Forex

GBP/USD Eyes Bailey, Jobs Report

The British pound is showing limited movement at the start of the week. In Monday’s North American session, GBP/USD is trading at 1.2610, down 0.15%. Bank of England Governor Andrew Bailey will speak at a public event later today and the markets will be listening...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8733; (P) 0.8747; (R1) 0.8763; More…. USD/CHF’s rally continues today and intraday bias stays on the upside. Current rise from 0.8332 should target 61.8% retracement of 0.9243 to 0.8332 at 0.8995. On the downside, below 0.8725 minor support will...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2604; (P) 1.2624; (R1) 1.2648; More… GBP/USD edged higher to 1.2653 today but failed to sustain above 55 4H EMA again. Intraday bias remains neutral for the moment. On the upside, firm break of 1.2653 resistance will affirm the case that...

Brent Crude Prices Edge Higher Amid Middle East Tensions

Brent crude oil prices are currently hovering around $82.00 per barrel this Monday, with market sentiment influenced by recent developments in the Middle East. Although concerns over disruptions to energy supplies from the region have somewhat subsided, the...

Sunset Market Commentary – Action Forex

Markets Core bonds marginally gained at the beginning of the new week. In super quiet trading (already starting in Asia as Japan and China kept their doors shut), US yields pared initial drops between 1.5 and 2.6 bps. German rates ease a little more, changes ranging...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0766; (P) 1.0781; (R1) 1.0799; More… Intraday bias in EUR/USD remains neutral and outlook is unchanged. While stronger recovery cannot be ruled out, outlook will stay bearish as long as 1.0896 resistance holds. On the downside, sustained break of...

Yen Regaining Ground, GBP/AUD Staying Bullish Despite Loss of Momentum

Japanese Yen stages a broad recovery today, buoyed by notable retreat in European benchmark yields. Meanwhile, Dollar is softening against Yen, yet holding its ground across other major currencies. New Zealand Dollar emerges as the day’s underperformer, yet its losses...

NZD/USD Dips Despite Hawkish RBNZ

RBA’s Orr says high rates still needed New Zealand releases inflation Expectations on Tuesday The New Zealand dollar is lower on Monday. In the European session, NZD/USD is trading at 0.6127, down 0.35%. The New Zealand dollar ended the week on a high note, gaining...

Copper stabilizes after selloff on supply concern, no clear bounce yet

Copper trades steadily in range today, showing no immediate signs of a rebound. Near term selloff intensified following last week’s announcement by KoBold Metals, a venture with backing from notable figures including Bill Gates, about the discovery of a substantial...

EUR/USD: Recovery Likely to Stall Under the Base of Thick Daily Cloud

Recovery leg from 1.0723 double bottom (Feb 5/6) started to face increased headwinds on approach to daily Tenkan-sen (1.0810), with the base of thick daily cloud (spanned between 1.0828 and 1.0969) laying just above and adding pressure. Initial signals of recovery...

GBP/USD: Limited Recovery Warns of Prolonged Sideways Mode

Cable ticked higher and hit new highest since Feb 2 in early Monday but was so far unable to sustain gains, keeping the price within congestion which extends into fourth straight day. A double Doji (Fri/Thu) signal indecision as daily studies are mixed and keep...

WTI Oil: Oil Price Dips on Easing Concerns About Middle East Supply

WTI oil edged lower in early Monday, following calmer tones regarding possible end of Israeli strikes on southern Gaza, which eased fears about supply disruptions from the Middle East. Fresh easing started to develop a reversal pattern on daily chart after the recent...

Gold Slides Below 50-day SMA, Hitting Ascending Trendline

Gold trades sideways in the past week Closes profoundly below the 50-day SMA on Friday Momentum indicators turn negative Gold has been rangebound in the past few trading sessions, following its rejection at the 2,065 mark on February 1. However, on Friday, the price...

Nikkei 225 Index Price Sets 34-year High

The price of the Nikkei 225 index is fixed above the level of 37,000 points. The last time this happened was after the index reached its all-time high in 1989. The bullish behavior of the Japanese stock market has the following reasons: → Strong corporate reporting....

Bitcoin Pushes Cryptos Upwards – Action Forex

Market picture The crypto market reached a capitalisation of $1.82 trillion in the early hours of trading on Monday. By the early European session, it had corrected to $1.8 trillion, but this is still more than 10% above the levels of a week earlier. Bitcoin remains...

Are EURCHF Bulls Ready for a Breakout?

EURCHF trades higher, tests key resistance trendline Strong upmove in place since late January Momentum indicators support the current upleg EURCHF is trying to record its eighth consecutive green candle since the January 31 trough. It is now testing the resistance...

Central Bankers Advocated Cautious Wait-and-See Bias

Markets Except for the (strong) US services ISM on Monday last week’s eco calendar was light. Friday’s US CPI revision in this respect didn’t change the picture. US auctions (3-y, 10-Y, 30-y) all met solid investor demand. Even so, yields on both sides of the Atlantic...

Forex and Cryptocurrencies Forecast – Action Forex

EUR/USD: Dollar Dips but Promises a Rebound Last week saw a scarcity of significant macroeconomic data. In anticipation of new drivers, market participants analysed the state of the US labour market and statements from Federal Reserve officials. Data released on...

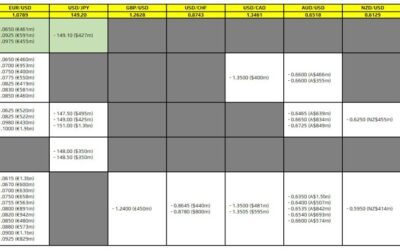

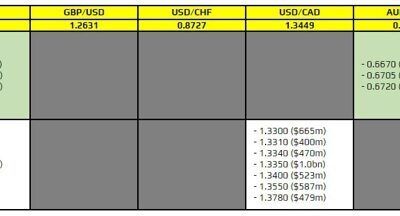

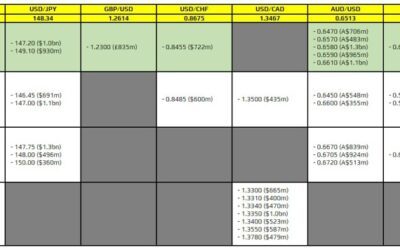

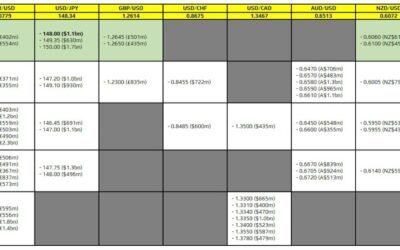

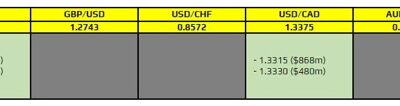

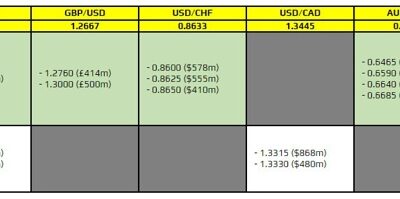

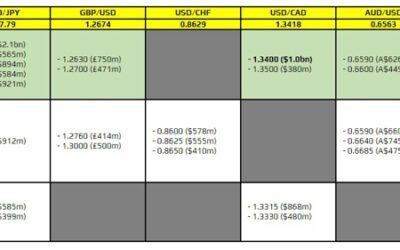

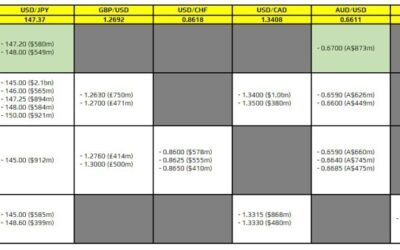

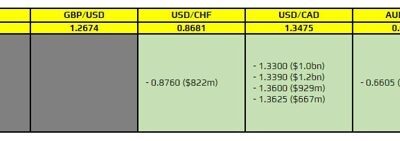

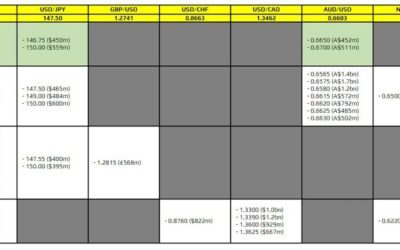

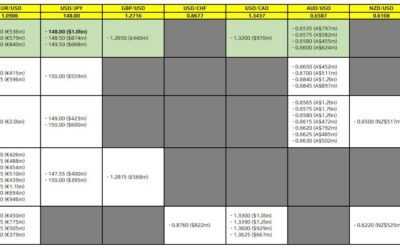

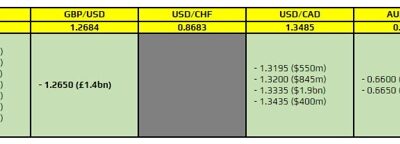

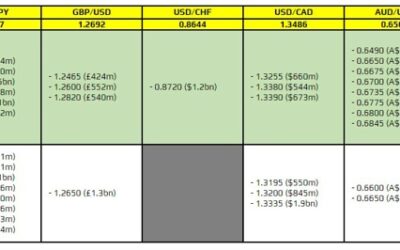

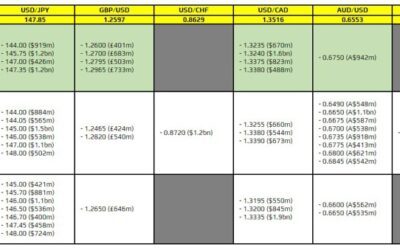

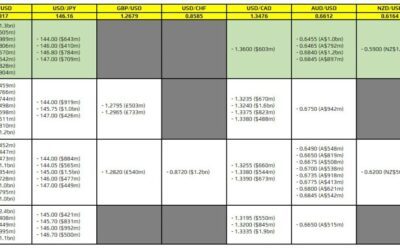

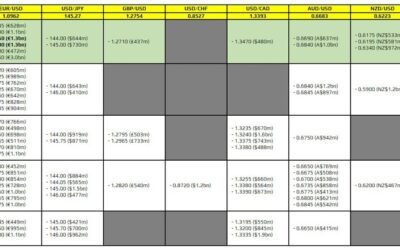

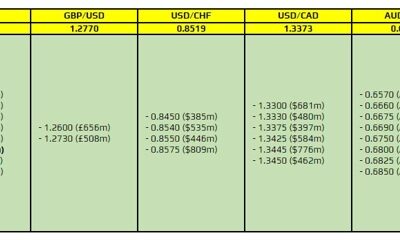

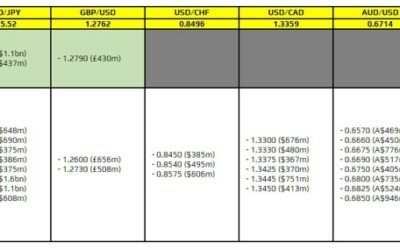

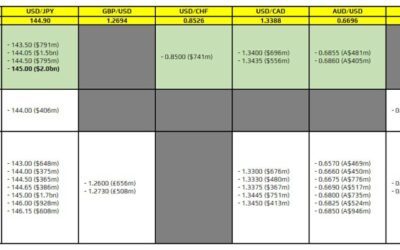

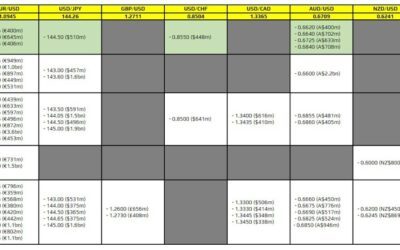

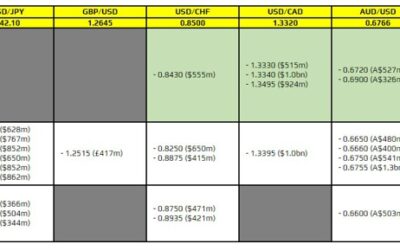

FX option expiries for 12 February 10am New York cut

There aren't any major expiries to take note of for today. And looking out to the rest of the week, there doesn't seem to be too much else either. But we'll take things one day at a time to see how they play out.As for the start of the week, price action is likely to...

Asia Calm in a Quiet Prelude, US CPI and UK Major Data to Highlight the Week

Today’s Asian session sees an unusual quietness across the region, with major markets closed for holidays, leading to limited movement among major currency pairs and crosses. New Zealand Dollar is having a slight downtick following RBNZ Governor Adrian Orr’s...

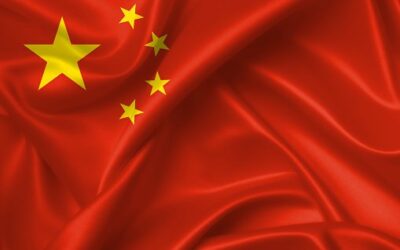

Buckle Up for EU-China Trade Tensions

In this piece, we argue that there is a high probability that the EU will increase the tariff on Chinese electric cars, but there are also good arguments why that might not lead to a large-scale trade war. The EU Commission has rung alarm bells over a doubling of the...

Week Ahead Europe – A Big UK Data Drop, ECB Speakers and Eurozone GDP

Will ECB policymakers leave the door open to a March rate cut? UK data eyed amid division at the BoE Eurozone GDP may leave bloc on the brink of recession The eurozone appears to have avoided a recession at the end of last year but it may have simply been delayed. GDP...

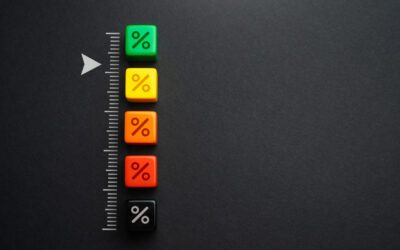

Week Ahead North America – US Inflation Data Eyed, Canada Quiet

US inflation and retail sales among the highlights Tier three Canada data only after employment update Could a March rate cut still be on the table? US economic data since the turn of the year has been far from ideal considering traders had priced in up to 175 basis...

U.S. Inflation to Fall Below 3% for First Time in Nearly Three Years

U.S. retail sales and consumer price index reports for January will be closely watched for whether strong consumer spending and slowing inflation continue to unexpectedly coexist. The U.S. Federal Reserve remains wary that strong demand could reignite price growth,...

Weekly Economic & Financial Commentary: Central Banks Still in the Spotlight

Summary United States: Growth Still Solid, but Slowdown on the Horizon The ISM services index shot higher into expansion territory during January, which is the latest piece of evidence that economic growth is still firmly in positive territory. A sharp rise in the...

Central Bankers Work to Recast Rate Expectations, Yet Market Optimism Remains Unwavering

Last week’s financial markets were characterized by a mix of resilience, speculation, and divergent central bank signals. In the US, the narrative remained steadfast with Fed officials emphasizing a patient approach towards monetary policy, firmly pushing back against...

The Weekly Bottom Line: Fed Officials Continue to Signal Patience on Rate Cuts

U.S. Highlights The ISM Services index, which was on the cusp of falling into contractionary territory in December, improved notably in January, rising 2.9 points to 53.4. The one blemish to the report was a sharp move up in the prices index. With little on the data...

Summary 2/12 – 2/16

Monday, Feb 12, 2024 Tuesday, Feb 13, 2024 Wednesday, Feb 14, 2024 Thursday, Feb 15, 2024 Friday, Feb 16, 2024 The post Summary 2/12 – 2/16 appeared first on Action Forex.

EUR/CHF Weekly Outlook – Action Forex

EUR/CHF’s rebound last week suggests that pull back from 0.9471 has completed at 0.9304 already. Initial bias remains on the upside this week for 0.9471. Firm break there will resume whole rebound from 0.9252 to 100% projection of 0.9252 to 0.9471 from 0.9304 at...

EUR/AUD Weekly Outlook – Action Forex

EUR/AUD stayed in consolidation in range of 1.6348/6671 last week and outlook is unchanged. Initial bias stays neutral this week first. On the upside, decisive break of 1.6671 will revive the case that whole correction from 1.7062 has completed with three waves down...

EUR/GBP Weekly Outlook – Action Forex

EUR/GBP stayed in consolidation above 0.8512 last week and outlook is unchanged. Initial bias remains neutral this week first. While another recovery cannot be ruled out, outlook will stay bearish as long as 0.8591 resistance holds. On the downside, break of 0.8512...

EUR/JPY Weekly Outlook – Action Forex

EUR/JPY’s rebound last week suggests that corrective pull back from 161.84 has completed at 158.06 already. Initial bias remains on the upside for 161.84 resistance first. Firm break there will rebound whole rise from 153.15 to retest 161.84. For now, further rally is...

GBP/JPY Weekly Outlook – Action Forex

GBP/JPY’s rise last week indicates that pull back from 188.90 has completed at 185.21 already. Initial bias remains on the upside this week. Decisive break there will confirm larger up trend resumption. Next near term target will be 61.8% projection of 178.71 to...

USD/CAD Weekly Outlook – Action Forex

USD/CAD rebounded strongly last week but failed to break through 1.3540 resistance decisively. Initial bias remains neutral this week for more consolidations first. Further rise is mildly in favor as long as 1.3357 support holds. On the upside, decisive break of...

AUD/USD Weekly Report – Action Forex

AUD/USD edged lower to 0.6468 last week but turned sideway since then. Initial bias remains neutral this week for more consolidations. While stronger recovery cannot be ruled out, outlook will stay bearish as long as 0.6621 resistance holds. Break of 0.6468 will...

USD/CHF Weekly Outlook – Action Forex

USD/CHF’s rise from 0.8332 resumed by breaking 0.8727 resistance last week. Initial bias stays on the upside this week despite loss of upside momentum. Next target is 61.8% retracement of 0.9243 to 0.8332 at 0.8995. On the downside, below 0.8687 minor support will...

GBP/USD Weekly Outlook – Action Forex

GBP/USD rebounded after initial dip to 1.2517 last week, but upside was capped by 55 4H EMA. Initial bias remains neutral this week first. On the upside, firm break of 1.2641 resistance will affirm the case that correction from 1.2826 has completed at 1.2517, after...

USD/JPY Weekly Outlook – Action Forex

USD/JPY’s rally from 140.25 resumed by breaking through 148.79 last week. Initial bias remains on the upside for retesting 151.89/93 key resistance zone. Decisive break there will confirm resumption of larger up trend. For now, downside, outlook will remain cautiously...

EUR/USD Weekly Outlook – Action Forex

EUR/USD fell further to 1.0722 last week but recovered since then. Initial bias remains neutral this week for more consolidations. While stronger recovery cannot be ruled out, outlook will stay bearish as long as 1.0896 resistance holds. On the downside, sustained...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 148.35; (P) 148.91; (R1) 149.89; More… USD/JPY’s rally from 140.25 is still in progress and intraday bias stays on the upside. Further rally would be seen to retest 151.89/93 key resistance zone. Decisive break there will confirm resumption of...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8721; (P) 0.8741; (R1) 0.8757; More…. Intraday bias in USD/CHF remains on the upside at this point. Current rise from 0.8332 would target 61.8% retracement of 0.9243 to 0.8332 at 0.8995 next. On the downside, below 0.8687 minor support will turn...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2580; (P) 1.2609; (R1) 1.2647; More… Intraday bias in GBP/USD stays neutral at this point. On the upside, above 1.2641 will resume the rebound from 1.2517 to retest 1.2826 high. On the downside, however, decisive break of 1.2499 will argue that...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0750; (P) 1.0770; (R1) 1.0797; More… Intraday bias in EUR/USD remains neutral and outlook is unchanged. On the downside, decisive break of 1.0722 will argue that whole rise from 1.0447 has completed. Deeper fall would then be seen to target this...

Canada’s Labour Market Strengthens in January, But Details Less Constructive

The Canadian labour market added 37.3k positions in January, with full-time employment down 11.6k and part-time employment up 48.9k. The unemployment rate declined 0.1 percentage point to 5.7%, helped by a 0.1 percentage point to decline in the labour force...

Sunset Market Commentary – Action Forex

Markets The US Bureau of Labor Statistics published its annual CPI revisions today. The same event last year showed some deviations from the initial outcomes large enough that they casted doubt on the speed of the disinflationary process. This time around, however,...

Week Ahead – US CPI in the Spotlight as Dovish Fed Bets Fade

All eyes on US CPI on Tuesday after run of strong data Retail sales on the agenda too for the US dollar Pound on standby for UK data flurry, including CPI and GDP Japanese GDP and Australian employment coming up too Will US CPI remain sticky? Inflation in the United...

Will January’s US CPI Inflation Be a Game Changer?

Forecasts point to stable inflation, weaker core CPI Upside surprise is likely, as business indicators point to higher prices US economy has a blockbuster performance The US economy has left analysts speechless. Although the Fed has raised interest rates to the...

Weekly Focus – Higher Rates and Central Bank Pricing

Focus this week has been on the increase in interest rates and the decline in market expectations for central bank rate cuts that were initiated by the strong US job market report late Friday last week. While the headline numbers were very strong, we stress that the...

USD/CAD Dips as Canadian Employment Shines

Canadian employment jumps, wage growth falls USD/CAD edges lower The Canadian dollar has climbed higher in the North American session after the release of Canada’s December employment report. In the North American session, USD/CAD is trading at 1.3432, down 0.20%....

Canadian Dollar Rises on Strong Job Data, Yen and Franc Weakness Persists

Canadian Dollar bounces broadly in early US session, bolstered by unexpectedly robust Canadian employment data. This development comes amidst cautious remarks earlier in the week from BoC Governor Tiff Macklem, who tempered expectations by noting that achieving the 2%...

Canada’s employment rises 37k in Jan, unemployment down to 4.7%

Canada’s employment grew strongly by 37k in January, well above expectation of 35k. Unemployment rate fell -0.1% to 5.7%, the first decline since December 2022, and below expectation of a rise to 5.9%. Participation rate fell -0.2% to 65.3%. Employment rate fell -0.1%...

Copper’s Fall An Early Signal of Global Slowdown

Copper exchange prices on Thursday fell to their lowest since November, approaching $8200 a tonne and breaking out of the broad consolidation range of the past two months. A move out of the $8250-8700 range technically leaves copper vulnerable to a quick fall into the...

Still No Clear Trend in Major FX

Markets As was the case since Tuesday, global trading was kept in some kind of holding pattern. Potential drivers were central bank speakers, a US (30-y) auction and the weekly jobless claims. Fed Barkin joined his colleagues in their view that robust demand and...

Bitcoin Rises Ahead of Schedule

Market picture The crypto market capitalisation has hit new highs since 12th January, passing the $1.75 trillion mark. The market has confidently moved into a state of greed, which we also last saw a month ago. Last month’s corrective pullback and early February’s...

GBPJPY Works Towards Uptrend Resumption

GBPJPY surrounded by bullish vibes Could re-activate long-term uptrend Next resistance expected at 189.50 GBPJPY finally closed above the 188.25 region on Thursday, which had been keeping upside movements in control since mid-November, providing a ray of hope that the...

GBPUSD Retreats After Bullish Spike

GBPUSD rests near the 20-period SMA RSI and MACD suggest bearish wave GBPUSD is falling after a bullish spike earlier today, testing the 20-period simple moving average (SMA) in the 4-hour chart. According to technical oscillators, the RSI is still standing below its...

USDCAD Retreats Towards Crucial Trendline

USDCAD gets repeatedly repelled by 1.3543 Latest rejection triggers decline below 200-day SMA Momentum indicators ease but remain positive USDCAD had been staging a solid recovery from its December low of 1.3176, but its advance was rejected twice at the 2024 peak of...

ANZ forecasts RBNZ rate hikes, triggering Kiwi surge and AUD/NZD range breakout

New Zealand Dollar rises broadly today, buoyed by ANZ’s forecast that RBNZ is set to increase the official cash rate in its upcoming meetings on February 22 and again in April, elevating interest rate to 6%. ANZ’s chief economist, Sharon Zollner, highlighted RBNZ’s...

AUD/USD Struggles While NZD/USD Grinds Higher

AUD/USD is declining below the 0.6540 support zone. NZD/USD is rising and could extend its increase above the 0.6130 resistance zone. Important Takeaways for AUD USD and NZD USD Analysis Today The Aussie Dollar started a fresh decline below the 0.6540 level against...

ECB’s Villeroy confident in Eurozone’s path to overcoming inflation sickness

ECB Governing Council member Francois Villeroy de Galhau, in an interview with LCI television, anticipates reducing interest rates within the year, marking a significant move away from the aggressive inflation-fighting measures. “We will probably cut rates this year...

Friday FX option expiries | Forexlive

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUDJPY’s Gentle Climb Continues – Action Forex

AUDJPY trades higher, clears the 100-day SMA A contracting triangle has been forming as AUDJPY volatility drops Momentum indicators remain uninterested in current upmove AUDJPY is enjoying its fourth consecutive green candle as JPY remains under pressure across the...

Franc and Yen Underperform, Canadian Dollar Anticipates Jobs Report

Swiss Franc and Japanese Yen are currently the weakest performers for the week on a couple of interrelated factors. Firstly, global central bankers are tempering expectations for early rate cuts, suggesting rate difference between SNB/BoJ and other central banks would...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2599; (P) 1.2620; (R1) 1.2650; More… GBP/USD retreated ahead of 55 4H EMA (now at 1.2642) and intraday bias is turned neutral first. Above 1.2641 will resume the rebound from 1.2517 to retest 1.2826 high. On the downside, however, decisive break...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0755; (P) 1.0770; (R1) 1.0787; More… EUR/USD is still holding above 1.0722 support and intraday bias stays neutral. On the downside, decisive break of 1.0722 will argue that whole rise from 1.0447 has completed. Deeper fall would then be seen to...

USD/JPY Slides After BOJ Uchida’s Hawkish Comments

The Japanese yen is down sharply on Thursday. In the European session, USD/JPY is trading at 149.12, up 0.64%. This is the yen’s lowest level against the US dollar since November 27. BoJ’s Uchida hints at policy shift The Bank of Japan dropped its latest hint of a...

EUR/USD Eyes German Inflation – Action Forex

EUR/USD is slightly lower on Wednesday. In the North American session, the euro is trading at 1.0751, down 0.20%. German inflation expected at 0.2% Germany’s CPI is expected at 0.2% m/m on Friday, which would confirm the initial estimate from two weeks earlier. On an...

BTCUSD Advances Towards Crucial Resistance

BTCUSD ascends sharply after claiming 50-day SMA Currently challenges the December peak of 44,785 Momentum indicators are starting to look overbought BTCUSD (Bitcoin) experienced a strong decline from its recent two-year peak of 49,051, dropping to as low as 38,460....

Sunset Market Commentary – Action Forex

Markets Japanese stock markets and JPY still account for today’s biggest market move in a telling sign about current market momentum. The Nikkei closed slightly over 2% higher. USD/JPY sets a new YTD high at 149.40 with both the psychologic 150 mark and the 2022...

USD/JPY: Rallies on Diverging BoJ/Fed Rate Outlook

USDJPY rallied on Thursday (up 0.80% until early hours of the US session) as BoJ kept dovish stance in rate talks which deflated yen, while dollar appreciated from growing signs that the Fed would slow the action towards rate cuts in 2024. The pair rose to the highest...

Pound Traders Lock Gaze on UK Inflation and GDP Data

Investors price in rate cuts despite BoE’s ‘higher for longer’ mantra Will the UK CPI and GDP data confirm that view? CPI inflation on Wednesday (07:00 GMT), GDP on Thursday (07:00 GMT) Traders assign an 80% chance of a June BoE rate cut When they last met, Bank of...

Fed’s Barkin: We’ve got some time to be patient

Richmond Fed President Thomas Barkin highlighted the strength of the labor market and the encouraging trend of decreasing inflation in a Bloomberg TV interview. The cautious yet optimistic outlook grants Fed a period of watchful waiting before starting interest rate...

Dollar Rises on Relative Yield Strength and Economic Optimism

Dollar rises broadly in early US session, standing out in a day characterized by relatively slow news flow. The move in the greenback can be primarily attributed to the rise in US benchmark yields, which outpaced those of other regions, thereby bolstering the...

ECB’s Wunsch sees some value to waiting

ECB Governing Council member Pierre Wunsch said today, “I’m on the side of those that believe there’s some value to waiting” before cutting interest rates. Nevertheless, Wunsch also acknowledged the inherent uncertainties in economic forecasting and the eventual need...

US initial jobless claims falls to 218k, vs exp 220k

US initial jobless claims fell -9k to 218k in the week ending February 3, slightly better than expectation of 220k. Four-week moving average of continuing claims rose 4k to 212k. Continuing claims fell -23k to 1871k in the week ending January 27. Four-week moving...

AUD/USD Outlook: Dips After Soft China CPI Data

AUDUSD eased below 0.6500 mark (cracked Fibo 61.8% of 0.6270/0.6871 rally) on Thursday, deflated by softer than expected China inflation data. Fresh weakness emerged after recovery attempts from 0.6468 (new 2024 low, posted on Feb 5) were repeatedly capped by 100DMA...

WTI Oil Futures Need One More Confirmation

WTI oil aims for some recovery but lacks confidence Price fluctuates within a bullish channel Resistance at 74.40; support at 72.70 WTI oil futures have been tip-toeing higher after last week’s steep downfall paused at the lower boundary of a short-term bullish...

US 30 Index Flirts With All-Time High

US 30 index retains bullish outlook above uptrend line Technical oscillators indicate more gains The US 30 (cash) index is traveling slightly below the all-time high of 38,782 and above the medium-term rising trend line, suggesting a potential move to the upside...

Why Are Chinese Stocks Melting Down?

Chinese stock markets sink to lowest levels in five years Real estate crisis and other problems haunt investors Valuations are cheap, but more is needed for lasting recovery Chinese equities implode It’s been a tough few years for Chinese stock markets. Shares in...

Bitcoin Completes Consolidation and Rushes to the High

Market Picture The crypto market made an impressive move higher, rising 3.4% in 24 hours to $1.71 trillion. The rise to its highest level since 12 January came as the S&P500 and Nasdaq-100 indices hit all-time highs. Bitcoin rose above its 50-day moving average,...

GBP/USD Daily Outlook – Action Forex

Daily Pivots: (S1) 1.2599; (P) 1.2620; (R1) 1.2650; More… Intraday bias in GBP/USD remains mildly on the upside. Correction from 1.2826 might have completed with three waves down to 1.2517. Further rise would be seen to retest 1.2826 high. On the downside, however,...

USD/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 147.79; (P) 148.02; (R1) 148.42; More… Intraday bias in USD/JPY remains neutral with focus on 148.79 resistance. Firm break there will resume the rally from 140.25 to 151.89/93 key resistance zone. For now, further rise will remain in favor as long...

EUR/USD Daily Outlook – Action Forex

Daily Pivots: (S1) 1.0755; (P) 1.0770; (R1) 1.0787; More… Intraday bias in EUR/USD remains neutral for the moment, with focus staying on 1.0722 structural support. Decisive break there will argue that whole rise from 1.0447 has completed. Deeper fall would then be...

AUDUSD Bounces Off 2024 Low

AUDUSD hits its lowest level since mid-November Although decline halts, rebound looks unconvincing Momentum indicators remain tilted to the downside AUDUSD has been in a constant decline after peaking at 0.6870 in December, breaking below both its 50- and 200-day...

UK house prices (RICS survey) to highest level since October 2022

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

NZD/USD Rate Recovering from Its Low of the Year amid News from Labour Market

Yesterday’s news showed that New Zealand’s labour market is stronger and more resilient than expected. In the fourth quarter of 2023, employment grew by 0.4% in the fourth quarter (forecast = +0.3%, quarter earlier = -0.1%). The unemployment rate is 4%, forecast =...

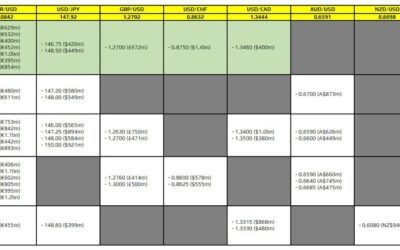

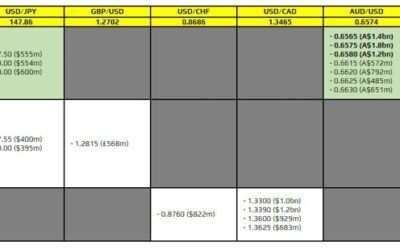

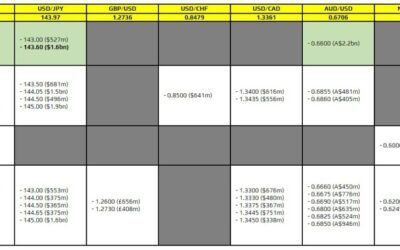

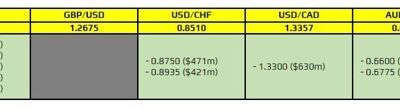

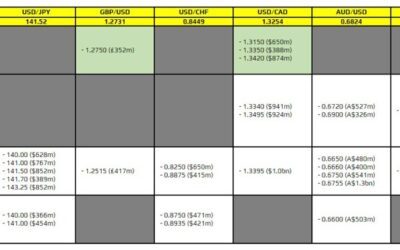

FX option expiries for 8 February 10am New York cut

There aren't any major expiries to take note of on the day. As such, trading sentiment will continue to be reliant on the action in the bond market and overall risk mood mostly. On the former, the push and pull this week is making it tough to gather much conviction....

Yen Weakens Amid BoJ’s Dovish Signals, S&P 500 Poised to Break Through 5000 Milestone

Japanese Yen declines broadly in today’s Asian session, reacting to dovish remarks made by BoJ Deputy Governor. The official’s commentary emphasized a cautious approach to monetary tightening, highlighting that even with exit from negative interest rate policy, the...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0731; (P) 1.0746; (R1) 1.0770; More… No change in EUR/USD’s outlook and intraday bias stays neutral. Focus remains on 1.0722 structural support. Decisive break there will argue that whole rise from 1.0447 has completed. Deeper fall would then be...

AUDUSD: Initiating Macro Bearish Reversal

Bearish Scenario: Selling below 0.6516 with TP1: 0.65, TP2: 0.6487, and upon its breakout TP3: 0.6469. It is recommended to place a stop loss above 0.6541, at least 1% of the account capital. Trailing stop can be used. Bullish Scenario: Buying above 0.6540 with TP1:...

EUR/GBP One Step Away from a Descending Stair

The euro is back at 0.8520 against the pound. The pair bounced off this level in June and August last year. Reaching the same level in late January triggered a shake-out, but active declines resumed on Tuesday and Wednesday, and the pair is testing multi-month lows...

EURJPY Rotates Lower as Rebound Falters

EURJPY bounces back after 50-day SMA prevents decline But reverses lower again, finding support at descending trendline Momentum indicators are neutral-to-negative EURJPY has been sliding lower in the short term, following its rejection at 161.85 in late January....

What Impact Will Canada’s Employment Figures Have on Loonie?

Canada’s economy likely added more jobs in January Ivey PMIs rises to its highest level in 9 months BoC summary of deliberations gets releasedon Wednesday Loonie rises ahead of Friday’s data due at 13:30 GMT In Canada, a number of data releases are scheduled for this...

Australia & New Zealand: What’s Up For The Down Under Economies?

Summary The Reserve Bank of Australia (RBA) held its policy rate steady at 4.35% this week as expected, and its accompanying announcement was more hawkish than expected. The RBA did not rule out a further increase in interest rates, saying inflation—especially...

XAU/USD: Gold Remains in Prolonged Consolidation Before Larger Bulls Resume

Short-term action remains in a sideways mode after the metal’s price spiked to new record high ($2141) in early December, holding within $1973/$2088 range, but mainly above psychological $2000 level, which adds to positive bias. Gold is consolidating after Oct-Dec...

WTI Oil: Recovery Extends into Third Day But Risk of Stall Exists

WTI oil price extends recovery from new multi-week low ($71.40) into third consecutive day. Profit-taking after last week’s 8.1% drop was contained by 200WMA, lifted the price along with lower than expected increase in US crude inventories (API report) and cut in...

Sunset Market Commentary – Action Forex

Markets In the absence of key eco data, both in the US and Europe, central bankers’ talk today was again earmarked as the main guide for bond markets. ECB board member Isabel Schnabel in the FT gave an in extenso assessment on the importance of the ECB walking the...

Sterling and Euro Gain on Central Bank Patience, Swiss Franc Falls

Sterling, and to a lesser extent, Euro, are propelled slightly higher by hawkish comments from key figures in BoE and ECB. These officials have adopted a stance of patience, preferring to wait for additional economic data before making any decisions on interest rate...

Fed’s Kashkari sees only two or three rate cuts this year

Minneapolis Fed President Neel Kashkari offered a more conservative outlook on policy loosening compared to market expectations. In a conversation with CNBC today, Kashkari indicated his anticipation of only two or three interest rate cuts throughout 2024, a stance...

NZD/USD Shrugs after NZ Employment Report

New Zealand’s unemployment rises, wages ease The New Zealand dollar is drifting on Wednesday, after jumping 0.73% a day earlier. In the North American session, NZD/USD is trading at 0.6104, up 0.12%. New Zealand’s employment change rises New Zealand’s employment...

EUR/USD Drops Again While USD/CHF Regains Strength

EUR/USD started a fresh decline below the 1.0810 support. USD/CHF is rising and might aim a move toward the 0.8800 resistance. Important Takeaways for EUR/USD and USD/CHF Analysis Today The Euro struggled to clear the 1.0900 resistance and declined against the US...

EUR/AUD Technical: AUD Weakness Stalling after RBA’s Cautionary Stance on Inflation

Despite a recent slowdown in Australia’s monthly CPI for December 2023, the Australian central bank, RBA has chosen to remain on the cautious side and push back rate cut expectations. RBA’s monetary policy statement has stated that service inflation may remain sticky...

NZDUSD Bounces Off 2-month Low

NZDUSD extends its bearish leg below 200-day SMA But manages to rebound strongly from 2-month bottom Oscillators remain tilted to the downside NZDUSD has been in a steady downtrend since its rejection from near 0.6373 in late December, which is the 78.6% Fibonacci...

Ethereum Nears Recent Turning Point

Market Picture The crypto market cap remained at $1.65 trillion. Bitcoin spent another day almost unchanged at $42.8K. Ethereum was a major growth driver, gaining 1.6% on the day to $2,350 and reversing to the downside as it approached $2,400. This is the same place...

BoE’s Breeden highlights coming months as incredibly important to inflation and wage assessment

BoE Deputy Governor Sarah Breeden indicated in a speech growing confidence that further tightening of rates might not be necessary. She noted a pivotal shift in focus towards “how long rates need to remain at their current level.” Breeden underscored the importance of...

GBP/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 186.12; (P) 186.45; (R1) 186.71; More… Intraday bias in GBP/JPY remains neutral and outlook is unchanged. On the upside, firm break of 187.60 will turn bias to the upside for 188.90. Break there will confirm resumption of larger up trend. Meanwhile,...

A Tug of War Between Hawks and Doves

The selloff in US sovereign bonds reversed yesterday after a solid demand for the US 3-year bond auction counterweighed a bulk of hawkish comments from Federal Reserve (Fed) members. The Fed members are on the battlefield, fighting the doves. Loretta Mester said there...

Chinese Investors Still Ponder Impact of Authorities to Arrest Equity Sell-off

Markets Amid a very thin eco calendar, core bonds yesterday found some relief after the self-off that started with Powell’s push back against early rate cuts last Wednesday, reinforced by an exceptionally strong payrolls report and solid services ISM afterwards....

ECB’s Schnabel: Incoming data signals tough final stretch in inflation battle

ECB Executive Board member Isabel Schnabel highlighted in an FT interview the challenges facing Eurozone as it approaches what she terms the “last mile” in the fight against inflation. Despite rapid disinflation experienced due to the reversal of supply-side shocks,...

USDJPY Hovers Above a Key Support Area

USDJPY is in the red again today, reacts to last week’s jump It continues to hover a tad above its 100-day SMA Most momentum indicators tentatively support the ongoing upleg USDJPY is recording its second consecutive red candle, recouping a good part of last week’s...

FX option expiries for 7 February 10am New York cut

There is just one to take note of for the day, as highlighted in bold.That being for EUR/USD at the 1.0725 level. The price action so far today might not be suggestive of one to see the expiries come into play. However, it does run near the December low of 1.0723 -...

Commodity Currencies in Fragile Rebound, Await Concrete Market Stabilization Moves from China

Commodity currencies are the main movers in Asian markets today, gaining broadly, albeit against a backdrop of continued weak momentum. This situation unfolds as Chinese stocks carry forward their rebound from earlier this week, showcasing a divergence from Hong...

Gold Flips Backwards But Still Shines Above 2,000

Gold loses ground after hitting tough resistance Lacks bullish signals but pattern of higher lows remains intact Gold could not mark a new higher high above January’s tough resistance of 2,065, correcting lower to close around its 50-day exponential moving average...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8669; (P) 0.8694; (R1) 0.8731; More…. Break of 0.8272 resistance suggest that USD/CHF’s rebound from 0.8332 is resuming. Intraday bias is back on the upside. Further rally should be seen to 61.8% retracement of 0.9243 to 0.8332 at 0.8995 next. On...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 148.33; (P) 148.62; (R1) 148.96; More… No change in USD/JPY’s outlook as intraday bias stays neutral. Focus stays on 148.79 resistance. Firm break there will resume the rally from 140.25 to 151.89/93 key resistance zone. For now, further rise will...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2488; (P) 1.2566; (R1) 1.2614; More… No change in GBP/USD’s outlook and intraday bias remains on the downside. Strong support could be seen from 1.2499 structural support. Break of 1.2628 minor resistance will turn bias back to the upside for...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0714; (P) 1.0751; (R1) 1.0778; More… No change in EUR/USD’s outlook and intraday bias stays on the downside. Focus remains on 1.0722 structural support. Decisive break there will argue that whole rise from 1.0447 has completed. Deeper fall would...

Sunset Market Commentary – Action Forex

Markets Core bonds, US Treasuries in particular, opened higher in an attempt to recoup some of the Powell-Payrolls-ISM triple whammy they suffered over the previous days. But US yields shedding between 0.1 and 3 bps across the curve is nothing compared to the 30bps+...

Is German Industry Ready for Revival?

Industrial orders rose 8.9% in December against expectations for a 0.1% decline, a rare positive for Germany that the euro chose to ignore. This is the most robust monthly increase since mid-2020’s lockdowns. In the same month last year, the increase was 2.7%. A...

Japanese Yen Calm After Mixed Spending and Income Data

The Japanese yen is showing limited movement on Tuesday. In the North American session, USD/JPY is trading at 148.56, down 0.09%. Japan released mixed data on Monday. Average Cash Earnings for December rebounded with a 1% gain, following a 0.2% gain in November. This...

ECB’s Vujcic: We need some patience now

In an interview with Reuters, ECB Governing Council member Boris Vujcic emphasized the need for “patience” in the current monetary policy environment. He acknowledged the positive disinflationary trends observed so far. However, “we still see also quite a lot of...

NZD/USD Calm Ahead of NZ Job Data

New Zealand’s job growth expected to rise to 0.2% The New Zealand dollar is showing limited movement on Tuesday. Early in the North American session, NZD/USD is trading at 0.6052, down 0.03%. New Zealand job growth expected to rebound New Zealand releases the...

Dollar in Consolidation Mode as Kiwi Eyes Upcoming NZ Job Data

Dollar is largely in a state of consolidation today, except with a minor uptick observed against Swiss Franc. In the absence of significant economic data from the US, market participants are poised to gauge the sentiment from forthcoming comments by Fed officials....

BoE Dhingra urges not to take risk on the economy

In a Financial Times interview, BoE MPC member Swati Dhingra articulated her concerns regarding the UK’s economic outlook and inflationary trends. As the sole member to vote for a rate cut in the last meeting, she cautioned against underestimating the downside risks...

Australian Dollar Yawns as RBA Stands Pat

The Australian dollar is showing limited movement on Tuesday, after the Reserve Bank of Australia held interest rates. In the European session, AUD/USD is trading at 0.6493, up 0.61%. RBA maintains rates The RBA left interest rates unchanged at 4.35% at its first...

Gold Flips Backwards But Still Shines Above 2,000

Gold loses ground after hitting tough resistance Lacks bullish signals but pattern of higher lows remains intact Gold could not mark a new higher high above January’s tough resistance of 2,065, correcting lower to close around its 50-day exponential moving average...

Eurozone retail sales falls -1.1%mom, EU down -1.0%

Eurozone retail sales fell -1.1% mom in December, worse than expectation of -1.0% mom. Volume of retail trade decreased by -1.6% mom for food, drinks and tobacco, by -1.0% mom for non-food products and by -0.5% mom for automotive fuels. EU retail sales fell -1.0% mom....

Bitcoin is Looking at Stocks, and That’s Worrisome

Market picture The crypto market remains stable while waiting for further signals. The crypto cap is up 0.4% in 24 hours to $1.64 trillion. Bitcoin is trading at $42.7K – virtually unchanged in 24 hours, just 1.4% lower than a week ago and a 1.8% decrease over 30...

RBA’s Hawkish Surprise Temporarily Boosted Aussie But Failed to Turn It Around

The Reserve Bank of Australia kept its cash rate unchanged at 4.35% for the third consecutive meeting. The markets widely expected the decision, but the tone of the accompanying commentary was more hawkish than the market had anticipated, adding to Aussie buying. The...

AUD/USD Rate Rises after RBA Decision

This morning the Central Bank of Australia decided to keep the interest rate at the same level = 4.35%, as expected. However, RBA management said that further rate hikes cannot be ruled out as inflation is still too high. This is a clear signal that policy easing is...

ECB consumer survey reveals declining inflation expectations

ECB’s Consumer Expectations Survey for December highlighted a noteworthy trend in consumer sentiment regarding inflation and economic growth. In a positive development, consumers’ inflation expectations for the next 12 months have decreased for the third consecutive...

NZD: Unemployment Rate Could Weaken NZD

Traders are closely monitoring Fed speeches, particularly Fed’s Mester speech scheduled for Tuesday, for further insights into monetary policy directions. Additionally, market participants await key economic releases later in the week, including New Zealand’s...

GBPUSD Plummets to 2-month Low

GBPUSD tests 200-day SMA after strong sell-off Prices break trading range to the downside Outlook looks bearish in short-term GBPUSD plunged to a new almost two-month low of 1.2517 on Monday’s session, falling beneath the short-term trading range and the 200-day...

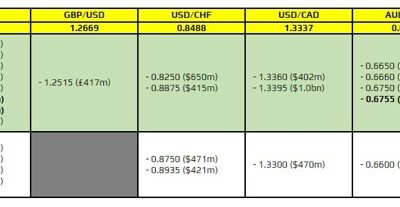

FX option expiries for 6 February 10am New York cut

There aren't any major expiries to take note of for the day. As such, trading sentiment will continue to revolve around the action in the bond market and risk mood mostly. For now, it seems like the dollar is taking a step back after the gains yesterday.As for the...

Aussie Recovers with RBA Hold and China Stocks Rally, But Momentum Tepid

Australian Dollar recovered mildly today, but momentum is so far limited. While RBA softened the hawkish stances after standing pat on rates, the left is still left open for more tightening. Governor Michele Bullock emphasized in the post-meeting press conference that...

EUR/USD: Bears Tighten Grip After Break of Another Strong Support

EURUSD remains firmly in red and hits two-month low on Monday morning, in extension of Friday’s 0.8% drop (the biggest daily loss since Jan 2). Fresh weakness broke through significant support at 1.0776 (100DMA) increasing pressure on next pivotal supports at...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0747; (P) 1.0822; (R1) 1.0864; More… EUR/USD’s fall from 1.1138 continues today, and the break of trend line in 4H MACD indicates downside acceleration. Intraday bias remains on the downside. Sustained break of 1.0722 structural support will argue...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2574; (P) 1.2673; (R1) 1.2732; More… Intraday bias in GBP/USD is back on the downside as the fall from 1.2826 resumes. Strong focus could be seen from 1.2499 structural support. Break of 1.2643 minor resistance will turn bias back to the upside...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8588; (P) 0.8634; (R1) 0.8716; More…. USD/CHF is still capped below 0.8727 resistance and intraday bias stays neutral first. On the upside, above 0.8727 will resume the rebound from 0.8332, and target 61.8% retracement of 0.9243 to 0.8332 at...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 145.85; (P) 146.48; (R1) 147.07; More… No change in USD/JPY’s outlook as focus remains on 148.79 resistance. Firm break there will resume the rally from 140.25 to 151.89/93 key resistance zone. For now, further rise will remain in favor as long as...

ISM services rises to 53.4, employment expands, price index leaps

US ISM Services PMI marked a significant uptick from 50.6 to 53.4 in January, above expectation of 52.1. This highlights a strengthening in the services sector A closer look at the index components reveals stable business activity level, with the production sub-index...

USD Strengthens Following Strong Employment Data

The US dollar has seen a significant increase in strength against the Euro, with the EUR/USD pair falling to 1.0770 by Monday morning. This movement is largely attributed to the recent release of robust employment sector reports in the US for January, which have...

ISM Shows Services Sector Expansion Accelerates in January

The ISM Services PMI jumped to 53.4 in January from 50.6 in December, comfortably beating the 52.0 consensus expectation. Ten industries out of 18 reported growth for the month – up from nine in December. The business activity sub-index was unchanged at 55.8, while...

Sunset Market Commentary – Action Forex

Markets: The payrolls-Powell combo resonated through today’s European trading session in absence of other data/events. It put core bonds under further pressure from the start with US Treasuries underperforming German Bunds. Recall that Powell ruled out a March rate...

Fed’s Kashkari: Monetary policy may not be as tight as assumed

Minneapolis Fed President Neel Kashkari argued in an essay that Fed’s current monetary policy stance “may not be as tight as we would have assumed”. This would afford Fed valuable leeway to sift through incoming economic data before deciding on any reduction to the...

EURCAD Selling Perfectly From The Blue Box Area

In this technical blog, we are going to take a look at the past performance of EURCAD 1-Hour Elliott wave Charts that we presented to our members. In which, the decline from the 1/25/2024 peak took place as an impulsive structure and showed a lower sequence with a...

Dollar’s Dominance Continues, Sterling and Euro Accelerate Down

Dollar’s robust rally persists in early US session, and gains momentum alongside the strong rise 10-year yield, now surpassing the 4.1% mark. Fed Chair Jerome Powell’s hawkish comments in CBS interview air during the weekend continued to shift market expectations. The...

Euro Falls to Two-Month Low

EUR/USD has extended its losses on Monday. In the European session, the euro is trading at 1.0749, down 0.34%. Earlier, the euro fell as low as 1.0747, its lowest level since December 11. Red-hot nonfarm payrolls boosts US dollar The US dollar ended the week with...

GBP/USD: Cable Falls Further as Solid US NFP Lift Dollar

Cable extends strong fall into second consecutive day, remaining under increased pressure from stronger dollar after upbeat US labor data and relatively hawkish comments from Fed Chair Powell. Fresh extension lower on Monday cracked the floor of near-term range...

AUD/USD Eyes RBA Rate Decision

The Australian dollar is slightly lower on Monday, after sliding 0.90% on Friday. In the European session, AUD/USD is trading at 0.6499, down 0.21%. Earlier, AUD/USD traded as low as 0.6486, its lowest level since mid-November. RBA set to hold rates The Reserve Bank...

OECD raises global growth forecasts to 2.9% in 2024 on robust US performance

OECD’s latest Interim Economic Outlook report presents a cautiously optimistic upgrade in global growth forecasts for 2024 to 2.9% (up from November’s 2.7% forecast), a notable uplift largely attributed to stronger performance of US economy. “Some moderation of...

USDJPY Stops Beneath 2-month High

USDJPY trades sideways after failing to extend its breakout RSI and MACD are hovering in their positive regions Stochastic indicates overstretched market USDJPY came close to breaking the 148.81 level in the preceding week, recording a two-month high. According to the...

Eurozone PPI down -0.8% mom, -10.6% yoy in Dec

Eurozone PPI was down -0.8% mom, -10.6% yoy in December, versus expectation of -0.8% mom, -10.6% yoy. For the month, industrial producer prices decreased by -2.3% mom for energy and by -0.3% mom for intermediate goods, while prices remained stable for both capital...

Eurozone Sentix rises to -12.9, Germany a negative economic pull

Eurozone Sentix Investor Confidence index climbed for the fourth consecutive month to -12.9, marking its highest point since April 2023. Both Current Situation Index, now at -20.0 (its peak since June 2023), and Expectations Index, reaching -5.5 (the highest since...

Eurozone PMI services finalized at 48.4, Southern strength versus Northern softness

Eurozone PMI Services was finalized at 48.4 in January, down slightly from December’s 48.8. PMI Composite was finalized at 47.9, up from prior month’s 47.6, a 6-month high. The data reveals a striking “north-south divide”, challenging conventional perceptions. Spain...

Forex and Cryptocurrencies Forecast – Action Forex

EUR/USD: Dollar Strengthening Prospects Increase Throughout January, a series of indicators: GDP, employment, and retail sales, consistently highlighted the strength of the US economy. The threat of recession diminished, and it became evident that the high interest...

It Might Take Until Summer for Fed to Start Easing Cycle

Markets Fed Chair Powell signaled last week that the Fed wants additional confirmation that the economy is on a path that should bring inflation back to 2% in a sustainable way, even as inflation developed favorably over the past six months. The labour market in this...

FX option expiries for 5 February 10am New York cut

There is just one to take note of, as highlighted in bold.That being for USD/JPY at the 148.00 mark. However, it isn't a level which holds much technical significance at the moment although there might be some bids lined up there on the day. As such, it could help to...

Continued Ascendancy of Dollar Awaits Validation from ISM Services Data

Dollar strengthens broadly in Asian session today, extending last week’s late rebound. This uptick comes in the wake of Fed Chair Jerome Powell’s interview on 60 Minutes, where he reiterated the premature nature of interest rate cuts in March. He also highlighted the...

EUR/AUD Weekly Outlook – Action Forex

EUR/AUD’s pull back from 1.6671 extended to as low as 1.6348 last week but rebounded since then. Initial bias remains neutral this week first. On the upside, decisive break of 1.6671 will revive the case that whole correction from 1.7062 has completed with three waves...

EUR/GBP Weekly Outlook – Action Forex

EUR/GBP edged lower to 0.8512 last week but recovered since then. Initial bias remains neutral this week for some more consolidations. But near term outlook will stay bearish as long as 0.8591 resistance holds. Below 0.8512 will resume the decline from 0.8713 to...

EUR/JPY Weekly Outlook – Action Forex

While EUR/JPY’s correction from 161.84 extended to 158.06, it drew some support from 158.55 and near term rising channel and rebounded. Initial bias remains neutral this week first. On the upside, firm break of 160.25 will indicate that rise from 153.15 is ready to...

USD/CHF Weekly Outlook – Action Forex

USD/CHF dipped further to 0.8550 last week but recovered since then. Initial bias remains neutral this week first On the upside, above 0.8727 will resume the rebound from 0.8332, and target 61.8% retracement of 0.9243 to 0.8332 at 0.8995. On the downside, below 0.8550...

GBP/USD Weekly Outlook – Action Forex

GBP/USD’s sideway consolidation continued last week and outlook is unchanged. Initial bias remains neutral this week first. In case of another fall, downside should be contained above 1.2499 support to bring rebound. On the upside, firm break of 1.2774 resistance will...

Investor Optimism Pushes Stocks to New Heights, While Dollar Rallies as March Fed Cut Speculation Subsides

This past week in the financial markets has been nothing short of a rollercoaster, with Dollar clinching the title of the strongest currency amidst considerable volatility. The narrative that dominated was the dissipating likelihood of a March rate cut by Fed. But at...

EUR/USD Weekly Outlook – Action Forex

EUR/USD’s decline from 1.1138 extended lower last week but continued to lose downside momentum. Break of 1.0779 will resume the fall, but considering bullish convergence condition in 4H MACD, downside could be contained by 1.0722 support. On the upside, break of...

USD/JPY Weekly Outlook – Action Forex

USD/JPY dipped to 145.88 last week as consolidation from 148.79 extended, but rebounded strongly since then. Initial focus now on 148.79 this week. Firm break there will resume the rally from 140.25 to 151.89/93 key resistance zone. For now, further rise will remain...

GBP/JPY Weekly Outlook – Action Forex

GBP/JPY’s pull back from 188.90 extended to 185.21 last week but recovered since then. Initial bias remains neutral this week first. Firm break of 187.60 will turn bias to the upside for 188.90. Break there will confirm resumption of larger up trend. Meanwhile, below...

USD/CAD Weekly Outlook – Action Forex

USD/CAD’s correction from 1.3540 extended lower to 1.3357 last week but recovered since then. Initial bias stays neutral this week first. On the upside, break of 1.3540 will resume the rise from 1.3176. That will also revive that case that whole fall from 1.3897 has...

AUD/USD Weekly Report – Action Forex

AUD/USD’s decline from 0.6870 resumed last week and edged lower to 0.6501. Initial bias is now on the downside for 61.8% projection of 0.6870 to 0.6524 from 0.6621 at 0.6407. On the upside, break of 0.6621 resistance is needed to signal short term bottoming....

EUR/CHF Weekly Outlook – Action Forex

EUR/CHF’s pull backed from 0.9471 continued last week but lost momentum and turned sideway after hitting 0.9304. Initial bias remains neutral this week first. While another decline cannot be ruled out, downside should be contained above 0.9252 low to bring rebound. On...

BoE’s Pill advocates patience, rate cut remains some way off

BoE Chief Economist Huw Pill articulated a cautious stance on the prospect of interest rate cuts, noting that such a move remains “some way off.” He underscored the absence of adequate evidence suggesting a trajectory towards the inflation target, which necessitates a...

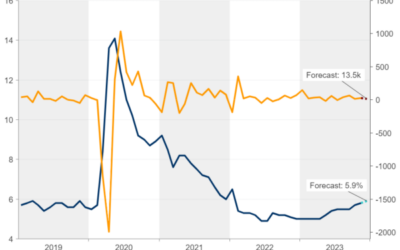

Canada’s January Unemployment Rate to Hit 5.9%—Highest Since Pandemic

Canadian jobs numbers for January will be centre stage next Friday as policymakers and market watchers look for signs of deterioration in the labour market. The data for the first month of 2024 will tell a similar story to the one we have observed over 2023—employment...

Weekly Economic & Financial Commentary: A March Rate Cut Bites the Dust

Summary United States: A March Rate Cut Bites the Dust It was a busy week for economic data, but Friday’s employment report stole the show. Nonfarm payrolls rose 353K in January, almost double the consensus expectation. While we suspect the Federal Reserve will put...

The Weekly Bottom Line: Resilient Labor Demand and A Patient Fed

U.S. Highlights The Federal Reserve opted to hold rates steady in their first decision of the year in order to give themselves more time to assess the sustainability of current disinflation trends. Employment gains in January nearly doubled expectations as strong...

Summary 2/5 – 2/9

Monday, Feb 5, 2024 Tuesday, Feb 6, 2024 Wednesday, Feb 7, 2024 Thursday, Feb 8, 2024 Friday, Feb 9, 2024 The post Summary 2/5 – 2/9 appeared first on Action Forex.

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 145.85; (P) 146.48; (R1) 147.07; More… USD/JPY’s strong rebound today maintains its near term bullishness. Focus is turning to 148.79 resistance. Firm break there will confirm that correction has completed at 145.88, and rise from 140.25 would then...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8549; (P) 0.8599; (R1) 0.8628; More…. USD/CHF rebounds notably today but stays in range below 0.8727. Intraday bias remains neutral first. On the upside, firm break of 0.8727 will resume the rebound to 61.8% retracement of 0.9243 to 0.8332 at...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2661; (P) 1.2708; (R1) 1.2792; More… Range trading continues in GBP/USD with today’s sharp fall, and intraday bias remains neutral. Consolidation from 1.2826 could still extend further, and deeper fall cannot be ruled out. But downside should be...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0810; (P) 1.0843; (R1) 1.0905; More… EUR/USD falls sharply in early US session but stays above 1.0779 temporary low. Intraday bias remains neutral first. On the downside, below 1.0779 will resume the fall from 1.1138. But considering bullish...

Aussie Slides After Hot US Nonfarm Payrolls

The Australian dollar has fallen almost 1% after the US nonfarm payrolls and has given up today’s earlier gains. In the North American session, AUD/USD is trading at 0.6644, down 0.40%. The US dollar has started 2024 on the right foot, recording gains against most of...

US: January Delivers a Scorching Hot Employment Report

Non-farm payrolls rose by 353k in January, well ahead of the consensus forecast calling for a smaller gain of 185k. This morning’s report also included annual benchmark revisions as well as revised seasonal factors. The revisions showed a slightly weaker rate of job...

Will Weak Jobs Data Prompt RBNZ to Drop Hiking Bias

RBNZ remains hawkish despite slowing inflation and weaker growth Investors price in 90bps rate cuts by the end of 2024 Focus turns to jobs data for Q4 on Tuesday at 21:45 Despite hawkish RBNZ, data drive investors to price in rate cuts At its November gathering, the...

Week Ahead – RBA Decision and US Data on the Menu

Dollar cannot sustain Fed-fueled advance, will ISM data help? Reserve Bank of Australia could abandon its tightening bias Crucial data releases also from China, Canada, and New Zealand Fed warns against early rate cuts It was an eventful week in global markets. The...

Groundhog Day: Hiring Once Again Starts the Year at Blistering Pace

Summary Hiring once again came out of the gate strong in 2023. Nonfarm payrolls rose by 353K in January, blowing past consensus expectations for a 185K gain. What’s more, revisions point to stronger momentum in hiring through the end of last year; payrolls in the...

Weekly Focus – Wait and See Mode in Central Banks

In a week with no big data or central bank surprises, renewed fears of turmoil in the US banking sector on the back of the free fall of the New York Community Bancorp (NYCB) stock, drove longer dated yields lower as markets largely ignored hawkish Fed comments. With...

Dollar Stages Comeback as Stellar NFP Triggers Rethink on Fed’s Easing Timeline

Dollar is staging a significant rebound in early US session, fueled by unexpectedly robust Non-Farm Payroll data. This surge was mirrored by a sharp increase in 10-year treasury yield, which is on the verge of reclaiming 4% handle. Conversely, stock futures took a...

US NFP rises 353k, average hourly earnings rises 0.6% mom

US Non-Farm Payroll employment rose 353k in January, significantly surpassing expectation of 178k. Prior month’s growth was also revised sharply higher from 216k to 333k. Both were well above monthly average of 255k growth in 2023. Unemployment rate was unchanged at...

GBP/USD Regains Strength While USD/CAD Dips Again

GBP/USD started a fresh increase above the 1.2625 zone. USD/CAD is declining and trading below the 1.3415 support. Important Takeaways for GBP/USD and USD/CAD Analysis Today The British Pound is eyeing more gains above the 1.2755 resistance. There was a break above a...

GBP/USD: Poised for Potential Bullish Breakout Ex-post BoE

BoE offered dovish guidance but projected that inflation may run hot again in Q1 2025. GBP has remained the top outperformer major currency against the US dollar. Technical analysis suggests a potential bullish breakout for GBP/USD. The British pound sterling (GBP)...

Canadian Dollar Eyes US Nonfarm Payrolls

US nonfarm payrolls expected to drop to 180,000 The week wraps up with the US nonfarm payroll report later today. The ADP employment report, which was released on Wednesday, fell from 158,000 to 107,000. The ADP report isn’t considered a reliable guide for nonfarm...

Is AUDUSD Set for a Break Higher?

AUDUSD sends some encouraging signals But the bulls need to claim the 0.6600 territory US nonfarm payrolls awaited at 13:30 GMT AUDUSD bulls came into action instantly after the price dropped to a more-than-two-month low of 0.6507 to test the ascending trendline from...

GBPJPY Ticks Up in BoE Aftermath

GBPJPY pauses its slide from a fresh 8½-year high Broader long-term uptrend remains in place RSI and MACD soften but remain positive GBPJPY has been in a prolonged uptrend since early 2023, posting a fresh 8½-year high of 188.91 on January 19 before experiencing a...

EUR/CHF Daily Outlook – Action Forex

Daily Pivots: (S1) 0.9309; (P) 0.9325; (R1) 0.9342; More… Further decline could be seen in EUR/CHF with 0.9363 minor resistance intact. But strong support is still expected above 0.9252 low to bring rebound. On the upside, above 0.9363 minor resistance will turn bias...

EUR/AUD Daily Outlook – Action Forex

Daily Pivots: (S1) 1.6453; (P) 1.6529; (R1) 1.6621; More… EUR/AUD failed to break through 1.6671 resistance and retreated sharply. Intraday bias is turned neutral again first. On the upside, decisive break of 1.6671 will revive the case that whole correction from...

EUR/GBP Daily Outlook – Action Forex

Daily Pivots: (S1) 0.8515; (P) 0.8537; (R1) 0.8553; More… EUR/GBP is staying in tight range above 0.8512 and intraday bias remains neutral. On the downside, below 0.8521 will resume the fall from 0.8764 to retest 0.8491. Break there will extend larger down trend to...

EUR/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 158.46; (P) 158.83; (R1) 159.59; More… EUR/JPY recovered quickly after dipping to 158.06. Some support is seen from 158.55 resistance turned support and rising channel for now. Intraday bias stays neutral first. On the downside, sustained break of...

GBP/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 185.67; (P) 186.17; (R1) 187.09; More… GBP/JPY rebounded after brief dip to 185.21 and intraday bias is turned neutral first. On the downside, below 185.21 will extend the correction from 188.90 to 55 D EMA (now at 184.99) and below. On the upside,...

FX option expiries for 2 February 10am New York cut

There aren't any major expiries to take note of for the day. As such, trading sentiment will rely mostly on two main factors today. The first being the obvious i.e. US non-farm payrolls data. The second is the action in the bond market. The strong bid in Treasuries...

Dollar Vulnerable after Dramatic Turnaround, Next Move Hinges on NFP

Dollar had a dramatic turnaround in its fortune overnight, following the significant slide in US 10-year yield, which coincided with robust rally in US stock markets. Major indexes effectively wiped out the sharp declines seen on Wednesday. Anticipation of a Fed rate...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 147.16; (P) 147.54; (R1) 147.99; More… USD/JPY is still holding above 145.97 resistance turned support. Intraday bias stays neutral at this point, and further rally is still in favor. As noted before, corrective fall from 151.89 should have...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8562; (P) 0.8603; (R1) 0.8655; More…. Intraday bias in USD/CHF remains neutral at this point. On the downside, below 0.8550 will resume the fall from 0.8727 for 0.8487 support. Break there will argue that rebound from 0.8332 has completed, and...

Sunset Market Commentary – Action Forex

Markets The Bank of England kept its policy rate unchanged at 5.25% in a 3-way split with two members (Mann & Haskel) preferring a 25 bps rate increase to 5.5% and one member (Dhingra) voting in favour to reduce it by 25 bps to 5%. That compares with consecutive...

ISM manufacturing rises to 49.1, nears expansion threshold, with rising prices and stronger orders

US manufacturing sector, as indicated by ISM Manufacturing PMI, showed signs of resilience in January 2024, slightly missing the mark of expansion. The index climbed from 47.1 to 49.1, surpassing market expectations of 47.7, yet marking the 15th consecutive month of...

Copper Futures Slip after Failing to Break 50% Fibo

Copper prices on the retreat after hitting wall at 50% Fibonacci But head towards breakout from bullish pennant Near-term bias is neutral Copper futures (HGCOP) confirmed the formation of a bullish pennant pattern after failing to post a higher high on Wednesday....

Bank of England Review – Removing the Tightening Bias

At today’s monetary policy meeting the BoE left the Bank Rate unchanged at 5.25% as widely expected. The BoE explicitly removed its tightening bias and signalled a shift to a more neutral stance on monetary policy. The reaction in EUR/GBP was muted with EUR/GBP set to...

AUDCAD Examines Potential Pivot Point

AUDCAD continues to trim gains, reaches key support level Technical picture reflects oversold conditions AUDCAD erased more than half of its October-December upleg to find support around the November 13 low of 0.8755, which overlaps with the 61.8% Fibonacci...

ISM Shows Contraction in U.S. Manufacturing Sector Slowed in January

The ISM Manufacturing Index ticked up to 49.1 in January, handily beating the 47.2 level markets had expected. Four industries reported growth in January, up from one in December. The new orders sub-index flipped to growth, rising 5.5 percentage points (pp) to 52.5....

Will RBA Drop Its Tightening Bias?

RBA stands pat in December after considering a hike Rate cut bets come forth after weak data and slowing inflation But CPI details may allow officials to keep the tightening door open The decision will be announced on Tuesday at 03:30 GMT December’s hawkish hold At...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0820; (P) 1.0838; (R1) 1.0865; More… Intraday bias in EUR/USD is back on the downside with breach of 1.0795 temporary low. Fall from 1.1138 is trying to resume to 1.0722 structural support. Decisive break there will argue that whole rise from...

February seasonals: The worst month of the year for the Nasdaq

There is bad news on the seasonal front as we enter February, it's the second-worst month for the S&P 500 over the past 100 years and the third-worst since the millennium. For the Nasdaq, it's the worst month since 2000. However there is strong evidence behind...

BoE’s Three-Way Split Vote Muddles Sterling’s Path, Yen Strength Continues

Sterling is currently trading with indecisiveness following BoE’s rate decision, which has provoked mixed reactions in the markets. The decision, notable for its combination of hawkish and dovish signals, resulted in a rare three-way voting split—the first occurrence...

US initial jobless claims rises to 224k, abv exp 211k

US initial jobless claims rose 9k to 224k in the week ending January 27, above expectation of 211k. Four-week moving average of initial claims rose 5k to 208k. Continuing claims rose 70k to 1898k in the week ending January 20. Four-week moving average of continuing...

BTCUSD Drops Below 50-day SMA

BTCUSD bounces off 2024 low and reclaims 40,000 But price dips back below 50-day SMA after advance pauses Momentum indicators suggest weakening buying pressures BTCUSD (Bitcoin) experienced a strong decline from its recent two-year peak of 49,051, dropping to as low...

Australian Dollar Falls to 10-Week Low after Fed Decision

The Australian dollar is sharply lower on Thursday after the Fed policy meeting a day earlier. In the European session, AUD/USD is trading at 0.6514, down 0.78%. Earlier, the Australian dollar dropped as low as 0.6508, its lowest level since November 20. Powell says...

BoE stands pat, two vote for hike, one for cut

BoE left the Bank Rate unchanged at 5.25% as widely expected. However, two MPC hawks (Jonathan Haskel and Catherine Mann) voted for another 25bps to 5.50%. Meanwhile, one dove (Swati Dhingra) voted for a 25bps cut to 5.00%. That resulted in a 6-3 vote for the...

JPY Carry Trades Downside Pressure Reinforced Ex-post FOMC

The US Federal Reserve pushed back the first Fed funds rate cut and Fed Chair Powell indicated that the “highly anticipated” March rate cut is not the base case for now. The dovish Fed Pivot narrative is still alive as both the 2-year and 10-year Treasury yields...

News from the Fed Push Down EUR/USD Price to a Year Low

Financial markets were buoyant last night due to news from the Fed. Interest rates remained unchanged — as expected. However, somewhat unexpected was the harsh rhetoric of Jerome Powell, who said that: → interest rate reduction in March is unlikely; → the Fed needs to...

GBPUSD Relies on Support Levels as Bears Stay in Play

GBPUSD exposed to more declines in the short-term Outlook to stay neutral as long as the price holds above 1.2485 BoE policy announcement due at 12:00 GMT GBPUSD came under renewed downside pressure on the first trading day of February, feeling the blues from Powell’s...

Eurozone CPI down to 2.8%, core falls to 3.3%, both above expectations

Eurozone CPI slowed from 2.9% yoy to 2.8% yoy in January, above expectation of 2.7% yoy. CPI core (excluding energy, food, alcohol & tobacco) slowed from 3.4% yoy to 3.3% yoy, above expectation of 3.2% yoy. Looking at the main components, food, alcohol &...

UK PMI manufacturing finalized at 47.0, challenged by cost pressures and supply disruptions

UK PMI Manufacturing was finalized at 47.0 in January, up from December’s 46.2. This modest improvement, however, did not signal an end to the sector’s downturn, with continued contractions observed across key areas. Rob Dobson, Director at S&P Global Market...

WTI Oil Futures Battle With 61.8% Fibo

WTI futures retreat after hitting 2-month high Violate 200-day SMA but 61.8% Fibo pauses decline Momentum indicators weaken but remain positive WTI oil futures (March delivery) had been staging a comeback from the December bottom of 68.00, jumping above both the 50-...

Nikkei (NKD_F) Looking for Further Downside Correction

Short Term Elliott Wave view in Nikkei (NKD_F) suggests that rally to 37014 ended wave 3. Wave 4 pullback is currently in progress as a double three Elliott Wave structure. Down from wave 3, wave (a) ended at 36060 and wave (b) ended at 36590. Down from there, wave i...

Banking Jitters Propel Yen to Forefront, Overshadowing Fed; BoE Next

In a week crowded with high-profile events like FOMC rate decision overnight and the upcoming BoE meeting today, Japanese Yen is surprisingly stealing the show as the star performer in the currency markets. This rally in Yen’s can be attributed to the significant drop...

FX option expiries for 1 February 10am New York cut

There aren't any major expiries to take note of for the day. As such, trading sentiment will continue to revolve around the same elements as we got from yesterday. The first of which will be the shift in the Fed rates outlook. The central bank said that a rate cut in...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2653; (P) 1.2687; (R1) 1.2734; More… Range trading continues in GBP/USD and intraday bias remains neutral. Another fall cannot be ruled out, but downside should be contained above 1.2499 support to bring rebound. On the upside, firm break of...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0820; (P) 1.0838; (R1) 1.0865; More… Intraday bias in EUR/USD is turned neutral first with current recovery. But further decline is expected as long as 1.0931 minor resistance holds. Below 1.0795 will resume the fall from 1.1138 to 1.0722...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8602; (P) 0.8622; (R1) 0.8639; More…. USD/CHF’s fall from 0.8727 resumed by breaking 0.8605 temporary low. Intraday bias is back on the downside for 0.8487 support. Break there will argue that rebound from 0.8332 has completed, and bring retest of...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 147.16; (P) 147.54; (R1) 147.99; More… USD/JPY’s consolidation from 148.79 is still in progress and intraday bias remains neutral. With 145.97 resistance turned support intact, further rally is in favor. As noted before, corrective fall from 151.89...

Canada’s Economy Beat Expectations in November, Strong Growth Expected for December

The Canadian economy bucked the trend of flat growth over the past several months, growing by 0.2% on a month-on-month (m/m) basis in November. This print comes in above Statistics Canada’s advanced guidance and market expectations for a 0.1% m/m gain. The flash...

Anticipating Fed: Potential Disruptions in Dollar’s Calm

The pause in the currency market is dragging on. Over the past two weeks, the Dollar Index has risen 0.15%, although intraday volatility has been within normal limits. This is by no means a balanced market but rather a manifestation of a wait-and-see attitude....

Sunset Market Commentary – Action Forex

Markets A busy eco calendar provided some distraction in the run-up to tonight’s FOMC gathering. French January CPI slowed more than forecast in January (-0.2% M/M & 3.4% Y/Y), balancing yesterday’s upward Spanish surprise. German Bunds immediately attempted to...

Will Fed Hint at a March Hike or Just Leave the Door Slightly Ajar?

It’s been a relatively slow start to trading on Wednesday which isn’t surprising considering what’s to come later in the day. On another day, earnings from Alphabet and Microsoft may have dictated sentiment in the broader markets but as it is, investors are more...

Dollar Dips on Weak ADP Jobs Data; Markets Await FOMC Outcome

Dollar weakens slightly in early US session, as dragged down by disappointing ADP private sector job data. Despite this, the downturn is contained, as market participants remain cautious ahead of FOMC rate decision later in the day. While no changes in interest rates...

Canada’s GDP grows 0.2% mom in Nov, primarily driven by goods-production sectors

Canada’s GDP grew 0.2% mom in November, above expectation of 0.1% mom. Growth was primarily driven by goods-producing industries, which marked the highest expansion rate since January 2023 at 0.6% mom. Services-producing industries experienced a modest increase of...

US ADP jobs grows 107k, below expectation 143k

US ADP private employment grew 107k in January, below expectation of 143k. By sector, goods-producing jobs rose 30k while service-providing jobs rose 77k. By establishment size, small companies added 25k jobs, medium added 61k, large added 31k. Pay gains for...

Australian Dollar Lower After Soft CPI Data

The Australian dollar has lost ground after Australia’s CPI was lower than expected. In the European session, AUD/USD is trading at 0.6578, down o.37%. The Aussie continues to struggle and has declined 3.4% in January. Australia’s CPI eases to 3.4% Australia’s...

Dollar Index Standing at the Front Foot Ahead of Fed

The dollar index firmed on Wednesday, as markets await the Fed rate decision, at the end of the first policy meeting this year. Although the price rose slightly, it remains within the larger congestion and lacks direction as a number of long-legged Doji candles in pat...

ECB’s de Guindos see lower growth and inflation than Dec forecasts

ECB Vice President Luis de Guindos, in an interview with Die Zeit, offered indicated that the growth forecast for the region, previously set at 0.8% for this year, might fall short of expectations. De Guindos highlighted several factors contributing to this revised...

How Will Eurozone Flash CPI Affect Euro?

Preliminary CPI inflation to slow down in January Investors to stick to their rate cut projections as GDP stagnates FOMC policy announcement might have a bigger impact on EURUSD Eurozone economy avoids recession but not Germany It’s not a secret that the Eurozone has...

NASDAQ Falls by 1.5% after Tech Giants Reports

NASDAQ E-Mini futures fell 1.5% in early trading after the publication of quarterly earnings reports from technology giants Google (GOOG), Microsoft (MSFT) and Advanced Micro Devices (AMD): → The parent company of Google, Alphabet Inc., reported revenue of 86.3...

Gold Price and Crude Oil Price Eye Additional Gains

Gold price started a decent increase above the $2,025 resistance level. Crude oil prices are gaining bullish momentum and might rise toward $82.00. Important Takeaways for Gold and Oil Prices Analysis Today Gold price started a decent increase from the $2,025 zone...

Gold Develops Ascending Triangle in Near-Term