) — The Industry value of luxury interior...

Soft Inflation at the Top of Santa’s Wishlist

Appetite in European stocks waned yesterday, yet the US counterparts recovered Wednesday losses and closed the session more than 1% higher as the latest growth data was revised slightly lower to 4.9%, real consumer spending was revised down from 3.6% to 3.1%,...

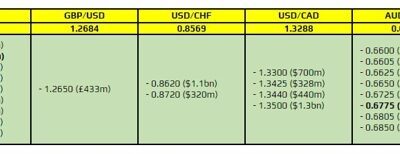

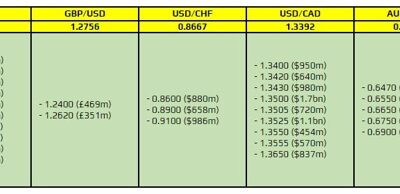

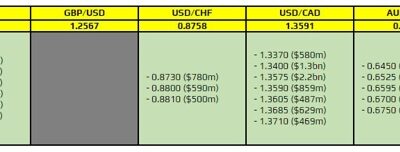

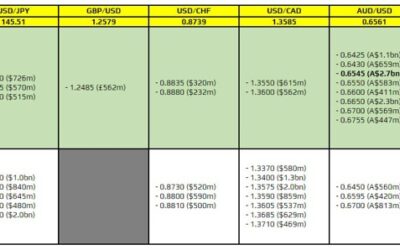

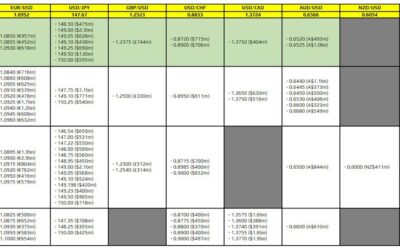

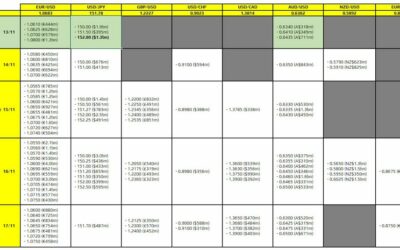

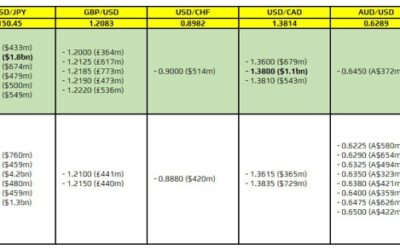

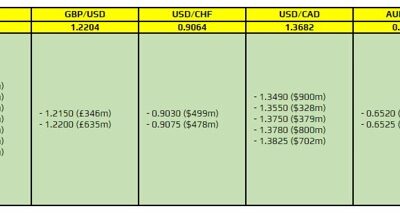

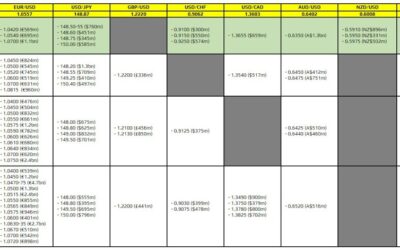

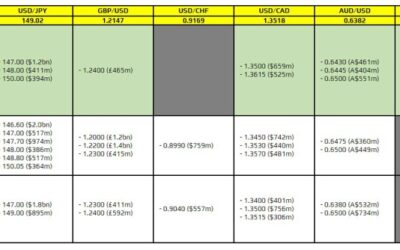

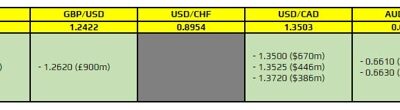

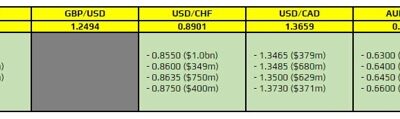

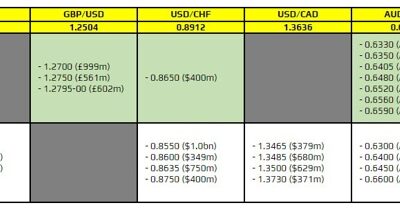

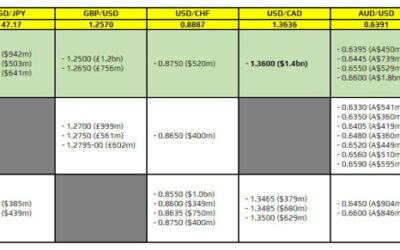

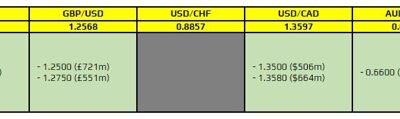

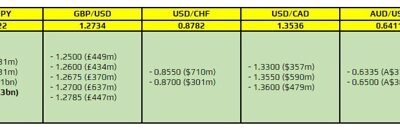

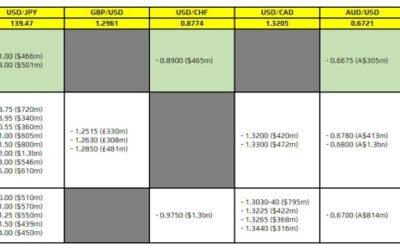

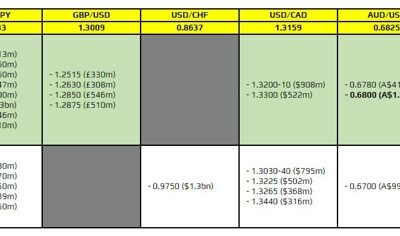

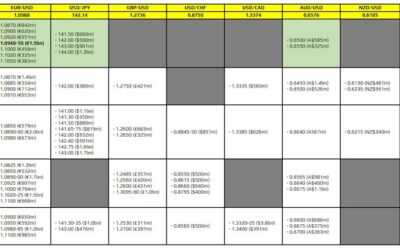

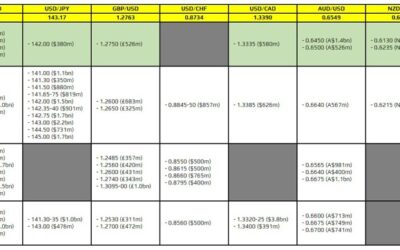

FX option expiries for 22 December 10am New York cut

There are a couple to take note of, as highlighted in bold.Considering that trading conditions today are likely to be lighter as market players take off for the holidays, the remaining expiries could act more as a magnet to hold price action before rolling off later...

Quiet Forex Markets in Asia; Focus Shifts to Upcoming US, UK, and Canadian Data

The forex markets have entered a quieter phase in Asian session, likely influenced by the holiday season, leading to reduced market activity. This calm follows an overnight sell-off of Dollar, driven by renewed risk-on sentiment as seen in the stock markets. Despite...

Mountain America Brings Holiday Magic to Utah Kindergartners

Kindergarten students from South Clearfield Elementary School receive new socks and Nike shoes for ChristmasSANDY, Utah, Dec. 21, 2023 (GLOBE NEWSWIRE) — On December 12, 2023, employees of Mountain America Credit Union, members of the Davis Education Foundation and...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8599; (P) 0.8625; (R1) 0.8654; More…. Intraday bias in USD/CHF stays on the downside for 0.8551 support. Strong support could be seen there to bring rebound. Break of 0.8650 minor resistance will indicate short term bottoming, and turn bias back...

Dental Implant Experts Take Center Stage in Informative Video

AAID releases 5-minute video, Changing the World One Smile at A TimeChicago, IL, Dec. 21, 2023 (GLOBE NEWSWIRE) — The American Academy of Implant Dentistry (AAID) is excited to spotlight its public video, which educates viewers on the history of the field of implant...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2596; (P) 1.2667; (R1) 1.2710; More… GBP/USD recovers today but stays in consolidation from 1.2793. Intraday bias remains neutral for the moment. While sideway trading could extend, further rally is still expected as long as 1.2499 support holds....

BCS 12-DAY DEADLINE ALERT: Hagens Berman, National Trial Attorneys, Encourages Barclays PLC (BCS) Investors with Substantial Losses to Contact Firm’s Attorneys Before Jan. 2nd Deadline in Securities Class Action Over Ties to Jeffrey Epstein

SAN FRANCISCO, Dec. 21, 2023 (GLOBE NEWSWIRE) — Hagens Berman urges Barclays PLC (NYSE: BCS) investors who suffered substantial losses to submit your losses now. Class Period: July 22, 2019 – Oct. 12, 2023Lead Plaintiff Deadline: Jan. 2, 2024Visit:...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0920; (P) 1.0953; (R1) 1.0975; More… EUR/USD rebounds notably today but stays below 1.1008/1016 resistance zone. Intraday bias remains neutral first. Another retreat cannot be ruled out. But further rally is expected as long as 1.0722 support...

Gainey McKenna & Egleston Announces A Class Action Lawsuit Has Been Filed Against The Lovesac Company (LOVE)

NEW YORK, Dec. 21, 2023 (GLOBE NEWSWIRE) — Gainey McKenna & Egleston announces that a securities class action lawsuit has been filed in the United States District Court for the District of Connecticut on behalf of all persons or entities who purchased or otherwise...

ETHUSD Attempts to Erase Recent Pullback

ETHUSD forms structure of lower highs and lower lows But the latest rebound advances above previous high Momentum indicators suggest strengthening positive bias ETHUSD (Ethereum) had experienced a strong rally since late October, which propelled the price to a fresh...

AdCare Hospital Designated as a Blue Distinction® Center for Substance Use Treatment and Recovery

WORCESTER, Mass., Dec. 21, 2023 (GLOBE NEWSWIRE) — AdCare Hospital, a leading provider of services for co-occurring mental health and substance use disorders, has been recognized by Blue Cross Blue Shield of Massachusetts as a Blue Distinction® Center for Substance...

Canada: Retail Trade Enters Holiday Season on a High Note.

Retail sales rose by 0.7% month-on-month (m/m) in October, coming in slightly lower than Statistics Canada’s advance estimate of the +0.8% m/m reading. September’s print was revised slightly lower to +0.6% m/m from +0.7% m/m, reported in the advance estimate....

Dollar Down after Lackluster Economic Data, Yen Extending Rebound

As US session gets underway, Dollar is declining broadly, influenced by a series of lackluster economic reports. US GDP growth for Q3 was revised downward to annualized rate of 4.9% in the final estimate. Additionally, Philadelphia Fed business outlook survey for...

Volvo Joins VERSES Genius™ Beta Program

Collaboration Centered on Assisted and Autonomous Driving SafetyVANCOUVER, British Columbia, Dec. 21, 2023 (GLOBE NEWSWIRE) — VERSES AI Inc. (CBOE: VERS) (OTCQB:VRSSF) (“VERSES” or the “Company”), a cognitive computing company specializing in next-generation...

BTC/USD: News Reports Encourage Bulls to Attack the $44k Level

Optimism associated with the SEC regulator’s approval of applications to launch BTC-ETF is the main driver of Bitcoin price growth. Coindesk reports that representatives from BlackRock, Nasdaq and the Securities and Exchange Commission (SEC) met for the second time in...

Gold Price Turns Soft After Downbeat UK Inflation Figures

Gold could jump higher as long as it stays above the lower median line. A new higher high activates further growth. The US CB Consumer Confidence should bring high action. The gold price is trading in the red at $2,036 at the time of writing. However, the outlook is...

After BoJ Decision, Yen Traders Turn to CPIs and Summary of Opinions

BoJ keeps policy ultra-loose, does not hint at change Friday’s data may reveal slowdown in inflation Wage negotiations key for exiting negative rates Next week’s Summary of Opinions also in focus Yen traders turn attention to national CPI numbers On Tuesday, the Bank...

Metaworks Platforms, Inc. Introduces ECHO: The AI-Powered Metaverse Chatbot for Investor Relations

ECHO Revolutionizes Investor Relations by Providing, for the First Time, 24/7/365 Access and User Engagement of Company Data Powered by AIFairfield, CA., Dec. 21, 2023 (GLOBE NEWSWIRE) — MetaWorks Platforms, Inc. (“MetaWorks” or the “Company”), (OTCQB: MWRK), an...

EURUSD Rangebound After Forming a Double Top

EURUSD gets rejected a tad below its recent 4-month peak A failure to claim that level could validate a double top structure Momentum indicators lose steam but remain positive EURUSD experienced a solid correction from its recent four-month high of 1.1016, but the...

Bitcoin (BTC) Price Analysis: Dying-Minute $50k Breakout or Another Pullback?

Key Insights: Bitcoin’s (BTC) price grazed the $44,000 mark in the early hours of Thursday, Dec 21, and the bulls swung back into action. But despite the positive price action, Bitcoin investors transferred 4,610 BTC (~$202 million) into exchange wallets this week. ...

Canadian Dollar Edges Higher Ahead of Retail Sales

Canada to release retail sales today, GDP on Friday US GDP expected to confirm estimate 5.2% gain The Canadian dollar is slightly higher on Thursday. In the European session, USD/CAD is trading at 1.3324, down 0.19%. Canadian retail sales, GDP expected to improve It’s...

Industrial Racking System Market Size to Reach US$ 21,591.3 million at 5.6% CAGR by 2034: Fact.MR Report

Global Industrial Racking System Market Value to total US$ 12,521 million in 2024; Mobile Racking to constitute over 50% revenueRockville , Dec. 21, 2023 (GLOBE NEWSWIRE) — The global industrial racking system market is estimated at US$ 12,521 million in 2024,...

ECB’s de Guindos: Premature for rate cut discussions, emphasizes Europe’s growth challenge

In an interview with 20 Minutos, ECB Vice President Luis de Guindos emphasized that it is “too early” to discuss rate cuts, despite recent favorable data. He stressed that the data available are still insufficient for ECB to alter its current monetary policy stance...

Yen Rebounds on Upgraded Growth Forecasts, Global Risk-On Sentiment Eases

Yen rebounds broadly in today’s Asian trading session, buoyed by optimistic revisions in Japan’s economic growth forecasts. The government, in its semi-annual economic report, upgraded its growth projections for both the current and next fiscal years. Forecast for...

Automated Blinds and Shades Market Set to Hit US$ 24,102.5 Million at 4.6% CAGR by 2034: Fact.MR Report

Effective Integration of Technologies into Popular Smart Home Ecosystems to Drive Automated Blinds and Shades MarketRockville , Dec. 21, 2023 (GLOBE NEWSWIRE) — As per Fact.MR, a provider of market research and competitive intelligence, the global Automated Blinds and...

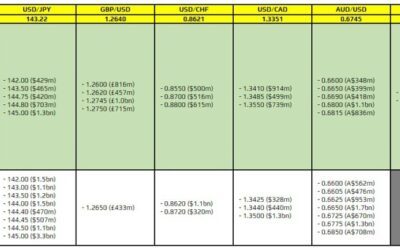

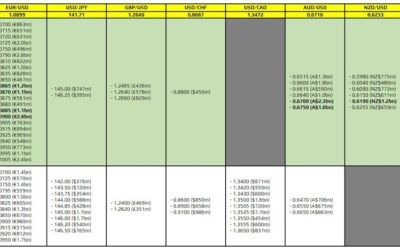

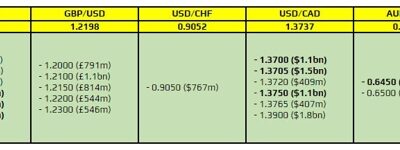

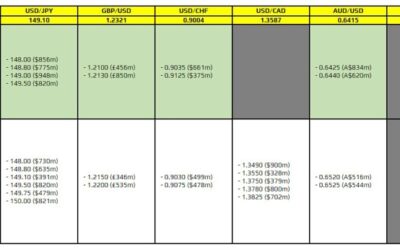

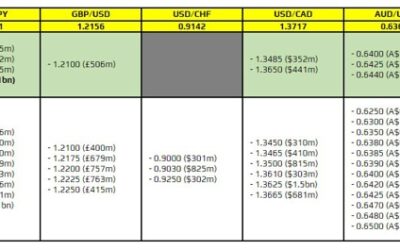

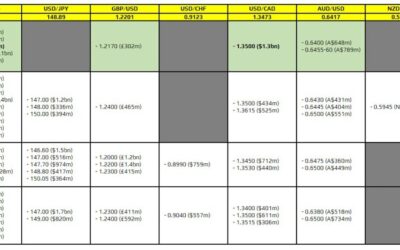

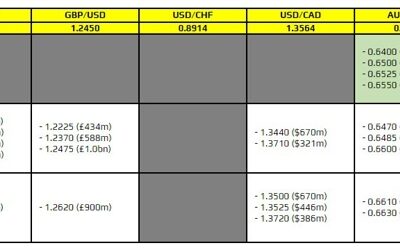

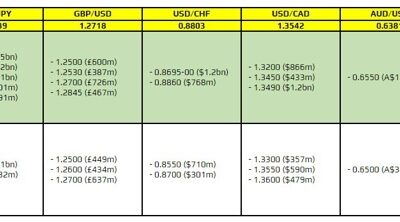

FX option expiries for 21 December 10am New York cut

There are just a couple to take note of on the day, as highlighted in bold.They are expiries for EUR/USD at 1.0900, 1.0955, and 1.1000. Put together, that should keep price action more contained and even more so considering the quiet nature of trading sentiment in...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8573; (P) 0.8630; (R1) 0.8667; More…. Intraday bias in USD/CHF stays on the downside and outlook is unchanged. Current fall from 0.9243 is in progress for retesting 0.8551 key support next. On the upside, above 0.8710 minor resistance will turn...

Indie Rock Heroes Mt. Joy, The Head And The Heart To Headline Jackson Hole Rendezvous Music Festival

Additional Acts for Annual Celebration to be Announced at a Later DateRendezvous Music Fest ackson Hole Mountain Resort (JHMR) is pleased to announce that platinum-selling indie rock heroes Mt. Joy and The Head And The Heart will headline the 2024 Rendezvous Music...

Steady Recovery Signals Strength Amid Market Cautiousness

Market picture Crypto market capitalisation has changed little over the past 24 hours, standing at $1.61 trillion with fluctuations between $1.57 trillion and $1.62 trillion. The cryptocurrency market remains cautious, which can easily be explained by the perception...

Aquafil Ranked First Among Global Companies in the “textiles” Subindustry According to Morningstar Sustainalytics Esg Risk Rating

Arco, Italy, Dec. 20, 2023 (GLOBE NEWSWIRE) — AQUAFIL RANKED FIRST AMONG GLOBAL COMPANIES IN THE “TEXTILES” SUBINDUSTRY ACCORDING TO MORNINGSTAR SUSTAINALYTICS ESG RISK RATINGArco, December 20, 2023 – Aquafil S.p.A. [ECNL:IM] [ECNLF:OTCQX] ranked as the top company...

Soft Inflation Has Pressed the Pound, But Hardly the BoE

Britain’s impressive slowdown in inflation has increased speculation around a rate cut next year. The headline consumer price index lost 0.2% in November, and the annual rate slowed from 4.6% to 3.9% – impressively below the expected 4.3%. Inflation excluding food and...

Seven tech stocks that can broaden your exposure beyond the “Magnificent Seven”

During the bull market of 2023, the “Magnificent Seven” stocks have dominated financial media coverage, and rightly so, but investors might want to gain exposure to other important “quality” tech-related names.Read Full Story Latest posts by Market Watch (see...

Will US Data Bring Pre-Christmas Joy to the Dollar?

Core PCE inflation to fall further on Friday 13:30 GMT, no big surprises expected Philly Fed manufacturing index, new home sales also on the agenda Investors see more than three rate cuts in 2024; US dollar could react moderately The transition to monetary easing The...

American Addiction Centers Announces New CEO Leadership

Dr. David Hans, American Addiction Centers Co-CEO Dr. David Hans, American Addiction Centers Co-CEOEllen-Jo Boschert, American Addiction Centers Co-CEO Ellen-Jo Boschert, American Addiction Centers Co-CEOBRENTWOOD, Tenn., Dec. 20, 2023 (GLOBE NEWSWIRE) — American...

US consumer confidence rises to 110.7 in Dec

US Conference Board Consumer Confidence rose from 101.0 to 110.7 in December, above expectation of 103.9. Present Situation Index rose from 136.5 to 148.5. Expectations Index rose from 77.4 to 85.6. “December’s increase in consumer confidence reflected more positive...

Volcon ePowersports Operational Update for December 2023

Volcon ePowersports Operational Update for December 2023 Mr. King operates a fork lift to move Volcon vehicles into the company warehouse for distribution.AUSTIN, Texas, Dec. 20, 2023 (GLOBE NEWSWIRE) — Volcon Inc. (NASDAQ: VLCN) (“Volcon” or the “Company”), the first...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 142.41; (P) 143.68; (R1) 145.12; More… Outlook in USD/JPY is unchanged and intraday bias stays neutral at this point. Upside of current recovery should be limited below 156.48 resistance to bring another decline. Firm break of 140.94 will resume the...

UK Inflation Data Triggers Sterling Slump and Shift in BoE Rate Cut Expectations

Sterling faced a broad decline today following release of UK CPI data, which indicated that inflation slowed more significantly than anticipated. This unexpected deceleration in inflation has led markets and economists to quickly adjust their expectations for BoE rate...

DCGO INVESTOR ALERT: Bronstein, Gewirtz & Grossman LLC Announces that DocGo Inc. Investors with Substantial Losses Have Opportunity to Lead Class Action Lawsuit!

NEW YORK, Dec. 20, 2023 (GLOBE NEWSWIRE) — Attorney Advertising — Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against DocGo Inc. (“DocGo” or “the Company”) (NASDAQ: DCGO) and...

GER 40 Index Near New Highs at the End of 2023

GER 40 looks strongly bullish However, RSI suggests overbought market As the 2023 is coming to an end, the GER 40 index added more than 17% after the bounce off the 14,600 support level and the 100-week simple moving average (SMA). The price reached a new high near...

U.K. bond yields dive and stocks rally after inflation surprise

The pound and U.K. government bond yields fell on Wednesday, while the London stock market jumped, as traders boosted bets that the Bank of England will make a bigger batch of interest cuts in 2024, after inflation hit its slowest pace in more than two years.Read Full...

Bundesbank’s Nagel cautions against premature ECB rate cut expectations

Bundesbank President Joachim Nagel has issued a warning to investors and analysts anticipating an early interest rate cut by ECB. In an interview, Nagel emphasized the importance of maintaining the current interest rate levels to ensure the effective management of...

Agrifiber Product Market Size to Exceed US$ 3.36 Billion by 2034 with 6.2% CAGR: Fact.MR Report

Supportive Government Initiatives Worldwide Promoting Use of Eco-friendly Construction Materials Benefiting Agrifiber Product ManufacturersRockville , Dec. 20, 2023 (GLOBE NEWSWIRE) — The global agrifiber product market is estimated to account for a value of US$ 1.78...

Nikkei 225 Technical: Potential Major Bullish Breakout After Pull-Back

Yesterday’s swift rally has led to an overstretched upside momentum condition. At the risk of a minor corrective pull-back within its short-term uptrend phase. Watch the 33,150 key short-term support. The price actions of the Japan 225 Index (proxy of the Nikkei 225...

Industrial Waste Management Market to Attain a Valuation of USD 2.3 trillion by 2031: Transparency Market Research Study

The demand for industrial waste management is expected to be driven by cost reductions and a demand for sustainable products.Wilmington, Delaware, United States, Dec. 20, 2023 (GLOBE NEWSWIRE) — Transparency Market Research Inc. – The industrial waste management...

USDJPY Holds Within Key Lines

USDJPY rebounds off 140.90 Momentum indicators suggest more gains in the near term USDJPY stormed higher after penetrating the 200-day simple moving average (SMA) but found strong resistance at the 200-day exponential moving average (EMA), recouping some of last...

Telefonica stock climbs as Spanish government to match Saudi stake

Shares in Telefonica rallied on Wednesday after the Spanish government said it would buy a stake of up to 10% in the country’s telecommunications giant, which would match the investment made by a Saudi Arabian company.Read Full Story Latest posts by Market Watch (see...

Could EURGBP Bulls Keep the Rebound Alive?

EURGBP edges higher after weaker UK CPI Path higher filled with strong resistance points Momentum indicators are mostly bullish EURGBP is trading higher today after the downside surprise registered by the UK inflation report. The 0.8635 level was easily surpassed with...

Risk-On Sentiment Prevails in US, Mixed Trends in Asia, Sterling Eyes UK CPI

Robust risk-on sentiment was seen in the US markets overnight, with DOW extending its record-breaking run. S&P 500 is also approaching its historical peak, now just 50 points shy, and appears poised to challenge this high. The bullish momentum is underpinned by...

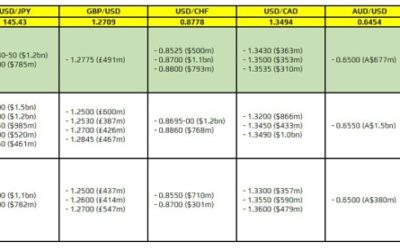

FX option expiries for 20 December 10am New York cut

There are a couple of expiries to take note of on the day, as highlighted in bold.The first being for EUR/USD at 1.1000, which should keep a lid on price action as it coincides with key resistance as of late around the figure level on the daily chart.Then, there is...

Ripple (XRP) Price Forecast: Will it Fall Below $0.60 Despite Altcoin Rally?

XRP on-chain analysis identifies a major driving factor behind the flat price action this week. Will the Ripple-backed cryptocurrency suffer another downswing while the likes of Solana, Avalanche, and Cardano score historic gains Latest posts by Crypto Editor (see all)

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2616; (P) 1.2660; (R1) 1.2691; More… GBP/USD rebounds strongly today but stays below 1.2793 resistance. Intraday bias remains neutral first. Further rally is expected as long as 1.2499 support holds. On the upside, firm break of 1.2793 will resume...

Natural Gas, WTI Oil, Brent Oil Forecasts – Oil Gains Ground Amid Tensions In Red Sea

Global firms suspend Red Sea voyages amid worries about the safety of their vessels. Latest posts by Crypto Editor (see all) Natural Gas, WTI Oil, Brent Oil Forecasts – Oil Gains Ground Amid Tensions In Red Sea - December 19, 2023 Gold, Silver, Platinum Forecasts –...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0900; (P) 1.0916; (R1) 1.0939; More… EUR/USD is staying below 1.1008/16 resistance zone despite today’s rebound. Intraday bias remains neutral for the moment. Further rally is expected as long as 1.0722 support holds. On the upside, break of...

Independent Bank Corporation Announces the Adoption of Its 2024 Share Repurchase Plan

GRAND RAPIDS, Mich., Dec. 19, 2023 (GLOBE NEWSWIRE) — Independent Bank Corporation (NASDAQ: IBCP), the holding company of Independent Bank, a Michigan-based community bank, announced that its Board of Directors authorized a 2024 share repurchase plan on December 19,...

USD/CAD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.3363; (P) 1.3386; (R1) 1.3422; More… USD/CAD’s decline is resuming by breaking 1.3348 temporary low. Intraday bias is back on the downside. Sustained trading below 1.3378 will extend the fall from 1.3897 to retest 1.3091 support next. On the...

New Data Shows More Americans Turning to Cannabis During the Holidays in 2023

1 in 4 Americans3 plan to gift cannabis this holiday season63%2 of American adults1 plan to incorporate cannabis into their 2023 Holiday plansGen Z and Millennials are leading the trend with 78% (vs. 56% of Gen X and Boomers) in planning to include cannabis in their...

Canada: Cloudy Signals on Inflation in November Have a Sliver Lining

Canadians aren’t getting much relief on inflation for Christmas this year, with CPI inflation remaining at 3.1% on a year-on-year (y/y) basis in November. For headline inflation, Statistics Canada cited that higher prices for travel tours (+26.1% y/y,) due to events...

UPDATE – Landing Partners with CLEAR to Bring New Level of Security and Convenience to Apartment Rentals

Partnership offers seamless identity verification to Landing membersBIRMINGHAM, Ala., Dec. 19, 2023 (GLOBE NEWSWIRE) — Landing, the company behind the first membership for flexible apartment living, has partnered with CLEAR, the secure identity company, to introduce a...

Will UK CPI Please the Market Ahead of Festive Break?

Market recovering from Thursday’s relatively hawkish show by the BoE Pound would benefit against the euro from an upside CPI surprise November inflation report will be released on Wednesday (07.00 GMT) A surprisingly hawkish BoE last week Contrary to market...

Canadian CPI Boosts Loonie, Yet Overshadowed by Sterling’s Strength

Canadian Dollar jumps against US Dollar in early US session. The move is primarily attributed to Canada’s CPI data, which came in stronger than anticipated, signaling persistent inflationary pressures. Despite this uptick, CAD is not leading the pack, as it faces...

Apiiro and Wiz Partner to Unite Application and Cloud Security

The technology partnership brings together the power of Apiiro’s ASPM platform and Wiz’s CNAPP to unify application and cloud securityNEW YORK, Dec. 19, 2023 (GLOBE NEWSWIRE) — Apiiro, the leading application security posture management (ASPM) platform, today...

BoE’s Breeden focuses on inflationary persistence for future policy

BoE Deputy Governor Sarah Breeden acknowledged in a speech that the UK economy is making strides towards bringing inflation back to the BoE’s 2% target, but emphasized that “our job isn’t done.” Breeden expressed a focused concern on the persistence of inflationary...

Confidential Artists Issues Statement Debunking Saint Von Colucci’s Secret Society Contract and Replacement Rumors

Saint Von Colucci Saint Von ColucciSaint Von Colucci Saint Von ColucciNew York City, Dec. 19, 2023 (GLOBE NEWSWIRE) — Confidential Artists’s managers have released a full statement in regards to the false rumors being spread online involving its artist, Saint Von...

EURJPY Retraces Higher as 200-day Holds Ground

EURJPY falls sharply but the 200-day SMA acts as a strong floor Repeated failure to violate the latter triggers an upward spike Momentum indicators improve, but remain in negative zones EURJPY had been experiencing a steep pullback from its recent 15-year peak of...

Canned Tuna Market Set to Surge at 4.9% CAGR, to Reach USD 13.8 billion by 2031 | Transparency Market Research, Inc.

Increasing awareness of fishing methods and the need for convenience food products are expected to generate a market for canned tuna.Wilmington, Delaware, United States, Dec. 19, 2023 (GLOBE NEWSWIRE) — Transparency Market Research Inc. – The canned tuna market was...

Eurozone CPI finalized at 2.4%, core at 3.6%

Eurozone CPI was finalized at 2.4% yoy in November, down from October’s 2.9% yoy. CPI core (excluding energy, food, alcohol & tobacco) was finalized at 3.6% yoy , down from prior month’s 4.2% yoy. The highest contribution came from services (+1.69 percentage...

eSports Market Poised for 18.1% CAGR Growth, Targeting US$ 9.5 Billion by 2033: Fact.MR Report

Media companies’ growing investments in eSports are set to solidify the dominance of the media rights segment in the current and future marketplace.Rockville, Dec. 19, 2023 (GLOBE NEWSWIRE) — According to a new industry analysis by Fact.MR, a market research and...

GBP/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 179.99; (P) 180.59; (R1) 181.20; More… GBP/JPY’s rebound from 178.32 accelerates higher today and focus is back on 184.43 resistance. Firm break there will argue that pull back from 188.63 has completed and bring retest of this high. Nevertheless,...

GOGOLIVE Expands to Europe and America in 2024

Slide SlideMusic Festival Music FestivalSeoul, South Korea, Dec. 19, 2023 (GLOBE NEWSWIRE) — South Korea-based event production and promotion company GOGOLIVE (GGL Events) is expanding to Europe and America in 2024.GOGOLIVE is one of the largest concert promoters in...

GBPUSD Attempts to Recoup Some Losses

GBPUSD maintains weak bias in near term Falls from 4-month high MACD and RSI suggest horizontal move GBPUSD climbed to a new four-month high in the previous week, but it reversed lower again, falling beneath the 61.8% Fibonacci retracement level of the down leg from...

Yen Dips Post-BoJ, Kiwi and Aussie Gain

Yen falls broadly today after BoJ’s to maintain monetary policy unchanged. The sell-off can be attributed to the dismay of investors who had hoped for indications of a shift towards stimulus exit next year. BoJ’s steadfastness in its easing bias, without any hint of a...

FX option expiries for 19 December 10am New York cut

There aren't any significant option expiries for today. As such, trading sentiment will rely more to flows and the overall risk mood in markets. So far, there isn't much to suggest any notable trends in price action as there is very little to work with besides the...

Advantest Collaborates with Amarisoft for 5G/IoT Device Testing

AMARI Callbox Users to Gain Access to Advantest Device Test Software for Enhanced User Interface and Network Operator Approved Test PlansTOKYO, Dec. 19, 2023 (GLOBE NEWSWIRE) — Leading semiconductor test equipment supplier Advantest Corporation (TSE: 6857) today...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8665; (P) 0.8689; (R1) 0.8726; More…. Intraday bias in USD/CHF remains neutral as consolidation from 0.8629 is in progress. Outlook remains bearish with 0.8819 resistance intact. On the downside, break of 0.8629 will resume larger fall from 0.9243...

CENTRAL WYOMING COLLEGE ANNOUNCES ROANHORSE AS STUDENT OF THE YEAR

Central Wyoming College Student of the Year RoanhorseCentral Wyoming College Student of Year Roanhorse Central Wyoming College Student of Year RoanhorseCentral Wyoming College Main Campus in Riverton, Wyo. Central Wyoming College Main Campus in Riverton, Wyo.Riverton,...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2638; (P) 1.2715; (R1) 1.2760; More… Intraday bias in GBP/USD remains neutral as consolidation from 1.2793 is extending. While deeper retreat cannot be ruled out, outlook will stay cautiously bullish as long as 1.2499 support holds. On the upside,...

Thumzup Grows Advertisers by Over 40% Since June 1, 2023

Thumzup Media Corporation Thumzup mobile appCompany Adds Over 50 New Advertisers as the Thumzup Platform Continues to Gain AdoptionLos Angeles, CA, Dec. 18, 2023 (GLOBE NEWSWIRE) — Thumzup Media Corporation (“Thumzup” or the “Company”) (OTCQB: TZUP) is pleased to...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0855; (P) 1.0929; (R1) 1.0970; More… Intraday bias in EUR/USD remains neutral at this point. Consolidation from 1.1016 could extend further and deeper retreat cannot be ruled out. But further rally is expected as long as 1.0722 support holds. On...

Associa H.R.W. Partners With Fearrington Village To Honor America’s Veterans

Associa H.R.W. Management and Fearrington Village Honor America’s Veterans Fearrington Village resident and Navy veteran Ken Samuelson served aboard the battleship USS Texas as she supported the Allied D-Day landings at Normandy, France on June 6, 1944.RALEIGH, N.C.,...

EUR/USD Finds Stability – Action Forex

On Monday, the EUR/USD pair is demonstrating stability, trading around the 1.0910 mark. Last week was notable for the currency markets, as key financial updates were released. The Federal Reserve and the European Central Bank maintained their interest rates at 5.50%...

ARC (Association of Related Churches) Announces Partnership With SEU

The ARC (Association of Related Churches) is excited to announce a new partnership with Southeastern University that will provide an online learning series for ARC church pastors.BIRMINGHAM, Ala., Dec. 18, 2023 (GLOBE NEWSWIRE) — The ARC (Association of Related...

Bitcoin and Ether Set to Deepen Correction

Market Picture The crypto market has started the new week with a correction sentiment, reducing capitalisation by 3% to $1.54 trillion in the last 24 hours. As is often the case with intense moves, Bitcoin looks more stable than the market, losing only 1.8% to $41.1K....

Yen Traders Exercise Caution Ahead of BoJ

Japanese Yen is extending its broad-based pullback today. This movement appears to be a strategic response from traders lightening their positions in anticipation of the upcoming BoJ policy decision. Although a rate hike by the BoJ seems highly unlikely at this stage,...

Newsweek’s Naveed Jamali Gets Exclusive Access Inside the U.S. Air Force’s B-2 Stealth Bomber in Special Episode of ‘Unconventional’ Celebrating the Aircraft’s 30th Year of Service

NEW YORK, Dec. 18, 2023 (GLOBE NEWSWIRE) — Newsweek, the modern global digital news organization, announced today a new episode of “Unconventional,” featuring the iconic, Northrop Grumman-built B-2 Spirit Stealth Bomber, with Newsweek Editor at Large, Naveed...

USD/JPY – Yen Climbs to 4.5 Month High, BoJ Next

BoJ to make rate announcement on Tuesday Fed’s Williams says no rate cuts planned The Japanese yen is lower at the start of the week. In the European session, USD/JPY is trading at 142.77, up 0.44%. The yen continues to power higher and surged 1.9% last week. It...

Calvetti Ferguson Acquires Local Dallas CPA Firm

Jason Ferguson Managing Partner at Calvetti FergusonDALLAS, Dec. 18, 2023 (GLOBE NEWSWIRE) — Calvetti Ferguson, a nationally recognized CPA and advisory firm, has acquired Dallas-based Gummer Group, LLC (“Gummer Group”) effective December 1, 2023.Calvetti Ferguson...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 141.57; (P) 142.02; (R1) 142.61; More… USD/JPY is still extending consolidation from 140.95 and intraday bias remains neutral. Stronger recovery cannot be ruled out. But upside should be limited well below 146.58 resistance to bring another decline....

LCS promotes David Mercugliano to lead business development strategy

Des Moines, IA, Dec. 18, 2023 (GLOBE NEWSWIRE) — LCS, the nation’s third-largest senior living provider, has announced the promotion of David Mercugliano to Vice President of Business Development. In his new role, Mercugliano will lead business development initiatives...

Fed’s Mester: The next phase is not when to reduce rates

In a Financial Times interview, Cleveland Fed President Loretta Mester put emphasis on the duration of maintaining restrictive monetary policy to ensure that inflation reliably returns to the 2% target. That’s contrary to market expectations, which centers on timing...

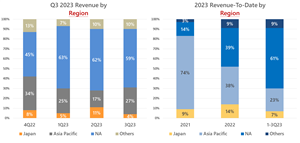

Alchip Technologies Q3 Revenue and Net Income Set Records

Gross Profit and Operating Income Also Up Year-on-YearAlchip 2023 Q3 Revenue Breakdown by Region Alchip Technologies’ North America Region accounted for 59 percent of Q3 2023 revenue and 61 percent of 2023 fiscal year revenue to date. The Asia Pacific Region accounted...

Market’s Move Back to Reality May Heal the Dollar

The Dollar made a crucial technical breakdown the previous week following a public admission from the Fed of a policy reversal. The Fed’s comments and subsequent press conference pressed the Dollar index under its 200-day moving average. The decline continued on...

Electron Microscopes Market to Surge at a CAGR of 7.2% to Hit US$ 6 Billion by 2033: Fact.MR Report

The rising demand for high-resolution electron microscopes in the semiconductor industry is a major driver shaping the market growthRockville , Dec. 18, 2023 (GLOBE NEWSWIRE) — As per Fact.MR, a provider of market research and competitive intelligence, the global...

USD/CAD Analysis: Rate Reaches Its Minimum in 4 Months

On Friday, the rate dropped below 1.366 for the first time since the beginning of August. This was facilitated by fundamental drivers: → The US dollar weakens after the Federal Reserve meeting, which signaled the possibility of lowering interest rates next year....

IdentiFlight Enters French Energy Market as e3 IDF GmbH Announces New Office in Nantes

Yoann Payelleville Yoann Payelleville, General Manager of e3 IdentiFlight FranceImages and video compiled in b-roll style video of the IdentiFlight unit in actionNANTES, France, Dec. 18, 2023 (GLOBE NEWSWIRE) — e3 IDF GmbH and IdentiFlight announce the launch of e3...

Long Japanese Yen – Action Forex

The Federal Reserve’s (Fed) rate cut talk becomes chaotic and frankly, hard to follow. After the Fed signaled a possible end to its monetary policy tightening campaign and the European policymakers refused to adhere, some Fed members including John Williams and...

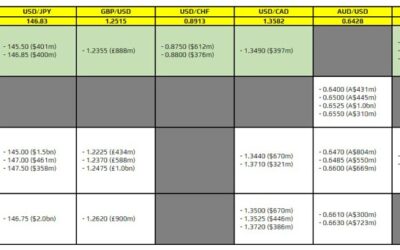

FX option expiries for 18 December 10am New York cut

There are a couple to take note of on the day, as highlighted in bold.The first being for EUR/USD at 1.0910, which could just keep price action more sticky before the expiries roll off. From a technical perspective, the level doesn't hold any significance as key...

New Zealand Dollar Rises on Robust Domestic Data; Market Awaits BoJ’s Pivotal Decision

New Zealand Dollar strengthens broadly in an otherwise quiet Asian session today, leading Aussie along with it. This notable rise can partly be attributed to two key domestic factors: a significant improvement in consumer sentiment and robust data from the country’s...

ROSEN, A LEADING LAW FIRM, Encourages Microvast Holdings, Inc. Investors with Losses to Secure Counsel Before Important Deadline in Securities Class Action – MVST, MVSTW

NEW YORK, Dec. 17, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, reminds of purchasers of securities of Microvast Holdings, Inc. (NASDAQ: MVST, MVSTW) between October 19, 2022 and November 20, 2023, both dates inclusive (the “Class...

ROSEN, A LEADING INVESTOR RIGHTS LAW FIRM, Encourages Veradigm Inc. f/k/a Allscripts Healthcare Solutions, Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – MDRX

NEW YORK, Dec. 17, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of common stock of Veradigm Inc. f/k/a Allscripts Healthcare Solutions, Inc. (NASDAQ: MDRX) between February 26, 2021 and June 13, 2023, both dates...

Global Hyperscale Cloud Market to garner a value over US$ 3,411.30 billion by 2034 | Future Market Insights, Inc. Projection

Hyperscale cloud refers to cloud computing infrastructure designed to deliver vast computing resources and storage capabilities for large-scale applications. Hyperscale cloud applications can scale IT infrastructure on demand using off-site data centers, which are...

ROSEN, TRUSTED INVESTOR COUNSEL, Encourages General Motors Company Investors with Losses to Secure Counsel Before Important Deadline in Securities Class Action – GM

NEW YORK, Dec. 17, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, announces the filing of a class action lawsuit on behalf of purchasers of securities of General Motors Company (NYSE: GM) between February 2, 2022 and October 26, 2023,...

Gold Outlook for 2024 – ForexTV

As we look toward 2024, the gold markets could be one of the more interesting places to be. We have seen a very bullish 2023, and at this point in time, it’s very possible that we could see 2024 show even more fireworks. Latest posts by Crypto Editor (see all)

Farfetch (FTCH) Tumbles Amid Liquidity Problems and Pending Securities Class Action – Hagens Berman

HAGENS BERMAN Encourages Farfetch Limited (FTCH) Investors with Substantial Losses to Contact Firm’s Attorneys Before Dec. 19th DeadlineSAN FRANCISCO, Dec. 17, 2023 (GLOBE NEWSWIRE) — Hagens Berman urges Farfetch Limited (NYSE: FTCH) investors who suffered substantial...

Kaplan Fox & Kilsheimer LLP Reminds Acelyrin Investors of a Class Action Lawsuit and Upcoming Deadline

NEW YORK, Dec. 17, 2023 (GLOBE NEWSWIRE) — Kaplan Fox & Kilsheimer LLP reminds investors that a complaint has been filed on behalf of investors that purchased or otherwise acquired Acelyrin, Inc. (“Acelyrin” or the “Company”) (NASDAQ: SLRN) securities between May...

2024 International Economic Outlook: Weathering the Storm

Summary Key Themes As we head into 2024, we are downbeat on the prospects for global GDP growth. In our view, the global economy is likely to experience a period of below-trend growth in 2024, with the global economy expanding just 2.4%. Growth prospects are to be...

Kaplan Fox & Kilsheimer LLP Reminds Eagle Pharmaceuticals Investors of a Class Action and Upcoming Deadline

NEW YORK, Dec. 17, 2023 (GLOBE NEWSWIRE) — Kaplan Fox & Kilsheimer LLP reminds investors that a complaint has been filed on behalf of investors that purchased or otherwise acquired Eagle Pharmaceuticals, Inc. (“Eagle” or the “Company”) (NASDAQ: EGRX) securities...

EUR/CHF Weekly Outlook – Action Forex

While EUR/CHF’s recovery from 0.9402 extended last week, it failed to break through 0.9543 resistance and reversed from there. Initial bias remains neutral this week first, and further decline is expected. On the downside, firm break of 0.9407 will confirm larger down...

EUR/GBP Weekly Outlook – Action Forex

EUR/GBP recovered after edging lower to 0.8548 last week, but upside is capped below 0.8648 support turned resistance so far. Initial bias remains neutral this week first. Some more consolidations could be seen but downside breakout is expected. Break of 0.8548 will...

EUR/JPY Weekly Outlook – Action Forex

EUR/JPY extended the consolidation from 153.15 last week and outlook is unchanged. Initial bias remains neutral this week first and further decline is expected. On the downside, break of 153.15 will resume whole fall from 164.39 to 61.8% retracement of 139.05 to...

GBP/JPY Weekly Outlook – Action Forex

Much volatility was seen in GBP/JPY, as it reversed after failing to break through 184.44 support turned resistance, and then dived to 178.32, then recovered again. Initial bias stays neutral this week first. Deeper decline is expected as long as 184.30 resistance...

USD/CAD Weekly Outlook – Action Forex

USD/CAD’s fall from 1.3897 resumed and accelerated lower last week, closing below 1.3378 support. The development argues that whole rise from 1.3091 has completed at 1.3897 already. Initial bias stays on the downside this week. Sustained trading below 1.3378 will...

AUD/USD Weekly Report – Action Forex

AUD/USD’s rise from 0.6269 resumed last week and the break of medium term falling channel suggests that whole fall from 0.7156 has completed with three waves down to 0.6269. Initial bias stays on the upside this week. Further rise should be seen to 0.6894 resistance...

AHCO DEADLINE ALERT: ROSEN, NATIONAL TRIAL COUNSEL, Encourages AdaptHealth Corp. Investors With Losses in Excess of $100K to Secure Counsel Before Important Deadline in Securities Class Action – AHCO

NEW YORK, Dec. 16, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of common stock of AdaptHealth Corp. (NASDAQ: AHCO) between (1) August 4, 2020 and February 27, 2023, both dates inclusive (the “Class Period”) and/or...

Forex and Cryptocurrencies Forecast – Action Forex

EUR/USD: Dovish Fed Reversal The fate of EUR/USD was determined by two events last week: the FOMC (Federal Open Market Committee) meeting of the US Federal Reserve and the meeting of the Governing Council of the European Central Bank (ECB), which took place a day...

Acelyrin, Inc. (SLRN) Shareholder Reminder: Kessler Topaz Meltzer & Check, LLP Reminds SLRN Investors of Securities Fraud Class Action Lawsuit Filed on Their Behalf

RADNOR, Pa., Dec. 16, 2023 (GLOBE NEWSWIRE) — The law firm of Kessler Topaz Meltzer & Check, LLP (www.ktmc.com) informs investors that a securities class action lawsuit has been filed in the United States District Court for the Central District of California...

USD/CHF Weekly Outlook – Action Forex

USD/CHF’s fall from 0.9111 continued last week and edged lower to 0.8629 last week. Nevertheless, with subsequent recovery, initial bias is neutral this week for consolidations first. Break of 0.8629 will resume the decline to retest 0.8551 key support level. However,...

ROSEN, LEADING INVESTOR COUNSEL, Encourages ON Semiconductor Corporation Investors to Secure Counsel Before Important Deadline in Securities Class Action – ON

NEW YORK, Dec. 16, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, announces the filing of a class action lawsuit on behalf of purchasers of common stock of ON Semiconductor Corporation (“onsemi”) (NASDAQ: ON) between May 1, 2023 and...

GBP/USD Weekly Outlook – Action Forex

GBP/USD’s rise from 1.2036 resumed last week and edged higher to 1.2793. But with subsequent retreat, initial bias stays neutral this week for consolidations first. Outlook will stay bullish as long as 1.2499 support holds. On the upside, break of 1.2793 will resume...

SHAREHOLDER INVESTIGATION: Halper Sadeh LLC Investigates SUM, BVH, ORRF

NEW YORK, Dec. 16, 2023 (GLOBE NEWSWIRE) — Halper Sadeh LLC, an investor rights law firm, is investigating the following companies for potential violations of the federal securities laws and/or breaches of fiduciary duties to shareholders relating to:Summit Materials,...

USD/JPY Weekly Outlook – Action Forex

Despite much volatility last week, USD/JPY’s fall from 151.89 is still in progress. But as a temporary low was formed at 140.94, initial bias is neutral this week first for consolidations. Upside should be limited well below 146.58 resistance to bring another decline....

Risk-On Wave Sweeps Markets, Stocks Hit Records, Dollar Declines

The financial markets concluded last week on a robust risk-on sentiment, driven primarily by the flurry of central bank activities. The stock markets, in particular, resonated with a bullish tone, cementing their position after Fed’s dovish shift. This sentiment...

ROSEN, NATIONAL TRIAL LAWYERS, Encourages FMC Corporation Investors to Secure Counsel Before Important Deadline in Securities Class Action – FMC

NEW YORK, Dec. 16, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of common stock of FMC Corporation (NYSE: FMC) between November 2, 2022 and October 20, 2023, both dates inclusive (the “Class Period”), of the...

EUR/USD Weekly Outlook – Action Forex

EUR/USD rose to 1.1008 last week but failed to break through 1.1016 resistance and retreated. Initial bias remains neutral this week first. Further rally is expected as long as 1.0722 support holds. Break of 1.1016 will resume the whole rise from 1.0447 to retest...

ROSEN, SKILLED INVESTOR COUNSEL, Encourages SolarEdge Technologies, Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – SEDG

NEW YORK, Dec. 16, 2023 (GLOBE NEWSWIRE) —WHY: Rosen Law Firm, a global investor rights law firm, announces the filing of a class action lawsuit on behalf of purchasers of securities of SolarEdge Technologies, Inc. (NASDAQ: SEDG) between February 22, 2022 and October...

EUR/AUD Weekly Outlook – Action Forex

EUR/AUD’s decline resumed last week but recovered after dipping to 1.6206. Initial bias remains neutral this week first. Outlook stays bearish as long as 1.6478 resistance holds. Firm break of 1.6206 will resume whole fall from 1.7062. Next target is 100% projection...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2653; (P) 1.2724; (R1) 1.2835; More… Intraday bias in GBP/USD is turned neutral with current retreat. Some consolidations would be seen but outlook will stay bullish as long as 1.2499 support holds. On the upside, break of 1.2793 will resume the...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8627; (P) 0.8680; (R1) 0.8728; More…. Intraday bias in USD/CHF remains mildly on the downside for the moment. Current decline from 0.9243 should extend to target 0.8551 key support level. For now, near term outlook will stay bearish as long as...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 140.92; (P) 141.92; (R1) 142.87; More… Intraday bias in USD/JPY remains mildly on the downside for the moment. Current decline from 151.89 should target next fibonacci level at 136.63. On the upside, above 142.91 minor resistance will turn intraday...

Canadian CPI to Edge Back Below 3% in November

We expect Canadian inflation pressures to have moderated more in November. Headline inflation is expected to have dropped to 2.9% from 3.1% in October reflecting a pullback in retail gasoline prices and further easing in food price growth. That would mark the second...

The Weekly Bottom Line: Cuts! The Herald Angels Sing

U.S. Highlights The Federal Reserve held the policy rate steady at 5.25-5.5% at its final interest rate announcement of the year. However, a markdown in the FOMC’s interest rate projections and little pushback from Chair Powell in the press conference on the recent...

Weekly Economic & Financial Commentary: A Win for the Doves

Summary United States: Consumers Maintain Spending Power Amid Slowing Price Growth Data released this week revealed that gradually easing price pressures are promoting consumer resilience, while high financing costs continue to bite producers. Although core CPI...

FMC Corporation STOCK ALERT: Robbins LLP Reminds Investors of the Upcoming Lead Plaintiff Deadline in the Class Action Against FMC Corporation

SAN DIEGO, Dec. 16, 2023 (GLOBE NEWSWIRE) — Robbins LLP reminds investors that a shareholder filed a class action lawsuit on behalf of persons and entities that purchased or otherwise acquired FMC Corporation (NYSE: FMC) common stock between November 2, 2022 and...

2024 International Economic Outlook: Weathering the Storm

Summary Key Themes As we head into 2024, we are downbeat on the prospects for global GDP growth. In our view, the global economy is likely to experience a period of below-trend growth in 2024, with the global economy expanding just 2.4%. Growth prospects are to be...

CLVR Shareholder News: Robbins LLP Reminds Investors it is Looking into the Officers and Directors of Clever Leaves Holdings Inc.

SAN DIEGO, Dec. 16, 2023 (GLOBE NEWSWIRE) — Shareholder rights law firm Robbins LLP is investigating Clever Leaves Holdings Inc. (NASDAQ: CLVR) to determine whether certain Clever Leaves officers and directors violated securities laws and breached fiduciary duties to...

Commodities Year Ahead 2024: Fed Policy to Drive Gold, Oil to Dance to Rhythm of OPEC+

Gold enters uncharted territory twice in 2023 Fed policy to remain gold’s main driver in 2024 Industrial metals to stay locked on China Easing demand, OPEC+ supply, and geopolitics will shape crude oil Fed rate cut expectations fuel gold After a dull 2022, gold staged...

Paycom Software, Inc. Stock News: Robbins LLP Reminds Investors of Fast Approaching Lead Plaintiff Deadline in Class Action Against PAYC

SAN DIEGO, Dec. 16, 2023 (GLOBE NEWSWIRE) — Robbins LLP reminds investors that a shareholder filed a class action lawsuit on behalf of persons and entities that purchased or otherwise acquired Paycom Software, Inc. (NYSE: PAYC) securities between May 3, 2023 and...

Summary 12/18 – 12/22

Monday, Dec 18, 2023 Tuesday, Dec 19, 2023 Wednesday, Dec 20, 2023 Thursday, Dec 21, 2023 Friday, Dec 22, 2023 The post Summary 12/18 – 12/22 appeared first on Action Forex.

Illumina, Inc. Lead Plaintiff Deadline Alert: Robbins LLP Reminds Investors of the Lead Plaintiff Deadline in the ILMN Class Action

SAN DIEGO, Dec. 16, 2023 (GLOBE NEWSWIRE) — Robbins LLP reminds investors that a shareholder filed a class action lawsuit on behalf of persons and entities that purchased or otherwise acquired Illumina, Inc. (NASDAQ: ILMN) securities between May 1, 2023 and October...

Sunset Market Commentary

Markets Today’s PMIs marked the end of a busy week. They would either confirm or challenge yesterday’s ECB en BoE case for signaling steady rates for the foreseeable future. It turned out to be the latter for Frankfurt, triggering Bund outperformance vs US Treasuries....

Resurgent ‘animal spirits’ in financial markets may undermine Fed’s inflation battle, Nomura says

A contrarian viewpoint is emerging that challenges investors’ recent optimism over the Federal Reserve’s ability to bring inflation down to 2% without a U.S. recession or a big rise in unemployment.Read Full Story Latest posts by Market Watch (see all)

US PMI composite rises to 51.0, picks up a little momentum

US PMI Manufacturing fell from 49.4 to 48.2 in December. PMI Services rose from 50.8 to 51.3. PMI Composite rose from 50.7 to 51.0, a 5-month high. Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said: “The early PMI data indicate that...

Col. Jennifer Pritzker Named Best in Biz Awards’ 2023 Philanthropist of the Year

The 13th Annual Best in Biz Awards recognizes notable companies and professionals from all spectrums.2023 Best in Biz Awards’ Philanthropist of the Year Col. Jennifer Pritzker was named a Bronze winner in the 13th Annual Best in Biz Awards’ Philanthropist of the Year...

Weekly Focus – Central Bankers Boost Christmas Spirit

Repricing continued in the rates markets this week as central bankers did little to talk rates back up. The market is currently pricing in the US short-term rates to fall below 4% by end of next year. In euro area, short-term rates are priced to approach the 2% mark...

DEADLINE ALERT for EH and EGRX: The Law Offices of Frank R. Cruz Reminds Investors of Class Actions on Behalf of Shareholders

LOS ANGELES, Dec. 15, 2023 (GLOBE NEWSWIRE) — The Law Offices of Frank R. Cruz reminds investors that class action lawsuits have been filed on behalf of shareholders of the following publicly-traded companies. Investors have until the deadlines listed below to file a...

Week Ahead – BoJ Meets for the Last Time in 2023, US Core PCE and UK CPIs Also On Tap

Yen traders await BoJ decision for pivot clues US core PCE index the highlight of the US agenda UK CPI numbers to be the pound’s next test Loonie and aussie await Canada’s CPIs and RBA minutes Will BoJ policymakers hint at the end of negative rates? Following a...

ROCKLEY SHAREHOLDER ACTION REMINDER: Faruqi & Faruqi Securities Litigation Partner James (Josh) Wilson Encourages Investors Who Suffered Losses Exceeding $25,000 In Rockley To Contact Him Directly To Discuss Their Options

Photo 1 James (Josh) Wilson Faruqi & Faruqi, LLPIf you suffered losses exceeding $25,000 investing in SC Health Corporation (“SC Health”) (NYSE: SCPE; NYSE: SCPE.WS; NYSE: SCPE.U) and Rockley Photonics Holdings Limited (“Rockley”) (NYSE: RKLY; NYSE: RKLY.WS)...

Bank of Japan Meeting: Another Baby Step to Exiting Negative Rates?

Despite heightened rate hike speculation, BoJ to likely stand pat in December No change is anticipated either in yield curve control But yen traders will be seeking fresh clues in Tuesday’s announcement BoJ still to join the rate hike club The Bank of Japan is the...

Dollar Rebounds on New York Fed President’s Remarks, Euro and Sterling Soften after PMIs

Dollar is having a notable rebound in early US trading session, buoyed by comments from New York Fed President John Williams. Speaking on CNBC’s “Squawk Box,” Williams stated, “we aren’t really talking about rate cuts right now,” adding that it is “premature” to...

XPO Named One of “America’s Greatest Workplaces for Diversity for 2024” by Newsweek

GREENWICH, Conn. , Dec. 15, 2023 (GLOBE NEWSWIRE) — XPO (NYSE: XPO), a leading provider of freight transportation in North America, has been named one of “America’s Greatest Workplaces for Diversity for 2024” by Newsweek magazine. XPO received this honor for...

AUDUSD: Solid Chinese Data Further Boost Post-Fed Rally

AUD/USD keeps firm bullish tone for the third consecutive, with better than expected China retail sales and industrial production data adding to positive near-term outlook, established after dovish Fed on Wednesday. The pair is trading near new 4 ½ month high in early...

Shimmick Corporation Appoints Joe Del Guercio to Board of Directors

IRVINE, Calif., Dec. 15, 2023 (GLOBE NEWSWIRE) — Shimmick Corporation (“Shimmick”) (Nasdaq: SHIM), a leading water infrastructure company, today announced the appointment of Joe Del Guercio to the Company’s Board of Directors (the “Board”), effective on December 14,...

British Pound Steady after Mmixed PMIs

UK Services PMI accelerates, Manufacturing PMI declines Bailey’s dampens rate cut expectations The British pound is steady on Friday, after posting gains of 1.1% a day earlier. In the European session, GBP/USD is trading at 1.2767, up 0.03%. UK PMIs a mix British PMIs...

TFF Pharmaceuticals Announces Reverse Stock Split

Common Stock Will Begin Trading on a Split-Adjusted Basis on December 19, 2023FORT WORTH, Texas, Dec. 15, 2023 (GLOBE NEWSWIRE) — TFF Pharmaceuticals, Inc. (NASDAQ: TFFP), a clinical-stage biopharmaceutical company focused on developing and commercializing innovative...

AUDUSD Looks for Bullish Expansion

AUDUSD marks new higher high, breaks key resistance area Short-term bias positive, but 0.6715 zone adds some pressure AUDUSD experienced a spectacular rally after a dovish FOMC policy meeting earlier this week, crawling as high as 0.6727 on Thursday – the highest...

Fuse Group Holding Inc. Announces Signing of Consulting Agreement

Arcadia California, Dec. 15, 2023 (GLOBE NEWSWIRE) —Fuse Group Holding Inc. Announces Signing of Consulting Agreement Arcadia, CA. December 15, 2023 – Fuse Group Holding Inc., (OTCQB: FUST) (hereinafter referred to as “Fuse Group” or the “Company”), a company in...

USDCAD Plummets Below Crucial Trendline

USDCAD posts a fresh 2½-month low in today’s session Decline shows no signs of easing after break below 200-day SMA Momentum indicators are pointing at an overstretched retreat USDCAD has been constantly losing ground following its 13-month high of 1.3898 on November...

Electric Vehicle (EV) Battery Market Size Worth US$ 347 Billion By 2033: Fact.MR Report

Technological advancements in battery technology, particularly in terms of energy density, charging speed, and overall performance, are expected to boost the market growth during the forecast periodRockville , Dec. 15, 2023 (GLOBE NEWSWIRE) — As per Fact.MR, a...

UK services sector boosts PMI composite, averting recession, BoE cut premature

UK PMI Manufacturing fell from 47.2 to 46.4, below the expected 47.5. Conversely, PMI Services rose from 50.9 to 52.7, exceeding expectations of 51.0 and reaching a six-month high. This surge in services also lifted PMI Composite from 50.7 to 51.7, marking another...

Natural Cosmetic Ingredients Market Set for Exponential Growth, Projected to Reach US$1,238.9 Million by 2030 at a 7.1% CAGR, Recent Report by Persistence Market Research

The global natural cosmetic ingredients market fuels a rising consumer demand for pure beauty products. As awareness grows about potential risks linked to synthetic chemicals in traditional cosmetics, a transformative shift in consumer preferences drives market...

USD/CAD Daily Outlook – Action Forex

Daily Pivots: (S1) 1.3473; (P) 1.3540; (R1) 1.3586; More… Intraday bias in USD/CAD remains on the downside at this point, with focus on 1.3378 support. Decisive break there will argue that whole rise from 1.3091 has completed at 1.3897. Deeper fall should then be seen...

FX option expiries for 15 December 10am New York cut

There is just one to take note of, as highlighted in bold.That being for EUR/USD at 1.0950, in which I detailed its potential impact in this post here. Besides that, there isn't any significant ones that should impact price action across the board before we wrap up...

Euro Strong Ahead of PMI Release, Dollar Weak as 10-Yr Yield Broke 4%

Euro is emerging as the strongest currency for the week, bolstered by ECB’s resistance to the expectations of a rate cut. The common currency will now look into today’s Eurozone data. Positive surprises from there could solidify ECB’s stance, and give Euro more fuel...

Red Cat Holdings Selected by U.S. Army as Finalist for Short Range Reconnaissance Tranche 2 Drone Program

Defense Innovation Unit and U.S. Army to provide $3 million in additional funding to support final program milestonesSAN JUAN, Puerto Rico, Dec. 14, 2023 (GLOBE NEWSWIRE) — Red Cat Holdings, Inc. (Nasdaq: RCAT) (“Red Cat” or the “Company”), a drone technology company...

Bank of England Hawks Extend the Pound’s Rally

The Fed’s dovish attitude, for now, hasn’t extended too far into Europe. The Bank of England kept its key rate unchanged at 5.25%, with three of the nine members voting in favour of a quarter-point hike. In a commentary on the decision, the Bank of England emphasised...

“I Need to See It With My Own Eyes”: How US Ophthalmologists React to Apellis’ Syfovre Safety Warnings When Managing Geographic Atrophy

Ophthalmologists’ reservations about using Syfovre in Geographic Atrophy are more limited to “new start” patients, according to Spherix Global Insights.Exton, PA, Dec. 14, 2023 (GLOBE NEWSWIRE) — Geographic Atrophy (GA), the most severe stage of dry age-related...

Bank of England Review – Push-Back on Rate Cut Expectations

At today’s monetary policy meeting the BoE left the key policy rate unchanged at 5.25% as widely expected. The BoE delivered hawkish communication in an attempt to push-back on markets expectation of rate cuts next year. EUR/GBP declined on the back of the statement...

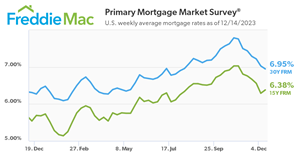

Mortgage Rates Drop Below Seven Percent

Primary Mortgage Market Survey® U.S. weekly average mortgage rates as of 12/14/2023.MCLEAN, Va., Dec. 14, 2023 (GLOBE NEWSWIRE) — Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate...

ECB Review: A Conditional Push-Back

Today’s ECB policy meeting saw no changes to the policy rates, as unanimously expected across analysts and market pricing, hence the deposit rate was maintained at 4%. The ECB already surprised with an announcement today of its schedule for PEPP reinvestments for next...

Oxford Park Income Fund, Inc. Provides November Net Asset Value Update

GREENWICH, Conn., Dec. 14, 2023 (GLOBE NEWSWIRE) — Oxford Park Income Fund, Inc. (“Oxford Park”, “the Fund”, “our”) announced today the Net Asset Value (“NAV”) as of November 30, 2023 was $26.80 per share of common stock.The fair value of the Fund’s portfolio...

Sunset Market Commentary – Action Forex