Forex

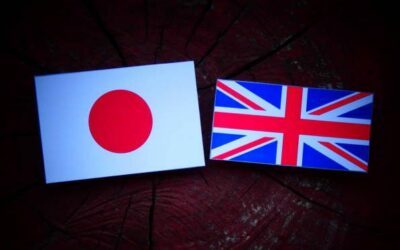

GBPJPY Trades Lower Ahead of Key Market Events

GBPJPY is in the red again today, not far from its recent high It has dropped below the January 2, 2024 ascending trendline Momentum indicators are in waiting mode for the next key market events GBPJPY is trading lower again today as the market is preparing for...

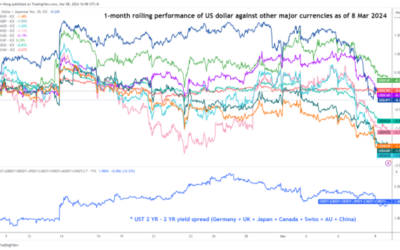

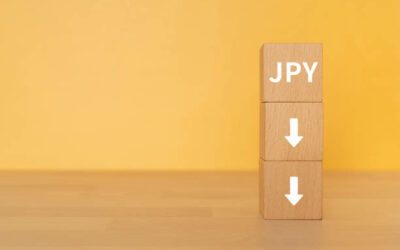

BoJ Ueda’s Rate Hike Musings Propel Yen, Dollar Regains Ground on Risk Aversion

Japanese Yen rebounded broadly in Asian session today, shot up by comments from BoJ Governor Kazuo Ueda regarding the conditions for future interest rate hikes. Ueda’s discussion, while not immediately setting the stage for rate increases, could be taken as a sign to...

EUR/USD Extends Gains as Euro Services PMIs Improve

The euro is on a bit of a roll and has pushed slightly higher on Thursday. In the European session, EUR/USD is trading at 1.0857, up 0.19%. The euro is up for a third straight day and has climbed 0.8% since Monday. Eurozone and German services PMIs accelerate Business...

AUD/USD: Strong Recovery Cracks Pivotal Barriers at 0.6600 Zone

AUDUSD rallies for the third straight day, lifted by weaker US dollar and downbeat US services PMI data (released on Wednesday). Bulls cracked pivotal 0.6600 resistance zone (double-Fibo/100DMA/round-figure), trading at these levels for the first time since Mar 21....

BTCUSD Pauses Pullback But Still Under Pressure

BTCUSD halts its retreat and recoups some losses But momentum indicators remain tilted to the downside BTCUSD (Bitcoin) experienced a strong pullback following its repeated inability to conquer the 71,750 hurdle. Although the price seems to be finding its footing in...

(ECB) Monetary policy accounts – Action Forex

Account of the monetary policy meeting of the Governing Council of the European Central Bank held in Frankfurt am Main on Wednesday and Thursday, 6-7 March 2024 4 April 2024 1. Review of financial, economic and monetary developments and policy options Financial market...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0788; (P) 1.0812; (R1) 1.0861; More… Intraday bias in EUR/USD remains on the upside at this point. Rise from 1.0723 is seen as the third leg of the corrective pattern from 1.0694. Further rally would be seen to 1.0941/0980 resistance zone. On the...

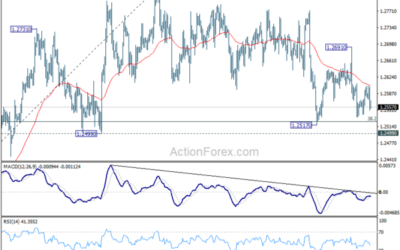

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2592; (P) 1.2624; (R1) 1.2685; More… Immediate focus is now on 1.2667 resistance. Firm break there will suggest that fall from 1.2892 has completed at 1.2538. Intraday bias will be turned back to the upside for 1.2802 resistance next. On the...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.9005; (P) 0.9050; (R1) 0.9074; More…. Intraday bias in USD/CHF remains neutral for consolidation below 0.9094. On the downside, break of 55 4H EMA (now at 0.9018) will bring deeper pullback. But downside should be contained by 0.8884 resistance...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 151.44; (P) 151.70; (R1) 151.96; More… No change in USD/JPY’s outlook as range trading continues. Intraday bias remains neutral. On the downside, break of 151.02 support should confirm short term topping, and turn bias back to the downside for 55 D...

Sunset Market Commentary – Action Forex

Markets What a difference a revision makes… So often overlooked final figures of monthly (EMU) PMI broke headlines today. The euro area economy returned to growth for the first time since May 2023 after an upwardly adjusted composite PMI (50.3 from 49.9). Further...

Swiss Franc Dips as Swiss Inflation Falls

The Swiss franc is lower on Thursday. Early in the North American session, USD/CHF is trading at 0.9050, up 0.24%. It has been a bumpy year for the Swiss franc, which is down 7.7% against the US dollar and is trading at its lowest level since November. Switzerland’s...

EUR/USD Surges Following Powell’s Remarks on Interest Rates

The EUR/USD pair moved upward to 1.0844 on Thursday, marking an unexpected shift following a period of strong US dollar performance. This change in dynamics can be attributed to investors’ positive response to comments made by US Federal Reserve Chair Jerome Powell...

CHF Renewed Its Decline on Weak Inflation

Weak Swiss inflation renewed the downward momentum of the franc, which is losing over 0.5% against the euro, sending EURCHF to highs last seen in May 2023. The Swiss Consumer Price Index was virtually unchanged for March, with annual inflation slowing to just 1.0% –...

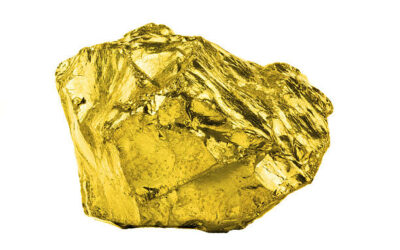

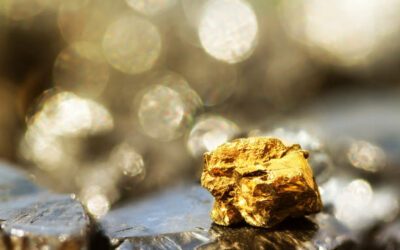

Gold Too Hot – Action Forex

Overnight, the gold price briefly exceeded $2300, recording another round level, not counting an update of the all-time high. This is an occasion to assess gold’s prospects, which are becoming a little less unambiguous. Touching the level of $2300 marked the...

Swiss Franc Plummets on CPI Data Which Fuels Expectations of Further SNB Easing

Swiss Franc faced broad selling pressure in European session, driven by CPI lower than CPI data. Inflation in Switzerland slowed to its lowest since September 2021 at 1.0%, and remained within the SNB’s target range for the tenth consecutive month. This development...

ECB March meeting accounts: Consensus against immediate rate cut, eyes on June for Data

ECB’s March meeting accounts unveiled a unified stance among Governing Council members against discussing rate cuts at that time, citing it as “premature.” However, the narrative within the ECB is evolving, with increasing acknowledgment that “the case for considering...

USDJPY Hovers Beneath 152 Ceiling as Bulls Refuse to Give Up

USDJPY remains stuck within 151-152 range Neutral trend looks safe for now But strong support keeps bullish forces alive USDJPY has been gradually inching higher after dropping near the floor of the sideway range at the end of March to briefly touch 151.01. Prices...

Gold Rally Turns Golden After Another Record

Gold unlocks fresh all-time high Bullish wave could stabilize, but perhaps temporarily Gold has been in an uninterrupted record rally over the past week, ticking to a new high of 2,304 before losing some steam early on Thursday. While investors continue to debate the...

GBP/USD: Slight Bullish Bias Above 200-DMA But Thin Daily Cloud Still Significant Obstacle

Cable extends recovery from 1.2540 double bottom (Apr 1 / 2 lows) and pressuring significant barrier at 1.2674 (daily cloud top / Fibo 38.2% of 1.2893/1.2539), as bulls regained traction after a false break below pivotal 200DMA support (1.2586). Near-term action is...

WTI Futures Surge to a 5-month High

WTI futures in a steady advance since early December Posted a fresh 5-month peak before paring some gains Oscillators point to overbought conditions WTI oil futures (May delivery) have been in a slow but constant recovery from their December bottom of 67.97, posting a...

AUDUSD Continues the Bounce Off 0.6475 Mark

AUDUSD holds within trading range Prices rise above SMAs RSI indicates more gains AUDUSD is surging after the rebound off the 0.6475 support level, surpassing the simple moving averages (SMAs) and extending its move towards the 0.6633 barrier, which is acting as the...

Eurozone PMI services finalized at 51.5, gradually finding its footing

Eurozone PMI Services was finalized at 51.5 in March, up from February’s 50.2, a 9-month high. PMI Composite was finalized at 50.3, up from prior month’s 49.2, a 10-month high. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said the service sector is...

UK PMI Services finalized at 53.1, inflation pressures persist

UK PMI Services was finalized at 53.1 in March, down from February’s 53.8. PMI Composite was finalized at 52.8, down from prior month’s 53.0. Tim Moore, Economics Director at S&P Global Market Intelligence, said, “The solid growth rate achieved in March reinforces...

Fed Powell and Soft Data Dampen Dollar, While Commodity Boom Propels Aussie

Dollar was sold off overnight after weaker than expected ISM Services data, and the weakness persisted following comments from Fed Chair Jerome Powell. Powell downplayed the significance of recent robust labor and inflation figures, suggesting them as fluctuations in...

Gold Hits Record High; Silver Peaks on Fed Rate Cut Speculation

Gold prices have soared to an all-time high of 2288.00 USD per troy ounce, while silver reached its highest in two years, driven by speculation surrounding the US Federal Reserve’s monetary policy. This surge followed comments from two Fed officials, Mary Daly of the...

USD/JPY Analysis: Calm Before the Storm?

The USD/JPY chart today shows that the rate has stabilized at 152 yen per US dollar. But can we say that there is calm in the market? Hardly. First, it is important to note that in 2023 there was a sharp reversal of trend around the 152.00 level due to intervention by...

Start of Correction, Or Support Already in Play?

Market picture Crypto market capitalisation is down 1% in 24 hours but has seen a cautious rise from a low of $2.43 trillion to $2.51 trillion since the start of the day on Wednesday. The Cryptocurrency Fear and Greed Index has rolled back to 71 (“Greed”) after over a...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 151.41; (P) 151.61; (R1) 151.75; More… USD/JPY is staying in tight range below 151.96 and intraday bias remains neutral. On the downside, break of 151.02 support should confirm short term topping, and turn bias back to the downside for 55 D EMA (now...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.9050; (P) 0.9071; (R1) 0.9100; More…. USD/CHF’s rally is in progress and intraday bias stays on the upside. Current rise is in progress for 0.9243 key resistance next. On the downside, break of 0.9005 support is needed to indicate short term...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2552; (P) 1.2565; (R1) 1.2592; More… Intraday bias in GBP/USD remains neutral as consolidations continue above 1.2538. But risk will stay on the downside as long as 1.2667 resistance holds, in case of recovery. Below 1.2538 will target 1.2517...

US ISM services falls to 51.4, prices down sharply to 53.4

US ISM Services PMI fell from 52.6 to 51.4 in March, below expectation of 52.8. Business activity/production ticked up from 57.2 to 57.4. New orders fell from 56.1 to 54.4. Employment rose slightly from 48.0 to 48.5. Prices fell sharply from 58.6 to 53.4. ISM said:...

Will NFP Report Take June Off the Rate-Cut Map?

Investors have second thoughts about a Fed rate cut in June Dollar benefits from latest market repricing Spotlight turns to the NFP data on Friday at 12:30 GMT Data and Fed rhetoric weigh on Fed rate cut bets At its latest gathering, the Fed appeared more dovish than...

Preview of RBNZ: Nothing to See Here

We expect the RBNZ will leave the OCR at 5.5% at its April policy review. We think the RBNZ will remain comfortable with the forward outlook communicated in the February Monetary Policy Statement. GDP growth was slightly weaker than expected – but the impact is very...

Sunset Market Commentary – Action Forex

Markets: EMU Flash March CPI ‘eased’ slightly more than expected from 2.6% Y/Y to 2.4% Y/Y. Core inflation (ex-energy) dropped from 3.1% to 2.9%, the first sub 3% reading since February 2022. Food price inflation slowed further from 3.9% to 2.7%. Energy inflation was...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0736; (P) 1.0758; (R1) 1.0790; More… Intraday bias in EUR/USD remains neutral for consolidation above 1.0723. But risk will stay on the downside as long as 1.0834 support turned resistance holds, in case of recovery. Below 1.0723 will bring retest...

Fed’s Bostic eyes first rate cut in Q4, citing sluggish inflation decline

In a CNBC interview today, Atlanta Fed President suggested that rate cuts could be on the horizon by the end of 2024, contingent on the economy’s performance. Bostic outlined a scenario where “continued robustness in GDP, unemployment, and a slow decline of inflation...

Markets Unmoved by Eurozone CPI and US ADP Reports, Await Further Cues

The forex markets showed rather muted response to the latest batch of economic data released today. Euro has continued its near-term recovery, unaffected by Eurozone’s lower than expected CPI flash data coming. This lack of response likely stems from the understanding...

US ADP jobs rises 184k, pay growth heating up

US ADP private employment grew 184k in March, above expectation of 150k. By sector, goods-producing jobs increased 42k while service-providing jobs increased 142k. By establishment size, small companies added 16k jobs, medium companies added 93k, large companies added...

Silver Exits Long-Term Range – Action Forex

Silver’s future prospects turn brighter after reaching a two-year peak A retreat fueled by profit-taking is a risk in the short term Silver advanced to a two-year high of 26.54 on Wednesday, finally breaking the wide consolidation phase that started in May 2023. The...

EUR/USD Drifting as Eurozone Inflation Drops

The euro is showing little movement on Wednesday. In the European session, EUR/USD is trading at 1.0777, up 0.05%. Eurozone inflation ticks lower Inflation in the eurozone continues to decline. March CPI eased to 2.4% y/y, down from 2.6% in February and below of the...

XAU/USD: Healthy Correction Likely to Precede Fresh Push Higher

Gold edges lower from new record high ($2288) in early Wednesday, as bulls show signs of fatigue after advancing over 5% in a steep acceleration in past six days. Although the metal resumed the uptrend in early April, after an impressive 9.3% rally in March, remaining...

Gold Price XAU/USD Sets Another All-Time High

The XAU/USD gold chart today indicates that the price of the metal has exceeded USD 2,250 per ounce. Causes: → Geopolitical tensions. Military conflicts in Ukraine and the Middle East do not subside, the threat of terrorist attacks is growing, and new hot spots may...

EUR/USD Starts Recovery, USD/CHF Could Extend Gains

EUR/USD is attempting a recovery wave from the 1.0725 zone. USD/CHF climbed higher above 0.9070 and might extend gains in the near term. Important Takeaways for EUR/USD and USD/CHF Analysis Today The Euro declined toward 1.0725 before it started a recovery wave...

Eurozone CPI slows to 2.4% in Mar, core down to 2.9%, below expectations

Eurozone headline CPI slowed from 2.6% yoy to 2.4% yoy in March, below expectation of 2.5% yoy. CPI core (ex energy, food, alcohol & tobacco) slowed from 3.1% yoy to 2.9% yoy, below expectation of 3.0% yoy. Looking at the main components services is expected to...

NZDUSD Halts Decline at 23.6% Fibonacci

NZDUSD declines sharply within descending channel Drops below both 50- and 200-day SMAs to a 4-month low Oscillators remain deep in their negative territories NZDUSD has been in an aggressive downtrend since its double rejection at the 0.6217 level in early March....

Dollar Sees Mild Retreat Ahead of ISM Services, Gold Extends Record Run

Dollar retreated mildly following comments from two FOMC members, including a known hawkish figure, reiterating expectations for three interest rate cuts within the year. Despite this, the retreat remains subdued as there is no guarantee yet for a June cut. Fed’s...

WTI Oil: Brightening Demand Outlook Continues to Inflate the Price

WTI oil price continues to trend higher and hit five-month high on Tuesday, probing above $85.00 barrier for the first time since late October. The last bull-leg extends into fourth consecutive day, underpinned by brightening demand outlook on firmer than expected...

Pound Stabilizes as Shop Inflation Drops

The British pound is steady on Tuesday after starting the week with losses. In the European session, GBP/USD is trading at 1.2563, up 0.09%. On Monday, the pound fell 0.57% and dropped as low as 1.2539, its lowest level since February 14. UK shop inflation eases to...

Consolidation Not Going According to Plan

Market picture The crypto market lost 4% in 24 hours, falling to a capitalisation of $2.53 trillion. Bitcoin (-3.7%), Ethereum (-4.5%) and BNB (-3.5%) are all down by the same amount. Solana (-6.4%) and Doge (-7.9%) are lagging the market, not to mention the...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.9014; (P) 0.9036; (R1) 0.9066; More…. USD/CHF’s rally resumed by breaking through 0.9070 temporary top and intraday bias is back on the upside. Current rally is in progress for 0.9243 key resistance next. On the downside, break of 0.9005 support...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 151.33; (P) 151.55; (R1) 151.88; More… Range trading continues in USD/JPY and intraday bias remains neutral. On the downside, break of 150.25 support should confirm short term topping, and turn bias back to the downside for 55 D EMA (now at 149.35)....

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2513; (P) 1.2578; (R1) 1.2617; More… GBP/USD’s decline is still in progress and intraday bias stays on the downside for 1.2517 structural support. Decisive break there will suggest that rise from 1.2036 has completed at 1.2892 already, and turn...

EURUSD Gets Set to Go

The slowdown in German inflation is fuelling hopes that the ECB will ease policy in the coming months. German CPI rose 0.4% m/m, weaker than the 0.5% expected. Annual inflation slowed from 2.5% in February to 2.2% in March, the lowest since May 2021. Germany’s reading...

Australian Central Bank Meeting Removes Rate Hike Option – Minutes

The Reserve Bank of Australia minutes of the March meeting indicated that there was no mention of raising interest rates. This points to a less hawkish stance but the Australian dollar is unchanged following the release of the minutes. Reserve Bank drops reference to...

Sunset Market Commentary – Action Forex

Markets Core bonds dropped with a continued rise in oil prices ($88.5/b) serving as a common factor. German Bunds underperform US Treasuries. That’s partially a catch-up move as European markets missed out on US action yesterday (Easter Monday). German yields add...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0716; (P) 1.0758; (R1) 1.0784; More… EUR/USD’s decline is still in progress and intraday bias stays on the downside for 1.0694 support. Decisive break there will resume the whole decline from 1.1138 and target 100% projection of 1.1138 to 1.0694...

Swiss Franc Falls Amid Surging Treasury Yields and Manufacturing Optimism

Currency markets shifted their attention towards the sell-off in Swiss Franc today, a reaction to the substantial rally observed in European and US treasury yields. With the 10-year yields in Germany and UK climbing back above 2.4% and towards 4.1% respectively, and...

Dollar Strengthens Following Positive Manufacturing Data

The EUR/USD pair has dipped to its lowest since 15 February this year following the release of encouraging data regarding the US manufacturing sector’s activity on Monday. This improvement, the first since September 2022, has bolstered the US dollar’s position. The...

Oil Clears Way for Growth Above $90

Oil prices have been hitting five-month highs, and every trading session has been rising since 27 March. The price of a barrel of WTI reached $84.6 at the start of the day on Tuesday before retreating slightly by midday in Europe. To some extent, oil is managing to...

ECB consumer survey reveals 1-yr inflation expectations drop to 3.1%, a two-year low

ECB’s Consumer Expectations Survey for February indicated continuing decline in consumers’ median inflation perceptions over the past 12 months, marking a fifth consecutive month of decrease, settling at 5.5% down from 6.0% in January. Furthermore, median expectations...

Elliott Wave Analysis on USD/JPY: Correction Within Uptrend

JPY came down across the board, even though BOJ decided to end its ultra-loose policy, by raising rates for 10bp in March. USDJPY is coming higher anyhow, with price breaking some very important trendline connected from 2023 highs. It can even represent part of a...

EURJPY Pulls Back Towards Crucial Trendline

EURJPY retraces lower following a 16-year peak Tests ascending trendline drawn from July 2023 Oscillators suggest weakening momentum EURJPY had been in a steady advance since December 2023, peaking at a fresh 16-year high of 165.34 on March 20. Since then, the pair...

Eurozone PMI manufacturing finalized at 46.1, two largest cylinders out of action

Eurozone PMI Manufacturing was finalized at 46.1 in March, down from February’s 46.5. Disparities across member countries continued, with Greece achieving a 25-month high at 56.9, Italy at 12-month high at 50.4, and Spain dipped slightly to 5.1.4. Meanwhile, Germany...

UK PMI manufacturing finalized at 50.3, signaling first growth since July 2022

UK PMI Manufacturing was finalized at 50.3 in March, climbing from February’s 47.5 to mark a 20-month high. This development represents the sector’s first move above the critical 50.0 threshold since July 2022, indicating a tentative resurgence in manufacturing...

EUR/USD outlook: Bears Eye 2024 low

The Euro fell to new multi-week low early Tuesday, weighed by firm dollar and recent dovish comments from ECB policymakers, who see four rate cuts in 2024. Monday’s 0.4% drop and close below 1.0762 (Fibo 76.4% of 1.0695/1.0981 upleg), adds to bearish near-term outlook...

GBPUSD Starts April With a Drop

GBPUSD moves sharply down on the first trading day of April 2024 neutral trajectory valid above 1.2500 GBPUSD plummeted to a six-week low of 1.2538 as investors returned from the Easter holiday break, re-establishing the downward pattern from the March high. Given the...

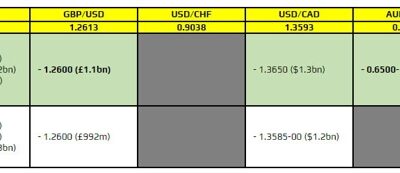

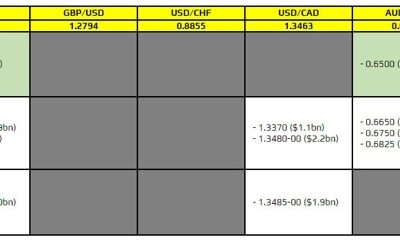

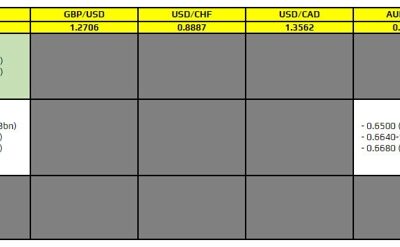

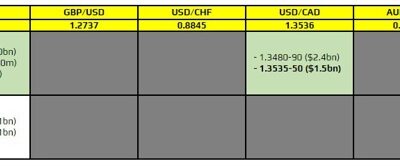

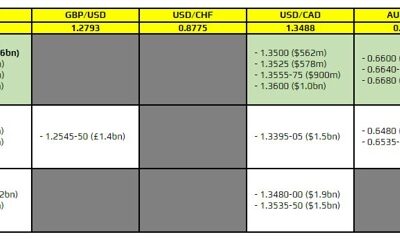

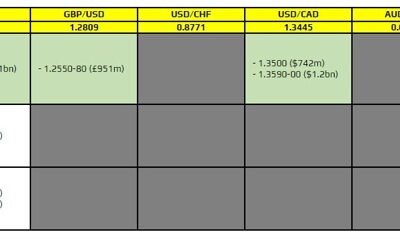

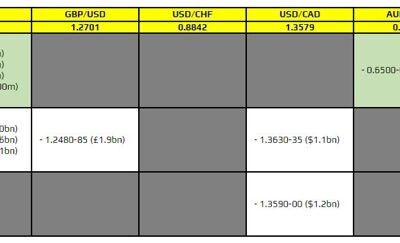

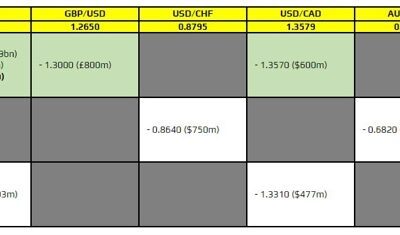

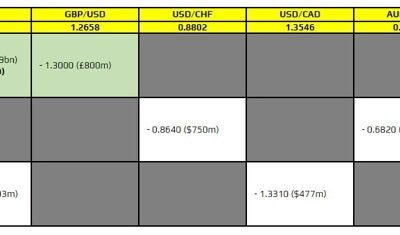

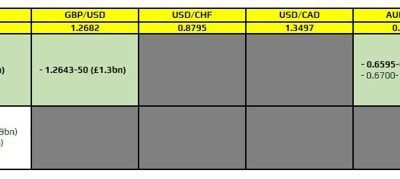

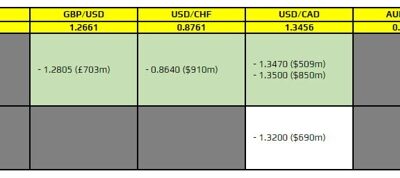

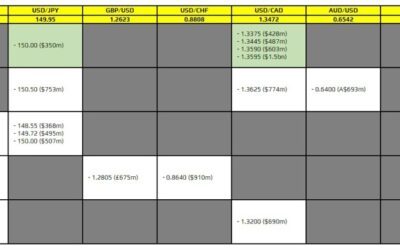

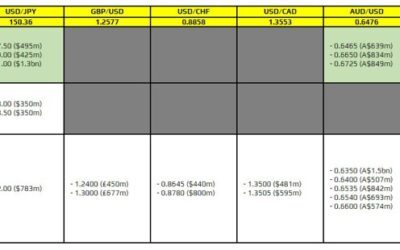

FX option expiries for 2 April 10am New York cut

There is just one to take note of, as highlighted in bold.That being for EUR/USD at the 1.0735 level. With the dollar in the driver's seat, the expiries may not matter too much as the level isn't technically significant. At best, it could limit price action before...

Dollar Strength Persists as Markets Await Fed Speakers

Dollar stayed broadly firm in Asian session today, after rallying on robust manufacturing data and significant rebound in treasury yields overnight. The spotlight now shifts to upcoming comments from Fed officials, including Governor Michelle Bowman and New York Fed...

USD/CAD Daily Outlook – Action Forex

Daily Pivots: (S1) 1.3528; (P) 1.3545; (R1) 1.3560; More… Intraday bias in USD/CAD remains neutral as range trading continues. On the upside, decisive break of 1.3612 resistance will resume whole rise from 1.3176 towards 1.3897 resistance. On the downside, firm break...

April seasonals: Soggy weather, sizzling markets

March seasonals provided a good clue for what might happen in the month. For starters, March is the second-strongest month for USD/JPY and that was tailwind as the pair rose to the 152.00 level after an early-month dip on BOJ tightening reports.In March I wrote:The...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2608; (P) 1.2626; (R1) 1.2643; More… GBP/USD’s fall from 1.2892 resumed by breaking 1.2574 support. Intraday bias is back on the downside for 1.2517 structural support first. Decisive break there will suggest that rise from 1.2036 has completed at...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0772; (P) 1.0789; (R1) 1.0810; More… EUR/USD’s fall from 1.0980 continues today and intraday bias remains on the downside. Next target is 1.0694 support. Decisive break there will resume the whole decline from 1.1138 and target 100% projection of...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.9007; (P) 0.9018; (R1) 0.9029; More…. USD/CHF is staying below 0.9070 resistance despite current recovery. Intraday bias remains neutral first. Nevertheless, further rally is expected as long as 0.8964 support holds. Firm break of 0.9070 will...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 151.18; (P) 151.34; (R1) 151.51; More… USD/JPY is staying below 151.96 resistance despite current recovery. Intraday bias remains neutral first. On the downside, break of 150.25 support should confirm short term topping, and turn bias back to the...

Wedge Issue: What’s Driving the Gap Between CPI and PCE Inflation?

Summary Progress in reining in inflation is further along by some measures relative to others. The gap between the two most prominent measures of U.S. inflation—the Consumer Price Index (CPI) and PCE deflator—is unusually wide at present. At 3.8%, the year-over-year...

Bitcoin Remains Within Extended Range

Bitcoin edged lower on Monday but remains within the longer range which extends into seventh consecutive day. Near-term action remains sideways and looking for stronger direction signals, as daily studies are mixed (fading positive momentum / MA’s in bullish setup),...

Post-Holiday Forex Awakening: Dollar Strengthens on Surprising ISM Manufacturing Expansion

The forex markets roared back to life from holiday lull in early US session, Dollar surges broadly as buoyed by unexpectedly strong ISM manufacturing data. This report marks a pivotal shift for the sector, which has transitioned back into expansion after 16 months of...

US ISM manufacturing rises to 50.3, first expansion in 16 mth, prices surge

US ISM Manufacturing PMI rose from 47.8 to 50.3 in March, above expectation of 48.5. The sector is now back in expectation for the first time since September 2022. Looking at some details, new orders rose from 49.2 to 51.4. Production jumped from 48.4 to 54.6....

AUD/USD Daily Report – Action Forex

Daily Pivots: (S1) 0.6502; (P) 0.6517; (R1) 0.6530; More…. AUD/USD recovered after dipping to 0.6484 and intraday bias is neutral at this point. Risk will remain on the downside as long as 0.6633 resistance holds. Firm break of 0.6484 support will indicate that larger...

Japanese Yen Yawns After Mixed Business Confidence Report

The Japanese yen is coming off a quiet week and is showing little movement on Monday. In the European session, USD/JPY is trading at 151.38, up 0.03%. Business confidence among major manufacturers falls The Bank of Japan’s Tankan business confidence survey was a mix...

Pound’s Pause Before Dive – Action Forex

The British Pound has spent the past week in a tight 500 pip range but has mostly traded around the 1.2620 level. Attempts by the bears to send the GBPUSD into a downtrend like the EURUSD have so far failed, with the pair finding buyers on dips towards the 200-day...

Bitcoin Sets the Stage for Growth

Market picture The crypto market capitalisation fell to $2.63 trillion. – the bottom of the range for the week. The top coins have moved without momentum over the past 24 hours, with losses for BTC (-0.9%), Ethereum (-1.9%) and BNB (-3%), but gains for Solana (1.4%),...

USD/CHF Daily Outlook – Action Forex

Daily Pivots: (S1) 0.9007; (P) 0.9018; (R1) 0.9029; More…. Intraday bias in USD/CHF remains neutral at this point. Some more consolidations could be seen, but further rally is expected as long as 0.8964 support holds. Firm break of 0.9070 will resume larger rise from...

XAU/USD: Gold Hits New Record High on Growing Hopes for Fed Rate Cut in June

Gold hit new record high ($2265) in early Monday’s trading, as markets reopened after Good Friday’s pause. The metal starts the month in firm bullish mode, after softer US inflation data boosted expectations for Fed’s first rate cut in June (bets currently show 69%...

GBP/USD Daily Outlook – Action Forex

Daily Pivots: (S1) 1.2608; (P) 1.2626; (R1) 1.2643; More… Intraday bias in GBP/USD remains neutral as range trading continues. Risk stays on the downside as long as 1.2666 support turned resistance. Below 1.2574 will resume the fall from 1.2892 to 1.2517 structural...

USD/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 151.18; (P) 151.34; (R1) 151.51; More… Intraday bias in USD/JPY remains neutral as range trading continues below 151.96. On the downside, break of 150.25 support should confirm short term topping, and turn bias back to the downside for 55 D EMA (now...

EUR/USD Daily Outlook – Action Forex

Daily Pivots: (S1) 1.0772; (P) 1.0789; (R1) 1.0810; More… Intraday bias in EUR/USD remains on the downside for the moment. Fall from 1.0980 should target 1.0694 support first. Break there will resume the whole decline from 1.1138 and target 100% projection of 1.1138...

Gold Flies to Consecutive Record Highs

Gold advances sharply in the past few sessions Extends its streak of new all-time highs Momentum indicators suggest overbought conditions Gold has experienced a massive surge following its profound break above the 50-day simple moving average (SMA) in the beginning of...

EURUSD’s Recent Bearish Tendency to be Tested this Week

EURUSD trades sideways in anticipation of this week’s key market events It remains below the various simple moving averages employed Momentum indicators support the current bearish move EURUSD is moving sideways today amidst a quieter start of the week due to the...

Nikkei Dips on New Fiscal Year, Gold Soars to New Highs, Currencies Unmoved

Activity in global financial markets remain generally subdued due to the extended Easter holiday in many regions. Nevertheless, Japan’s markets kicked off the new fiscal year on a tumultuous note, with Nikkei index having a sharp sell-off. Analysts have largely...

Weekly Economic & Financial Commentary: The First of Many Ticks Higher in the Longer-Run Median Dot

Summary United States: Steady, As She Goes This week’s economic data largely reinforced existing economic growth patterns. Consumer momentum remains largely intact, inflation continues to inch back down, albeit at a slower pace, and rate-sensitive sectors stayed in a...

Summary 4/1 – 4/5

Monday, Apr 1, 2024 Tuesday, Apr 2, 2024 Wednesday, Apr 3, 2024 Thursday, Apr 4, 2024 Friday, Apr 5, 2024 The post Summary 4/1 – 4/5 appeared first on Action Forex.

Currency Pairs To Trade In April

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you...

USD/JPY Could Consolidate Before Fresh Increase

Key Highlights USD/JPY climbed higher above the 150.50 and 151.20 resistance levels. A major bullish trend line is forming with support at 150.60 on the 4-hour chart. EUR/USD could gain bearish momentum below 1.0820. Crude oil prices are accelerating above the $82.50...

The Weekly Bottom Line: Fed in No Rush to Cut Interest Rates

U.S. Highlights New home sales fell in February, but remain fairly flat over the past three months. New home prices, meanwhile, continued to head lower last month, and are now down 13% from their 2022 peak. U.S. GDP growth in the fourth quarter of 2023 was revised up...

ECB’s Villeroy champions agile gradualism over wait-and-see in rate cut strategy

ECB Governing Council member Francois Villeroy de Galhau said in a speech overnight that risks to inflation are now “balanced”, but risks to growth are “on the downside”. There, “the time has come to take out an insurance against this second risk by beginning rate...

US PCE price index rises to 2.5% yoy in Feb, core PCE down to 2.8% yoy

US personal income rose 0.3% mom or USD 66.5B in February, below expectation of 0.4% mom. Personal spending rose 0.8% mom or USD 145.5B, above expectation of 0.8% mom. PCE price index rose 0.3% mom below expectation of of 0.4% mom. Core PCE price index (excluding food...

S&P500’s Soft Growth Could Last for Months

The US equity market continued its upward trend, with the S&P500 rising 10.8% in the first quarter, exceeding the historical average gain for a full calendar year. We are even more impressed by the low volatility of the index since the end of January. The...

Week Ahead – Rate Cut Hopes Rest on US Jobs Report and Eurozone Flash CPI

Nonfarm payrolls report and European flash CPI to shape rate cut bets ISM PMIs to also be important for Fed expectations and US dollar Canadian employment and Chinese PMIs also on the agenda Fed hawks rear their ugly heads The March round of policy meetings reinforced...

EUR/USD Falls to Five-Week Low

The euro has edged lower on Friday. In the European session, EUR/USD is trading at 1.0782, down 0.05%. It has been a bumpy road for the euro in 2024, as the currency has declined 2.3% so far this year. Earlier today, EUR/USD dropped as low as 1.0768, its lowest level...

GBP/USD: Cable Moves Within Extended Range Ahead of Key US Data

Cable remains in extended sideways mode, with a narrow range on holiday-thinned markets on Good Friday. Near-term action is ranging between 200DMA (1.2588) and thin daily cloud (spanned between 1.2634 and 1.2663), with predominantly bearish daily studies keeping the...

Dollar Edges Lower as PCE Inflation Data Aligns with Expectations, Gold Hits Record

Dollar dips mildly in the wake of the latest PCE inflation data, which largely met market expectations without delivering any significant surprises. Notably, headline inflation saw a slight uptick, primarily driven by rising energy costs. Core inflation saw a slight...

Bitcoin Fails to Surpass $71K this Week

Market picture The cryptocurrency market is up 0.3% in 24 hours to $2.66 trillion, but it’s not due to reduced volatility. Bitcoin and Ethereum are trading close to the previous day’s levels. Among the top coins, Doge (+7.4%) and BNB (+3.8%) are the best performers....

Japanese Yen Steady as Tokyo Core CPI Ticks Lower

The Japanese yen continues to have a quiet week and is unchanged in the European session at 151.17. Tokyo Core CPI inches lower to 2.4% Tokyo Core CPI, which excludes fresh food, eased to 2.4% y/y in March, a drop lower than the 2.5% gain in February and matching...

Gold’s Price Reaches New Heights Amid Global Market Uncertainty

On Friday, the price of gold reached an unprecedented peak, soaring above 2,230 USD. The global capital market experienced low activity due to the observance of Good Friday in many Catholic countries, leading to abrupt movements by investors. The surge in gold prices...

USDCAD Pauses Four-Day Slide – Action Forex

USDCAD pauses bearish correction near support area Technical signals are weak amid holiday-thinned liquidity conditions All eyes turn to the US core PCE inflation due at 12:30 GMT USDCAD was trading with soft positive momentum around 1.3547 during Friday’s early...

Tokyo inflation moderates, supporting BoJ’s measured approach

Japan Tokyo CPI core (ex-food) slowed slightly from 2.5% yoy to 2.4% yoy in March, matched expectations. Headline CPI ticked up from 2.5% yoy to 2.6% yoy. CPI core-core (ex-food and energy) also slowed from 3.1% yoy to 2.9% yoy. Service price gains slowed to from 2.1%...

S&P 500 (SPX) Looking to Complete 5 Waves Impulse

Short Term Elliott Wave view in S&P 500 (SPX) suggests cycle from 1.6.2024 low is in progress as a 5 waves impulse. Up from 1.6.2024 low, wave ((i)) ended at 4931.09 and pullback in wave ((ii)) ended at 4845.15. Wave ((iii)) higher ended at 5187.78 as the 30...

Record-breaking Gold targets 2250, poised for push toward 2500

Gold surges to new record high in quiet holiday trading today. The precious metal continues to be supported by expectation of global central bank easing ahead. SNB has already started rate cutting earlier this month. ECB is widely expected to follow in Spring,...

GBPJPY Weakens Near 191.00 – Action Forex

GBPJPY remains above the rising trend line But technical oscillators are losing steam as well GBPJPY has been posting some flat days over the last four sessions, holding near the short-term uptrend line. The market is developing near the 191.00 round number with the...

Gold Price and Crude Oil Price Gain Bullish Momentum

Gold price started a steady increase above the $2,200 resistance level. Crude oil prices are gaining bullish momentum and might rise toward $85.00. Important Takeaways for Gold and Oil Prices Analysis Today Gold price started a decent increase from the $2,158 zone...

Strong Growth is Good News If Inflation Remains Low

The US printed a better-than-expected growth of 3.4%. Sales grew more than expected, the GDP price index fell but fell slower than expected to 1.7%, corporate profits jumped nearly 4% in the Q3 versus less than 1% printed a quarter earlier and consumer sentiment...

EUR/USD Analysis: Price Today Has Set Its Minimum Since the Beginning of March

As the EUR/USD chart shows at the start of the European session today, the exchange rate has dropped below EUR 1.08 per US dollar. Tuesday’s news contributed to this. According to Nasdaq.com, on March 26, 2024, The Conference Board published a report for March,...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0813; (P) 1.0826; (R1) 1.0841; More… EUR/USD’s fall from 1.0980 resumed by breaking through temporary low. Intraday bias is back on the downside for 1.0694 support first. Break there will resume the whole decline from 1.1138 and target 100%...

Canada’s Economy Boosted in January, Strong Gain Expected for February

The Canadian economy kicked off the year on a positive note, growing by 0.6% on a month-on-month (m/m) basis in January. This print comes in above Statistics Canada’s advanced guidance and market expectations for a 0.4% m/m gain. The flash estimate for February points...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2617; (P) 1.2629; (R1) 1.2653; More… Range trading continues in GBP/USD and intraday bias remains neutral. Risk stays on the downside as long as 55 4H EMA (now at 1.2667) holds. Below 1.2574 will resume the fall from 1.2892 to 1.2517 structural...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 150.91; (P) 151.44; (R1) 151.85; More… Range trading continues in USD/JPY and intraday bias stays neutral. On the downside, break of 150.25 support should confirm short term topping, and turn bias back to the downside for 55 D EMA (now at 149.01)....

Sunset Market Commentary – Action Forex

Markets “There’s still no rush”, Fed governor Waller’s sequel to February’s “What’s the rush”, resonated through Asian and early European dealings. The Fed’s minority leader wants to see at least a couple of months of additional evidence that inflation is sustainably...

Bitcoin Doesn’t Fit the Downtrend Now

Market picture The crypto market capitalisation rose 1.4% in 24 hours to $2.66 trillion. Buyers stepped in the night before when Bitcoin touched $68.5K and pushed the price up to $70.7K at the start of active trading in Europe. Bitcoin was rocked on Wednesday, first...

Canada’s Unemployment Rate Will Continue to Tick Higher Despite Job Gains

Next Friday’s employment data is expected to show job growth remained in positive territory (+25,000 from February), but again it will not be enough to keep up with surging growth in labour supply. Therefore, we forecast another tick higher in the unemployment rate to...

BTCUSD Advances Towards All-Time Highs

BTCUSD pauses pullback and rotates higher Conquers 70,000 but encounters strong resistance Momentum indicators are tilted to the upside BTCUSD (Bitcoin) had been undergoing a strong pullback from its all-time highs, dropping to as low as 60,760 last week. However, the...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.9019; (P) 0.9046; (R1) 0.9064; More…. Intraday bias in USD/CHF is turned neutral with current retreat and some consolidations could be seen. But further rally is expected as long as 0.8964 support holds. Firm break of 0.9070 will resume larger...

GBP Consolidates Amid Concerns Over Economic Growth and Wage Trends

The GBP/USD pair is currently consolidating, hovering around the 1.2631 mark. This consolidation phase follows recent reports highlighting a slowdown in the expansion plans of British businesses for workforce and wage growth, raising concerns about future economic...

Dollar’s Momentary Rise Fades Amid Market Caution

Dollar initially gained momentum in European session and breaks through near term resistance against Euro. However, the greenback then saw a swift reversal as the market transitioned into US session. Despite a stronger final reading for US Q4 GDP, the impact on the...

Canada’s GDP expands 0.6% mom in Jan, above exp 0.4% mom

Canada’s GDP grew 0.6% mom in January, above expectation of 0.4% mom. Services-producing industries increased 0.7% mom. Goods-producing industries were up 0.2% mom. Overall, there was broad-based growth with 18 of 20 sectors increasing. Advance information indicates...

US initial jobless claims falls to 210k, vs exp 211k

US initial jobless claims fell -2k to 210k in the week ending March 23, slightly below expectation of 211k. Four-week moving average of initial claims fell -750 to 211k. Continuing claims rose 24k to 1819k in the week ending March 16. Four-week moving average of...

EUR/USD: Bears Probe Through Key Support Zone

The Euro holds in red for the third consecutive day and accelerates lower in early Thursday, cracking pivotal supports at 1.0800/1.0790 zone (former higher base / Fibo 61.8% of 1.0695/1.0981 / base of thick daily Ichimoku cloud). Technical picture is firmly bearish on...

Australian Dollar Slides After Weak Retail Sales Report

The Australian dollar is down sharply and has fallen to a three-week low. In the European session, AUD/USD is trading at 0.6491, down 0.66%. Australia’s retail sales rise 0.3% Australia’s retail sales slipped in February to 0.3% m/m, a sharp drop from the 1.1% gain in...

Nasdaq 100: Deteriorating Market Breadth Does Not Bode Well for the Bulls

The price actions of Nasdaq 100 have reached the lower limit of a major resistance zone of 18,435/620. Heightened over-concentration risk from Nvidia as its current year-to-date returns of 87% contributed to 55% of Nasdaq 100’s year-to-date return of 10.50% as of 27...

WTI Oil Futures in Fierce Battle With 50.0% Fibo

WTI futures post an almost 5-month peak But fail to advance further and hover around 50.0% Fibo Oscillators suggest that the bulls retain the upper hand WTI oil futures (May delivery) have been in a steady recovery from their December bottom of 67.97, posting an...

ECB’s Panetta: Conditions for monetary easing are materializing

In a speech delivered in Rome, ECB Governing Council member Fabio Panetta acknowledged the impact of restrictive policies on demand, attributing these measures, alongside the falling energy prices, as key factors in the “rapid fall in inflation”. More importantly,...

AUDUSD Gets Bearish Vibes – Action Forex

AUDUSD violates key support zone Bearish pressures could persist in short-term AUDUSD’s short-term upward pattern is under threat as it faces the risk of closing below the October support trendline at 0.6500, following another rejection near its exponential moving...

A First Fed Rate Cut in June Seems Highly Premature

Markets German Bunds outperformed US Treasuries yesterday on milder than expected Spanish CPI and soft comments from Italian ECB board member Cipollone. He suggested that the ECB might be able to reduce rates swiftly as the to give the economy a chance to recover as...

Swiss KOF falls to 101.5, yet outlook remains positive

Swiss KOF Economic Barometer fell from 102.0 to 101.5 in March, below expectation of 102.3. Despite this minor setback, the barometer continues to hover above its long-term average, indicating a positive outlook for the Swiss economy in the coming months. The decline...

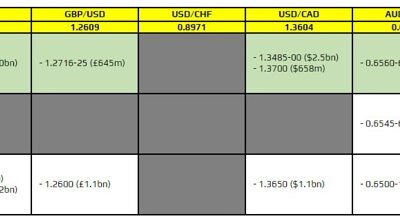

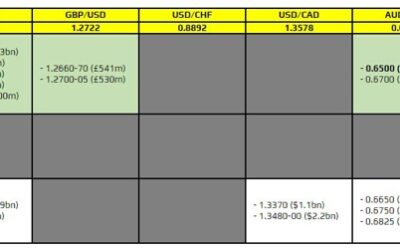

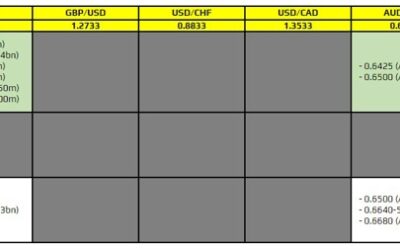

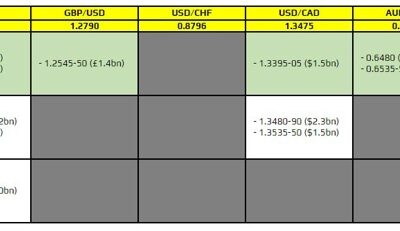

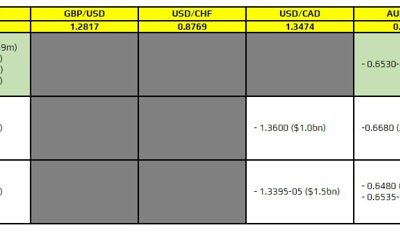

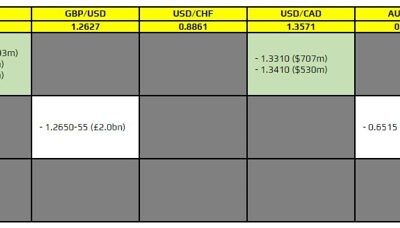

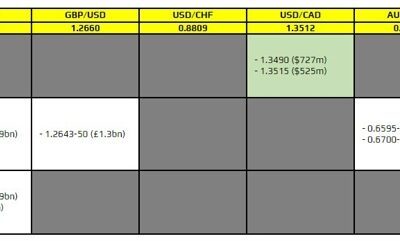

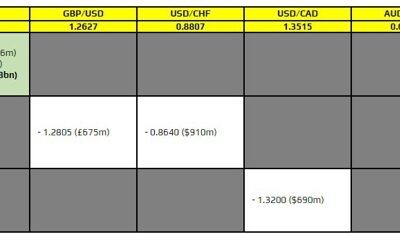

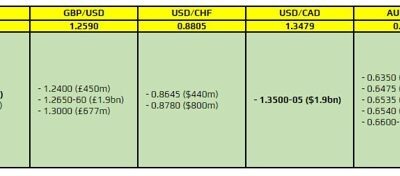

FX option expiries for 28 March 10am New York cut

There are a couple to take note of on the day, as highlighted in bold.The ones for EUR/USD are layered at 1.0815 through to 1.0850. And they should act similarly to the ones from yesterday around the same region as well. All else being equal, the expiries will help to...

Nikkei Takes Hit from Japan’s Vigorous Yen Verbal Intervention, But Yen’s Gain Lacks Strength

Nikkei tumbled sharply in Asian session today, largely in response to Yen’s rebound late yesterday, which followed strong verbal interventions by Japanese officials aimed at curbing the currency’s recent weakness. Additionally, profit-taking activities could be...

EUR/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 163.94; (P) 164.17; (R1) 164.39; More… Intraday bias in EUR/JPY remains neutral for consolidations below 165.33. Downside of current retreat should be contained by 55 4H EMA (now at 163.57) to bring rebound. On the upside, break of 165.33 will...

GBP/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 191.09; (P) 191.39; (R1) 191.67; More….. Intraday bias in GBP/JPY remains neutral for the moment. More consolidations could be seen but outlook will stay bullish as long as 187.94 support holds. On the upside, break of 193.51 will resume larger up...

Dollar Pushes Higher as S&P 500 Set for 5th Monthly Gain

Yesterday was a slow day in terms of data and information flow and a strong day in terms of meme trading and speculation, as Donald Trump’s Truth Social flew with its own wings for the first time yesterday, following last week’s successful merger with DWAC. Trump’s...

Australian Dollar Slides to Three-Week Low

The AUD/USD pair is declining, reaching 0.6539 on Wednesday. The Australian dollar is heading back to a three-week low following the release of softer-than-expected consumer price index (CPI) data from Australia. For February 2024, inflation in Australia stood at...

NIKKEI-225 Analysis Indicates Possibility of Correction from Historically High Levels

On March 21, the value of the Japanese stock index reached a historical maximum, exceeding the level of 41,100 points. This was facilitated by: → Weak yen supporting exporters. It increases the value of profits earned abroad for a large number of companies that sell...

Crypto Market: A Breather After the Climb

Market picture The capitalisation has stabilised around the $2.63 trillion level, losing 1.7% in 24 hours, but very close to where it was at the end of the day on Monday. Bitcoin is down 1.2%, Ethereum lost 2.3%, BNB sank 3%, and Solana is minus 4%. On the surface,...

Eyes on the fix | Forexlive

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 151.13; (P) 151.35; (R1) 151.64; More… Intraday bias in USD/JPY is turned neutral gain as it retreated after edging higher to 151.96. On the downside, break of 150.25 support should confirm short term topping, and turn bias back to the downside for...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.9004; (P) 0.9024; (R1) 0.9060; More…. USD/CHF’s rally continues today and met 100% projection projection of 0.8550 to 0.8884 from 0.8728 at 0.9062 already. Intraday bias remains on the upside at this point. Sustained trading above 0.9062 will...

USD/CHF: Rises to the Highest in Nearly Five Months

The USDCHF continues to trend higher within the broader bull-channel and hit new multi-week high (the highest since Nov 2) on Wednesday. Larger bulls accelerated after surprise rate cut by SNB last week, which increased pressure on Swiss franc and continues to weigh,...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2611; (P) 1.2639; (R1) 1.2657; More… No change in GBP/USD’s outlook as consolidation continues above 1.2574. Intraday bias stays neutral and risk remains on the downside as long as 55 4H EMA (now at 1.2675) holds. Below 1.2574 will resume the fall...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0816; (P) 1.0840; (R1) 1.0856; More… Outlook in EUR/USD remains unchanged as consolidations continue above 1.0801. Intraday bias remains neutral and But risk will stay on the downside as long as 55 4H EMA (now at 1.0855) holds. Below 1.0801 will...

Japan’s Financial Leaders Unite in Defense of the Yen, Sparking Rebound

Japanese Yen staged in a notable rebound in European session, triggered by heightened market vigilance towards market interventions. This reaction comes in the wake of a significant meeting between Japan’s Ministry of Finance, Financial Services Agency, and Bank of...

USD/JPY Slides to Lowest Level Since 1990

The Japanese yen has edged higher on Wednesday. In the European session, USD/JPY is trading at 151.17, down 0.26%. Yen falls to 34-year low, will Tokyo intervene? The Bank of Japan raised interest rates last week for the first time since 2007. The move marked a...

Eurozone economic sentiment rises to 96.3 in Mar, above exp 96.1

Eurozone Economic Sentiment Indicator rose from 95.5 to 96.3 in March, above expectation of 96.1. Employment Expectations Indicator rose from 102.5 to 102.6. Economic Uncertainty Indicator fell from 20.3 to 19.2. Eurozone industry confidence rose from -9.4 to -8.8....

Gold: Suspicious Storm of $2200

Gold breached the $2200 mark for the second time in history on Tuesday before retreating to $2182 in early US trading. Cryptocurrencies are trading in the same direction as gold today, but silver, platinum and copper are failing to make similar gains, causing some...

NZDUSD Returns to Bearish Trend

NZDUSD extends bearish trend to a four-month low Resistance near 0.6000; support seen at 0.5980 Following two weeks of losses, NZDUSD is now aiming to find a firm footing around 0.6000, having dropped to a four-month low of 0.5984. The latest bearish wave has...

Further Yen Losses Avoided as Fin Min Suzuki Warned

Markets Quite a long series of US data (including consumer confidence, house price data, durable goods orders and regional business sentiment) yesterday failed to provide any clear directional guidance for US and broader markets trading. US and German yields lost 1-2...

GBP/USD Dives While USD/CAD Gains Bullish Pace

GBP/USD declined below the 1.2665 support zone. USD/CAD is rising and might aim for more gains above the 1.3610 resistance. Important Takeaways for GBP/USD and USD/CAD Analysis Today The British Pound started a fresh decline from the 1.2800 resistance zone. There was...

Will EURJPY Re-Test 16-Year High Soon?

EURJPY rebounds off 163.30, holding above rising trend line Bullish bias in longer-term timeframes But MACD and RSI loses momentum in near term EURJPY found support at the 163.30 barrier and is moving again towards the 16-year high of 165.36 that was recorded on March...

Are USDJPY Bulls Ready for a New Record High?

USDJPY trades higher again, testing the October 21, 2022 high Last week’s events have renewed the bullish pressure as intervention risk increases Momentum indicators support the bullish move; all eyes are on the stochastic oscillator USDJPY is continuing its journey...

Verbal Intervention Heighten as Yen Stumbles, Kiwi Falls on Bleak Economic Projections

Japanese Yen breached its recent low against the broadly strong Dollar in Asian session today, but the selloff halted just before reaching 152 mark. The momentum of Yen’s decline appears to be cushioned by Japan’s heightened verbal intervention. Finance Minister...

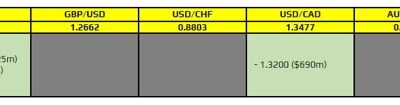

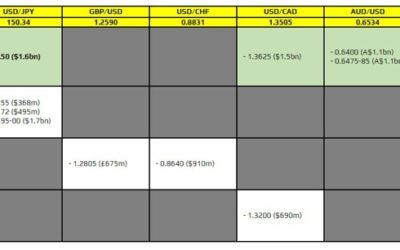

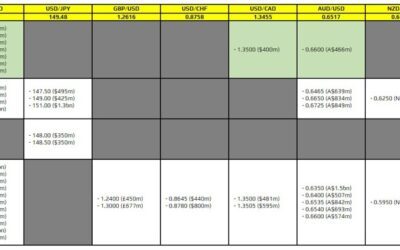

FX option expiries for 27 March 10am New York cut

There are a couple to take note of, as highlighted in bold.The first ones are for EUR/USD layered between 1.0800 to 1.0840. Those are likely to keep price action stickier on the day, before rolling off. And in case there is any dollar softness creeping in, the larger...

GBP/USD: Bulls Gaining Traction After Double Rejection at 200-DMA

Cable remains constructive in early Tuesday’s trading, after it was lifted by better than expected UK data on Monday and fading expectations for BOE rate cut in May. Fresh recovery was also underpinned by a double downside rejection at 200DMA (1.2591) on Fri/Mon...

USD/JPY Price Analysis: Consolidation ahead of US News

This morning, news about inflation in Japan was published. It did not bring any surprises — inflation in Japan is gradually weakening as expected. Core CPI in annual terms: actual = 2.3%, forecast = 2.5%, a month ago = 2.6%, a year ago = 3.0%. We also note that the...

Ethereum ETHUSD Buying The Dips After Elliott Wave Double Three

Hello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of Ethereum ETHUSD published in members area of the website. As our members know ETHUSD has recently made pull back that has unfolded as Elliott Wave Double...

BoE’s Mann signals market misalignment on rate cut expectations

BoE MPC member Catherine Mann cast doubts on the financial market’s anticipation of interest rate cuts in the near term, asserting that such expectations might be overly ambitious. Speaking to Bloomberg TV, Mann directly addressed the discrepancy, stating, “They’re...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8977; (P) 0.8986; (R1) 0.9004; More…. USD/CHF’s rally resumed after brief consolidations and intraday bias is back on the upside. Current rise from 0.8332 should target 100% projection projection of 0.8550 to 0.8884 from 0.8728 at 0.9062. Firm...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 151.13; (P) 151.35; (R1) 151.64; More… Outlook in USD/JPY remains unchanged at consolidation from 151.82 is still extending. Intraday bias stays neutral at this point. Further rally is expected as long as 150.25 support holds. On the upside,...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2602; (P) 1.2627; (R1) 1.2663; More… Intraday bias in GBP/USD stays neutral, as consolidations from 1.2574 continues. Risk will stay on the downside as long as 55 4H EMA (now at 1.6905) holds. Below 1.2574 will resume the fall from 1.2892 to...

USD/JPY springs to the highs of the day

We're rolling into the 4 pm hour in London and the fix. There are no headlines and nothing is happening in fixed income.it's pretty clear there are some fixing flows driving the move. In general, the trade on fixing moves is to fade them at the top of the hour. This...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0812; (P) 1.0827; (R1) 1.0852; More… Intraday bias in EUR/USD stays neutral for the moment, with consolidations from 1.0801 extending. Risk will stay on the downside as long as 55 4H EMA (now at 1.0862) holds. Below 1.0801 will resume the fall...

Sunset Market Commentary – Action Forex

Markets The eco calendar in Europe and the US this week is backloaded with the publication of key (national) EMU inflation data starting tomorrow and the Fed’s preferred inflation measure (PCE deflator) scheduled for release on Friday. Some less high profile data and...

WTI Oil Outlook: Takes a Breather after Monday’s 1.40% Advance

WTI oil price is holding within a tight range on Tuesday and consolidating Monday’s 1.40% advance, sidelined by mixed fundamentals. Supply concerns following recent attacks on Russian oil installation, which may cause longer disruptions from one of world’s top oil...

US consumer confidence down to 104.7, more concerned about political environment

US Conference Board Consumer Confidence ticked down from downwardly revised 104.8 to 104.7 in March, below expectation of 107.2. Present Situation Index rose from 147.6 to 151.0. Expectations Index fell from 76.3 to 73.8. Dana M. Peterson, Chief Economist at The...

Bitcoin tops $71K, about to retest highs

Market picture Crypto market capitalisation regained another 5% in 24 hours, peaking earlier in the day at $2.7 trillion against a recent peak of 2.7 in mid-March and around $3 trillion at the end of 2021. The recovery is faster than before the decline, promising...

Swiss Franc Declines Persist as DAX Hits New Heights, Aussie Awaits CPI

Risk-on sentiment is pressuring e Swiss Franc and, to a lesser extent, Yen and Dollar today. DAX soared to new record highs, undeterred by the latest weak German consumer sentiment data, while CAC and FTSE are also marking gains. Similarly, the CAC and FTSE indices...

US durable goods orders rises 1.4% mom in Feb, above exp 1.3% mom

US durable goods orders rose 1.4% mom to USD 277.9B in February, above expectation of 1.3% mom. Ex-transport orders rose 0.5% mom to USD 185.6B above expectation of 0.4% mom. Ex-defense orders rose 2.2% mom to USD 263.8B, above expectation of 1.3% mom. Transportation...

XAU/USD: Gold Retests $2200 Barrier on Renewed Safe-haven Demand

Gold price jumped on Tuesday and retested psychological $2200 barrier, inflated by weaker dollar on improved sentiment about Fed rate cuts and persisting geopolitical risks. Market awaits release of US inflation data, due later this week, which could bring fresh hints...

Australian Dollar Edges Higher, CPI Next

The Australian dollar has extended its gains on Tuesday. In the European session, AUD/USD is trading at 0.6557, up 0.26%. On today’s data calendar, the US will release two tier-1 events. Durable goods orders are expected to rebound with a 1.1% gain in February, after...

EURCHF Rallies Towards 8-Month High

EURCHF looks strongly bullish this year Technical oscillators confirm upside tendency EURCHF has added almost 6% since the beginning of the year, recording a new eight-month high of 0.9786. The pair is creating a steep upward tendency with no notable bearish...

Bitcoin Perfect Reaction Higher From Blue Box Area

In this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of Bitcoin ticker symbol: $BTCUSD. We presented to members at the elliottwave-forecast. In which, the rally from the 11 September 2023 low is unfolding as an impulse...

Fed Speakers Covered Full Spectrum of Intra-FOMC Views

Markets In a more or less synchronic, technically inspired move US, EMU and UK bond markets reversed most of Friday’s rally. Eco data were few and mostly second tier. Marginally softer-than-expected US new homes sales (-0,3% M/M) had little impact on trading. Fed...

German GfK consumer sentiment edges up to -27.4, uncertainty overshadowing facts

In a modest uptick, Germany’s GfK Consumer Sentiment Index for April has slightly improved to -27.4 from March’s -28.8, marginally above expectation of -27.8. March’s data revealed an improvement in economic expectations and income outlooks, with the former rising to...

CHF/JPY Technical: On the Brink of a Potential Major Bearish Breakdown (CHF Weakness)

The surprise rate cut by SNB has reinforced the bearish momentum of CHF/JPY. CHF has weakened across the board against the G-10 currencies; it is the weakest against the EUR. Watch the 169.00 key short-term resistance on CHF/JPY with key support coming in at 166.55....

GBPUSD Bounces Off 200-Day SMA

GBPUSD finds support at uptrend line But short-term outlook remains neutral MACD and RSI are mixed GBPUSD rebounded off the 200-day simple moving average (SMA), which coincides with the 1.2595 support level and the medium-term ascending trend line. The market has...

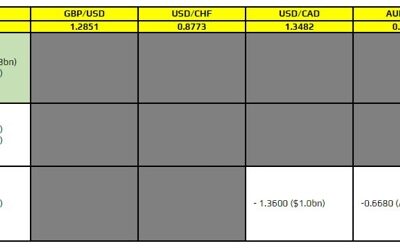

FX option expiries for 26 March 10am New York cut

There are a couple of large ones to be wary of for the day, as highlighted in bold.The first ones are for EUR/USD, layered at the 1.0860-70 level. That coincides with some technical layers that could keep a lid on price action in the session ahead. Of note, the 100...

Swiss Franc Dips in Muted Trade, Bitcoin Eyes Uptrend Resumption

Swiss Franc traded broadly lower in Asian session today, amidst a backdrop of general market inactivity with all other major pairs and crosses staying inside Monday’s range. Still, it remains to be seen whether the Franc’s sell-off could extend beyond last week’s...

Bitcoin Price Recovered over the Weekend, But Market Anxiety Remains

From the point of view of technical analysis of BTC/USD, on Friday evening the price of Bitcoin was near the lower boundary of the ascending channel (shown in blue). This was alarming as it indicated that the market action could result in a weekly bearish candle...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2558; (P) 1.2617; (R1) 1.2658; More… Intraday bias in GBP/USD is turned neutral with current recovery and some consolidations would be seen first. But risk will stay on the downside as long as 55 4H EMA (now at 1.2700) holds. Below 1.2574 will...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0784; (P) 1.0826; (R1) 1.0850; More… Intraday bias in EUR/USD is turned neutral with current recovery and some consolidations would be seen. But risk will stay on the downside as long as 55 4H EMA (now at 1.0868) holds. Below 1.0801 will resume...

Gold’s Prospects Look Promising

Gold prices have stabilized around $2170.00 per troy ounce after two days of decline. Investors are taking a pause ahead of an important US inflation indicator report due this week, which could provide insights into the future direction of the Federal Reserve’s...

USD/JPY Drifting at Start of Week

The Japanese yen is showing limited movement on Monday. In the North American session, USD/JPY is trading at 151.25, down 0.13%. Yen can’t find its footing Last week’s Bank of Japan was dramatic as the central bank raised interest rates for the first time since 2007....

Sunset Market Commentary – Action Forex

Markets The yuan’s sharp rebound this morning triggered some attention, if only because other news was so limited today. USD/CNY shot up last Friday on signals that Chinese authorities loosened their grip on the 7.2 handle it defended for several months. Clearly they...

Fed’s Goolsbee forecasts three rate cuts amid rising real interest rate restrictiveness

Chicago Fed President Austan Goolsbee told Yahoo Finance that he aligned with the “median” projections regarding the monetary easing path forward, as anticipates three rate cuts within the year. In this “murky period” of economic recovery as Goolsbee described, Fed...

Fed’s Cook: Risks of meeting dual manage more balanced

Fed Governor Lisa Cook pointed out in a speech that risks associated with meeting the dual mandate goals of inflation and employment are “moving into better balance”. She explained that prematurely easing monetary policy might “allow above-target inflation to become...

USDJPY- Bulls Hold Grip for Further Gains after Consolidation

Bulls are taking a breather and consolidating just under key barriers at 150.90/94 (2023/22 tops) after strong rally in past two weeks. USDJPY was inflated by a wide gap between US and Japan’s interest rates, with no positive impact from BoJ’s rate hike last week, as...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.8953; (P) 0.8987; (R1) 0.9009; More…. Intraday bias in USD/CHF remains neutral for consolidations below 0.9019 temporary top first. Downside of retreat should be contained above 0.8838 support to bring rebound. Break of 0.9019 will resume larger...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 151.02; (P) 151.44; (R1) 151.88; More… USD/JPY is still extending the consolidation from 151.92 and intraday bias stays neutral. Further rally is expected as long as 150.25 support holds. On the upside, decisive break of 151.93 key resistance will...

Subdued Currency Movements, Cautious Stocks, Range Trading Gold

Mild risk-off mood is seen in the global financial markets today, starting from the the noticeable retreat in Japan’s Nikkei, then the marginal declines across European stock indices, alongside soft US futures. However, this sense of caution has not significantly...

Gold Pulls Back from All-Time High

Gold moves horizontally within 2,145-2,195 MACD and RSI lose steam Gold prices have been moving lower over the last couple of days after the bullish spike towards the all-time high of 2,222.68 that was posted in the preceding week. The market has been developing...

Australian Dollar Stabilizes, Consumer Sentiment Next

The Australian dollar has started the week with slight gains, after sliding 0.86% on Friday. In the European session, AUD/USD is trading at 0.6530, up 0.24%. PBoC move sends Aussie sharply lower The Australian dollar ended the week with sharp losses after China’s...

ECB’s Lane confident that wages growth is on track to normalize

ECB Chief Economist Philip Lane, in a podcast published today, conveyed a sense of confidence among policymakers regarding wage growth trends. Lane articulated that policymakers are “confident” that wages growth is “on track” to return to normal. “If this assessment...

Crypto Market Comes to Life

Market picture The crypto market cap rose 4.5% over 24 hours to $2.56 trillion, roughly where it was a week ago, with an active rally over the last three days. Bitcoin is up 4.7%, and Ethereum is up 4.3% in 24 hours. Their momentum has encouraged even more robust...

Threat is the Only Way to Stop Yen Bleeding

The Bank of Japan’s (BoJ) decided to hike the interest rates for the first time after 17 years but the yen has been weakening since then, on fear that this would be a ‘one and done’ cut. As a result, not only that the yen bulls are nowhere to be found but some traders...

No Major Data Releases Today – ECB President Lagarde and Fed’s Bostic and Cook Will Speak

In focus today The week starts out without any major data releases today. ECB president Lagarde and Fed’s Bostic and Cook will speak today. Later this week we look out for local inflation prints from Spain, France, and Italy that will give clues of where we can expect...

Chinese and Japanese Officials Started Offensive to Prevent Further Currency Losses

Markets The path of least resistance on yields markets on Friday still was south. Investors after Wednesday’s Fed meeting/press conference clearly saw the glass half empty, rather than half full. The dots suggested otherwise with both growth and inflation forecasts...

EURUSD Dives Towards 1.0800 – Action Forex

EURUSD breaks SMAs to the downside Immediate support at rising trend line MACD and RSI suggest more negative movements EURUSD is showing some strong selling interest over the last couple of days, following the pullback from the 1.0940 resistance level. The price is...

Hang Seng Index: Potential Currency War May Kick Start Another Bearish Leg

A less dovish Fed with a surprise cut by SNB has triggered a bout of US dollar strength since last Thursday, 21 March. China’s central bank, PBoC responded with a lower-than-expected daily fixing on the onshore yuan (CNY) last Friday, 22 March which led the offshore...

FX option expiries for 25 March 10am New York cut

There aren't any significant expiries in play for the day ahead. As such, trading sentiment will continue to revolve around the mix of the technicals, risk mood, and broader market sentiment. So far today, there isn't much to really work with as most markets remain...

Light Week Ahead with Dollar Rally Awaiting PCE Inflation Insights

The forex markets display a calm demeanor in the Asian session, with most major pairs and crosses gyrating in very tight ranges. Australian Dollar finds modest support from the state orchestrated rebound in Chinese Yuan. However, this lift hasn’t translated into clear...

Forex and Cryptocurrencies Forecast – Action Forex

EUR/USD: Switzerland Strengthens the Dollar The key event of the past week was undoubtedly the FOMC (Federal Open Market Committee) meeting of the US Federal Reserve on March 20. As expected, the American Central Bank unanimously decided to maintain the key interest...

EUR/CHF Weekly Outlook – Action Forex

EUR/CHF’s rally accelerated to as high as 0.9786 last week. But a temporary top should be formed after hitting 61.8% retracement of 1.0095 to 0.9252 at 0.9773. Initial bias is turned neutral this week for some consolidations. Downside of retreat should be contained by...

EUR/AUD Weekly Outlook – Action Forex

EUR/AUD stayed in consolidation in range of 1.6439/6742 last week and outlook is unchanged. Initial bias remains neutral this week first. Near term outlook will stay cautiously bullish as long as 1.6439 support holds. On the upside, above 1.6677 will target 1.6742...

EUR/GBP Weekly Outlook – Action Forex

EUR/GBP’s break of 0.8577 resistance and 55 D EMA (now at 0.8562) last week suggest that rebound from 0.8497 is at least correcting the fall from 0.8764. Initial bias is now on the upside this week for 161.8% projection of 0.8497 to 0.8577 from 0.8503 at 0.8632. For,...

EUR/JPY Weekly Outlook – Action Forex

EUR/JPY’s up trend resumed last week and surged to 165.33. But as a temporary top was formed with subsequent retreat, initial bias stays neutral this week for more consolidations. Downside should be contained by 55 4H EMA (now at 163.23) to bring rebound. On the...

GBP/JPY Weekly Outlook – Action Forex

GBP/JPY’s up trend resumed last week and surged to 193.51, but retreated notably since then. Initial bias remains neutral this week for more corrective trading. Nevertheless, outlook will stay bullish as long as 187.94 support holds. On the upside, break of 193.51...

USD/CAD Weekly Outlook – Action Forex

Much volatility was seen in USD/CAD last week. But after all, near term outlook remains bullish with 1.3419 support intact. Initial focus is now on 1.3612 resistance. Decisive break there will resume whole rise from 1.3176 towards 1.3897 resistance. On the downside,...

USD/CHF Weekly Outlook – Action Forex

USD/CHF’s rally resumed last week and surged to 0.9019. Initial bias stays on the upside for 100% projection projection of 0.8550 to 0.8884 from 0.8728 at 0.9062. On the downside, below 0.8922 minor support will turn intraday bias neutral and bring consolidations....

GBP/USD Weekly Outlook – Action Forex

GBP/USD’s fall from 1.2892 accelerated lower last week, despite interim rebound. Initial bias stays on the downside this week for 1.2517 support. Decisive break there will suggest that rise from 1.2036 has completed at 1.2892 already, and turn near term outlook...

USD/JPY Weekly Outlook – Action Forex

USD/JPY’s rally resumed last week and edged higher to 151.82, but turned sideway since then. Initial bias stays neutral this week for more consolidations. Further rally is expected as long as 55 4H EMA (now at 150.11) holds. On the upside, decisive break of 151.93 key...

EUR/USD Weekly Outlook – Action Forex

EUR/USD’s fall from 1.0980 continued last week and the strong break of 55 D EMA suggest that rebound from 1.0694 has completed. Initial bias stays on the downside for retesting 1.0694 first. Break there will resume the decline from 1.1138 and target 100% projection of...

AUD/USD Weekly Report – Action Forex

AUD/USD’s strong was rebound last week was capped below 0.6666 resistance, and followed by equally steep decline. Initial bias remains neutral this week first, with focus on 0.6503 support. Decisive break there will indicate that larger fall from 0.6870 is ready to...

Dollar Triumphs Following a Turbulent Week of Central Bank Shocks

The past week in the currency markets was a dramatic whirlwind, marked by pivotal moves from major central banks across the globe. From BoJ’s unexpected hike to SNB’s surprise cut, from Fed’s hawkish leaning projections to BoE’s dovish voting, they collectively...

Weekly Focus – Historical Central Bank Week: A Hike and A Cut in G10

The past week will go down in history as the Bank of Japan (BoJ) hiked the policy rate for the first time in 17 years while the Swiss National Bank (SNB) cut its rate, becoming the first G10 central bank to do so in the current cycle. The BoJ decided to set the...

Canada’s January GDP to Edge Higher on Recovery from Quebec Strike

Canadian gross domestic product for January is expected to show modest growth on Thursday, while employment data will highlight whether weakness in job vacancies and wage growth still persists ahead of the Easter long weekend. We expect the Canadian economy to edge up...

Weekly Economic & Financial Commentary: Sitting, Waiting, Wishing

Summary United States: Residential Tailwind Set to Continue as Monetary Policy Becomes Less Restrictive This week’s economic data indicate that the U.S. economy is still expanding at a solid pace with the housing sector continuing to provide a tailwind. During...

The Weekly Bottom Line: Counting Cuts

U.S. Highlights Markets let out a sigh of relief as the Fed’s Summary of Economic Projections reaffirmed expectations for three rate cuts this year. The Fed’s forecast for the economy is interesting, as it implies above trend growth in each of the next three years –...

Summary 3/25 – 3/29

Monday, Mar 25, 2024 Tuesday, Mar 26, 2024 Wednesday, Mar 27, 2024 Thursday, Mar 28, 2024 Friday, Mar 29, 2024 The post Summary 3/25 – 3/29 appeared first on Action Forex.

GBP/USD Faces Sharp Decline Amid BoE’s Monetary Policy Stance

As of Friday, the GBP/USD pair hovered around 1.2642, following a substantial decline. The Bank of England (BoE) has yet to find reasons to lower the interest rate, indicating intentions to maintain high rates for an extended period to support the necessary inflation...

Rising Dollar Spooked Bitcoin, But Not the Entire Crypto Market

Market picture The cryptocurrency market closed lower on Thursday, but little changed from the $2.53 trillion market cap over 24 hours. However, the internal dynamics are mixed. Bitcoin loses 1.5% and retreats to $66K, while Ethereum hovers around $3500 (-0.25%), BNB...

Pound Drops to 1-Month Low After Flat Retail Sales

The British pound has extended its losses on Friday. In the European session, GBP/USD is trading at 1.2600, down 0.45%. Earlier, the pound fell as low as 1.2584, its lowest level since March 20. UK retail sales unchanged in February UK retail sales were flat in...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0830; (P) 1.0886; (R1) 1.0917; More… Intraday bias in EUR/USD remains on the downside at this point. Current development argues that corrective recovery from 1.0694 has completed at 1.0980 already. Deeper fall is expected to retest 1.0694 next....

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2605; (P) 1.2704; (R1) 1.2757; More… Intraday bias in GBP/USD remains on the downside for 1.2517 support Decisive break there will suggest that rise from 1.2036 has completed at 1.2892 already, and turn near term outlook bearish On the upside,...

USD/CHF Daily Outlook – Action Forex

Daily Pivots: (S1) 0.8878; (P) 0.8936; (R1) 0.9033; More…. Intraday bias in USD/CHF remains on the upside for the moment. Current rally from 0.8332 is in progress for 100% projection projection of 0.8550 to 0.8884 from 0.8728 at 0.9062. On the downside, below 0.8922...

Sunset Market Commentary – Action Forex

Markets Wednesday’s Fed dots & Powell’s press conference brought a diffuse message, hampering an unequivocal market reaction. Higher/above neutral growth, a material uplift in especially this year’s inflation forecast and the unemployment rate holding below NAIRU...

Weekly Focus – Historical Central Bank Week: A Hike and A Cut in G10

The past week will go down in history as the Bank of Japan (BoJ) hiked the policy rate for the first time in 17 years while the Swiss National Bank (SNB) cut its rate, becoming the first G10 central bank to do so in the current cycle. The BoJ decided to set the...

Week Ahead – Markets Quiet Down After Central Bank Frenzy

Dollar recovers after Fed selloff, turns to PCE inflation Yen falls despite rate increase, testing three-decade lows Quarter-end flows could disturb the waters in a quiet week Dollar stages recovery after Fed It was an action-packed week for FX traders, with five...

Will PCE Data Revive Concerns About Sticky US Inflation?

Fed continues to see three rate cuts for 2024 Investors add back to the June cut probability Focus shifts to next week’s core PCE index The data comes out on Friday at 12:30 GMT Fed appears more dovish than expected The Fed appeared more dovish than expected at its...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 150.69; (P) 151.22; (R1) 152.18; More… USD/JPY is staying in consolidation from 151.82 and intraday bias remains neutral. Further rally is expected as long as 55 4H EMA (now at 149.97) holds. On the upside, decisive break of 151.93 key resistance...

Canadian Dollar Dips as Retail Sales Disappoint

The Canadian dollar has extended its losses on Friday. USD/CAD is trading at 1.3569 in the North American session, up 0.29%. Canada’s retail sales slip in January Canada’s retail sales fell 0.3% m/m in January, revised from the earlier estimate of -0.4% and well off...

Yen Rebounds Amid Short-Covering, Dollar Rally Eases

Japanese Yen rebounds broadly today, likely driven by traders taking profits on short positions after a significant week of sell-off following BoJ’s rate hike. This stabilization comes amidst speculations stirred by Japan’s latest inflation data, raising the prospect...

Canada’s retail sales falls -0.3% mom in Jan, led by motor vehicle and parts dealers

Canada’s retail value fell -0.3% mom to CAD 67.0B in January, smaller than expectation of -0.4% mom decline. Sales were down in three of nine subsectors and were led by decreases at motor vehicle and parts dealers (-2.4% mom) Core retail sales—which exclude gasoline...

Gold’s Retreat Not Yet a Reversal

The Fed’s comments led to a 3% rise in gold, but the dollar’s recovery in the second half of Thursday reduced this gain to just 0.5%. Technically, the outlook is unclear, but fundamentally, things are still on the side of the bulls. In early trading on Thursday, gold...

ECB’s Nagel: June cut increasingly likely, but no automatism afterwards