Forex

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.9128; (P) 0.9141; (R1) 0.9151; More…. USD/CHF’s retreat from 0.9157 extends lower but stays above 0.9077 minor support. Intraday bias remains neutral and another rise is in favor. On the upside, above 0.9157 will bring retest of 0.9223. However,...

AUD/USD Rises After Retail Sales Tick Higher

The Australian dollar has edged higher on Tuesday. AUD/USD is trading at 0.6667, up 0.25% on the day at the time of writing. Australia’s retail sales rise 0.1%, CPI next Australian consumers remain frugal and cautious, as retail sales rose just 0.1% m/m April. This...

Sunset Market Commentary – Action Forex

Markets With US and UK markets closed for a holiday yesterday, markets still showed some Monday-like slow trading dynamics today. German yields are changing less than 2 bps across the curve. Inflation expectations in the ECB April consumer survey declined slightly...

US consumer confidence jumps to 102, above exp 96.1

US Conference Board Consumer Confidence rose from 97.5 to 102.0 in May, well above expectation of 96.1. Present Situation Index rose from 140.6 to 143.1. Expectations Index also rose from 68.8 to 74.6. “Confidence improved in May after three consecutive months of...

Swiss Franc Rises Sharply Amid Middle East Tensions; EUR/CHF in Short-Term Correction?

Swiss Franc is having a significant surge today, likely due to flight to safe-haven assets amid rising tensions in the Middle East. Reports have emerged that Israeli military tanks were seen in central Rafah for the first time since the Israel Defense Forces entered...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2744; (P) 1.2761; (R1) 1.2788; More… GBP/USD’s rally continues today and intraday bias stays on the upside. Rise from 1.2298 should target 1.2892 resistance next. For now, further rally is expected as long as 1.2670 support holds, in case of...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0844; (P) 1.0856; (R1) 1.0871; More… EUR/USD is staying in range below 1.0894 and intraday bias stays neutral. More consolidations could still be seen. On the upside, break of 1.0894 will resume the rally from 1.0601 to 1.0980 resistance next....

USD/JPY Shrugs as Japan’s Inflation Data a Mix

The Japanese yen continues to drift and showing little movement on Tuesday. USD/JPY is trading at 156.92, up 0.01% on the day at the time of writing. Corporate service prices jumps, BoJ core CPI dips Japanese inflation indicators have been a mix this week. The...

Gold Prices Edge Towards $2351 Amid Weakening US Dollar

Gold prices are on an upward trajectory, moving towards 2351.00 USD per troy ounce on Tuesday. This marks a significant rise after days of sideways movement, highlighting the metal’s renewed appeal among investors. This surge in gold prices can be attributed to a...

Bitcoin Under Pressure But Beats Expectations

Market picture The crypto market capitalisation is down 0.8% in 24 hours to $2.55 trillion. Bitcoin is losing 0.7%, Ethereum is down 1.1%, and the top altcoins are changing between -0.9% (Toncoin) and +1.1% (Solana). Bitcoin’s hashrate updated a record after the...

Cable Moving into Daily Trendline Resistance Near 1.2800

Cable has seen some nice recovery at the end of 2023; move is looking impulsive so more gains can be seen after the corrective retracement which has unfolded down from March highs. So far, price came down with three waves but pair is making a nice turn-up in last few...

EUR/USD: Bulls Hold Grip and Eye Key Barriers as Markets Await Release of German CPI Data

The Euro keeps firm tone on fading hopes for ECB rate cut, with markets focusing on tomorrow’s release of German inflation data (annualized CPI expected to rise in May). The bull leg off higher low at 1.0805, where 100DMA contained recent pullback, extends into third...

ECB: Consumer inflation expectations reach lowest level since Sep 2021

ECB Consumer Expectations Survey for April shows a slight decline in inflation expectations and a modestly improved economic outlook. Median inflation expectations for the next 12 months have decreased to 2.9%, down from 3.0%, reaching their lowest point since...

Fed’s Kashkari: More positive inflation data needed before easing monetary policy

In an interview with CNBC today, Minneapolis Fed President Neel Kashkari emphasized the need for “many more months of positive inflation data” before considering a reduction in monetary policy restrictions. Moreover, he noted that Fed might still need to hike rates if...

EURJPY Advances Towards 40-Year High

EURJPY is in a steady uptrend, threatening multi-year peak But oscillators point to overbought conditions EURJPY has been in a steady advance since the beginning of May following its bounce off the long-term ascending trendline. However, the risk of a pullback has...

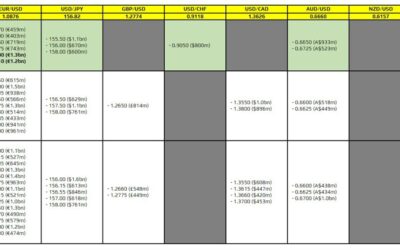

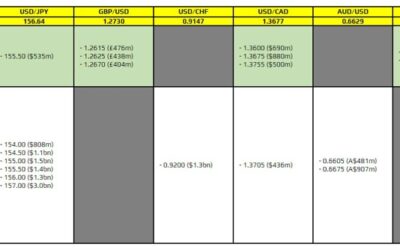

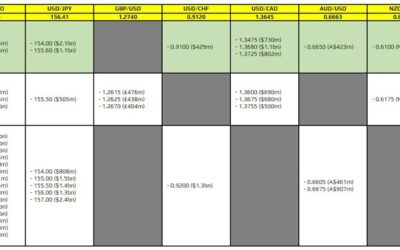

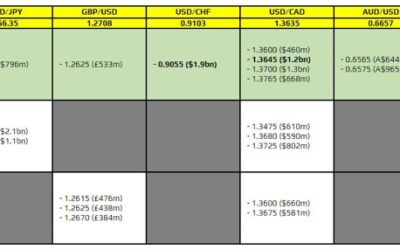

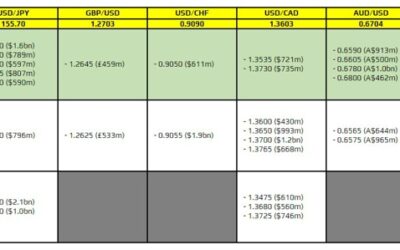

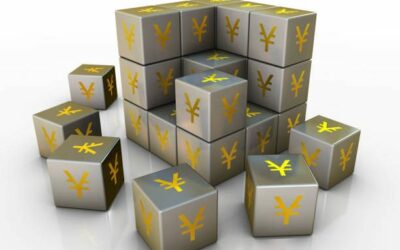

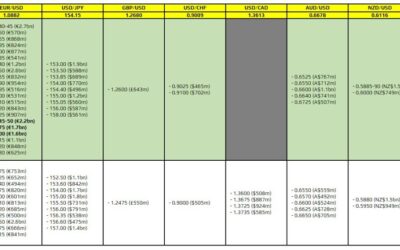

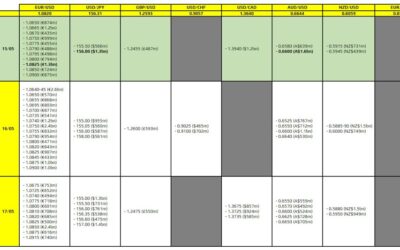

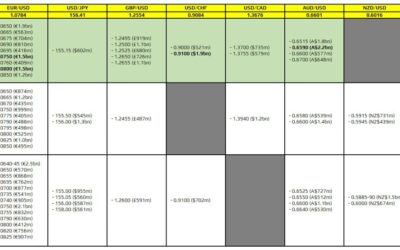

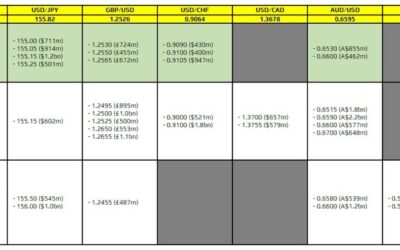

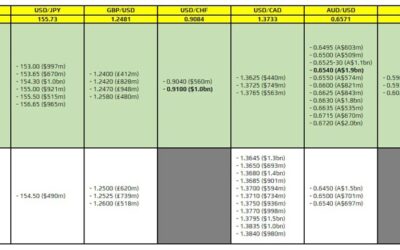

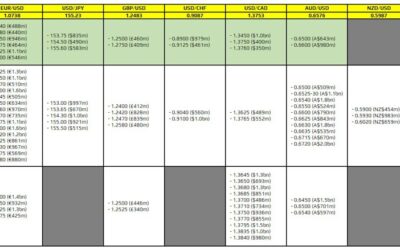

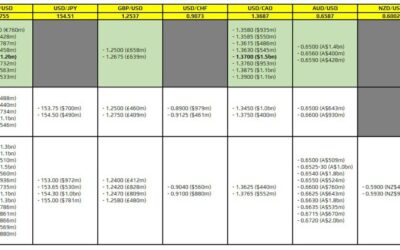

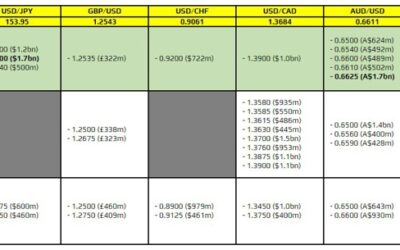

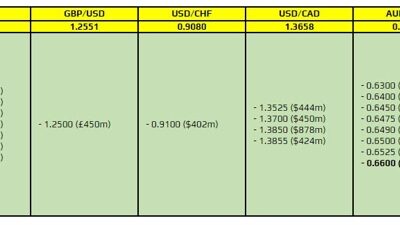

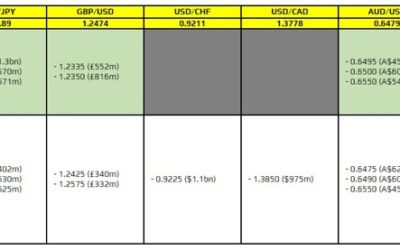

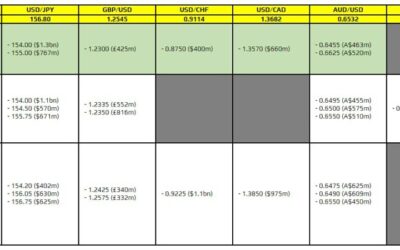

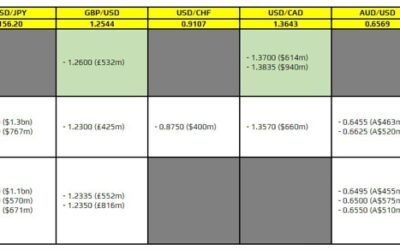

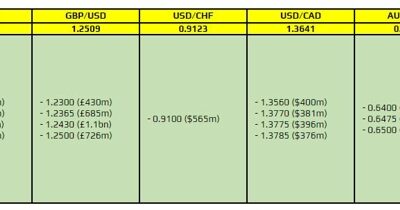

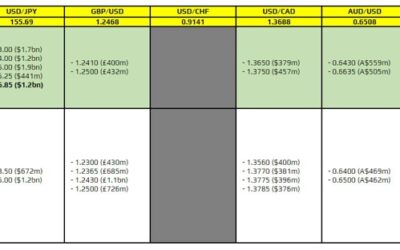

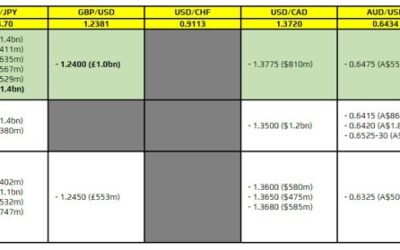

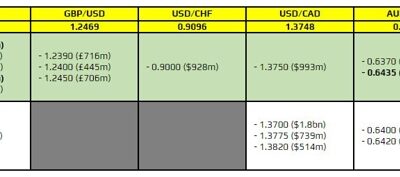

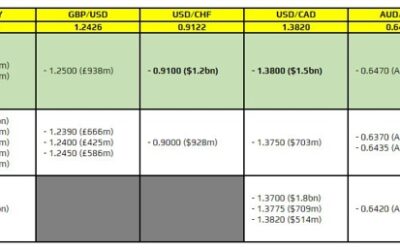

FX option expiries for 28 May 10am New York cut

There are just two to take note of, as highlighted in bold.They are for EUR/USD and stuck together at the 1.0900-10 region. Alongside some technical resistance around 1.0885 and offers near the figure level, the expiries should keep a lid on price action in the...

Aussie Rises Despite Sluggish Retail Sales, Boosted by Chinese Housing Measures

Australian Dollar strengthened broadly in Asian session today, shrugging off lackluster retail sales data. Instead, Aussie is responding positively to Shanghai’s announcement of significant policy measures aimed at boosting the housing market. Yesterday, China’s...

AUD/USD Daily Report – Action Forex

Daily Pivots: (S1) 0.6602; (P) 0.6619; (R1) 0.6647; More... Intraday bias in AUD/USD remains neutral for the moment. Further rally is in favor with 0.6578 cluster support (38.2% retracement of 0.6361 to 0.6713 at 0.6579 intact. On the upside, firm break of 0.6713 will...

Quiet Start to a Week Where Inflation Will Be in Focus

In focus today The week kicks off with a very light schedule. We receive the Germany Ifo indicator for May at 10.00 CET. The past two months have seen an increase in the assessment of the business situation, and it will be interesting to see if this continued in May....

Trading Probably Will Take a Slow Start

Markets With investors looking ahead to a long weekend in the US and the UK; the upleg in core yields slowed on Friday. US and EMU yields closed with changes of less than 1.5 bps across the curve. US durable goods orders (+0.7% M/M) and core shipments (+0.4% M/M)...

USD/CHF Daily Outlook – Action Forex

Daily Pivots: (S1) 0.9134; (P) 0.9146; (R1) 0.9160; More…. Intraday bias in USD/CHF remains neutral for the moment. Current development suggests that pull back from 0.9223 has completed already. Above 0.9157 will bring retest of 0.9223. However, break of 0.9077...

GBP/USD Daily Outlook – Action Forex

Daily Pivots: (S1) 1.2692; (P) 1.2721; (R1) 1.2767; More… Intraday bias in GBP/USD stays neutral and further rise is in favor with 1.2670 support intact. Above 1.2760 will resume the rally from 1.2298 to 1.2892 resistance next. On the downside, below 1.2670 will turn...

USD/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 156.83; (P) 156.99; (R1) 157.16; More… Intraday bias in USD/JPY remains mildly on the upside for 100% projection of 151.86 to 156.78 from 153.59 at 158.51. On the downside, below 155.83 minor support will turn intraday bias neutral first. Further...

Sunset Market Commentary – Action Forex

Markets Bank of France governor and ECB governing council member Villeroy leveraged low volume trading conditions (UK & US markets are closed) to get maximum market impact with some dovish comments. So far, ECB members generally didn’t pre-commit on the H2 2024...

Will Gold Resume Its Prevailing Uptrend?

Gold stabilizes after last week’s sharp slide Oscillators point to corrective phase A break of record high could challenge $2,500 For the outlook to change, a dip below $2,145 may be needed Gold stabilized on Friday and is recovering ground today, following a decent...

German Business Climate Worse Than Expected; Euro/Pound Under Pressure

The improvement in Germany’s business climate stalled in May, according to data released by Ifo. The index remained at the same level of 89.3 as a month earlier. The indicator was last higher in May last year, but analysts, on average, were expecting a further...

EUR/USD Daily Outlook – Action Forex

Daily Pivots: (S1) 1.0815; (P) 1.0836; (R1) 1.0868; More… Intraday bias in EUR/USD stays neutral and further rise is mildly in favor. Break of 1.0894 will resume the rally from 1.0601 to 1.0980 resistance next. However, break of 1.0804 will turn bias back to the...

XAU/USD: Thick Daily Cloud Contained Sharp Pullback But Fresh Recovery So Far Lacks Strength

Gold price edges higher in early trading on Monday after last week’s 5% pullback from new record high found solid ground at $2327/25, provided by the top of thick rising daily Ichimoku cloud. Partial profit taking lifted the price, although recovery was mild so far...

Crypto Market Struggles With Downtrend, Ethereum Tests Resistance

Market picture Crypto market capitalisation rose 6.2% in seven days to $2.57 trillion, approaching the area of this year’s highs above $2.7 trillion. Bitcoin’s price, like the overall market capitalisation chart, tests the upper boundary of the downward range that has...

ECB’s Rehn: Time is ripe for Jun rate cut

In a speech today, ECB Governing Council member Olli Rehn indicated that the ongoing disinflationary process is bringing inflation closer to the 2% target in a sustained manner. He stated, “the time is thus ripe in June to ease the monetary policy stance and start...

USD/JPY Steady as BoJ’s Ueda Urges Caution

The Japanese yen has been drifting since late last week and is calm on Monday. USD/JPY is trading at 156.85, down 0.09% on the day at the time of writing. Ueda: BoJ will proceed with caution The Bank of Japan has been outlier, as it looks to raise interest rates at a...

USD/JPY Analysis: The Market is Indecisive Near Its Peak Since May 1

As the USD/JPY chart shows today: → The price is in an upward trend (indicated by the blue channel) that has been relevant since the beginning of 2024. → On Thursday, May 23, the exchange rate nearly reached 157.2 yen per US dollar, surpassing the peak of May 14. →...

Dollar Index outlook: Stands at the Back Foot Ahead of Key Economic Releases This Week

The dollar moved within a narrow range in Asian / early European session on Monday, but near-term picture remains bearishly aligned, weighed by Friday’s 0.3% drop and formation of bearish engulfing pattern on daily chart. Rising negative momentum adds to downside...

Japanese Yen Slightly Rises Against USD

The Japanese yen slightly increased against the US dollar on Monday, with the USD/JPY pair holding near 156.73. Investors have already priced in previous remarks from Bank of Japan (BoJ) officials. BoJ Governor Kazuo Ueda emphasized the need to anchor inflation...

DAX Elliott Wave: Buying the Dips at the Blue Box Area

Hello fellow traders. In this article we’re going to take a quick look at the Elliott Wave charts of DAX published in members area of the website. DAX is showing impulsive bullish sequences in the cycle from the October 2023 low. Recently we got a 3 waves pull back...

EURUSD Ticks Up Before Testing Descending Trendline

EURUSD retreats from a fresh 2-month high of 1.0894 But meets support a tad above its long-term restrictive trendline Oscillators suggest bulls remain in charge despite the latest drop EURUSD had been in a steady advance following its 2024 bottom of 1.0600 on April...

German Ifo steady at 89.3, working out of crisis step by step

German Ifo Business Climate was unchanged to 89.3 in May, below expectation of 90.3. Current Assessment Index fell from 88.9 to 88.3, below expectation of 89.9. Expectations Index rose from 89.7 to 90.4, slightly below expectation of 90.5. By sector, manufacturing...

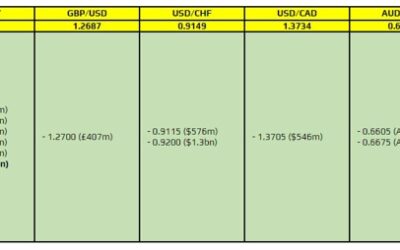

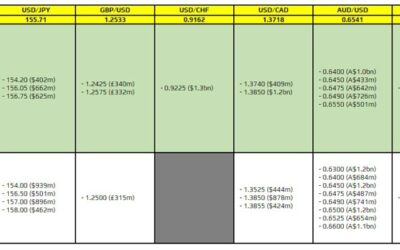

FX option expiries for 27 May 10am New York cut

There is just one to take note of, as highlighted in bold.That being for USD/JPY at the 157.00 level. And the expiries should help to act alongside offers to keep a lid on price action in the session ahead, before rolling off later in the day.Besides that, the...

Subdued Holiday Trading Precedes Key Inflation Data Releases

Trading has been characteristically subdued in the Monday’s Asian session. Japanese Yen is have a broad but weak recovery, with no clear indication of a reversal from its recent selloff. Australian and New Zealand Dollars are also mildly firmer, following rebound in...

Forex and Cryptocurrency Forecast – Action Forex

EUR/USD: The Battle of Europe and US PMIs Overall, the past week favoured the dollar, but the advantage over the European currency was minimal. If you look at where the EUR/USD pair was on 15 May, it returned to this zone on 24 May, regaining the losses of recent...

EUR/AUD Weekly Outlook – Action Forex

EUR/AUD’s extended rebound last week suggests short term bottoming at 1.6211, on bullish convergence condition in 4H MACD. Intraday bias stays mildly on the upside this week. Sustained trading above 55 D EMA (now at 1.6412) will argue that fall from 1.6742 has...

EUR/GBP Weekly Outlook – Action Forex

EUR/GBP fell to as low as 0.8498 last week but recovered just ahead of 0.8491/7 support zone. Initial bias is turned neutral this week for some consolidations first. Further decline is expected as long as 55 D EMA (now at 0.8564) holds. Decisive break of 0.8491/7 will...

EUR/JPY Weekly Outlook – Action Forex

EUR/JPY’s rise from 164.01 extended by breaking through 169.38 resistance last week. This rally is seen as the second leg of the corrective pattern from 171.58. Initial bias remains on the upside for 61.8% projection of 164.01 to 169.38 from 167.31 at 170.62, and then...

GBP/JPY Weekly Outlook – Action Forex

GBP/JPY’s rally from 191.34 continued last week and outlook is unchanged. This rise is still seen as the second leg of the corrective pattern from 200.53. Initial bias stays on the upside for 100% projection of 191.34 to 180.07 from 195.02 at 200.75. But upside should...

USD/CAD Weekly Outlook – Action Forex

USD/CAD rebounded strong last week but reversed after hitting 1.3742. Initial bias is turned neutral this week first. Break 1.3742 will affirm the case that correction from 1.3845 has completed at 1.3589. Further rally would then be seen to retest 1.3845 high....

AUD/USD Weekly Report – Action Forex

AUD/USD’s pull back from 0.6713 extended lower last week but stayed above 0.6578 cluster support (38.2% retracement of 0.6361 to 0.6713 at 0.6579. Initial bias remains neutral this week first, and further rally is in favor. On the upside, firm break of 0.6713 will...

Sterling Climbs as Markets Dial Back BoE Rate Cut Expectations

Last week, global financial markets were heavily influenced by evolving expectations surrounding central bank monetary easing paths and unexpected political developments. British Pound emerged as the most significant gainer, buoyed by fading expectations of an...

GBP/USD Weekly Outlook – Action Forex

GBP/USD turned sideway after rising to 1.2760 last week. Intraday bias remains neutral this week for some consolidations, but further rally is in favor. Above 1.2760 will resume the rally from 1.2298 to 1.2892 resistance next. On the downside, below 1.2670 will turn...

USD/JPY Weekly Outlook – Action Forex

USD/JPY’s rebound from 151.86 resumed last week by breaking through 156.78 resistance. Initial bias remains mildly on the upside this week for 100% projection of 151.86 to 156.78 from 153.59 at 158.51. On the downside, below 155.83 minor support will turn intraday...

EUR/USD Weekly Outlook – Action Forex

EUR/USD’s retreat from 1.0894 continued last week and recovered after dipping to 1.0804. Initial bias stays neutral this week first, and further rise is mildly in favor. Break of 1.0894 will resume the rally from 1.0601 to 1.0980 resistance next. However, break of...

Sterling Climb as Markets Dial Back BoE Rate Cut Expectations

Last week, global financial markets were heavily influenced by evolving expectations surrounding central bank monetary easing paths and unexpected political developments. British Pound emerged as the most significant gainer, buoyed by fading expectations of an...

USD/CHF Weekly Outlook – Action Forex

USD/CHF’s rebound from 0.8987 extended to 0.9157 last week before turning sideway. Current development suggests that pull back from 0.9223 has completed already. Initial bias remains neutral this week first and further rise is in favor. Above 0.9157 will bring retest...

EUR/CHF Weekly Outlook – Action Forex

EUR/CHF’s rally continued last week despite some brief interim retreat. Initial bias is now on the upside this week. Current rise from 0.9252 should target 100% projection of 0.9304 to 0.9847 from 0.9563 at 1.0106, which is slightly above 1.0095 key structural...

Weekly Economic & Financial Commentary: Higher for Longer Mantra on Repeat in Week Replete with Fed Speak

Summary United States: High Mortgage Rates Burden Homebuyers Homebuying retreated in April following a leg up in mortgage rates. Meanwhile, durable goods orders surprised to the upside, suggesting the manufacturing industry is on better footing. Next week: Consumer...

The Weekly Bottom Line: FOMC Continues to Preach Patience

U.S. Highlights U.S. equity markets briefly touched a new all-time high mid-week, while measures of market volatility dipped to multi-year lows. Minutes from the April 30th-May 1st FOMC meeting struck a more hawkish tone, resulting in markets now pricing in just 34...

Summary 5/27 – 5/31

Monday, May 27, 2024 Tuesday, May 28, 2024 Wednesday, May 29, 2024 Thursday, May 30, 2024 Friday, May 31, 2024 The post Summary 5/27 – 5/31 appeared first on Action Forex.

Canada’s retail sales falls -0.2% mom in Mar, slightly worse than expectations

Canada’s retail sales value fell -0.2% mom to CAD 66.4B in March, slightly worse than expectation of -0.1% mom. Sales were down in seven of nine subsectors and were led by decreases at furniture, home furnishings, electronics and appliances retailers. Core retail...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2674; (P) 1.2710; (R1) 1.2736; More… Intraday bias in GBP/USD is turned neutral as it recovered ahead of 55 4H EMA (now at 1.2671). On the upside, break of 1.2760 will resume the rally fro 1.2290 towards 1.2892 resistance. On the downside, break...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.9128; (P) 0.9143; (R1) 0.9160; More…. Intraday bias in USD/CHF stays neutral and further rise is in favor with 0.9077 minor support intact. On the upside, above 0.9157 will resume the rebound from 0.8987 to retest 0.9223 high. On the downside,...

Sunset Market Commentary – Action Forex

Markets Today’s eco calendar was light compared to earlier this week but that didn’t prevent a further sell-off on core bond markets. April US durable goods orders were stronger than expected, but March figures face a downward revision. Core shipments, input for GDP...

Weekly Focus – Euro Economy on Track for Mild Recovery

Economic news was to the solid side this week with not least euro area PMIs painting a stronger picture. The main surprise came from manufacturing PMI which increased from 45.7 to 47.4 (consensus 46.1) while the service sector stayed at a decent level of 53.3. The...

Canadian GDP Per Capita Likely Shrunk for Seventh Consecutive Quarter in Q1

The Canadian economy likely grew more quickly in Q1 2024 based on headline figures, but it was not fast enough yet again to keep up with surging population growth. That means gross domestic product on a per-person basis contracted for a seventh consecutive quarter. We...

Week Ahead – US PCE Inflation and Eurozone CPI Data Enter the Spotlight

Dollar traders lock gaze on core PCE index Eurozone CPIs in focus as June cut looms Tokyo CPIs may complicate BoJ’s policy plans Aussie awaits Australian CPIs and Chinese PMIs Will PCE data break the “higher for longer” mantra? The US dollar stabilized this week,...

Could Developments in Iran and Saudi Arabia Turn the Tide for Oil?

Iran is still quiet about reasons behind the helicopter accident Saudi Arabia’s King health scare turns focus on Crown Prince Oil still under pressure; a new catalyst could reverse the recent trend Iranian Presidential elections to be held on June 28 News of the...

ECB Preview – A Political Rate Cut in June, and No Cut in September

On Thursday 6 June, the ECB is widely expected to deliver a 25bp rate cut, largely because the governing council members have stated as much. The updated June staff projection is expected to suggest that the prevailing economic and monetary policy narrative stays...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0794; (P) 1.0827; (R1) 1.0850; More… Intraday bias in EUR/USD stays neutral and outlook is unchanged. On the upside, break of 1.0894 will resume the rise from 1.0601 to 1.0980 resistance. Decisive break there will confirm that whole fall from...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 156.55; (P) 156.92; (R1) 157.30; More… No change in USD/JPY’s outlook and intraday bias remains mildly on the upside. Rise from 161.86, as the second leg of the corrective pattern from 160.20, should now target 100% projection of 151.86 to 156.78...

Euro Rebounds With Sterling, Dollar Softens Despite Solid Durable Goods

Euro rebounded notably today despite the absence of substantial news from Europe. Sterling followed suit, shrugging off poor UK retail sales data. Conversely, Dollar ignored upbeat durable goods data and weakened alongside Yen and Swiss Franc. Commodity currencies...

US durable goods orders rise 0.7% mom, ex-transport orders up 0.4% mom

US durable goods orders rose 0.7% mom to USD 284.1B in April, above expectation of 0.5% mom. Ex-transport orders rose 0.4% mom to USD 187.9B, above expectation of 0.1% mom. Ex-defense orders was flat at 268.0B. Transportation equipment rose 1.2% mom to USD 96.2B. Full...

AUD/USD: Regains Traction After Losing Over 1% This Week

AUDUSD edges higher on Friday as traders collected part of profits from the drop in past four days. Today’s action marks the first gain this week, but the pair remains on track for a weekly loss of over 1% so far. Technical studies on daily chart are mixed and lack...

Ethereum: Too Soon to Say Goodbye to $3000

Market picture The crypto market lost 2.9% in the last 24 hours, retreating to a market capitalisation of $2.5 trillion. The market came under pressure as active trading began in the US on a fresh batch of strong economic data. News of the approval of spot ETFs on...

Is the Pause in NGAS a Warning Signal?

Natural gas faces limits near January’s peak Technical signals flag some weakness Improved trend signals suggest bullish continuation Lower-than-usual storage increases, improved demand forecasts, and a summer season ahead boosted natural gas prices above the key...

ECB’s Schnabel warns against hasty moves following likely June cut

ECB Executive Board member Isabel Schnabel indicated in an interview that if inflation outlook and upcoming data support a sustainable convergence towards 2% target, “a rate cut in June will be likely.” However, Schnabel emphasized the need for caution regarding...

Australian Dollar Rapidly Depreciates – Action Forex

The AUD/USD pair has fallen rapidly in the final week, reaching 0.6592. This decline is primarily driven by the US dollar’s robust performance, following stronger-than-expected US economic data. Investors now speculate that the Federal Reserve may postpone any...

GBPJPY Continues its Journey North

GBPJPY closing in to pre-intervention levels BoJ has the habit of intervening during bank holidays Momentum indicators remain bullish GBPJPY is edging higher again today, trading very close to the levels that forced the BoJ to intervene twice in late April. This pair...

Canadian Dollar Eyes Retail Sales

The Canadian dollar is unchanged on Friday. USD/CAD is trading at 1.3726 in the European session at the time of writing at the time. Canada releases retail sales later, which may trigger some volatility in the North American session. The US will release durable goods...

WTI Crude Oil Opens the Way for Bearish Actions

WTI drops below diagonal line 20- and 200-day SMAs post death cross RSI flattens and Stochastics hold in oversold region WTI crude oil with delivery in July is plummeting from the 80.00 level, which is acting as a strong resistance obstacle as well as the 200-day...

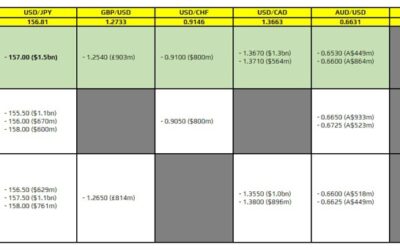

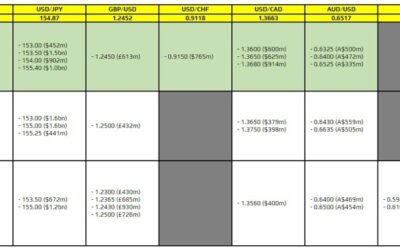

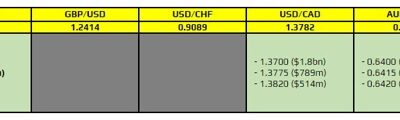

FX option expiries for 24 May 10am New York cut

There is just one large one to take note of, as highlighted in bold.That being for USD/JPY at the 157.00 mark. As such, that could keep price action to be stickier to the figure level in the session ahead until the expiries roll off later in the day. That despite a...

Dollar Gains Momentum as Fed Hike Re-Enters Markets Pricing, Despite Ultra Low Odds

Dollar’s rebound is gathering momentum, as fueled by yesterday’s data indicating a resurgence in the services sector, which could impede disinflation progress. While fed fund futures still reflect over 50% probability of a rate cut in September, there is now a 0.6%...

Eurozone PMI composite hits 12-month high at 52.3, pointing to 0.3% GDP growth in Q2

In May, Eurozone’s PMI Manufacturing rose from 45.7 to 47.4, surpassing expectations of 46.6 and marking a 15-month high. PMI Services remained unchanged at 53.3, slightly below the forecast of 53.5. PMI Composite increased from 51.7 to 52.3, reaching a 12-month high....

New Zealand Dollar Rises After Hot Retail Sales Data

The New Zealand dollar is in positive territory on Thursday. NZD/USD is up 0.38%, trading at 0.6120 in the European session at the time of writing. The New Zealand dollar showed some strength after the Reserve Bank of New Zealand rate decision on Wednesday, gaining as...

Gold: Hawkish Fed Minutes Further Weaken Near-Term Sentiment

Gold price remains in red for the third straight day and fell to the lowest since May 15 during early European session on Thursday, in extension of Wednesday’s 1.75% drop. Fed minutes, released late Wednesday, showed that the US central bank believes that inflation...

EURGBP Tests Critical Pivot Area After Slump

EURGBP at a make-or-break point near 0.8500 after plunge Oversold conditions detected, but the bears not ready to give up the battle EURGBP was knocked down near the 200-day simple moving average (SMA) at the start of the month, subsequently losing around 1.0% to...

US initial jobless claims falls to 215k, vs exp 220k

US initial jobless claims fell -8k to 215k in the week ending May 18, below expectation of 220k. Four-week moving average rose 2k to 220k. Continuing claims rose 8k to 1794k in the week ending May 11. Four-week moving average of continuing claims rose 5k to 1782k....

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2691; (P) 1.2726; (R1) 1.2753; More… Intraday bias in GBP/USD stays neutral for the moment. On the upside. decisive break of 100% projection of 1.2298 to 1.2633 from 1.2445 at 1.2780 will extend the rally from 1.2298 to 1.2892 resistance next....

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 156.33; (P) 156.58; (R1) 157.07; More… Intraday bias in USD/JPY stays neutral and outlook is unchanged. Price actions from 160.20 are seen as a corrective pattern. On the upside, break of 156.78 will resume the rise from 151.86, as the second leg,...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.9117; (P) 0.9138; (R1) 0.9178; More…. Intraday bias in USD/CHF is turned neutral with current retreat. On the upside, above 0.9157 will resume the rebound from 0.8987 to retest 0.9223 high. On the downside, break of 0.9077 support will bring...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0805; (P) 1.0834; (R1) 1.0852; More… EUR/USD recovers ahead of 1.0810 resistance turned support. Intraday bias stays neutral at this point. On the upside, break of 1.0894 will resume the rise from 1.0601 to 1.0980 resistance. Decisive break there...

US PMI composite jumps to 25-month high, upturn accelerates again

US PMI Manufacturing rose from 50.0 to 50.9 in May. PMI Services rose fro 51.3 to 54.8, a 12-month high. PMI Composite rose from 51.3 to 54.4, a 25-month high. Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said: “The US economic...

EUR/USD: Recovery Needs Further Positive Signals to Resume

The Euro regained traction and bounced 0.3%, after pullback from 1.0895 (May 16 high) was repeatedly rejected at 100DMA (1.0814), generating initial signal of a double-bottom and potential end of corrective phase. Fresh strength so far retraced over 50% of...

Sunset Market Commentary

Markets European May PMIs were generally speaking good. The services reading stabilized at a decent 53.3 in May but a better-than-expected improvement in the admittedly still struggling manufacturing sector (from 45.7 to 47.4) lifted the composite figure to the...

USD/JPY Steady as Japanese PMIs Mixed

The Japanese yen is slightly lower on Thursday. USD/JPY is trading at 156.70, down 0.08% on the day at the time of writing. Japan’s PMIs for April were a mixed bag and the yen didn’t show much reaction. Services PMI dipped to 53.6, down from 54.3 in March and just shy...

Euro Recovers on Eurozone PMIs, But Gains Limited

As trading progresses into US session, activity in the forex markets remains relatively muted. Euro is showing signs of recovery ahead of key support levels against Dollar and crucial support against Sterling. Eurozone PMIs revealed that economic recovery is...

EUR/USD Price Forms Bullish Reversal Amid Key News

Last night, the FOMC meeting minutes were released. According to USNews, there were no major surprises. However, the confirmation of persistent inflation – along with hints that some officials discussed potential future rate hikes – displayed a “hawkish” stance. The...

Gold Falls from Highs – Action Forex

The price of gold fell to $2370.00 per troy ounce by Thursday following the release of the minutes from the latest US Federal Reserve meeting. The general tone of the Fed’s policymakers was notably cautious, aligning with previous calls for a restrained approach to...

Bitcoin Prepares for $100K Hike

Market picture The crypto market is quiet, hovering around a total capitalisation of $2.6 trillion for the third day. Bitcoin has so far failed to gain a foothold above $70K, and this is curbing the enthusiasm. It is losing 0.3% in 24 hours against Ethereum’s 0.6%...

GBP/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 198.20; (P) 198.56; (R1) 198.84; More… Intraday bias in GBP/JPY remains on the upside for the moment. Current rise from 191.34, as the second leg of the corrective pattern from 200.53, should target 100% projection of 191.34 to 180.07 from 195.02 at...

EUR/USD Fell With Noticeable Acceleration After FOMC Minutes

Markets Above-consensus April inflation figures in the UK triggered an obvious underperformance of gilts, resulting in yield gains between 7.2 (30-yr) and 14.2 bps (2-yr). A June rate cut by the BoE is just short of fully priced out. Steep gilt losses dragged core...

Eurozone PMI composite hits 12-month high at 52.3, pointing to 0.3% GDP growth in Q2

In May, Eurozone’s PMI Manufacturing rose from 45.7 to 47.4, surpassing expectations of 46.6 and marking a 15-month high. PMI Services remained unchanged at 53.3, slightly below the forecast of 53.5. PMI Composite increased from 51.7 to 52.3, reaching a 12-month high....

Is USDJPY Still Searching for New Highs?

USDJPY surpasses key resistance, but more steps needed Short-term risk tilted to the upside; 157.00 mark under examination US S&P Global PMIs, initial jobless claims, new home sales on the agenda USDJPY closed Wednesday’s session with modest gains at 156.75 as the...

UK PMI manufacturing rises to 22-month high, services growth slows

UK PMI Manufacturing rose from 49.1 to 51.3 in May, surpassing expectations of 49.2 and reaching a 22-month high. However, PMI Services fell from 55.0 to 52.9, below the anticipated 54.8 and marking a 6-month low. Consequently, PMI Composite dropped from 54.1 to 52.8....

FX option expiries for 23 May 10am New York cut

There aren't any major expiries to take note of for the day. As such, trading sentiment will be a bit of a mix of things in the day ahead. For one, we have PMI data to deal with alongside the US weekly jobless claims. Then, we also have to consider the overall risk...

Dollar Recovers Post-Hawkish FOMC Minutes, EUR/GBP in Focus

Trading has been relatively quiet in Asian session today. Dollar regained some ground overnight following hawkish minutes from the latest FOMC meeting, which revealed that several members are prepared to support further rate hike if necessary. Despite this, the...

GBP/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 198.20; (P) 198.56; (R1) 198.84; More… GBP/JPY’s rally continues today and intraday bias stays on the upside. Current rise from 191.34, as the second leg of the corrective pattern from 200.53, should target 100% projection of 191.34 to 180.07 from...

Bitcoin Waits for Ethereum Story to Develop

Market picture The crypto market cap has stabilised at $2.6 trillion after an impressive surge following the Ethereum rally. Among the top coins over 24 hours, Toncoin is leading the decline, falling 5%, while Dogecoin is leading the way with a 3.4% increase. Bitcoin...

New Zealand Dollar Shows Steady Rise

The NZD/USD pair is preparing for a mid-week rally, approaching the 0.6116 level. These current values mark the highest point for the Kiwi in two months, following the Reserve Bank of New Zealand’s decision to maintain its monetary policy structure unchanged during...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2689; (P) 1.2708; (R1) 1.2729; More… Intraday bias in GBP/USD remains on the upside for 100% projection of 1.2298 to 1.2633 from 1.2445 at 1.2780. Firm break there will target 1.2892 resistance next. However, break of 1.2685 will minor support...

Bank of England – Revised BoE Call – Hot Service Inflation Spells Trouble

On the back of continued strong inflationary pressures in the service sector, as evident in the April inflation print, we revise our BoE call. We now expect the first 25bp cut in August (prev. June). We expect quarterly cuts from August and through 2025, leaving the...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0840; (P) 1.0857; (R1) 1.0872; More… EUR/USD dips notably today but stays above 1.0810 resistance turned support. Intraday bias remains neutral and further rally is still in favor. On the upside, break of 1.0894 will resume the rise from 1.0601 to...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.9092; (P) 0.9104; (R1) 0.9122; More…. USD/CHF’s rebound from 0.8987 extends higher today, and intraday bias stays on the upside. Further rally would be seen to 0.9223 resistance. On the downside, below 0.9086 minor support will turn intraday bias...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 155.75; (P) 156.03; (R1) 156.56; More… No change in USD/JPY’s outlook and intraday bias stays neutral. Price actions from 160.20 are seen as a corrective pattern. On the upside, break of 156.78 will resume the rise from 151.86, as the second leg, to...

Sunset Market Commentary – Action Forex

Markets April UK inflation figures set the tone from the start of trading. The Bank of England, with a leading role for chair Bailey, hyped the number way in advance as coming a long way in the direction of the 2% inflation target. That was because of the anticipated...

UK Inflation Distanced the Expected Rate Cut

Inflation in the UK exceeded forecasts, making traders and investors cautious about the prospects for policy easing in the coming months. Consumer prices rose by 0.3% m/m vs. 0.2% expected. Annual inflation slowed to 2.3% last month from 3.2% in March. This is the...

GBP/USD Shrugs as UK Inflation Higher Than Expected

The British pound edged higher earlier today but has pared most of those gains. GBP/USD is trading at 1.2703, up 0.06% early in the North American session. UK inflation declines less than expected UK inflation fell sharply in April, falling to 2.3% y/y. This was down...

Sterling Up as BoE June Cut Hopes Diminish; But Dollar and Kiwi Outshine

Sterling climbed broadly today after data showed that UK disinflation progress was slower than anticipated, with services inflation remaining persistently high. This development dashed hopes for an imminent rate cut by BoE, causing the odds of a rate cut in June to...

Bundesbank sees German economy gradually gaining momentum in Q2

In its monthly report, Bundesbank indicated that Germany’s economic output is “likely to increase slightly again” in Q2. The general trend suggests that the economy is gradually “picking up speed,” with positive impulses expected from private consumption and a...

New Zealand Dollar Climbs after Hawkish RBNZ Announcement

The New Zealand dollar has pushed higher on Wednesday. NZD/USD is up 0.54%, trading at 0.6124 in the European session at the time of writing. The New Zealand dollar rose as high as 0.6152 (0.80%) in the Asian session after the RBNZ meeting but has pared much of these...

GBP/USD: Cable Hits Two-Month High After Inflation Data

Cable rose to two-month high (1.2761) on Wednesday, after UK inflation data for April showed that prices pressure eased below expectations, hurting bets for BoE’s June rate cut. Fresh acceleration higher generates initial signal of bullish continuation after the price...

Nvidia’s Stock Price Has Doubled Since the Beginning of this Year

Federal Reserve’s (Fed) Christopher Waller gave a C+ to the latest US inflation data, saying that it’s ‘far from failing but it’s not stellar’. Equity investors, however, continue giving the US stock indices a big, fat A+ on robust earnings, yes, but also on hope that...

Sterling Soars Once Again in the Wake of Consensus-Beating CPI

Markets US Treasury and German yields both ended a fairly quiet trading day a few basis points lower. Fed’s Waller in a second speech yesterday said that he’d consider a rate cut at the end of the year (December) if the data warranted it. He added that policy was...

NZDUSD Posts New 2-Month High

NZDUSD starts the day with strong upside momentum after RBNZ decision MACD and RSI tick higher NZDUSD had an aggressive bullish start at the beginning of the day, following the bounce off the 0.6080 support level and creating a spike towards a fresh two-month high of...

Market Analysis: GBP/USD Climbs Steadily While EUR/GBP Struggles

GBP/USD is gaining pace above the 1.2640 resistance. EUR/GBP declined steadily below the 0.8565 and 0.8550 support levels. Important Takeaways for GBP/USD and EUR/GBP Analysis Today The British Pound is attempting a fresh increase above 1.2700. There is a key bullish...

GBPUSD Renews Positive Momentum Within Channel

GBPUSD strengthens to a two-month high within bullish channel Short-term bias looks positive, but buying appetite might lose pace UK S&P Global PMIs and BoE member Pill on the agenda on Wednesday Following a short period of consolidation around the 1.2700 level,...

NZD Spikes on Hawkish RBNZ Decision, Focus Shifts to UK Inflation Data

New Zealand Dollar surged sharply higher following RBNZ’s unexpectedly hawkish rate decision. While OCR was left unchanged, the central bank signaled the increased possibility of another rate hike this year and delayed projected timing of the first rate cut to the...

FX option expiries for 22 May 10am New York cut

There aren't any major expiries to take note of for the day.As such, trading sentiment will continue to be driven by the recent market mood. And that means we might be in for another duller session overall, with traders mostly waiting on the Fed minutes later today...

USDCAD’s Upturn Still Lackluster – Action Forex

USDCAD pivots gently higher but still constrained between trendlines A decisive bounce above 1.3745 needed for fresh buying Canadian CPI scheduled for release at 12:30 GMT; Fed speakers on the agenda too USDCAD has been tip-toeing higher since its downward pattern...

Is the Time for WTI Crude Oil to Create Bearish Correction?

Fed’s cautious stance drives WTI crude oil lower Commodity capped by bearish cross and 80.00 level in daily chart Prices consolidate in 4-hour timeframe Oil prices continued to decrease on Tuesday due to the cautious stance of Fed officials despite the recent...

Canada’s CPI falls to 2.7% in Apr, matches expectations

Canada’s CPI slowed from 2.9% yoy to 2.7% yoy in April, matched expectations. Ex-gasoline, CPI slowed from 2.8% yoy to 2.5% yoy. Gasoline prices accelerated from 4.5% yoy to 6.1% yoy. Food prices slowed from 1.9% yoy to 1.4% yoy. On a monthly basis CPI rose 0.5% mom,...

USD/CAD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.3602; (P) 1.3618; (R1) 1.3641; More… USD/CAD recovered notably today but stays below 1.3689 resistance. Intraday bias stays neutral first. Strong bounce from current level will confirm support by 55 D EMA (now at 1.3628). Break of 1.3689 minor...

Canada: Inflation Cools Further in April

Headline CPI inflation edged lower in April to 2.7% year-on-year (y/y), matching expectations. The broad-based deceleration was led by food prices, services and durable goods. However, higher prices at the pump in April worked against the cooling in inflation....

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 155.75; (P) 156.03; (R1) 156.56; More… Outlook in USD/JPY is unchanged and intraday bias stays neutral. Price actions from 160.20 are seen as a corrective pattern. On the upside, break of 156.78 will resume the rise from 151.86, as the second leg,...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.9087; (P) 0.9098; (R1) 0.9118; More…. Intraday bias in USD/CHF stays mildly on the upside at this point. Corrective fall from 0.9223 might have completed with three waves down to 0.8987 already. Further rally should be seen back to retest 0.9223....

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2687; (P) 1.2707; (R1) 1.2725; More… Intraday bias in GBP/USD remains on the upside at this point. Rise from 1.2298 would target 100% projection of 1.2298 to 1.2633 from 1.2445 at 1.2780. On the downside, below 1.2642 minor support will turn...

Sunset Market Commentary – Action Forex

Markets: Trading was again confined to rather tight ranges today. US yields created some breathing space end last week compared to important support levels (4.7% area US 2-y yield, 4.3/37% area 10-y yield), but for now follow-through gains look rather difficult. Eco...

How Will Eurozone PMIs Impact ECB Expectations?

Eurozone economy has been improving in 2024 But investors still anticipate an ECB rate cut in June The flash PMIs could impact bets beyond that meeting The data comes out on Thursday at 08:00 GMT ECB signals confidence in lowering rates At their latest gathering, ECB...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0846; (P) 1.0865; (R1) 1.0877; More… EUR/USD is still bounded in consolidations below 1.0894 and intraday bias stays neutral. Further rally is expected as long as 1.0810 resistance turned support holds. Break of 1.0894 will resume the rise to...

Fed’s Waller: Several months of data needed before supporting rate cuts

Fed Governor Christopher Waller emphasized in a speech today that “several more months” of favorable inflation data are necessary before he would consider supporting interest rate cuts. While the latest CPI data was a “reassuring signal” indicating that inflation is...

CAD Sinks after CPI, NZD Await RBNZ

Canadian Dollar sees a broad decline in early US session due to growing speculation about rate cut by BoC in the near future. April’s headline CPI slowed as expected, despite a significant increase in gasoline prices. Core inflation measures also showed more progress...

NZD/USD Steady Ahead of RBNZ Rate Announcement

The New Zealand dollar is almost unchanged on Tuesday. NZD/USD is down 0.06%, trading at 0.6102 in the European session at the time of writing. RBNZ expected to maintain cash rate The Reserve Bank of New Zealand has shown it can be patient, having held the cash rate...

IMF recommends BoE cut rates by 50-75 bps in 2024

IMF issued a report today suggesting that with UK inflation currently 2% above its neutral rate estimate, BoE should consider moving towards monetary easing. IMF highlighted the risks of “delayed easing”, cautioning that while BoE emphasizes the need to wait for...

Fed Rate Expectations Whipsawed by Fed Speakers and US CPI

It has been a rollercoaster period for Fed rate cut expectations Sticky US inflation is keeping the market on its toes Numerous Fed speakers this week; market sensitive to hawkish comments Dollar’s 2024 gains dented despite divergent monetary policy outlooks The year...

GBP/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 197.76; (P) 198.21; (R1) 199.01; More… Intraday bias in GBP/JPY remains on the upside. Current rise from 191.34, as the second leg of the corrective pattern from 200.53, should target 100% projection of 191.34 to 180.07 from 195.02 at 200.75. On the...

Number of Central Bank Speakers Increases

Markets Markets took a slow start to the new trading week. An empty eco calendar facilitated the status quo. Cleveland Fed Mester said that inflation risks moved up in Q1 while the economy was a little bit stronger than anticipated. Given that she wasn’t on the median...

Commodity Currencies Retreat from Local Highs

Despite the cooling labour market in the US and declining inflation, the American currency continues to move towards new highs. For instance, the USD/JPY currency pair might update the current month’s high at 156.70, the NZD/USD sharply declines after retesting...

Gold Price Reaches Historic High

According to confirmed information, Iranian President Ebrahim Raisi, considered a potential successor to the country’s supreme leader, Ayatollah Ali Khamenei, died in a helicopter crash in a mountainous area near the border with Azerbaijan. The helicopter also carried...

Eurozone goods exports down -9.2% yoy in Mar, imports down -12.0% yoy

Eurozone goods exports fell -9.2% yoy to EUR 245.5B in March. Goods imports fell -12.0% yoy to EUR 221.3B. Trade balance recorded EUR 24.1B surplus. Intra-Eurozone trade fell -12.4% yoy to EUR 222.1B. In seasonally adjusted term, goods exports rose 0.1% mom to EUR...

EURJPY Shows Appetite for Retesting 40-Year High

EURJPY holds well above uptrend line RSI stands near 70 level Next target at multi-year peak EURJPY is rallying sharply higher after the strong bounce off the 164.00 support level and the medium-term ascending trend line. The pair is heading towards the previous...

FX option expiries for 21 May 10am New York cut

There are a couple to take note of, as highlighted in bold.The first one is for EUR/USD at the 1.0840 level. It isn't one that is too technically significant but could hold price action from slipping much lower at least in the session ahead. That being said, we are...

Aussie and Yen Decline, Loonie Awaits Crucial CPI Data

Australian Dollar weakened broadly during Asian session as its recent rally lost momentum. Despite RBA minutes revealing that a rate hike was considered earlier this month, which should have been supportive for the Aussie, this positive sentiment was countered by weak...

Pound Shrugs After BoE’s Broadbent Signals Rate cut

The British pound is almost unchanged on Monday. GBP/USD is trading at 1.2704 in the European session at the time of writing. The pound is coming off a strong week, with gains of 1.4%. GBP/USD touched a high last week of 1.2711, its highest point since March 21. The...

Australian Dollar Eyes RBA Minutes

The Australian dollar is unchanged at the time of writing, trading at 0.6692 in the European session. There are no economic releases out of the US or Australia today, which should translate into a quiet day for AUD/USD. The Aussie is coming off an excellent week,...

USD/JPY: Conflicting Factors at Play, Sideways for Now in the Short-Term

The Japanese Government Bond (JGB) market is now anticipating a potential Q2 recovery in the Japanese economy as the 2-year and 10-year JGB yields have rallied to more than a decade high. The 10-year and 20-year yield premiums of US Treasuries over JGBs have shrunk in...

Bitcoin Cautious Despite Global Rise in Risk Appetite

Market picture Crypto market capitalisation rose 5.2% over the past seven days to $2.41 trillion. Over the weekend, it reached $2.44 trillion, its highest level in nearly four weeks. Bitcoin is treading near local highs, remaining just below $67K. That’s a gain of...

Will UK Inflation Corroborate a June BoE Rate Cut?

Investors assign 60% chance for a June rate cut by the BoE UK CPI data to reveal whether inflation hit the BoE’s target But PMIs imply some upside risks The data is scheduled for Wednesday at 06:00 GMT BoE appears more dovish than expected While a few weeks ago...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0844; (P) 1.0861; (R1) 1.0886; More… EUR/USD is staying in consolidation below 1.0894 and intraday bias stays neutral. Further rally is expected as long as 1.0810 resistance turned support holds. Break of 1.0894 will resume the rise to 1.0980...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2660; (P) 1.2686; (R1) 1.2727; More… No change in GBP/USD’s outlook and intraday bias stays on the upside. Firm break of 1.2708 resistance will extend the rise from 1.2298 to 100% projection of 1.2298 to 1.2633 from 1.2445 at 1.2780. On the...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.9062; (P) 0.9080; (R1) 0.9110; More…. No change in USD/CHF’s outlook and intraday bias stays neutral. On the upside, firm break of 0.9101 will argue that corrective fall from 0.9223 has completed with three waves down to 0.8987 already. Further...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 155.29; (P) 155.63; (R1) 156.02; More… No change in USD/JPY’s outlook and intraday bias stays neutral. Price actions from 160.20 are seen as a corrective pattern. On the upside, break of 156.78 will resume the rise from 151.86, as the second leg, to...

Oil Shows Weakness – Action Forex

Oil is losing about 0.75% of its peak on Monday, having hit a strengthening sell-off as it attempts to climb above $80/bbl WTI and $84/bbl Brent. Interestingly, oil is declining despite the death of Iran’s president, which should reinforce the risk premium, and...

Risk-On Rally Continues in Quiet Markets, Forex Lacks Direction

Global financial markets are trading with a risk-on sentiment today, starting from the Asian session and continuing through the European and early US sessions. However, gains in stocks have been relatively limited, partly constrained by recovery in benchmark treasury...

Fed’s Bostic: Maybe only one rate cut this year

Atlanta Fed President Raphael Bostic stated in a BloombergTV interview today that it will take time before the Fed is confident that inflation will return to 2%. He reiterated his stance that “nothing has changed” regarding his view that perhaps only one rate cut will...

Fed’s Barr: Not confident to start easing monetary policy yet

Fed Vice Chair Michael Barr stated in a speech today that while inflation has decreased from its peak of 7.1% to 2.7%, it is “not yet all the way to 2% target. He noted that inflation readings for the first quarter were “disappointing,” as highlighted in FOMC’s recent...

AUDCAD Rises to New 14-Month High

AUDCAD is higher again today above 0.9100 RSI and MACD are holding in their positive regions AUDCAD has been in an upward movement since February 8, posting a 14-month high of 0.9125 earlier in the day. Entering the 0.9100 area has been a struggle over the past two...

EUR/AUD Daily Outlook – Action Forex

Daily Pivots: (S1) 1.6210; (P) 1.6259; (R1) 1.6288; More… Intraday bias in EUR/AD is back on the downside with breach of 1.6216 support. Current fall from 1.6742 is seen as the third leg of the corrective pattern from 1.7062. Deeper fall would be seen to 1.6127...

EUR/GBP Daily Outlook – Action Forex

Daily Pivots: (S1) 0.8547; (P) 0.8566; (R1) 0.8577; More… Intraday bias in EUR/GBP remains on the downside for 0.8259 support. Decisive break there will suggest that larger down trend is ready to resume through 0.8491/7 support one. On the upside, above 0.8579 minor...

Gold Unlocks Another Record High

Gold advances above sideways channel 20- and 50-day SMAs tick up MACD and RSI suggest more upside pressure Next target at 261.8% Fibo extension of 2,515 Gold prices skyrocketed to another fresh high of 2,450 earlier in the day, currently holding above the previous...

Gold Hits New Record High

On Monday, a troy ounce of gold set a new price peak of 3438.00 USD. This surge was fuelled by renewed speculation about potential interest rate cuts by the US Federal Reserve, vigorous gold purchases by banks globally, and strong investor demand for safe-haven...

BoE’s Broadbent: Summer rate cut possible

In a speech today, BoE Deputy Governor Ben Broadbent indicated that if current forecasts hold, which suggest that monetary policy will need to become “less restrictive at some point”, a rate cut could occur “over the summer”. Broadbent noted that the direct impact of...

Could RBNZ Support Kiwi’s Recent Strength?

RBNZ meets on Wednesday, no rate change expected Quarterly forecasts and press statement will be closely scrutinized Press conference to gain interest if RBNZ turns dovish Kiwi’s recent run against the dollar could be under threat Third RBNZ meeting in 2024 The...

EUR/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 168.87; (P) 169.10; (R1) 169.42; More… EUR/JPY’s rise from 1.6401 resumed by breaking 169.38 and intraday bias is back on the upside. This rally, as the second leg of the corrective pattern from 171.58, should target this high next. On the downside,...

GBP/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 197.03; (P) 197.45; (R1) 198.10; More… Intraday bias in GBP/JPY stays on the upside at this point. Rise from 191.34, as the second leg of the corrective pattern from 200.53, should target this high next. On the downside, firm break of 195.02 will...

FX option expiries for 20 May 10am New York cut

There are a couple to take note of on the day, as highlighted in bold.The first ones are for EUR/USD at 1.0875 and 1.0900. That is likely to keep price action more compact in that range on the day, considering little to work with in European trading as well. It's a...

Week Begins with Market Optimism, Metals See Strong Gains

Asian markets kicked off the week on a positive note, buoyed by the record-breaking rally in US markets last week. Despite escalating geopolitical tensions in the Middle East, which have spurred strong rallies in metals, stock investors appear relatively calm. Trading...

Forex and Cryptocurrency Forecast – Action Forex

EUR/USD: Weak Inflation = Weak USD The American currency suffered two significant blows last week. Although these were not knockdowns, let alone knockouts, these minor shocks pushed the DXY Dollar Index down from 105.26 to 104.20 points, and EUR/USD up from 1.0766 to...

Weekly Economic & Financial Commentary: Fed Rate Cuts Back on the Table?

Summary United States: Let’s Wait and See There was no shortage of economic data this week, but little did much to change the macro landscape. The April inflation data were a step in the right direction, and if sustained, we see the first rate cut coming in September....

The Weekly Bottom Line: Inflation Breaks Its Heat Streak

U.S. Highlights After three consecutive months of hotter-than-expected inflation, consumer prices in the U.S. finally broke the heat streak in April, with headline and core inflation decelerating. Retail sales also lost momentum in April, with spending coming in flat...

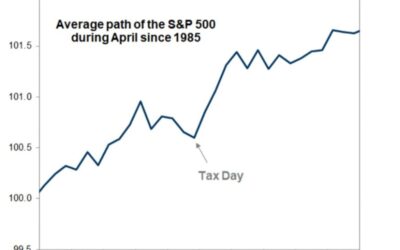

Risk-On Sentiment Pushes US Stocks to New Highs, Safe-Haven Currencies Underperform

Risk-on sentiment dominated global financial markets last week, with investors buoyed by US inflation report that alleviated fears of another interest rate hike by Fed. The DOW defied gravity and surged to a new record high above the 40k mark, while S&P 500 and...

EUR/AUD Weekly Outlook – Action Forex

EUR/AUD stayed in sideway trading above 1.6216 last week and outlook is unchanged. Initial bias remains neutral this week first and further decline is expected. Break of 1.6216 will resume the fall from 1.6742, as the third leg of the corrective pattern from 1.7062....

EUR/GBP Weekly Outlook – Action Forex

EUR/GBP’s fall last week argues that rebound from 0.8529 has completed at 0.8619 already. Initial bias remain the downside this week for 0.8529 support first. Decisive break there will that larger down trend is ready to resume through 0.8491/7 support one. On the...

EUR/JPY Weekly Outlook – Action Forex

EUR/JPY retreated after rising further to 169.38 last week but then recovered. Initial bias remains neutral this week first, and further rise is expected. Break of 169.38 will resume the rally from 164.01, as the second leg of the corrective pattern from 171.58,...

USD/CAD Weekly Outlook – Action Forex

USD/CAD edged lower to 1.3589 last week but recovered. Initial bias remains neutral this week first. Further decline is in favor as long as 1.3689 resistance holds. Break of 1.3589 will resume whole fall from 1.3845 and target 100% projection of 1.3845 to 1.3608 from...

AUD/USD Weekly Report – Action Forex

AUD/USD’s rally from 0.6361 resumed last week but retreated after hitting 0.6713. Initial bias remains neutral for some consolidations. Further rally is expected as long as 0.6578 support holds. As noted before, fall from 0.6870 has probably completed with three waves...

USD/CHF Weekly Outlook – Action Forex

USD/CHF rebounded strongly after edging lower to 0.8987 last week, but upside is capped below 0.9101 resistance. Initial bias stays neutral this week first. On the upside, firm break of 0.9101 will argue that corrective fall from 0.9223 has completed with three waves...

GBP/USD Weekly Outlook – Action Forex

GBP/USD’s rise from 1.2298 resumed by breaking through 1.2633 last week. Initial bias is now on the upside this week. Firm break of 1.2708 resistance will target 100% projection of 1.2298 to 1.2633 from 1.2445 at 1.2780. On the downside, below 1.2642 minor support...

EUR/USD Weekly Outlook – Action Forex

EUR/USD’s rally from 1.0601 resumed last week and further to 1.0894 before retreating. Initial bias remains neutral this week for consolidations first. Further rally is expected as long as 1.0810 resistance turned support holds. Break of 1.0894 will resume the rise to...

USD/JPY Weekly Outlook – Action Forex

USD/JPY fell sharply after edging higher to 156.78 but recovered again after hitting 153.59. Initial bias remains neutral this week first. Price actions from 160.20 are seen as a corrective pattern. On the upside break of 156.78 will resume the rise from 151.86, as...

GBP/JPY Weekly Outlook – Action Forex

GBP/JPY’s rebound from 191.34 continued last week despite interim retreat. Initial bias stays on the upside this week for 200.53 resistance. On the downside, break of 195.02 support will argue that corrective pattern from 200.53 has started the third leg already, and...

EUR/CHF Weekly Outlook – Action Forex

EUR/CHF’s rally from 0.9252 resumed by breaking through 0.9847 resistance last week. Initial bias stays on the upside this week for 61.8% projection of 0.9304 to 0.9847 from 0.9563 at 0.9899. Decisive break there could prompt upside acceleration to 100% projection at...

Summary 5/20 – 5/24

Monday, May 20, 2024 Tuesday, May 21, 2024 Wednesday, May 22, 2024 Thursday, May 23, 2024 Friday, May 24, 2024 The post Summary 5/20 – 5/24 appeared first on Action Forex.

GBPJPY Ascends as BoJ is on the Lookout

GBPJPY in the green again, returns to pre-intervention levels Increasing possibility of another BoJ intervention Momentum indicators remain mostly bullish GBPJPY is edging higher again today, recording its ninth green candle in the last 10 sessions. The bearish...

Euro Edges Lower Despite Positive Inflation Report

The euro has posted slight losses on Friday. EUR/USD is down 0.28%, trading at 1.0837 in the North American session at the time of writing. Eurozone CPI steady, core CPI falls The April inflation report showed that headline inflation remained steady at 2.4% y/y,...

S&P 500 Index Hits Record High Amidst Lower Inflation

The US stock market has surged to new heights, with the S&P 500 index reaching a record high of 5,325 points and the DJIA index touching 40,000 points. Investors are experiencing euphoria, spurred by the unexpectedly low US inflation figures released earlier....

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0850; (P) 1.0872; (R1) 1.0890; More… EUR/USD is staying in consolidation below 1.0894 and intraday bias stays neutral at this point. Further rally is expected as long as 1.0765 support holds. Break of 1.0894 will resume the rise from 1.0601 to...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2642; (P) 1.2672; (R1) 1.2699; More… GBP/USD is staying in consolidation below 1.2669 and intraday bias remains neutral. Further rally is expected as long as 1.2445 support holds. Break of 1.2708 resistance will pave the way to 1.2892 resistance...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.9013; (P) 0.9038; (R1) 0.9088; More…. Intraday bias in USD/CHF stays neutral at this point. Further decline is expected as long as 0.9101 resistance holds. Break of 0.8987 will resume the whole fall from 0.9223 and target 38.2% retracement of...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 154.15; (P) 154.84; (R1) 156.08; More… Intraday bias in USD/JPY remains neutral and outlook is unchanged. Price actions from 160.20 are seen as a corrective pattern. On the upside break of 156.78 will resume the rise from 151.86, as the second leg,...

Sunset Market Commentary – Action Forex

Markets Several ECB policymakers hit the wires today, including Holzmann, de Guindos and heavyweight Schnabel. As a loyal hawk it was no surprise for Holzmann to caution against easing before the central bank is certain of inflation’s return to 2%. De Guindos stuck to...

Elliott Wave Expects Silver (XAGUSD) Pullback to Find Support

Short Term Elliott Wave in Silver (XAGUSD) suggests the metal rallies in impulsive structure from 10.3.2023 low. Up from there, wave (1) ended at 25.91 and dip sin wave (2) ended at 21.94. The metal then extended higher in wave (3) towards 29.79. Pullback in wave (4)...

Canadian Inflation Prints to Show Another Step Down in April

Next week’s Canadian April inflation report will be the last major data release before the Bank of Canada’s next interest rate decision on June 5th. Absent an upside surprise, we think the soft conditions in the economy and labour markets should warrant a 25-bps...

Week Ahead – Flash PMIs, UK & Japan CPIs in Focus; RBNZ to Hold Rates

After cool US CPI, attention shifts to UK and Japanese inflation Flash PMIs will be watched too amid signs of a rebound in Europe Fed to stay in the spotlight as plethora of speakers, minutes on tap No fireworks expected from RBNZ policy decision Will CPI report bring...

Dollar Still in Recovery With Indecisive Momentum; Eyes on USD/CHF Resistance

Dollar is gradually recovering from the selloff triggered by US CPI data release earlier in the week. However, the recovery momentum remains indecisive. US stock markets, after a record run, are taking a breather, but bullish sentiment still appears dominant. The...

Crypto Market Ready to Grow Further

Market picture The crypto market cooled off on Thursday afternoon, but on Friday morning, buyers stepped up again, bringing capitalisation back to levels from the day before at $2.39 trillion. Strong growth was followed by rapid profit-taking, which is a necessary...

After Surpassing $30, Silver May Aim for $50

Silver climbed above $29.8, rewriting the highs from January 2021, but once again faced selling intensification from that level for the first time in four years and has pulled back to $29.40 at the time of writing. Silver does not look overheated, as it is only now...

Australian Dollar Hits 4-month High

The Australian dollar is lower on Friday. AUD/USD is currently trading at 0.6658 in the European session, down 0.31% on the day. The Aussie touched a high of 0.6714 on Thursday, its highest level since January 10th. This followed a massive 1% surge on Wednesday after...

Pound Edges Lower, Markets Eye FedSpeak

The British pound is down slightly on Friday. GBP/USD is down 0.14%, trading at 1.2648 in the European session at the time of writing. It has been a good week for the pound, which has gained 1% against the US dollar. Wednesday’s inflation release showed CPI dipping in...

Calm Before Storm for WTI Oil Futures?

WTI oil futures hold near recent lows; develop within narrow neutral structure Technical signals indicate improving sentiment, but downside risks could emerge near 80.80 Despite occasional drops, WTI oil futures remained squeezed within the 78.00-80.00 area and...

Eurozone CPI finalized at 2.4% in Apr, core CPI at 2.7%

Eurozone CPI was finalized at 2.4% yoy in April, unchanged from March’s reading. CPI core (ex-energy, food, alcohol & tobacco) was finalized at 2.7% yoy, down from prior month’s (2.9% yoy). The highest contribution to the annual Eurozone inflation rate came from...

ECB’s de Guindos: Inflation to fluctuate at current levels before falling to 2% in 2025

ECB Vice President Luis de Guindos addressed inflation expectations at an event today, noting that “headline inflation is there at 2.4%, core inflation below 3%.” He projected that inflation will “fluctuate around these values” in the coming months. Looking further...

Selling Pressure Shifts to Yen and Swiss Franc, Dollar Recovers on Fed’s Hawkish Remarks

Yen’s selloff resumed after brief recovery yesterday and continued to weaken throughout Asian session. Markets largely ignored comments from former BoJ chief economist Toshitaka Sekine, who suggested the next rate hike could happen as soon as in June. The general...

FX option expiries for 17 May 10am New York cut

There are a couple to take note of, as highlighted in bold.And they are for EUR/USD at 1.0850 and 1.0875 on the day. The former especially is a relatively large one, which should help to contain price action around current levels in European morning trade. That should...

Crypto Market Shakes Off Consolidation

Market picture The release of US inflation data sparked a surge in risk asset purchases, with cryptocurrencies leading the charge. This follows a period of prolonged consolidation, which provided enough pent-up energy to fuel increased volatility. Over the past 24...

Bitcoin Price Hits a Month’s High, Breaking Key Resistance

Yesterday’s release of CPI figures suggests that inflation is slowing down and a rate cut could be on the horizon. This weakened the dollar and boosted the value of assets priced in dollars, including BTC/USD. As a result, the price of Bitcoin hit a May high....

Australian Dollar Surges After US Inflation Ease

The Australian dollar is lower on Thursday after surging 0.98% a day earlier. AUD/USD is currently trading at 0.6671, down 0.33% on the day. Australian job growth rebounds but unemployment rate rises Australian employment bounced back in April with an increase of...

US initial jobless claims falls to 222k, slightly above expectations

US initial jobless claims fell -10k to 222k in the week ending May 11, slightly above expectation of 219k. Four-week moving average of initial claims rose 2.5k to 218k. Continuing claims rose 13k to 1794k in the week ending May 4. Four-week moving average of...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.9001; (P) 0.9036; (R1) 0.9057; More…. Intraday bias in USD/CHF is turned neutral again first with current recovery. But further decline is expected as long as 0.9101 resistance holds. Break of 0.8987 will resume the whole fall from 0.9223 and...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 154.21; (P) 155.38; (R1) 156.08; More… Intraday bias in USD/JPY is turned neutral with current recovery. Outlook is unchanged that fall from 156.78 is seen as the third leg of the corrective pattern from 160.20 high. Below 153.59 will target 151.86...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2610; (P) 1.2648; (R1) 1.2725; More… Intraday bias in GBP/USD remains on the upside for the moment. Rise from 1.2298 is in progress. Firm break of 1.2780 will pave the way to 1.2892 resistance next. On the downside, below 1.2624 minor support will...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0783; (P) 1.0804; (R1) 1.0842; More… Intraday bias in EUR/USD remains on the upside for the moment. Current rise from 1.0601 is in progress for 1.0980 resistance. Decisive break there will confirm that whole fall from 1.1138 has completed already....

Euro Edges Lower After ECB’s Financial Stability Warning

The euro has posted slight losses on Thursday. EUR/USD is down 0.20%, trading at 1.0860 in the North American session at the time of writing. ECB warns of risks to financial stability The ECB’s Financial Stability Review expressed concern that financial stability...

Sunset Market Commentary – Action Forex

Markets Since the May 1 Fed decision/communication dominos fell in place for markets to embrace a correction on the April higher-for-long rally in US (and broader) yields. Despite US inflation holding sticky, Fed Chair Powell ‘reassured’ markets that policy was tight...

USD/JPY Steady as Japanese Economy Contracts

The Japanese yen climbed as much as 0.85% earlier on Thursday but has pared most of those gains. USD/JPY is trading at 155.38, up 0.31% in the European session. Japan’s economy contracted in the first quarter. GDP declined by 2% y/y in the first quarter, following a...

Gold Retreats After Hitting Upper Bollinger Band

Gold remains bullish in near term RSI moves horizontally below 70 level Gold prices recorded their second session of losses in the 4-hour chart after a failed attempt to break significantly above the 2,400 round level. Chances for a reversal are increasing as the RSI...

Dollar Recovers as US Stock Rally Stalls, Import Prices Pose Challenge

The strong rally in US stocks seen yesterday appears to lack follow-through momentum, with futures indicating a flat open today. The benchmark 10-year yield is fluctuating within a tight range, and Dollar is broadly recovering as selling momentum wanes. The strong...

US import price index rises 0.9% mom in Apr, highest since Mar 2022

US import price index rose 0.9% mom in April, well above expectation of 0.2% mom. That’s also the highest 1-month increase since March 2022. Over the past 12 months, import prices rose 1.1% yoy, highest since December 2022. Export price rose 0.5% mom, 1.0% yoy. Full...

Fed’s Williams: Monetary policy in a good place, no need to tighten today

In a Reuters interview, New York Fed President John Williams expressed confidence in the current state of monetary policy, stating that it is “in a good place.” He highlighted the positive mix of economic data, noting strong consumer spending, business investment, and...

ECB’s Centeno: Interest rate will come down

ECB Governing Council member Mario Centeno stated at a news conference today that Eurozone inflation rate’s fall towards the 2% target is “real,” and assured that the monetary policy interest rate will decrease. “The market expects that the interest rate reduction...

JPY Has Sharply Strengthened

The yen’s exchange rate rose to the US dollar on Thursday in response to improving prospects for the Federal Reserve interest rate. The USDJPY pair has declined to 153.88. After the US released up-to-date data on April inflation, the likelihood of a reduction in the...

EUR/GBP Daily Outlook – Action Forex

Daily Pivots: (S1) 0.8570; (P) 0.8585; (R1) 0.8595; More… EUR/GBP’s break of 0.8585 minor support argues that rebound from 0.8529 has completed at 0.8619. Intraday bias is back on the downside for 0.8529 support. Decisive break there will argue that larger down trend...

EUR/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 167.99; (P) 168.70; (R1) 169.30; More… Intraday bias in EUR/JPY is turned neutral with current retreat. On the downside, break of 166.73 support will argue that corrective pattern from 171.58 has started the third leg. Deeper fall would then be seen...

GBP/JPY Daily Outlook – Action Forex

Daily Pivots: (S1) 195.88; (P) 196.49; (R1) 197.11; More… Intraday bias in GBP/JPY is turned neutral with current retreat. On the downside, break of 194.74 support will suggest that corrective pattern from 200.53 has started the third leg. Deeper fall would be seen...

Elliott Wave Analysis on SPX Looking to Extend Higher in Impulsive Structure

Short Term Elliott Wave in SPX suggests that the Index ended wave (4) pullback at 4953.98. From there, it rallies higher in wave (5) as a nesting impulse Elliott Wave structure. Up from wave (4), wave ((i)) ended at 5121.45 and dips in wave ((ii)) ended at 5013.45....

AUDUSD Eases After Bullish Spike to 4-Month High

AUDUSD jumps above trading range MACD indicates more gains; but RSI heads south 20- and 50-day SMAs post bullish cross AUDUSD posted a strong bullish day on Wednesday, showing some more upside pressure today, towards a fresh four-month high, exiting from the...

Dollar Selloff Continues as Risk-On Sentiment Drives US Stocks to New Highs

Dollar faced broad sell-offs overnight and continued to weaken in Asian session. Investors breathed a sigh of relief after US CPI data indicated that disinflation is progressing, which has reignited speculation about near-term rate cuts by Fed. Or at least, another...

FX option expiries for 16 May 10am New York cut

There are a few to take note of, as highlighted in bold.And they are all for EUR/USD layered from 1.0845 through to 1.0900. The upper bound in particular is a notable one, acting alongside offers in pinning price action down for now. But with a thick layer of expiries...

Australian Dollar Higher, Wage Growth Dips Lower

The Australian dollar has extended its gains on Wednesday. AUD/USD is up 0.24%, trading at 0.6642 in the European session at the time of writing. Has Australia’s wage growth peaked? Australian wages rose less than expected in the first quarter, a sign that...

Gold Technical: Stagflation Risk and Softer US 10-year Treasury Real Yield Supporting Bulls

Stagflation risk has led to a softer US 10-year Treasury real yield below 2.38%. The 6% decline of Gold (XAU/USD) from its recent all-time high in April may have reached an inflection point to kickstart another potential medium-term impulsive bullish sequence. Watch...

US CPI slows to 3.4% in Apr, core CPI down to 3.6%

US CPI rose 0.3% mom in April, matched expectations. CPI core (ex food and energy) rose 0.3% mom, matched expectations. Energy index rose 1.1% mom while food index was unchanged. Over the 12-months, CPI slowed from 3.5% yoy to 3.4% yoy , matched expectations. CPI core...

USD/JPY Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 156.09; (P) 156.43; (R1) 156.78; More… USD/JPY’s break of 155.25 minor support argues that rebound from 151.86 has completed already. Fall from 156.78 is seen as the third leg of the corrective pattern from 160.20 high. Intraday bias is back on the...

USD/CHF Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 0.9047; (P) 0.9074; (R1) 0.9094; More…. USD/CHF is holding above 0.9005 support and intraday bias remains neutral first. Further decline is expected as long as 0.9101 resistance holds. On the downside, break of 0.9005 will resume the fall from...

GBP/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.2538; (P) 1.2565; (R1) 1.2621; More… GBP/USD’s rebound from 1.2298 resumed by breaking through 1.2633 and intraday bias is back on the upside. Further rise should be seen to 1.2708 resistance first. Firm break there will pave the way back to...

EUR/USD Mid-Day Outlook – Action Forex

Daily Pivots: (S1) 1.0783; (P) 1.0804; (R1) 1.0842; More… Intraday bias in EUR/USD remains on the upside as rise from 1.0601 is in progress. Firm break of 1.0884 will pave the way to 1.0980 resistance next. On the downside, below 1.0812 minor support will turn...

U.S. Retail Sales Starts Q2 on a Subdued Note

Retail sales came in flat for the month of April. Additionally, March’s growth was revised downward to a 0.6 % gain (previously 0.7%). The reading was lower than the consensus forecast calling for a modest increase of 0.4% Trade in the auto sector was down -0.8% m/m,...

US: Core Inflation Cools to Near Three-Year Low in April